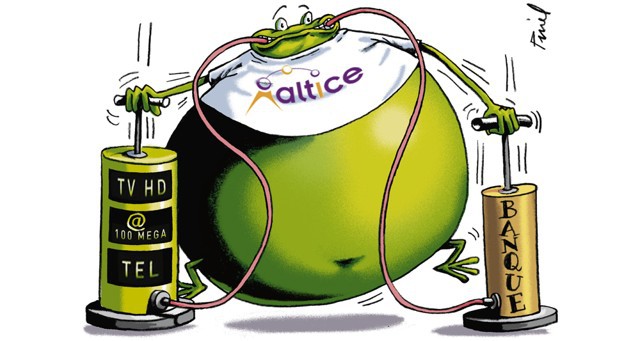

New York City officials are questioning the promised benefits of allowing Patrick Drahi’s Altice to acquire Cablevision in an all-cash deal that would combine ownership of Suddenlink and Cablevision under the European-based cable conglomerate.

New York City officials are questioning the promised benefits of allowing Patrick Drahi’s Altice to acquire Cablevision in an all-cash deal that would combine ownership of Suddenlink and Cablevision under the European-based cable conglomerate.

Mayor Bill de Blasio’s chief legal counsel told the Wall Street Journal she is skeptical about Altice’s proposed $900 million in cost cutting at Cablevision leading to better service.

“Altice is talking about $900 million in synergies. Well, what’s getting cut? How’s that going to impact the economy of New York and quality of services?” asked Maya Wiley. “We certainly are not afraid to disapprove a transaction.”

Altice’s Public Interest Statement, outlining the public benefits of the acquisition, was perceived as long on rhetoric but woefully short on specifics. Altice officials made vague promises to expand fiber optics across Cablevision’s footprint in return for approval of the transaction, but stopped short of committing to offer fiber to the home service.

Stop the Cap!’s Special Report, reviewing the proposed acquisition of Cablevision, attracted the interest of investors on Wall Street as well as several New York City public officials we spoke with about the proposed buyout.

City Hall of New York (Photo: Will Steacy)

On our recommendation, New York officials reviewed French press coverage of Altice and its colorful CEO Patrick Drahi. Dozens of articles have covered Drahi’s controversial business practices over the years, including efforts to stall payments for suppliers, initiating salary and job cuts, and a reduction in spending on meaningful service upgrades. His French operation SFR-Numericable lost one million customers in just one year. Earlier this year, he promised increased investment to turn those subscriber numbers around.

Wall Street is also increasingly skeptical about Drahi’s American business plans.

Cablevision’s stock price has dropped well below Altice’s all-cash offer of $34.90 a share, telegraphing concern the deal will not escape regulator scrutiny and ultimately will not close.

“The spread has widened in large part because people have become increasingly concerned that neither the city nor the state will find that the transaction is in the public interest, or alternatively, they’ll demand so much in terms of givebacks that ultimately the deal won’t be palatable to Altice,” Craig Moffett, analyst at MoffettNathanson LLC, told the Journal. “Altice dramatically overpaid, and their attempts to cut costs are both overly ambitious and are potentially injurious to what we already expected to be very weak operating results.”

If Drahi wins approval to take over Cablevision, Altice is likely to curtail promotional spending at the cable company. The cable operator competes head-to-head with Verizon FiOS across much of its downstate New York, New Jersey and Connecticut service areas. That will likely lead to higher prices and fewer deals for consumers as price competition cools down.

If Drahi wins approval to take over Cablevision, Altice is likely to curtail promotional spending at the cable company. The cable operator competes head-to-head with Verizon FiOS across much of its downstate New York, New Jersey and Connecticut service areas. That will likely lead to higher prices and fewer deals for consumers as price competition cools down.

The deal remains under review by the New York Public Service Commission and the FCC. Decisions from both are not expected until next spring.

On Monday, Altice closed its acquisition deal for Suddenlink, a cable operator serving states with more forgiving and business-friendly regulators.

As expected, Altice immediately named an executive team that will oversee significant cost cutting and reorganization at the cable operator that serves mostly rural and small city customers.

Two Suddenlink employees reached out to Stop the Cap! on Tuesday to tell us morale was dropping among middle managers at the cable operator.

“Most of our employees have little idea who Patrick Drahi or Altice is and they are not aware of the business reviews we’ve been told are coming after the holidays,” said one West Virginia based middle manager. “Some of my colleagues in customer care are updating their resumes this week and I’ve also heard concerns from technicians and IT workers. Some want to jump out early to secure new jobs before expected job cuts cause a small flood of resumes all over the state.”

“Most of our employees have little idea who Patrick Drahi or Altice is and they are not aware of the business reviews we’ve been told are coming after the holidays,” said one West Virginia based middle manager. “Some of my colleagues in customer care are updating their resumes this week and I’ve also heard concerns from technicians and IT workers. Some want to jump out early to secure new jobs before expected job cuts cause a small flood of resumes all over the state.”

“It’s a worrisome Christmas because we are not sure how many will be let go,” writes a Suddenlink mid-level IT manager working in Texas. “Salaries at Suddenlink have never been high but a lot of us prefer to work in our hometown and not move to Dallas or Houston to work for companies like Time Warner Cable or AT&T. It’s also a more relaxed work environment, but now there is a lot of concern what the new management will be doing.”

Goei

Chairman and CEO Jerry Kent announced he will be leaving Suddenlink in those roles but has agreed to chair a new advisory council at Altice USA, the subsidiary established to manage Altice’s American cable assets.

Head chopper Michel Combes, the new chief operating officer of Altice NV, is expected to coordinate U.S. operations. Combes brings his reputation for ruthless cost-cutting from his last job — CEO of Alcatel-Lucent. In an effort to boost profitability and cut costs, Combes presided over 10,000 job cuts and a salary freeze (except for himself and select others) at the company better known as the former Bell Labs. Two years after wielding the hatchet, Combes engineered a sale of the company to Nokia and secured a large golden parachute package for himself. The optics of Combes’ overseeing salary freezes and job cuts while later lobbying for a retirement package focusing on his own personal enrichment caused a political furor in France.

The new management of Suddenlink has limited experience in cable but plenty of experience working at Wall Street banks.

The chairman of Altice USA is Dexter Goei, who joined Altice in 2009 after a career in investment banking at JP Morgan and Morgan Stanley that spanned 15 years. Charles F. Stuart, also a former investment banker at Morgan Stanley, will become co-president and chief financial officer. Abdelhakim Boubazine, former CEO of Altice’s operations in the Dominican Republic, will also serve as co-president and chief operating officer. His LinkedIn profile mentions his involvement in telecommunications began in 2013. His educational background strongly emphasizes fossil fuel engineering.

Subscribe

Subscribe The Communications Workers of America today

The Communications Workers of America today  Many of Altice’s claims appeared “disingenuous and misleading” to the CWA. From the CWA’s filing:

Many of Altice’s claims appeared “disingenuous and misleading” to the CWA. From the CWA’s filing:

Any final approval of Charter Communication’s planned acquisition of Time Warner Cable and Bright House Networks will likely not come before next summer, as

Any final approval of Charter Communication’s planned acquisition of Time Warner Cable and Bright House Networks will likely not come before next summer, as  Patrick Drahi is hoping New York regulators will look more favorably on his proposal to buy Cablevision with a promise to upgrade more than three million of its customers in New York City to fiber-to-the-home service.

Patrick Drahi is hoping New York regulators will look more favorably on his proposal to buy Cablevision with a promise to upgrade more than three million of its customers in New York City to fiber-to-the-home service. Requiring Frontier Communications to increase broadband speeds could make the service unaffordable for rural and poor Americans, the company is arguing before federal and state regulators.

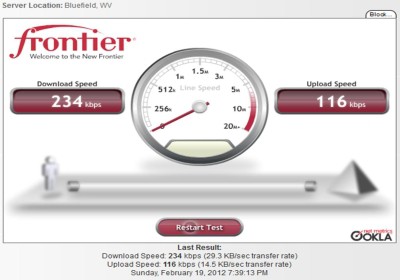

Requiring Frontier Communications to increase broadband speeds could make the service unaffordable for rural and poor Americans, the company is arguing before federal and state regulators. Frontier’s ability to deliver consistent 10Mbps service in rural areas is the issue.

Frontier’s ability to deliver consistent 10Mbps service in rural areas is the issue.