Won first place nationally for the best 4G LTE network with the fastest overall speeds and best performance.

PC Magazine went to a lot of effort to test the data speeds of America’s wireless providers, traveling to 30 U.S. cities sampling both 3G and 4G wireless networks to see which carrier delivers the most consistent and fastest results.

After 240,000 lines of test data, the magazine declared the results a bit “muddy.”

They have a point.

Depending on which carrier’s flavor of “4G” is being utilized, where reception was strongest, how much spectrum was available in each tested city, and how many people were sharing the cell tower at the time of each test, PC Magazine was able to deliver the definitive results. And it was effectively a draw.

Verizon Wireless achieved victory in 19 cities, AT&T won in ten others, and T-Mobile came in pretty close behind, and that carrier does not even operate an LTE 4G network. But taking all factors into account, including upload and download speeds, whether or not test downloads actually completed, and whether streamed media was tolerable, Verizon Wireless won first prize nationwide.

But by how much?

Not enough to matter, if you are using Verizon, AT&T, or T-Mobile.

But the results do offer some things to think about.

- MetroPCS is a mess. Despite the fact this smaller carrier is building its own 4G LTE network, results were simply terrible. Either its backhaul network from cell towers offers lower capacity or its backbone network is screaming for an upgrade.

- Cricket was not willing to participate in the test. Their network, still 3G, delivers dependably “meh” results in the places where they actually provide coverage. The company has been reducing data allowances on their mobile broadband plans and raising prices on others. In one conference call with investors, company executives admitted they have been losing mobile broadband customers and expect that to continue at the prices they are charging.

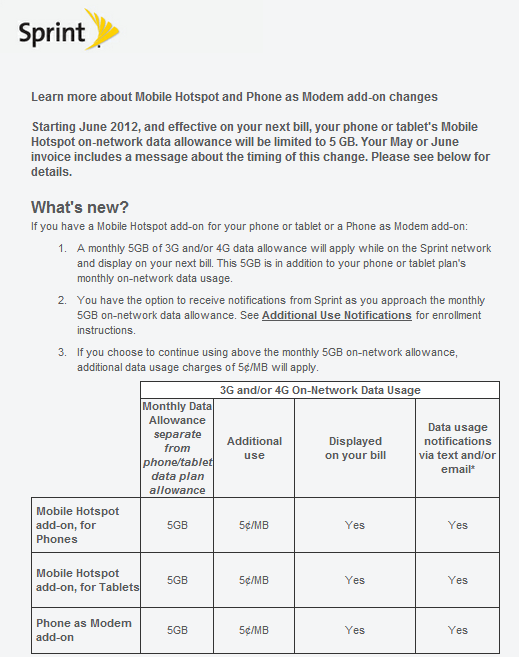

- Sprint needs their forthcoming 4G LTE network more than ever. Their 3G data service turned in mediocre results and their 4G WiMAX network was yesterday’s news a year ago. Sprint’s 3G network is also notorious for dead-end downloads, a situation I have witnessed on friends’ phones for several months.

- Verizon Wireless remains far ahead of AT&T in covering more cities with their 4G LTE network. But more customers are also starting to use Verizon’s newer network, and the more customers piling on, the slower the speeds get for everyone. AT&T turned in some superior speed results in several cities, but those networks are often used less than the competition, for now.

- No network is good if you cannot afford to use it. As America’s wireless carriers keep raising prices and reducing usage allowances to keep data usage under control, there will be a breaking point where customers decide the money they spend for wireless data just is not worth it, especially if they live in a place where Wi-Fi is free and easy to find.

- What you test today will probably be different tomorrow. Wireless networks are constantly evolving and changing, with a wide range of factors contributing to their overall performance. Perhaps a more useful test would have been measuring how wireless carriers respond when their networks need upgrading and how long it takes them to respond to changing usage patterns. Verizon seems particularly aggressive, AT&T less so based on these results. The real surprise seems to be how well T-Mobile’s older technology is performing, and how quickly Sprint is now falling behind. On Cricket and MetroPCS, “you get what you pay for” seems to apply.

Subscribe

Subscribe