Frontier Communications faced unhappy investors Thursday after announcing it was slashing its dividend nearly in half in an effort to raise money to sustain the company’s cash flow and reduce its debt.

Frontier Communications faced unhappy investors Thursday after announcing it was slashing its dividend nearly in half in an effort to raise money to sustain the company’s cash flow and reduce its debt.

The company’s earnings fell 8.1% as customers continued to leave for the competition, seeking better service and lower prices.

The poor earnings results and the dividend cuts delivered a one-two punch to Frontier stock, which slid to $4.20 a share, down 16 percent in the last three months.

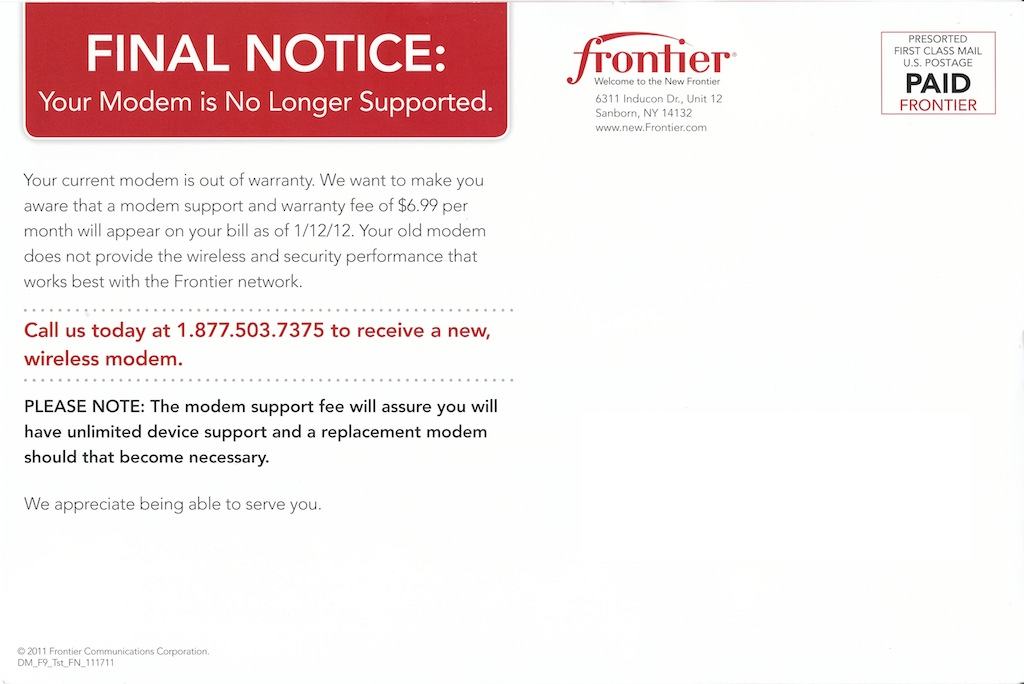

Among Frontier’s biggest challenges remains the quality of its broadband service to customers. Where competition exists, Frontier DSL continues to lose the speed battle, and recent junk fees padding customer bills, including a “High Speed Internet surcharge,” and increasing modem rental fees have alienated some customers.

Frontier’s chief operating officer and executive vice president Dan McCarthy told investors 83 percent of Frontier’s service area has access to the company’s broadband product. However, fewer than 20% of Frontier’s customers have access to speeds as high as 20Mbps. Only just over half can access the Internet at 6Mbps. Many of Frontier’s customers can only access lower speed service (66% can choose 4Mbps, 76% — 3Mbps, and the rest 768kbps-3Mbps).

“We’ll be investing throughout the year to improve speed-reaching capability in all our markets,” McCarthy told investors on a conference call last week.

In the second half of 2010, Frontier is expected to increase the amount of Ethernet in its middle mile network, which McCarthy expects will allow the company to deliver faster speeds over VDSL2 and VDSL2 bonding as means of driving both speed increases in the residential and the commercial markets.

However, Frontier’s preoccupation with an internal system conversion, to integrate its acquired Verizon service areas with the rest of its network, has stalled much of the company’s marketing. Promotions, in particular, have been anemic over the last several months and will likely remain that way until later this year. Where competition exists, cable operators have successfully been picking off Frontier’s customers.

- Broadband and satellite TV additions are down, in part due to the lack of promotions and marketing;

- FiOS video losses continue as the company shuns its fiber video service in favor of satellite TV cross-marketing;

- Line loss rates remain very high: 8.3% of Frontier’s customers disconnected their landline service in the last quarter, 5.9% in areas that were not acquired from Verizon.

- Once customers leave, they rarely return. Churn rate of Frontier customers coming and going is at just 1.6%.

As with similar Verizon landline sales in the past, initial revenue growth from acquired customers starts out high, boosting revenue numbers and often the value of a company’s stock. But the heavy debt load incurred from acquisitions and ongoing line losses to the competition eventually take their toll, and Frontier’s revenue now reflects the reality of a company trying to sell more services to a declining number of customers.

Morningstar notes the company’s debt problems are significant:

Frontier has struggled to bring leverage down and hasn’t successfully placed new debt since closing the Verizon transaction in 2010. Management has talked about taking care of the $580 million maturity it faces in early 2013 for the better part of a year, with no result to date. Yields on the firm’s existing debt have increased over the past year, despite the sharp decline in Treasury rates.

Standard & Poor’s Ratings Services reduced its outlook on the company from stable to negative, noting the competition is increasingly hurting Frontier’s capability to raise revenue.

The company’s decision to slash its dividend in an effort to reduce debt has created consternation for some investors who stuck with the company when the share price was above $7 and the dividend was declared safe for two years. Neither seems to the be case any longer.

Subscribe

Subscribe