The business community of Poulsbo, Wash., a Seattle suburb of 9,000 in Kitsap County, is fed up waiting around for CenturyLink and Comcast to increase broadband speeds in the area so several have joined forces to share the city’s underused, existing fiber-optic cables to offer free Internet access for area businesses and residential users.

The business community of Poulsbo, Wash., a Seattle suburb of 9,000 in Kitsap County, is fed up waiting around for CenturyLink and Comcast to increase broadband speeds in the area so several have joined forces to share the city’s underused, existing fiber-optic cables to offer free Internet access for area businesses and residential users.

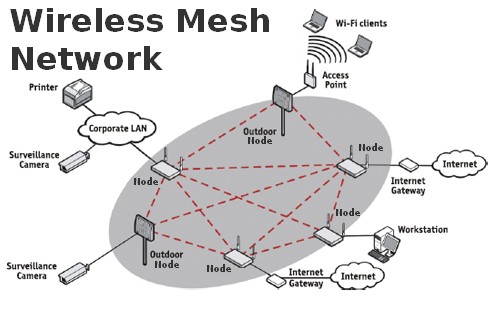

The Kitsap Public Utility District has launched a public-private partnership that offers free wireless mesh antennas to businesses willing to host them and pay any power costs incurred, so long as they agree to let customers and others in range of the network use it at no charge. The wireless mesh technology, more robust than traditional Wi-Fi, costs the public utility district between $7,000-$12,000 per site, but the resulting wireless coverage is cheap compared to wiring individual homes and businesses with fiber.

Local businesses, community leaders and the public consider it a win-win for everyone, especially because the existing institutional fiber network already in place is underutilized. The comparatively inexpensive wireless technology has not created any significant issues for area taxpayers or ratepayers, which effectively underwrite the antenna purchases, installation, and maintenance.

The wireless network offers speedy connections — as much as six times faster than the current broadband speeds sold by Comcast and CenturyLink in the county.

So far, four antennas have been installed downtown at local restaurants and a Lutheran church.

Stephen Perry, the PUD’s superintendent of telecommunications, says the new network is a pilot program to test if an economic model can be created to sustain the service and eventually expand it.

Stephen Perry, the PUD’s superintendent of telecommunications, says the new network is a pilot program to test if an economic model can be created to sustain the service and eventually expand it.

“The whole idea was to have it be a community network. It’s community based and owned so to have the community step up and want to take ownership of it … thought we’d have to force it on people,” Perry told the Kitsap Sun, noting district workers “can’t go fast enough” responding to fiber-optic interest.

The surprising support from the local business community has helped drive the project and publicize it. Local businesses love the new service, which they consider more reliable than paying for and maintaining a Wi-Fi network and Internet connection from Comcast or CenturyLink. The service does not require a password or complicated setup to access and has proved more reliable than older Wi-Fi solutions. Customers also enjoy the higher speeds.

Ed Stern, a member of the city council, said wireless mesh technology represents a major improvement over traditional Wi-Fi.

“It’s not a typical ‘hot spot’ limited to that business or specific location, but rather like ‘umbrella’ coverage, in that the antennas join together to create seamless coverage of everything and everybody throughout the area,” Stern said, adding network expansion is now inching into residential neighborhoods as well. “It’s really exciting.”

With countless towns and cities equipped with underutilized institutional fiber broadband networks lacking money to install direct fiber connections to homes or businesses, the wireless mesh option can offer an affordable introductory solution to expand service, publicize the community broadband initiative, and build support for even more ambitious public broadband opportunities in the future.

One local resident told the newspaper it was about time.

“The privatization business model has proven a failure,” wrote one reader. “Kitsap PUD needs to offer retail broadband to residents and businesses. These fiber cables are just sitting there doing nothing. There is one at the end of my driveway, but no one will sell me the service. Why would CenturyLink bother when they can continue to get overpaid for very slow speeds. In most places, there aren’t choices.”

Subscribe

Subscribe