Verizon has a moratorium on further expansion of its fiber to the home service except in areas where it has existing agreements to deliver service.

Virtually every mayor in the urban centers of upstate New York is accusing Verizon Communications of redlining poor and minority communities when deciding where to provide its fiber-to-the-home service FiOS.

Now they are telling the Federal Communications Commission and Department of Justice to become more closely involved in reviewing a proposed anti-competitive marketing partnership between the phone company and some of the nation’s largest cable operators.

The mayors are upset that Verizon has chosen to target its limited FiOS network primarily on affluent suburbs surrounding upstate New York city centers.

“Verizon has not built its all-fiber FiOS network in any of our densely-populated cities. Not in Albany, Buffalo, Syracuse, Binghamton, Kingston, Elmira or Troy,” the mayors say. “Yet, Verizon has expanded its FiOS network to the suburbs ringing Buffalo, Albany, Troy, and Syracuse, as well as many places in the Hudson Valley, and most of downstate New York. As a result, the residents and businesses in our cities are disadvantaged relative to their more affluent suburban neighbors who have access to Verizon’s FiOS, providing competitive choice in high-speed broadband and video services.”

The mayors fear the reduced competition that will come from the marketing partnership between the phone and cable industry will eliminate any pressure on Verizon to expand its fiber optic network into more New York cities. The agreement allows Verizon Wireless customers to received significant bundled discounts when they sign up for cell phone service and a cable package from Comcast, Time Warner Cable, Cox, or Bright House Networks. No corresponding discount is available to a Verizon Wireless customer choosing to bundle Verizon FiOS, putting the fiber service at a competitive disadvantage.

“These commercial agreements appear to eliminate any incentive that Verizon might have had to expand its all-fiber network to our high-density urban centers,” the mayors say. “After all, Verizon Wireless, a subsidiary of Verizon Communications, will now be able to sell Time Warner’s video and broadband service as part of their bundled package in our communities.”

That leaves most with Verizon’s DSL service, a product Verizon has been marketing less and less to its customers. The company recently announced it would no longer sell standalone DSL broadband, another point of contention for the mayors.

That leaves most with Verizon’s DSL service, a product Verizon has been marketing less and less to its customers. The company recently announced it would no longer sell standalone DSL broadband, another point of contention for the mayors.

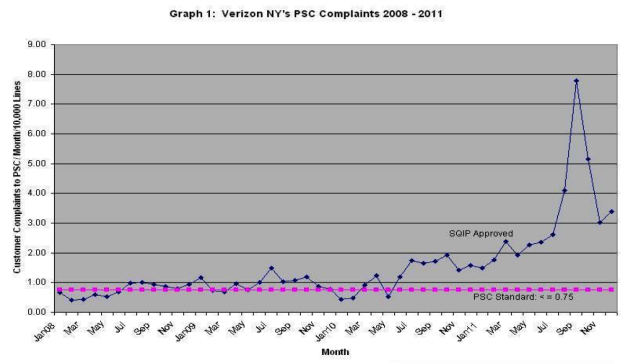

The mayors are concerned that Verizon’s deteriorating landline network will have profound implications for city centers, where tele-medicine, education, business, and entertainment services will all be left lacking if the fiber network is not extended.

“As you are well aware, high-speed broadband is critical to economic development and job creation, as well as improvements in health care, education, public safety, and civic discourse which is so essential to communal life,” say the mayors. “The economic health of our cities and our upstate region depends upon access to the same first-rate communications infrastructure available to the New York City metropolitan region and the suburban communities that ring our cities.”

The nine mayors are also questioning whether Verizon executives misled them when they claimed Verizon’s strong financial performance would allow the company to reinvest profits into further expansion of its FiOS network. Verizon executives have since admitted the company is indefinitely finished with FiOS expansion, except in areas where it already committed to build the fiber network.

Signing the letter were:

- Byron W. Brown – Mayor, City of Buffalo

- Stephanie A. Miner – Mayor, City of Syracuse

- Gerald D. Jennings – Mayor, City of Albany

- Matthew T. Ryan – Mayor, City of Binghamton

- Shayne R. Gallo – Mayor, City of Kingston

- Susan Skidmore – Mayor, City of Elmira

- Brian Tobin – Mayor, City of Cortland

- Robert Palmieri – Mayor, City of Utica

- Lou Rosamilla – Mayor, City of Troy

(The city of Rochester is served by Frontier Communications, which has no plans to deliver a fiber to the home network within its local service area.)

Subscribe

Subscribe