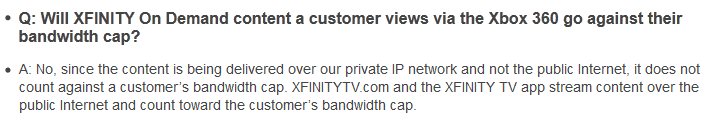

Comcast Monday announced it was exempting its new Xbox streaming video service from the company’s long standing 250GB monthly usage cap, claiming since the network doesn’t exist on the public Internet, there is no reason to cap its usage.

Comcast Monday announced it was exempting its new Xbox streaming video service from the company’s long standing 250GB monthly usage cap, claiming since the network doesn’t exist on the public Internet, there is no reason to cap its usage.

Net Neutrality advocates immediately denounced the cable operator for violating Net Neutrality, giving favorable treatment to its own video service while leaving Netflix, Amazon, and others under its usage cap regime.

Public Knowledge president Gigi Sohn:

“The Xbox 360 provides a number of video services to compete for customer dollars, yet only one service is not counted against the data cap—the one provided by Comcast.” Sohn said. “This is nothing less than a wake-up call to the Commission to show it is serious about protecting the Open Internet.”

Stop the Cap! believes Comcast also inadvertently undercut its prime argument for the company’s 250GB usage cap — that it assures “heavy users” don’t negatively impact the online experience of other customers:

We work hard to manage our network resources effectively and fairly to ensure a high-quality online experience for all of our customers. But XFINITY Internet service runs on a shared network, so every user’s experience is potentially affected by his or her neighbors’ Internet usage.

Our number one priority is to ensure that every customer has a superior Internet service experience. Consistent with that goal, the threshold is intended to protect the online experience of the vast majority of our customers whose Internet speeds could be degraded because one or more of their neighbors engages in consistent high-volume Internet downloads and uploads.

The threshold also addresses potential problems that can be caused by the exceedingly small percentage of subscribers who may engage in very high-volume data consumption (over 250 GB in a calendar month). By applying a very high threshold on monthly consumption, we can help preserve a good online experience for everyone.

Comcast argues around the exemption of the Xbox service by reclassifying it as somehow separate from the public Internet. The company then tries to claim the Xbox app functions more like an extra set top box, not as a data service. But, in fact, it –is– a data service delivered over the same cable lines as Comcast’s broadband service, subject to the same “last-mile congestion problem” Comcast dubiously uses as the primary justification for placing limits on customers.

Cable providers who limit broadband use routinely use the “shared network experience” excuse as a justification for usage control measures. Since cable broadband delivers a fixed amount of bandwidth into individual neighborhoods which everyone shares, a single user or small group of users can theoretically create congestion-related slowdowns during peak usage times. Cable operators have successfully addressed this problem with upgrades to DOCSIS 3 technology, which supports a considerably larger pipeline unlikely to be congested by a few “heavy users.”

Cable providers who limit broadband use routinely use the “shared network experience” excuse as a justification for usage control measures. Since cable broadband delivers a fixed amount of bandwidth into individual neighborhoods which everyone shares, a single user or small group of users can theoretically create congestion-related slowdowns during peak usage times. Cable operators have successfully addressed this problem with upgrades to DOCSIS 3 technology, which supports a considerably larger pipeline unlikely to be congested by a few “heavy users.”

Comcast’s argument the Xbox service doesn’t deserve to be capped because it is delivered over Comcast’s own internal network misses the point. That content reaches customers over the same infrastructure Comcast uses to reach every customer. If too many customers access the service at the same time, it is subject to precisely the same congestion-related slowdowns as their broadband service. Data is data — only the cable company decides whether to treat it equally with its other services or give it special, privileged attention.

Even if Comcast argues the Xbox streaming service exists on its own segregated, exclusive “data channel,” that represents part of a broader data pipeline that could have been dedicated to general Internet use. The fact that special pipeline is available exclusively for Comcast’s chosen favorites, while keeping usage limits on immediate competitors, is discriminatory.

Even if Comcast argues the Xbox streaming service exists on its own segregated, exclusive “data channel,” that represents part of a broader data pipeline that could have been dedicated to general Internet use. The fact that special pipeline is available exclusively for Comcast’s chosen favorites, while keeping usage limits on immediate competitors, is discriminatory.

Comcast customers who have lived under an inflexible 250GB usage limit since 2008 should be wondering why the company can suddenly open unlimited access to some services while refusing to adjust its own usage limits on general broadband service.

Stop the Cap! believes Comcast has forfeit its own justification for usage caps and network management techniques that can slow customer Internet speeds. We have no problem with the company offering unlimited access to the Xbox streaming service. But the company must treat general Internet access with equal generosity, removing the unjustified and arbitrary usage cap it imposed on customers in 2008. After all, if the company can find vast, unlimited resources for a service it launched only this year, it should be able to find equal resources for a service it has sold customers (at a remarkable profit) for more than a decade.

Anything less makes us believe Comcast’s usage caps are more about giving some services an unfair advantage — violating the very Net Neutrality guidelines Comcast claimed it would voluntarily honor.

Stop the Cap! strongly believes usage caps are increasingly less about good network management and more about controlling and monetizing the online experience, seeking marketplace advantages and new revenue streams from consumers who already pay some of the world’s highest prices for broadband service. As we’ve argued since 2008, Internet Overcharging through usage caps and usage based billing is also an end run around Net Neutrality. The evidence is now apparent for all to see.

[Thanks to our readers Scott and Yannio for sharing developments.]

Subscribe

Subscribe