Testimony to Federal Communications Commission

Testimony to Federal Communications Commission

Re: Charter’s Petition to Sunset Merger-related Deal Conditions

July 22, 2020

Stop the Cap! is an all-consumer, all-volunteer advocacy group created in 2008 to oppose data caps on home broadband internet service. Our group does not accept corporate contributions of any kind and our only motivation is to promote better, more affordable broadband service without the imposition of unnecessary data caps or usage-based pricing schemes. We have submitted comments to the FCC in multiple proceedings over the last decade, including the 2016 merger of Charter Communications and Time Warner Cable and Bright House Networks.[1] We feel well-qualified to share our views on this issue because our group recommended the FCC ban data caps as a condition of approving this merger.

We are strongly opposed to Charter’s petition to sunset the order that prohibits Charter from imposing data caps and usage-based pricing for a period of 7-years. We are disappointed the company has petitioned the FCC to do so in the middle of a historic pandemic and economic downturn rivaling the Great Depression. Never before has reliable and affordable broadband service been more important to the American people. From at-home learning to tele-commuting for work, online health care and teleconferencing, updates on the coronavirus and testing, filing for unemployment or applying for a job – all require the use of the internet to fully maintain social distancing to keep people safe. Charter’s untimely petition demonstrates it does not have the best interests of its customers at heart.

Consumers Hate Data Caps and Usage-based Pricing Schemes

Time Warner Cable, which today is part of Charter/Spectrum, learned quickly that customers loathe data caps and usage-based pricing schemes. An effort to replace flat-rate unlimited internet with a compulsory usage-based billing scheme flopped after the company announced it would expand a data cap trial to customers in parts of New York, Texas, and North Carolina in April 2009.[2] The trial caused a media sensation in cities like Rochester, San Antonio, Austin, and the Triangle region around Greensboro in North Carolina. Rep. Eric Massa (D-N.Y.) proposed federal legislation banning data caps as a result. Sen. Charles Schumer (D-N.Y.) criticized the caps as anti-consumer and anti-competitive.

Just two weeks after word leaked about the expanded data cap trial and protests erupted, then-Time Warner Cable CEO Glenn Britt permanently shelved the plan. That was the last attempt Time Warner Cable would make to impose a compulsory data cap and usage-based pricing scheme on its customers.

Subsequent efforts to test optional usage-based pricing plans were spectacular failures for Time Warner Cable. Consumers simply do not want compulsory data-capped internet service or usage-based pricing. Inadequate competition is the key reason such unpopular plans still exist today.

Time Warner Cable management shared their experiences with data caps with investors while exploring how customers would react to two optional usage-based discount programs the company offered consumers for a time in the early 2010s.

In 2013, Time Warner Cable welcomed new broadband customers with an unlimited Standard Broadband plan for $44.99/month. (Today, Charter’s Standard Internet plan starts at a less affordable $65/month, although it delivers substantially faster speed than Time Warner Cable’s basic plan did in 2013.) The voluntary usage-capped plan that Time Warner Cable offered that year provided a paltry $5/month discount off the price of Standard Broadband if subscribers agreed to keep usage under 5 GB a month. The cost of that usage-based plan was $39.99/month. In that year, average broadband usage was approximately 28 GB a month, according to the company. Assuming a customer enrolled in the usage capped plan accidentally consumed the average amount of data most customers used, their total bill including overlimit fees would have been $62.99, far more than the cost of the unlimited option. Consumers fearing unplanned bill shock made the company’s traditional unlimited plans far more attractive.

Former Time Warner Cable CEO Rob Marcus told investors in September 2013:

“Most customers today — the vast, vast majority — take our unlimited offering and I think over time most customers will continue to take unlimited,” said Marcus, who was serving as Time Warner Cable’s chief operating officer at the time. “They value it and will be willing to pay for it. I think that is great and we have no desire to change that.”[3]

In the spring of 2014, Marcus told investors at a Deutsche Bank investor conference that its attempt to introduce a more generous, optional 30 GB usage plan was also a major failure.

“If you take the 30GB a month and compare it to what median usage is, let’s say high 20s — 27GB a month, that would suggest a whole lot of customers would do well by taking the 30GB service,” Marcus said. “Notwithstanding that, very few customers — in the thousands — have taken the usage-based tiers and I think that speaks to the value they place on unlimited — not bad because we plan to continue to offer unlimited for as far out as we can possibly see.”[4]

Based on Marcus’ figures, less than 1% of Time Warner Cable customers enrolled in one of their usage-based billing schemes.

Coincidentally, just prior to Charter’s announcement it would merge with Time Warner Cable and Bright House Networks, the company suddenly shelved its own data caps.[5]

Despite the overwhelming distaste for data caps and usage pricing in the home broadband marketplace, many providers have ignored consumer sentiment and implemented data caps averaging 1 TB, with a punishing overlimit fee that averages an extra $10 for each additional 50 GB increment of usage.

The Seven-Year Ban on Charter Imposing Data Caps Remains Warranted

Stop the Cap! argues, and the FCC stated in its May 5, 2016 “Memorandum Opinion and Order” granting the merger between Charter, Time Warner Cable, and Bright House Networks, that data caps can be an anticompetitive weapon to protect video profits, are a tool to earn even more revenue from subscribers, and can be symptomatic of a lack of competition in the broadband provider marketplace.

The FCC’s reasoning for the imposition of a 7-year ban on Charter imposing data caps was to protect consumers and competition. In fact, the FCC found that absent conditions, the merger deal Charter proposed was not in the public interest. Specifically, the FCC concluded that Charter’s desire to protect its video profits “will increase incentives to impose data caps and usage-based prices in order to make watching online video more expensive, and in particular more expensive than subscribing to a traditional pay-TV bundle.”[6] To approve the deal, the FCC required “New Charter” to comply with certain conditions to clearly demonstrate “its claimed public interest benefits so that the transaction’s benefits will clearly outweigh the likely public interest harms.”[7]

Nearly five years after the merger was approved, Charter is now petitioning the FCC to sunset various deal conditions early, including a prohibition on implementing data caps or usage-based billing. Charter’s petition narrowly focuses its argument on the state of the competitive video marketplace.

Since the 2016 order granting the merger, some consumers have chosen to drop Spectrum’s TV packages in favor of new linear TV streaming packages like Sling TV, YouTube TV, and AT&T TV Now, while a potentially larger number have chosen on-demand video content from Netflix, Hulu, Amazon Prime Video, and others.

Charter argues the presence of these “OVD” services and their relative success is evidence that data caps already imposed by other companies have not stifled their growth. Charter’s core argument is that the prohibition on data caps imposed by the FCC leaves Charter on an unlevel playing field where other providers are free to impose data caps while it cannot until the 7-year ban sunsets.

But the likely outcome of rescinding the ban on data caps would result in direct harm to consumers, potentially deterring usage either by limiting the quality of streamed video to keep data consumption down, or foregoing certain viewing opportunities. Charter seems to forget that other cable operators in the marketplace did not approach the FCC requesting approval of the largest cable industry merger deal in at least a decade – a merger the FCC declared was not in the public interest without conditions like the data cap ban.

We submit that any imposition of data caps on residential broadband service is anti-consumer and anti-competitive, providing strong evidence of the pricing power of a concentrated, uncompetitive marketplace for high-speed internet service – one that became even more concentrated with the merger of Charter, Time Warner Cable and Bright House Networks. The FCC itself found no discernable justification for usage-based billing or data caps in its 2016 Memorandum and Order approving the transaction:

“While wired BIAS providers sometimes claim there are cost-based and efficiency justifications for implementing usage-based billing policies, the Applicants fail to advance such a justification or demonstrate any cost-based or efficiency enhancing rationale for the implementation of data caps or UBP.”[8]

Charter’s petition also conveniently ignores the question of competitiveness in the high-speed internet marketplace. High-speed internet is required to take advantage of online video streaming services. Few companies would alienate their customers with unpopular usage-based pricing plans unless they understood consumers lacked good alternatives. The FCC’s 2016 Memorandum and Order noted the 7-year ban on data caps came partly as a result of concern about the lack of choice in broadband providers (emphasis ours):

“Seven years may also provide the high-speed BIAS provider market sufficient time to develop further with additional investments in fiber from established wireline BIAS providers, Wireless 5G technology, use of smartgrid fiber for broadband, additional overbuilding, and other potential competitors to traditional wired BIAS providers. It is our expectation that these developments will foster competition in the market to make the anticompetitive use of data caps less tenable in the future.”[9]

We submit there is already evidence that strong competition deters the imposition of unpopular data caps or usage-based pricing schemes. Comcast has conspicuously not imposed data caps or usage-based pricing in the northeast and mid-Atlantic regions where Verizon FiOS is its largest competitor.[10] Charter claimed in its petition that Verizon FiOS engages in usage-based pricing, which we argue is in error. As evidence, Charter cites Verizon’s prepaid offerings, which do not involve usage pricing.[11] In fact, Verizon FiOS has marketed its internet service without any disclosed data caps or usage pricing since its inception.

Stop the Cap! submits there has been only an incremental increase in competition among home broadband providers in the United States over the last four years. Fiber overbuilders have made some progress, but have also been hampered by pole attachment disputes, long permit and easement delays, and the need for more investment.[12]

AT&T has successfully completed its fiber expansion program, largely undertaken as a condition of the Commission’s 2015 approval of AT&T’s merger with DirecTV.[13] But AT&T is already the incumbent provider in those markets, which limits competitive benefits. One relatively new entrant, Google Fiber, once cited as a new and potentially strong competitor in the broadband marketplace has clearly retrenched from further expansion, at least for now.[14]

The launch of 5G as a wireless home broadband replacement has been modest, limited to a handful of neighborhoods in a very small number of cities. While 5G will certainly deliver an incremental upgrade to wireless mobile device users, its prospect as a direct competitor to wired cable and phone company home broadband products is questionable.[15] In December 2019, cable executives scoffed at 5G’s potential to deliver serious competition in the home broadband business. Dexter Goei, CEO of Altice USA, called available 5G plans “deeply flawed” because 5G service is not financially viable outside of densely populated urban areas.[16]

Stop the Cap! believes as of the date of this filing, there is still insufficient competition in the broadband marketplace. An early sunset of Charter’s prohibition on data caps will once again make the original merger deal not in the public interest. We agree with the FCC that strong and robust competition will likely eventually resolve the data cap issue, but we see no evidence of any potential marketplace entrant having sufficient scale and market share within the next two years to deter incumbent providers from engaging in anticompetitive data caps and usage-based pricing abuse.

Charter’s Claim It Has No Plans to Impose Data Caps or Usage-Based Pricing, Despite Lobbying for Permission to Do So is Suspect

Charter’s public comments on this issue are not reassuring:

“Once the conditions expire, Charter will weigh the options as we would any business decision, but is currently not even considering implementing data caps or charging for interconnection and has no plan to do so. What Charter seeks is a level playing field so that we can continue to grow and provide superior service to our customers across the country.”[17]

Charter can easily argue it isn’t currently considering implementing data caps because the earliest date that prohibition would sunset is nearly a year away: May 18, 2021. It is highly likely that “weighing the options” would include an assessment by Charter of the existing marketplace and level of competition. That would also include an analysis of Charter’s broadband pricing power, price elasticity and what some industry executives have suggested is broadband’s “long runway” for pricing. Broadband providers enjoy a scarcity in competition and a high demand for their product, which makes price increases inevitable. S&P Global quotes Kagan analyst Tony Lenoir noting “that in the long run, the industry could see more conversation around data caps as usage continues to grow.”[18]

It is questionable why a company like Charter would spend its valuable resources attempting to sunset deal conditions early only to reject taking full advantage of implementing data caps during the next two years before the conditions would have originally expired.

Charter’s petition is in direct conflict with what it argued before the Commission in 2016:

“Charter in particular emphasizes its aversion to data caps, stating that instead of enforcing usage limits it chooses to market the absence of data caps as a competitive advantage. Charter also argues there is a strong business case for not implementing caps. Specifically, Charter explains that it terminated its enforcement of the usage limits trial in the AUP in January 2012 because the benefits to customers of continuing the trial (minimizing bandwidth consumption to preserve a positive Internet experience) would not exceed the program’s costs. Charter also states that caps create marketing challenges because they complicate consumer purchasing decisions. Furthermore, Charter argues that data caps increase churn among subscribers. Finally, Charter states that it plans to distinguish itself from its competitors based largely on the quality and speed of its broadband offerings and that data caps undermine that marketing message.”[19]

Charter’s apparent understanding of how much consumers dislike usage caps and usage-based pricing is admirable, and no doubt was influenced by the lackluster reception Time Warner Cable received when it trialed optional data-capped tiers referenced above. Charter has also emphasized the fact it imposes no data caps in most of its broadband advertising to this day. But when a company faces few competitors, there are no market forces deterring Charter from changing its mind. Only the FCC’s 7-year ban on data caps has assured Charter’s customers they will not face the near-term prospect of data caps, usage pricing, and a possible regime of overlimit fees and costly add-on plans promising to restore unlimited service for an additional $30-40 a month.[20] [21]

Broadband Usage Growth During the Pandemic Exposes the Folly of Data Cap/Usage Pricing Arguments

After an unprecedented number of Americans remained in their homes to work, learn, and entertain themselves while socially distancing to stop the spread of COVID-19, broadband providers saw historic growth in network usage. In fact, a report from OpenVault, which collects U.S. cable subscribers’ usage behaviors and puts them into data sets, found a 47% increase in broadband traffic year-over-year during the first quarter of 2020.[22]

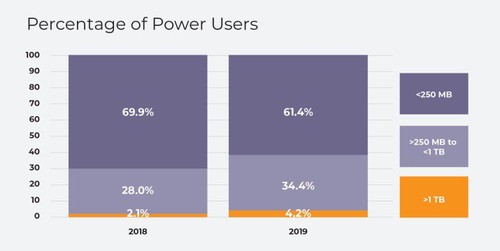

Average broadband consumption increased from 273.5 GB in the first quarter of 2019 to 402.5 GB in the first quarter of 2020. Prior to the COVID-19 pandemic, OpenVault had projected that average consumption would reach 425 GB by the end of the year. Instead, due in large part to subscriber self-quarantines and work from home policies, OpenVault said the average monthly usage for April was on track to top 460 GB.

OpenVault also predicted at least 10% of broadband subscribers, an unprecedented number, are now using in excess of 1 TB a month, which could subject them to usage penalties or overlimit fees if their provider has data caps. About 1.2% of customers consume more than 2 TB a month, which would likely result in additional monthly overlimit charges of $100, using Comcast’s overlimit penalty policy as an example.[23]

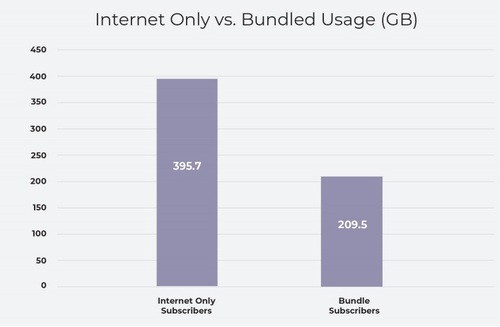

The average Charter Spectrum internet customer exceeds OpenVault’s averages. Charter Communications disclosed to investors in May 2020 that the average broadband-only Spectrum customer averaged over 600 GB of usage per month, increasing by more than 20% since the fourth quarter of 2019.[24] Despite the higher usage, Charter’s only significant disclosure of unusual first quarter capital expenditures was $87 million of mobile costs. Charter also told investors (emphasis ours), “Charter currently expects 2020 cable capital expenditures to decline as a percentage of cable revenue versus 2019.”

In other words, the costs to support rapidly increasing usage of Spectrum’s broadband service are not significant enough to require unusual investment. There is no evidence that justifies a need to implement usage caps or usage-based pricing. The cable industry’s largest lobbyist and trade organization, the NCTA, has touted how the cable industry has taken COVID-19 related traffic growth in stride, well prepared to manage current and future traffic increases.[25]

In fact, since the merger closed, Charter stock has more than doubled in value, from $227.41 on May 18, 2016 – the date the merger deal closed, to over $560 as of today, demonstrating the company’s current products, services, and pricing are more than adequate to deliver financial results that provide an excellent return on shareholder investments.[26]

We urge the Commission to carefully review claims that usage pricing and data caps deliver savings to any customer. Historically, any modest savings from discounts are more than absorbed by regular rate increases and occasional overage fees.

Charter’s claim that restricting it from imposing data caps “hamstrings Charter’s ability to allocate the costs of maintaining its network in a way that is efficient and fair for all of its customers—above-average, average, and light users alike” is simply not supported by the available evidence.[27] Except for the aforementioned, barely marketed offer of a slight discount for users agreeing to limit usage to 5 or 30 GB per month previously offered by Time Warner Cable (that has long been discontinued), and a somewhat similar discount offered in 2013 by Comcast which attracted almost no customers, no major cable operator or phone company has priced internet service fairly for “light users.”[28]

Charter, like many providers, already balances network costs and usage by offering different prices and speed tiers to meet the needs of its light, moderate and heavy users. The result is that Charter still collects increasing amounts of revenue from light and moderate use customers through periodic rate increases and heavy users often voluntarily upgrade to premium priced, faster speed tiers that more than cover any increased usage costs.

Every provider that implements data caps also claims those caps will affect almost none of their customers. Today, many providers choose a monthly usage allowance of around 1 TB, which sounds generous. But as we have shown above, average usage is rising quickly. But at the same time, costs to provide the service have not. The result has been costly broadband service that is also highly profitable. Giving a company like Charter permission to begin imposing usage caps in 2021 will leave many of its customers effectively trapped with that single monopoly provider, with the only alternative often a telephone company capable of providing only slow speed DSL service that does not meet the FCC’s standard for broadband speed.

Charter’s Performance Post-Merger is One of “Persistent Non-Compliance”

Stop the Cap! also reminds the Commission Charter Communications established a record of egregiously failing to meet its obligations to the State of New York. As a participant in the proceedings by the New York State Department of Public Service/Public Service Commission (NYDPS) to review Charter’s 2016 merger proposal, Stop the Cap! advocated for deal conditions including a requirement to expand its service area to cover unserved, rural areas of New York State.

The NYDPS ultimately approved the merger with the understanding Charter would expand service to 145,000 homes and businesses in largely rural, unserved areas on a strict timeline. In 2018, Charter failed to meet its merger obligations in what the NYDPS called “persistent noncompliance” and the Commission ultimately revoked the company’s franchise in New York State.[29]

The various instances of misconduct included:

- The company’s repeated failures to meet deadlines;

- Charter’s attempts to skirt obligations to serve rural communities;

- Unsafe practices in the field;

- Its failure to fully commit to its obligations under the 2016 merger agreement; and

- The company’s purposeful obfuscation of its performance and compliance obligations to the Commission and its customers.

After lengthy negotiations and additional fines and revised buildout requirements, the NYDPS reversed its decision. Still, Charter has a history of failing to meet its commitments, and we argue that makes the company’s commitments suspect.

Conclusion

A 7-year commitment to not data cap customers is a very small price to pay for the approval of a colossal merger worth more than $70 billion dollars. A deal is a deal. For customers, a guaranteed reprieve from the implementation of data caps and usage pricing provides solace in these extremely difficult times. It assures customers of internet service they can use as needed without worrying about a usage meter or overlimit fees.

Charter Communications has been extremely successful marketing its broadband products without data caps and clearly does not need them to achieve the kind of financial results that have doubled the company’s stock price. In most industries, adequate competition would dissuade companies from attempting to extract more money from customers with no discernable improvement in service. Absent that competition, some cable operators and phone companies have imposed arbitrary and unjustified usage caps as a result of market power.

To argue to also be allowed to impose similar unjustified usage caps as representative of a level playing field is ludicrous. It would be one of those rare cases where companies competed to see who could raise prices the most and the fastest.

Americans already pay too much for internet access. It is crucial for the FCC to do all it can to protect consumers and foster true competition that can demonstrably bring prices down and force unnecessary data caps from the marketplace. For now, the way to protect consumers is easy and clear: tell Charter a deal is a deal and the company has just two years left of a sensible, pro-consumer requirement that it not implement usage caps or usage-based billing.

[1] Stop the Cap! Comments on 2016 Merger of Charter, Time Warner Cable, et al. https://ecfsapi.fcc.gov/file/60001328856.pdf

[2] “Time Warner Cable shelves some Internet cap plans” https://abcnews.go.com/Technology/story?id=7368388&page=1

[3] “Time Warner Cable’s Incoming CEO Promises to Keep Unlimited Broadband Tier” https://stopthecap.com/2013/09/12/time-warner-cables-incoming-ceo-promises-to-keep-unlimited-broadband-tier/

[4] “Time Warner Cable Admits Usage-Based Pricing is a Big Failure – Only Thousands Enrolled” https://stopthecap.com/2014/03/13/time-warner-cable-admits-usage-based-pricing-is-a-big-failure-only-thousands-enrolled/

[5] “FCC Demands Details About Charter’s Suddenly Retired Usage Caps” https://stopthecap.com/2015/09/23/fcc-demands-details-about-charters-suddenly-retired-usage-caps/

[6] May 5, 2016 Memorandum Opinion and Order, page 4, executive summary number 7.

[7] May 5, 2016 Memorandum Opinion and Order, page 4, executive summary item numbers 8-9.

[8] 2016 Memorandum and Order, page 42, paragraph 84

[9] 2016 Memorandum and Order, page 44, paragraph 86

[10] https://www.xfinity.com/support/articles/data-usage-find-area

[11] Charter petition, page 22.

[12] “Access Issue Slows Rollout of Fiber Optic Network in Erie” https://www.goerie.com/news/20190609/access-issue-slows-rollout-of-fiber-optic-network-in-erie

[13] “FCC Grants Approval of AT&T-DirecTV Transaction” https://docs.fcc.gov/public/attachments/DOC-334561A1.pdf

[14] “Why Google Fiber stopped its plans to expand to more cities” https://www.sacbee.com/news/nation-world/national/article110655177.html

[15] “What You Need to Know About 5G in 2020” https://www.nytimes.com/2020/01/08/technology/personaltech/5g-mobile-network.html

[16] “5G Broadband is a threat to cable companies but execs aren’t worried.” https://www.cnbc.com/2019/12/01/5g-broadband-is-a-threat-to-cable-companies-but-execs-arent-worried.html

[17] “Charter seeks FCC OK to impose data caps and charge fees to video services” https://arstechnica.com/tech-policy/2020/06/charter-seeks-fcc-ok-to-impose-data-caps-and-charge-fees-to-video-services/

[18] “Broadband ARPU is Growing As Homes and Businesses Ask for Faster Speeds” https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/broadband-arpu-growing-as-homes-businesses-ask-for-faster-speeds-analysts-say-58637057

[19] 2016 Memorandum and Order, page 38, paragraph 78

[20] Comcast Xfinity Unlimited Data Pricing https://www.xfinity.com/support/articles/exp-unlimited-data

[21] Sparklight Unlimited Data Pricing https://www.sparklight.com/internet

[22] “Broadband usage spikes due to COVID-19” https://www.fiercetelecom.com/operators/due-to-covid-19-broadband-usage-spikes-47-q1-nearly-surpassing-all-2020-s-projections

[23] Comcast Xfinity Overlimit Fees https://www.xfinity.com/support/articles/data-usage-exceed-usage

[24] Charter 1st Quarter 2020 Results https://ir.spectrum.com/news-releases/news-release-details/charter-announces-first-quarter-2020-results

[25] “Why Cable’s Broadband Network is Handling the Pandemic and Ready for the Future” https://www.ncta.com/whats-new/why-cables-broadband-network-is-handling-the-pandemic-and-ready-for-the-future?utm_source=NCTA+Updates&utm_campaign=a959c28eb0-EMAIL_CAMPAIGN_2020_04_29_05_11&utm_medium=email&utm_term=0_58679950e4-a959c28eb0-90061877

[26] Charter Historical Stock Pricing for May 18, 2016 https://www.marketwatch.com/investing/stock/CHTR/historical?siteid=mktw&date=may%2018%2C%202016&x=0&y=0

[27] Charter petition, page 23, paragraph 2

[28] “Comcast testing a 5GB plan for subscribers. But don’t worry, you get a $5 discount!” https://gigaom.com/2013/08/01/comcast-testing-a-5gb-plan-for-subscribers-but-dont-worry-you-get-a-5-discount/

[29] PSC RESCINDS CHARTER MERGER APPROVAL https://apps.cio.ny.gov/apps/mediaContact/public/view.cfm?parm=9FA0F8EE-EFFA-9F23-60B0A25F0043BDD8

Subscribe

Subscribe Charter Communications is petitioning the Federal Communications Commission for permission to usage cap its internet customers two years before the FCC’s ban on the company imposing data caps runs out.

Charter Communications is petitioning the Federal Communications Commission for permission to usage cap its internet customers two years before the FCC’s ban on the company imposing data caps runs out. The FCC’s 2016 order approving the merger between Charter Communications, Time Warner Cable, and Bright House Networks, with a 7-year prohibition on data caps, was not unanimous. Separate statements from Republican Commissioners Ajit Pai and Michael O’Rielly were highly critical of most of the deal conditions the then-Democratic majority favored. Four years later, Pai now presides as chairman over a Republican-majority FCC that could take a favorable view of Charter’s request to end deal conditions early.

The FCC’s 2016 order approving the merger between Charter Communications, Time Warner Cable, and Bright House Networks, with a 7-year prohibition on data caps, was not unanimous. Separate statements from Republican Commissioners Ajit Pai and Michael O’Rielly were highly critical of most of the deal conditions the then-Democratic majority favored. Four years later, Pai now presides as chairman over a Republican-majority FCC that could take a favorable view of Charter’s request to end deal conditions early. But the FCC remained unconvinced by Charter’s statements. In a review of confidential internal company documents, the FCC found multiple instances where Time Warner Cable had not completely abandoned the idea of data caps, despite multiple high-profile consumer backlashes against the idea.

But the FCC remained unconvinced by Charter’s statements. In a review of confidential internal company documents, the FCC found multiple instances where Time Warner Cable had not completely abandoned the idea of data caps, despite multiple high-profile consumer backlashes against the idea. Hulu + Live TV is celebrating its successful signup of over an estimated 2.7 million customers with a major rate increase the company says reflects the service’s true value in the marketplace.

Hulu + Live TV is celebrating its successful signup of over an estimated 2.7 million customers with a major rate increase the company says reflects the service’s true value in the marketplace.

By the year 2022, 60% of the world’s population will be connected to the internet and 82% of online traffic will come from streaming video.

By the year 2022, 60% of the world’s population will be connected to the internet and 82% of online traffic will come from streaming video.