Should regulators bless the coupling of Comcast and Time Warner Cable, some TWC customers will not be invited to the wedding.

Should regulators bless the coupling of Comcast and Time Warner Cable, some TWC customers will not be invited to the wedding.

In an effort to appease Washington, Comcast is voluntarily abiding by a 30% market share cap the company itself successfully sued to overturn in federal court. That means Comcast plans to voluntarily shed the three million Time Warner Cable customers that would put the company over its self-imposed limit.

Comcast is so confident its merger will win approval, the company is already contemplating what to do with the orphaned customers. Bloomberg News reports Comcast is considering launching a new publicly traded independent cable company to manage the ex-Time Warner customers. It would automatically be the fourth largest cable company in the country, behind the super-sized Comcast, Cox Communications, and Charter Cable. Comcast would use the new entity to claim it was creating a new “cable competitor” in the industry, despite the fact it would almost certainly never compete in markets where other cable companies already offer service.

Other cable companies are already expressing interest in picking up the stranded TWC customers. Among the suitors:

- Charter Communications, which lost its original bid to take over Time Warner Cable;

- Bright House Networks, which now serves markets in the southern U.S.;

- Suddenlink Communications, which primarily serves rural communities and small cities ignored by larger providers.

Comcast hasn’t announced what cities will not be included in the Comcast-TWC merger, and does not plan to decide until at least late spring. Financial strategists are recommending Comcast “spinout” the subscribers to a new entity that would be loaded up with debt to win significant tax savings from the transaction. The new cable company would likely be worth at least $17 billion.

[flv]http://www.phillipdampier.com/video/Bloomberg Comcast Might Spin Off TWC Subs 2-28-14.flv[/flv]

Bloomberg News reports Comcast would be in the enviable position of creating its own “competitor” by spinning off certain Time Warner Cable customers into a new company Comcast would launch. (2:45)

Subscribe

Subscribe

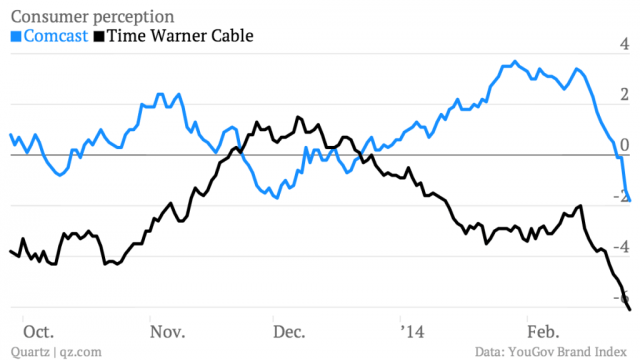

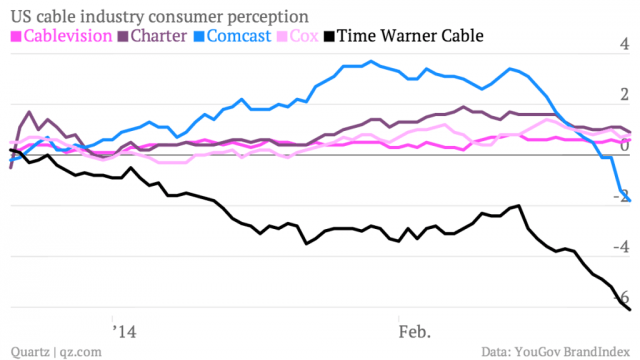

That may prove to be smart politics for Franken, seen as a polarizing figure in the left-right divide. The near-universal loathing among consumers for both Comcast and Time Warner Cable threaten to rise above traditional partisan politics. Republican lawmakers have kept largely quiet about the merger deal, and some are even openly questioning it. Franken may tapped into a re-election issue that voters across Minnesota are likely to support — especially older Republican-leaning independents.

That may prove to be smart politics for Franken, seen as a polarizing figure in the left-right divide. The near-universal loathing among consumers for both Comcast and Time Warner Cable threaten to rise above traditional partisan politics. Republican lawmakers have kept largely quiet about the merger deal, and some are even openly questioning it. Franken may tapped into a re-election issue that voters across Minnesota are likely to support — especially older Republican-leaning independents.

“Look, the amount of decision makers, which is so surprisingly small in the industry in general, is potentially getting smaller,” Steve Krakauer, TheBlaze’s vice president of digital content told POLITICO. “Keeping up the fight is so important.”

“Look, the amount of decision makers, which is so surprisingly small in the industry in general, is potentially getting smaller,” Steve Krakauer, TheBlaze’s vice president of digital content told POLITICO. “Keeping up the fight is so important.”