Zombie bill.

Time Warner Cable has pulled back on their winter promotions for new customers, bundling slower broadband and significant equipment fees into the bottom line price that may cost as much as $20 or more than the cable operator’s advertising suggests.

Several readers contacted Stop the Cap! over the last few weeks about the disparity between Time Warner’s advertised new customer pricing and the out the door price that arrives on the first month’s bill.

Diane, a Stop the Cap! reader in Brockport, N.Y., was attracted to an $89.99 triple play promotion for TV, Internet, and phone service until she learned what did not come with the deal.

“By the time I got off the phone, that $89.99 offer turned into more than $130 a month once adding a DVR, faster broadband service, and a second cable box,” Diane complains. “You really have to read the fine print. They only give you 3Mbps broadband speed on most of their offers now and DVR service is rarely included. In fact, all the equipment turned out to cost extra.”

Stop the Cap! checked out the offer Diane was interested in, and it turns out the $89.99 advertised price only tells half the story.

The wall of text. Time Warner’s rebate offer has hoops customers will consider an Olympic event.

First, Time Warner requires customers on this promotion to pay for at least one cable box, at $8.99 a month. A CableCARD is also available for $2.50 a month for televisions equipped to support that. Most consumers stick with traditional boxes. Diane wanted one DVR box and a second box for a bedroom. DVR Service from Time Warner, which does not include the box itself, has dramatically increased in price over the years. In 2013, the combined rate for the “box” and the “service” is $21.94 a month in western New York. A second cable box for Diane’s bedroom ran another $8.49 a month. The new Internet modem rental fee is also not included, so that adds an additional $3.95 a month.

Diane is also correct about broadband speeds. Time Warner bundles only 3Mbps service in most of its promotional packages. Increasing to Standard speed (15/1Mbps) generally costs an additional $10 per month. Now Diane’s monthly bill is well over $130 a month.

In fact, Diane should have selected a more deluxe package from Time Warner at the outset. Their $104.99 promotion bundles Turbo (20/2Mbps) Internet, free Showtime, and at least covers DVR service (although Diane still has to pay $9 a month for the DVR box). Her out the door price for that package is less than $127 a month.

Customers served by AT&T U-verse or Verizon FiOS stand to come out better if they plan to dump the phone company in favor of Time Warner. The cable operator is throwing in a debit card worth up to a $200, but only for customers switching away from a competitor. Diane just had Frontier phone service, so no $200 reward card for her. Time Warner requires customers to switch from services comparable to those selected from Time Warner to qualify for the maximum rebate.

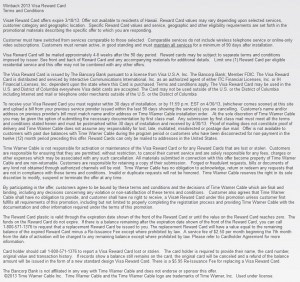

For those that do quality, the rebate hoop-jumping begins:

- Customers qualifying for the reward card have to write down a promotion code and register their rebate request online within 30 days of starting service.

- Customers must remain active, in good standing and must maintain all services for a minimum of 90 days after installation.

- Customers are required to upload a scanned copy of their last provider’s bill, showing active service within the last 90 days. Card should arrive 4-6 weeks after a 90 day waiting period.

- Comparable services do not include wireless telephone service or online-only video subscriptions.

- Offer is not available to customers with past due balances with Time Warner Cable during the program period or customers who have been disconnected for non-payment during the twelve months preceding this offer.

- The customer’s name and address on file with Time Warner must exactly match the name and address on your former provider’s bill.

- Customers better spend the money quickly. After six months, the issuing bank deducts a $2.50 monthly “service fee” from the debit card until empty, except where prohibited by law.

- If the card is lost or stolen, there is a $5.95 Re-Issuance Fee. If you need to dispute a charge on the card, you are out of luck. The issuing bank will not intervene on your behalf.

- Customers cannot apply the rebate to their Time Warner Cable bill.

Subscribe

Subscribe Time Warner Cable customers in southern California are bracing themselves for a rate increase that will

Time Warner Cable customers in southern California are bracing themselves for a rate increase that will  It is likely the latest rate increase does include the cost of the 2012 launch of Time Warner Cable SportsNet, which features the Los Angeles Lakers. Time Warner asks competing satellite and telephone company video services to pay between $4-5 a month to provide SportsNet to their customers.

It is likely the latest rate increase does include the cost of the 2012 launch of Time Warner Cable SportsNet, which features the Los Angeles Lakers. Time Warner asks competing satellite and telephone company video services to pay between $4-5 a month to provide SportsNet to their customers. Customers facing price increases can use the rate increase notification as the trigger to threaten to cancel service to win a lower price with a customer retention offer. Stop the Cap!

Customers facing price increases can use the rate increase notification as the trigger to threaten to cancel service to win a lower price with a customer retention offer. Stop the Cap!