Pai

I’ve done a LOT of interviews and talk shows on the issue of Net Neutrality over the last two weeks. After listening to the talking point-festooned “experts” and show hosts with a political agenda, your listeners, readers, and I will not be gaslighted by the exceptionally ridiculous condescension campaign now underway by Net Neutrality opponents.

For those who don’t know, “gaslighting” refers to manipulating someone into questioning or second-guessing their beliefs by distorting facts, attempting to delegitimize evidence with falsehoods, confusing the issues, and suggesting one lacks credibility to speak or write on an issue… because they said so.

Fortunately, when these “facts” come from a cable/telco bought-and-paid-for policy institute or lobbyist, it is easy to identify these campaigns and debunk them. It is also entertaining to turn the tables by questioning the source of their talking points and the agendas in play. We always ask these individuals where the money comes from for their “policy institute” and the answers are always not revealing. For the record, Stop the Cap! doesn’t accept corporate donations, period. We accept contributions exclusively from individuals. It takes just a few seconds to explain our funding while the other side takes minutes tap-dancing around the corporate dark money that funds their efforts.

Phillip Dampier: Don’t gaslight me, bro!

Thankfully, there have been a lot of newspaper reporters taking time to understand the issues and have shown professionalism in their reporting. But some radio talk show hosts unfortunately don’t do as well and rely on short-sighted political positioning, “rescue” their cornered allies with convenient commercial breaks, interrupt, or change the subject with baited questions when the facts don’t go their way. Net Neutrality is NOT a conservative or liberal issue, but some attempt to make it one by injecting President Barack Obama’s name into the debate or claim Net Neutrality represents government control of the internet.

Speaking of facts, FCC Chairman Ajit Pai’s latest arguments for his Christmas gift repeal of Net Neutrality for the telecom industry uses similar gaslighting and false talking points that distract from a fact-based debate on these issues.

As millions of consumers express outrage over Pai’s unbending agenda to allow internet service providers to create an unlevel internet playing field and paid prioritization fast lanes that favor some content over others (as long as they disclose it), Pai and his staff are now resorting to calling Americans who favor the current free and open internet “desperate” or ignorant about how the internet works.

FCC won’t delay vote, says net neutrality supporters are “desperate” https://t.co/zcMcNdXSOR by @JBrodkin

— Ars Technica (@arstechnica) December 4, 2017

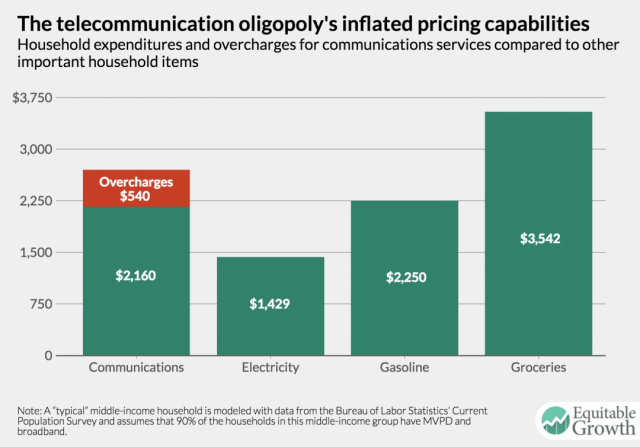

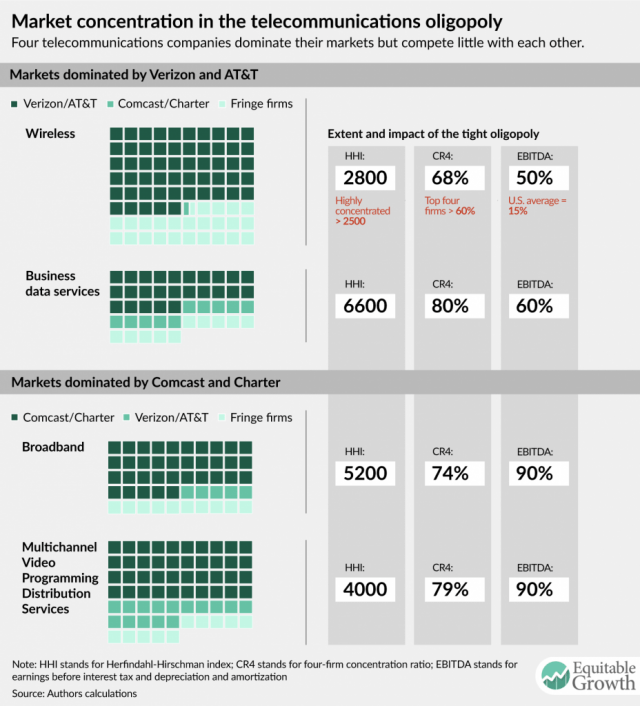

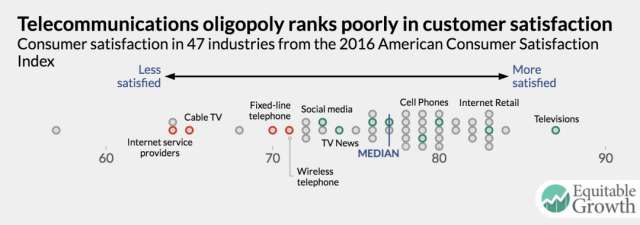

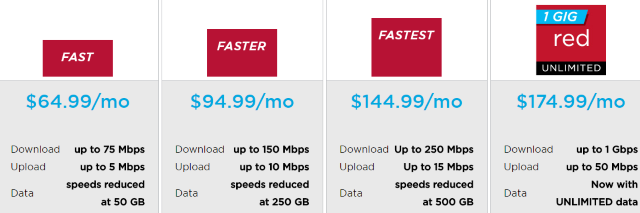

But you know more than you think, reminded each month (when the bill arrives) of the special ability of companies like Comcast to abuse the customer relationship with skyrocketing rates, data caps, and unhelpful customer service. Giving companies like this more ways to charge you more for the same service has never worked to your advantage.

Net Neutrality is one of only a few tools available to the FCC to keep ISPs in check. Banning data caps and zero rating schemes would be another great way to protect consumers from Wall Street’s insatiable demand for companies to extract more revenue from consumers. Investors know full well in a monopoly/duopoly marketplace there is every incentive to gouge and very little risk of losing customers doing so.

Our friends at Free Press did considerable research to debunk some of Mr. Pai’s talking points in a long series of tweets we thought would be illuminating:

Chairman Pai just released a #NetNeutrality explainer that denigrates serious public concerns as “myths” & presents his own lies as “facts.”

Let’s break down exactly why this is nonsense, shall we? #SaveNetNeutrality

— Dana Floberg (@dana_flo) November 28, 2017

Pai starts by claiming the internet was free & open before we had #TitleII #NetNeutrality rules — conveniently forgetting ISPs would violate open internet principles when it suited them: https://t.co/7iGcZVDvru pic.twitter.com/OMzVUXRFIH

— Dana Floberg (@dana_flo) November 28, 2017

He insists that startups will be just fine without #NetNeutrality, even tho hundreds of startups rallied to oppose Pai’s plan & preserve #TitleII: https://t.co/Zh1mNJHLXp and https://t.co/oQ4iI8wH1c pic.twitter.com/B2wnQ32fsy

— Dana Floberg (@dana_flo) November 28, 2017

Once again Pai ignores the long history of ISPs violating #NetNeutrality. He argues transparency & public shame will save us from bad behavior.

If public shame isn’t enough to stop the @FCC, a public agency, why would it stop Comcast? pic.twitter.com/iC0yG5cD5a

— Dana Floberg (@dana_flo) November 28, 2017

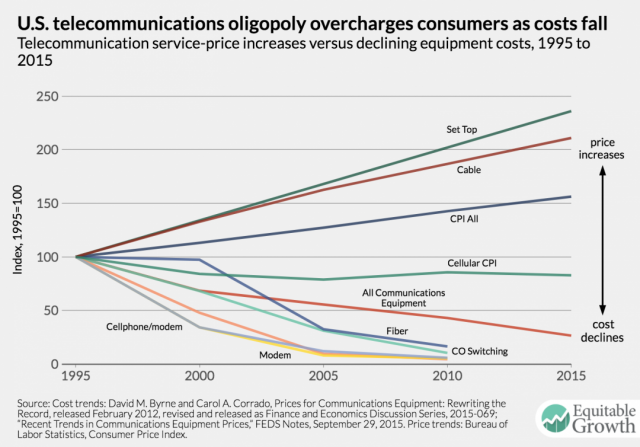

Pai is flat-out wrong on investment under #NetNeutrality. I’ve written about this before: https://t.co/uBRRQPng8X If you’re tired of my ranting, @businessinsider also wrote this up today: https://t.co/f7yg8sy7jX pic.twitter.com/FtkBi3w6MB

— Dana Floberg (@dana_flo) November 28, 2017

Unless Pai’s enormous Reese’s mug doubles as a crystal ball, there’s no way for him to know what ISPs will do if #NetNeutrality rules are scrapped. They COULD charge premiums, and if they DO, his @FCC will have abdicated all responsibility to help you. pic.twitter.com/GbikvA2o9C

— Dana Floberg (@dana_flo) November 28, 2017

Pai just wants to protect competition! Help the little guy! Except the little guys want real #NetNeutrality rules: https://t.co/a86F21AmrY and https://t.co/KeouT1vh4L pic.twitter.com/HplBHtPikF

— Dana Floberg (@dana_flo) November 28, 2017

Yeesh, this one is messy. Under #TitleII #NetNeutrality rules, ISPs have already been rapidly deploying better/faster broadband: https://t.co/Bn5V07E9Xt And since when has giving monopoly ISPs more power led to cheaper prices for consumers? pic.twitter.com/lS9DnjrL4s

— Dana Floberg (@dana_flo) November 28, 2017

Alas yes, that Portugal graphic isn’t what you think it is: https://t.co/Kev0psFcd6 BUT he’s lying about “curated services” — mass market ISPs like Comcast currently can’t offer such bundles. Pai’s #NetNeutrality repeal would let them. pic.twitter.com/pLApXSesSH

— Dana Floberg (@dana_flo) November 28, 2017

Innovation at the edge (anyone on the internet who isn’t an ISP) has flourished under #TitleII: https://t.co/k7DWdfdXKl Also, ISPs have repeatedly told investors that #NetNeutrality rules haven’t hurt them AT ALL: https://t.co/wkY8rSTrx2 pic.twitter.com/Kbk57rsHdA

— Dana Floberg (@dana_flo) November 28, 2017

Innovation at the edge (anyone on the internet who isn’t an ISP) has flourished under #TitleII: https://t.co/k7DWdfdXKl Also, ISPs have repeatedly told investors that #NetNeutrality rules haven’t hurt them AT ALL: https://t.co/wkY8rSTrx2 pic.twitter.com/Kbk57rsHdA

— Dana Floberg (@dana_flo) November 28, 2017

Let me say this again for the people in the back:

Broadband deployment has flourished under #TitleII #NetNeutrality. That means better, faster networks.

And if Pai actually cared about the digital divide, he wouldn’t be gutting #Lifeline. pic.twitter.com/bIYX0cXP4e

— Dana Floberg (@dana_flo) November 28, 2017

Who are you going to believe, a Trump-appointed chairman hellbent on destroying #NetNeutrality, or the FTC commissioner who testified before Congress that the FTC can’t protect the open internet alone? @TMcSweenyFTC https://t.co/sEo3BCEYgd pic.twitter.com/v44vX12XLr

— Dana Floberg (@dana_flo) November 28, 2017

This one’s my favorite.

“We don’t care that you like #NetNeutrality & also don’t like how you said it & also you’re just a bunch of Russian bots.”

First of all, those bots? They’re the only ones opposing #NetNeutrality: https://t.co/xVlOvIuL1U pic.twitter.com/Bh8EC6UpWM

— Dana Floberg (@dana_flo) November 28, 2017

And if Pai is so worried about fake comments, why won’t he cooperate w/ @AGSchneiderman‘s investigation? https://t.co/2d1b91Gt3o #NetNeutrality

— Dana Floberg (@dana_flo) November 28, 2017

Last one, still no cigar. #NetNeutrality rules have been held up in court before & Pai is fudging the impact of the SCOTUS decision by suggesting they endorsed his anti-#TitleII stance. SCOTUS upheld agency discretion, not Pai’s bogus plan. pic.twitter.com/KC8TWMszYZ

— Dana Floberg (@dana_flo) November 28, 2017

FINI.

If you’re also angry about Chairman Pai trying to gaslight the public re: #NetNeutrality, here’s some suggestions:

Read up: https://t.co/d6nZTyta7Q

Get involved: https://t.co/fjdLBbPJZO

And maybe lend @freepress a hand this #GivingTuesday?https://t.co/HVS0SdNy8C— Dana Floberg (@dana_flo) November 28, 2017

Subscribe

Subscribe The Federal Communications Commission has quietly

The Federal Communications Commission has quietly

A last-ditch effort last weekend by executives of SoftBank and Deutsche Telekom to overcome their differences in merging Sprint with T-Mobile USA

A last-ditch effort last weekend by executives of SoftBank and Deutsche Telekom to overcome their differences in merging Sprint with T-Mobile USA

But Son’s own failures are also responsible for Sprint’s current plight. Son attempted to cover his losses in Sprint by pursuing a merger with T-Mobile in 2014, but the merger fell apart when it became clear the Obama Administration’s regulators were unlikely to approve the deal. After that deal fell apart, Son has allowed T-Mobile to overtake Sprint’s third place position in the wireless market. While T-Mobile grew from 53 million customers to 70.7 million today, Sprint lost one million customers, dropping to fourth place with around 54 million current customers.

But Son’s own failures are also responsible for Sprint’s current plight. Son attempted to cover his losses in Sprint by pursuing a merger with T-Mobile in 2014, but the merger fell apart when it became clear the Obama Administration’s regulators were unlikely to approve the deal. After that deal fell apart, Son has allowed T-Mobile to overtake Sprint’s third place position in the wireless market. While T-Mobile grew from 53 million customers to 70.7 million today, Sprint lost one million customers, dropping to fourth place with around 54 million current customers. Sprint executives hurried out word on ‘Damage Control’ Monday that Altice USA would partner with Sprint to resell wireless service under the Altice brand. In return for the partnership, Sprint will be able to use Altice’s fiber network in Cablevision’s service area in New York, New Jersey, and Connecticut for its cell towers and future 5G small cells. The deal closely aligns to Comcast and Charter’s deal with Verizon allowing those cable operators to create their own cellular brands powered by Verizon Wireless’ network.

Sprint executives hurried out word on ‘Damage Control’ Monday that Altice USA would partner with Sprint to resell wireless service under the Altice brand. In return for the partnership, Sprint will be able to use Altice’s fiber network in Cablevision’s service area in New York, New Jersey, and Connecticut for its cell towers and future 5G small cells. The deal closely aligns to Comcast and Charter’s deal with Verizon allowing those cable operators to create their own cellular brands powered by Verizon Wireless’ network.

Wall Street’s merger-focused analysts are hungry for a deal now that the Sprint/T-Mobile merger has collapsed. Pivotal Research Group is predicting good things are possible for shareholders of Dish Network, and upgraded the stock to a “buy” recommendation this morning.

Wall Street’s merger-focused analysts are hungry for a deal now that the Sprint/T-Mobile merger has collapsed. Pivotal Research Group is predicting good things are possible for shareholders of Dish Network, and upgraded the stock to a “buy” recommendation this morning. Wlodarczak has also advised clients he believes the deregulation-friendly Trump Administration would not block the creation of a satellite TV monopoly, meaning AT&T should consider pairing its DirecTV service with an acquisition of Dish Networks’ satellite TV business, even if it forgoes Dish’s valuable wireless spectrum.

Wlodarczak has also advised clients he believes the deregulation-friendly Trump Administration would not block the creation of a satellite TV monopoly, meaning AT&T should consider pairing its DirecTV service with an acquisition of Dish Networks’ satellite TV business, even if it forgoes Dish’s valuable wireless spectrum.