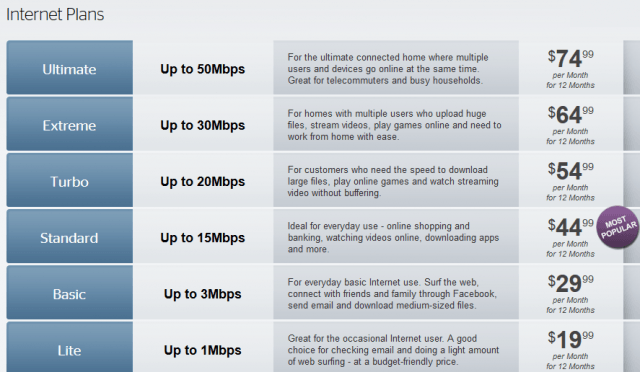

Time Warner Cable is increasing the cost of renting your cable modem. In the third increase in ten months, using the company-provided cable modem will now cost subscribers $5.99 a month. But the costs don’t stop there. Last week, Time Warner announced it was raising the price of its broadband service an average of $3 a month. Taken together, the cost of standalone 15/1Mbps broadband with a leased modem will now cost $61 a month.

SB6141 is a DOCSIS 3 modem

Time Warner introduced its $3.95 monthly modem rental fee last fall. In June, the company announced it was raising the price of the modem rental to $4.99 a month for new customers, and has now decided customers can afford to pay more — $6 a month for equipment that costs the cable company, on average, less than $50 per unit according to Wall Street analysts.

CEO Glenn Britt remarked earlier this year that customers accepted the modem rental fee with few complaints. Britt foreshadowed the modem rental fee increase saying the company had significant room to boost prices, noting Comcast charges $7 a month for its modem.

Customers can escape modem rental fees altogether by purchasing their own equipment. At Time Warner’s new prices, most customers will recoup the cost of the equipment within one year. Unfortunately, as news of the modem rental fee increase made its way to retailers and eBay resellers, prices have soared for equipment on Time Warner Cable’s approved modem list.

The popular Motorola SB6141, which sold for $78 two weeks ago, has now shot up to $99.99 in anticipation of a new wave of buyers. Prices on Newegg have also increased from $78 to $99.99 as of this morning. Best Buy has also boosted prices to $99.99. Amazon still lists this white version of the SB6141 this afternoon for $87, but is expected to quickly sell out.

Based on the last two waves of price increases, if thinking about buying your own modem the time to buy is right now because major retailers are likely to temporarily sell out and eBay resellers will begin a wave of price increases in response to demand.

Stop the Cap! top rates the Motorola SB6141 among the modems on the approved list. It is DOCSIS 3 capable, which means it will support faster Internet speeds. But also be aware that if you upgrade to a DOCSIS 3 modem, Time Warner’s Speedboost technology, which delivers a few seconds of additional speed at the start of a download, will no longer work. Speedboost is gradually being phased out by most cable operators so we still think buying a DOCSIS 3 modem makes the most sense over the long term.

Subscribe

Subscribe Time Warner Cable is once again

Time Warner Cable is once again

Stop the Cap! strongly encourages Time Warner Cable customers to buy their own cable modems and avoid the rental fees. Customers can also bypass the rental fee by

Stop the Cap! strongly encourages Time Warner Cable customers to buy their own cable modems and avoid the rental fees. Customers can also bypass the rental fee by

A California federal judge has rejected a class action case against Comcast for allegedly hiding modem fees as high as $15 a month when signing up new customers.

A California federal judge has rejected a class action case against Comcast for allegedly hiding modem fees as high as $15 a month when signing up new customers. Judge Armstrong wrote that Diacakis should have come to court with evidence beyond the spoken promises of a handful of Comcast salespeople the plaintiff identified only by their first names. She was swayed by Comcast’s arguments:

Judge Armstrong wrote that Diacakis should have come to court with evidence beyond the spoken promises of a handful of Comcast salespeople the plaintiff identified only by their first names. She was swayed by Comcast’s arguments: