Verizon Communications will bring fiber and enhanced DSL broadband service to an additional 32,000 New Yorkers in the Hudson Valley, Long Island, and upstate as part of a multi-million dollar agreement with the New York Public Service Commission.

Verizon Communications will bring fiber and enhanced DSL broadband service to an additional 32,000 New Yorkers in the Hudson Valley, Long Island, and upstate as part of a multi-million dollar agreement with the New York Public Service Commission.

When combined with an earlier agreement, Verizon has committed to bringing rural broadband service to more than 47,000 households in its landline service area, with the state contributing $71 million in subsidies and Verizon spending $36 million of its own money.

By the end of this year, Verizon expects to introduce high-speed fiber to the home internet service to 7,000 new locations on Long Island and 4,000 in the Hudson Valley and upstate regions.

“The joint proposal strikes the appropriate balance for consumers, Verizon and its employees,” said PSC Chairman John Rhodes. “The joint proposal builds upon and expands important customer protections previously approved by the Commission and it requires Verizon to expand its fiber network and invest in its copper network, both of which will result service improvements.”

The broadband expansion agreement will include copper reliability improvements in the New York City area, where FiOS is still not available to every home and business in the city. It also includes a commitment to provide fiber-to-the-neighborhood (FTTN) service in sparsely populated areas. This will allow Verizon to introduce or enhance DSL service capable of speeds of 10 Mbps or more.

Verizon has also committed to remove at least 64,000 duplicate utility poles over the next four years around the state. Utility companies have been criticized for installing new poles without removing damaged or deteriorating older poles.

For now, neither Verizon or the PSC is providing details about where broadband service will be introduced or improved.

The state has negotiated with Verizon for more than two years to get the company to improve its legacy landline and internet services, still important in New York. Verizon has complained that with most of its landline customers long gone, it didn’t make financial sense to invest heavily in older, existing copper wire technology. But Verizon suspended expansion of its fiber to the home network in upstate New York eight years ago, leaving many customers in limbo as landline service quality declined. There are still more than two million households and businesses in New York connected to Verizon’s copper wire network.

The state says the deal will “result in the availability of higher quality, more reliable landline telephone service to currently underserved communities and will increase Verizon’s competitive presence in several economically important telecommunications markets in New York.”

The upgrades will cover landline and broadband service improvements. Verizon has no plans to restart expansion of FiOS TV service.

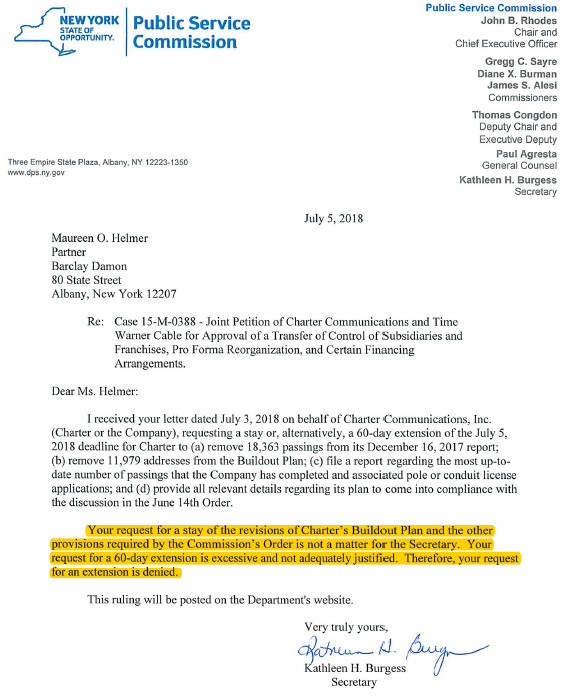

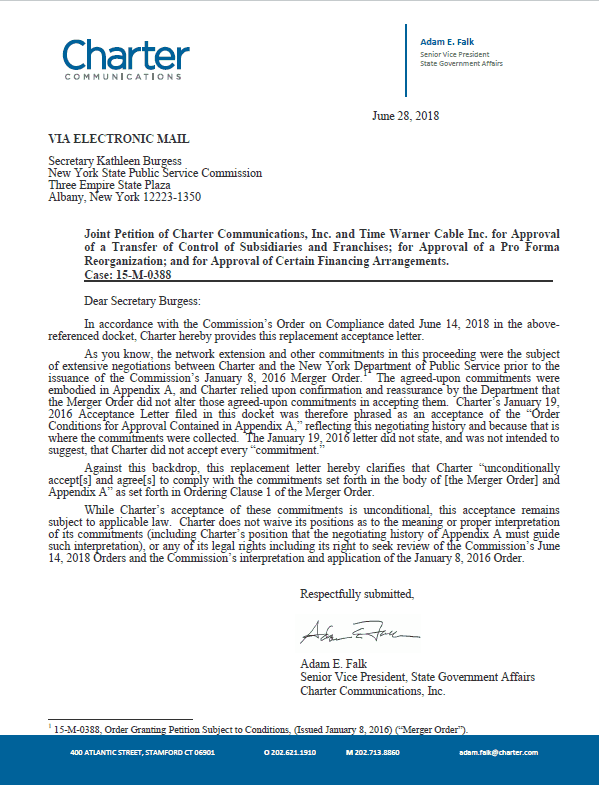

The agreement was reached as the PSC continues to threaten Charter Communications with additional fines and Spectrum cable franchise revocation for failure to meet the terms of its 2016 merger agreement with Time Warner Cable.

Subscribe

Subscribe

This isn’t going to be your parent’s HBO much longer.

This isn’t going to be your parent’s HBO much longer.

Whatever pleasantries were exchanged between Charter Communications and the New York Department of Public Service (Public Service Commission) earlier this year are now gone as the relationship between the cable company and state officials continues to deteriorate.

Whatever pleasantries were exchanged between Charter Communications and the New York Department of Public Service (Public Service Commission) earlier this year are now gone as the relationship between the cable company and state officials continues to deteriorate.