The new owner of John Malone’s cable empire?

John Malone’s big plan for consolidating the cable industry might never see the light of day if one of the world’s largest mobile operators buys the company out from under him.

Bloomberg News is reporting Vodafone is exploring an acquisition of Liberty Global, Europe’s largest cable conglomerate.

Vodafone CEO Vittorio Colao said John Malone’s European cable empire could be a good fit for the wireless provider assuming it is for sale “for the right price.”

Liberty owns cable operators in 12 European countries including Germany, Great Britain and the Netherlands. It also own a minority share of Charter Communications in the United States and controls Sirius/XM satellite radio.

Vodafone has recently been on a buying spree in Europe, mostly using the proceeds from the sale of its minority interest in Verizon Wireless. Vodafone has bought cable companies in Spain and Germany and is looking to acquire more “fixed networks” to offload mobile traffic.

Vodafone representatives denied there was any immediate interest in a deal with Liberty, but Wall Street analysts debated the prospects of a deal nonetheless. Vodafone’s operations are larger than Liberty’s in Europe, so the wireless provider has the resources to make the deal happen if it so chooses.

But Vodafone itself may be an acquisition target. Some analysts predict AT&T will make a bid to takeover the mobile operator after it completes its acquisition of DirecTV.

Subscribe

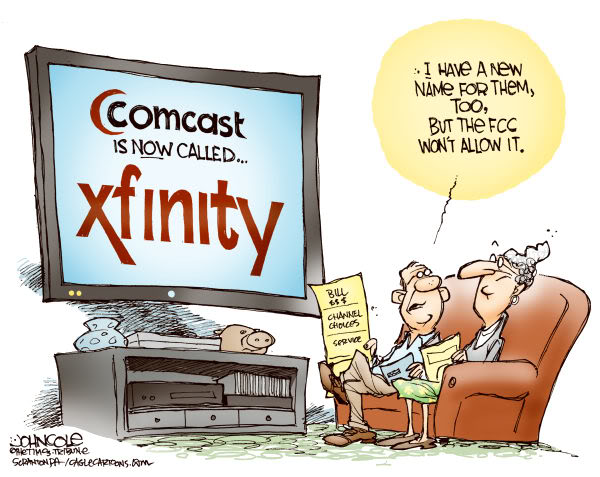

Subscribe If regulators believe they can turn Comcast and Time Warner Cable’s mega-merger into a consumer-friendly deal in the public interest, they are ignoring history.

If regulators believe they can turn Comcast and Time Warner Cable’s mega-merger into a consumer-friendly deal in the public interest, they are ignoring history.

Independent television in Great Britain

Independent television in Great Britain  John Malone’s Liberty Global is seen as a leading contender, already owning a 6.4% stake in ITV acquired from BSkyB for $824 million. Liberty Global and Discovery Networks have maintained close association and jointly bid $930 million to acquire All3Media, the production arm of reality shows like “Undercover Boss.”

John Malone’s Liberty Global is seen as a leading contender, already owning a 6.4% stake in ITV acquired from BSkyB for $824 million. Liberty Global and Discovery Networks have maintained close association and jointly bid $930 million to acquire All3Media, the production arm of reality shows like “Undercover Boss.” Zoom Telephonics, a major manufacturer of cable modems, has asked the FCC to deny the sale of certain customers to Charter Communications as a result of the merger of Comcast and Time Warner Cable because Charter enforces an unfair customer-owned cable modem policy.

Zoom Telephonics, a major manufacturer of cable modems, has asked the FCC to deny the sale of certain customers to Charter Communications as a result of the merger of Comcast and Time Warner Cable because Charter enforces an unfair customer-owned cable modem policy.