Windstream Corporation has agreed to acquire Newton, Iowa-based Iowa Telecom for $530 million in stock and cash, making it the fourth acquisition for the rural-focused Windstream in 2009. It will also take on $600 million of Iowa Telecom’s debt as part of the transaction, which caused Standard & Poors to reduce Windstream’s credit rating to junk status – BB.

Windstream Corporation has agreed to acquire Newton, Iowa-based Iowa Telecom for $530 million in stock and cash, making it the fourth acquisition for the rural-focused Windstream in 2009. It will also take on $600 million of Iowa Telecom’s debt as part of the transaction, which caused Standard & Poors to reduce Windstream’s credit rating to junk status – BB.

Like Frontier Communications, Windstream is engaged in aggressive expansion to stake out its position serving rural America. The company has spent $1.3 billion on acquisitions in just the last six months, trying to keep up with other large independent providers like Frontier and CenturyLink.

“Our whole investment thesis was to grow scale in rural America,” Windstream Chief Executive Jeff Gardner told the Wall Street Journal. “I still think there’s a great deal of consolidation left with smaller players, where the pressure is the most obvious.”

Windstream, based in Little Rock, Arkansas, serves customers in 16 states, mostly in the midwest and south. Iowa Telecom serves former GTE service areas in Iowa and Minnesota.

For employees in Newton, east of Des Moines, the purchase brings fear of significant job reductions. Iowa Telecom has 800 employees, and comments by Windstream’s Gardner suggest downsizing is forthcoming. Windstream expects $35 million in cost savings annually, and some of that will be achieved by dispensing with unneeded Iowa Telecom workers post-merger. Windstream has only promised to maintain a call center in Iowa.

[flv width=”512″ height=”308″]http://www.phillipdampier.com/video/WHO Des Moines Iowa Telecom Bought 11-25-09.flv[/flv]

WHO-TV Des Moines reported Windstream’s buyout of Iowa Telecom was like “lightning striking twice” for Newton residents, leaving an economically-challenged community in fear. (11/25/09 – 2 minutes)

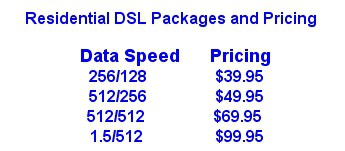

Iowa Telecom provides customers with a familiar bundle of services common among independent phone companies. As well as providing traditional wired phone lines, Iowa Telecom markets Xstream DSL at speeds up to 15Mbps in some areas, and resells DISH Network satellite service for customers looking for a video option.

Iowa Telecom provides customers with a familiar bundle of services common among independent phone companies. As well as providing traditional wired phone lines, Iowa Telecom markets Xstream DSL at speeds up to 15Mbps in some areas, and resells DISH Network satellite service for customers looking for a video option.

Windstream provides DSL service up to 12Mbps in some areas.

Before Iowa Telecom, Windstream’s earlier acquisitions included:

- D&E Communications of Pennsylvania — Windstream fetched the independent provider in a stock and cash transaction that added about 150,000 additional telephone lines to Windstream’s portfolio in Pennsylvania.

- Lexcom — Windstream picked up this Davidson County, North Carolina independent for $141 million. Lexcom needs serious technology upgrades to improve service.

- NuVox — A Greenville, South Carolina-based business services provider.

Windstream has hinted they’re not done with acquisitions yet, fueling some speculation their next targets may be Consolidated Communications, which provides service in Illinois, Pennsylvania, and Texas or Alaska Communications Systems, another business service provider.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/KCCI Des Moines Will $1.1B Iowa Telecom Sale Mean Job Losses 11-24-09.flv[/flv]

KCCI-TV Des Moines reported residents of Newton were “shocked” and “disturbed” about the Iowa Telecom buyout, because of potentially staggering layoffs to come after Windstream closes the deal. (11/24/09 – 2 minutes)

Not everyone is singing the blues about Windstream’s buyout of Iowa Telecom. Despite the transaction’s impact on Windstream’s credit rating, Wall Street has supported Windstream with a strong stock price, owing to the company’s relentless desire to deliver dividends to stockholders.

[flv]http://www.phillipdampier.com/video/CNBC Cramer on Windstream 12-7-09 1025.flv[/flv]

CNBC’s Jim Cramer loves the “massive dividends” Windstream provides to stockholders. But Cramer also issues some caveats, reminding viewers of FairPoint Communications, another former high-dividend stock… until it went bankrupt. Cramer interviews Windstream CEO Jeff Gardner about the company and the future of independent phone companies in general. (12/7/09 – 10 minutes)

[flv]http://www.phillipdampier.com/video/CNBC Windstream Profile NASDAQ 12-10-2009 222.flv[/flv]

CNBC reports on Windstream’s move to the NASDAQ and interviews CEO Jeff Gardner about the future for the telecom industry in general. (12/10/09 – 2 minutes)

Subscribe

Subscribe