If you are a Time Warner Cable customer, one of four things will happen by this time next year:

If you are a Time Warner Cable customer, one of four things will happen by this time next year:

- You will still be a Time Warner Cable customer if regulators shoot down its merger with Comcast;

- You will be a Comcast customer;

- You will be a Charter Communications customer;

- You will be served by a brand new cable company temporarily dubbed “SpinCo,” owned partly by Comcast but managed by Charter.

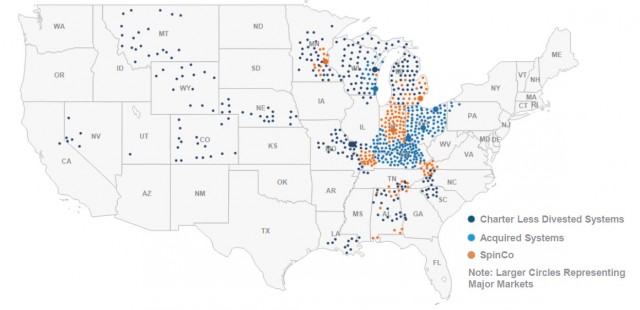

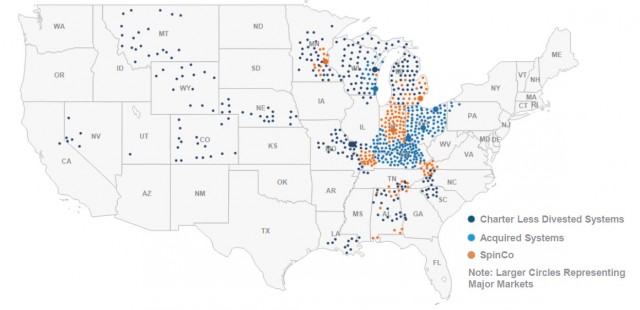

Comcast and Charter this week reached an agreement on how to handle the 3.9 million Time Warner Cable customers Comcast intends to spin-off to keep its total subscriber numbers at a level they believe will appease regulators. The transaction will affect Time Warner customers in the midwest the most, particularly former Insight Cable customers.

Charter Communications will say goodbye to customers in California, New England, northern Georgia, Texas, North Carolina, Oregon, Washington, Virginia and parts of Tennessee. Most of those customers will now be served by Comcast. Among the regions affected: New York, Boston, Dallas/Ft. Worth, Northern/Southern California, and Atlanta.

[flv]http://www.phillipdampier.com/video/WISN Milwaukee First Comcast Now Charter 4-28-14.flv[/flv]

WISN in Milwaukee reports Time Warner Cable customers there were just getting used to the idea of Comcast and they are not happy service will be provided by Charter Communications instead. (2:03)

Comcast and Time Warner Cable will in turn give up many of its cable systems in the midwest, either transferring them to Charter or the “SpinCo” venture managed by Charter.

Charter will take over directly in Ohio, Kentucky, Wisconsin, Indiana and Alabama.

Charter will take over directly in Ohio, Kentucky, Wisconsin, Indiana and Alabama.

If you are a Comcast or Time Warner Cable customer next to a current Charter service area in Michigan, Minnesota, Indiana, Alabama, Eastern Tennessee, Kentucky or Wisconsin, chances are you will end up a subscriber of the “SpinCo” venture. That will prove a distinction without much difference to customers, because Charter will manage the day-to-day operations of the new cable company and has the right to eventually acquire it outright.

With the exception of a small handful of systems in western sections of Pennsylvania, Virginia and North Carolina, all of New England, New York, and the mid-Atlantic region will be serviced by Comcast.

With the exception of Cablevision in eastern New York, Comcast will be the dominant cable provider across New York State from Manhattan to Buffalo.

The agreement also includes a commitment by Charter to drop its opposition to the Time Warner Cable/Comcast merger.

“Today’s announcement from Comcast would, in essence, lead to the creation of a three-company cable cartel. Masquerading as subscriber divestitures, the agreement with Charter brings together the three largest cable providers, who account for 38% of cable subscribers and 45% of Internet subscribers,” the Writers Guild of America West said in a statement. “The decision of these three powerful companies to divide markets and share ownership of subscribers through a new publicly traded corporation is unprecedented and adds to the mounting evidence against the Comcast-Time Warner Cable merger.”

The transaction is expected to be tax-free and will happen in three stages:

- Asset Sale: Charter acquires systems serving around 1.4 million former TWC customers for an estimated $7.3 billion in cash;

- Asset Transfer: Charter and Comcast transfer assets in a tax-free exchange involving around 1.6 million former TWC customers and about 1.6 million Charter customers;

- Asset Spin-off: Comcast will spin-off a new entity (“SpinCo”) composed of cable systems serving around 2.5 million Comcast customers to its shareholders, with Charter acquiring close to 33% of the equity of SpinCo in exchange for 13% of the equity of a new holding company of Charter.

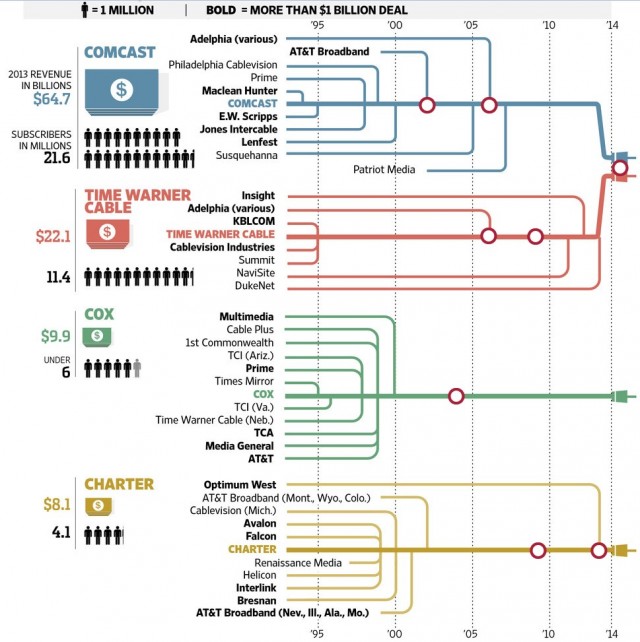

Charter Communications would become the nation’s second largest cable operator if the deal is approved, owning outright systems with an estimated 5.7 million video customers and managing an extra 2.5 million SpinCo customers, together totaling more than 8.2 million video customers.

Comcast wanted the deal done quickly so it could begin lobbying Washington and other regulators with detailed divestiture plans to keep Comcast’s total subscribers to less than 30% of the national cable market.

Although Comcast will face tough competition in Time Warner Cable territories also served by Verizon FiOS, Charter and its managed SpinCo will compete primarily with AT&T U-verse. Just 1% of Charter’s territory is expected to see competition from Verizon’s fiber network.

[flv]http://www.phillipdampier.com/video/Bloomberg Divesting Comcast Subs 4-28-14.flv[/flv]

Comcast agreed to divest 3.9 million customers to Charter Communications, potentially helping to ease the approval process for its merger with Time Warner Cable. Media Morph Chairman and Chief Strategist Shahid Khan and Bloomberg’s Paul Sweeney speaks on Bloomberg Television’s “In The Loop.” (6:23)

Subscribe

Subscribe

AT&T has approached DirecTV about a possible acquisition of the satellite provider in a deal expected to fetch at least $40 billion, spare change for AT&T’s $185 billion operation.

AT&T has approached DirecTV about a possible acquisition of the satellite provider in a deal expected to fetch at least $40 billion, spare change for AT&T’s $185 billion operation. DirecTV’s growth has fallen every year since 2010 and starting in 2013, the company began losing more subscribers than it signed up.

DirecTV’s growth has fallen every year since 2010 and starting in 2013, the company began losing more subscribers than it signed up.

If you are a Time Warner Cable customer, one of four things will happen by this time next year:

If you are a Time Warner Cable customer, one of four things will happen by this time next year:

Charter will take over directly in Ohio, Kentucky, Wisconsin, Indiana and Alabama.

Charter will take over directly in Ohio, Kentucky, Wisconsin, Indiana and Alabama.