(Image: Crooks and Liars)

The mother of all cable mergers between Comcast and Time Warner Cable will bring tens of millions in executive bonuses and golden parachutes, massive job losses at Time Warner, a lucrative stock buyback that will help Comcast shareholders, and a higher cable bill and usage cap for you.

Back in 2008 when Stop the Cap! started we offered this tip for rational living: When a cable company promises you it has a great deal that will save you money, grab your wallet and run. Just as the sun rises in the east, cable bills never really go down, they just keep going up.

Comcast at least admits that fact of life when discussing the “benefits” of a merger with Time Warner Cable.

“We’re certainly not promising that customer bills are going to go down or even that they’re going to increase less rapidly,” David L. Cohen, a Comcast executive vice president, said in a conference call with reporters.

Heaven forbid.

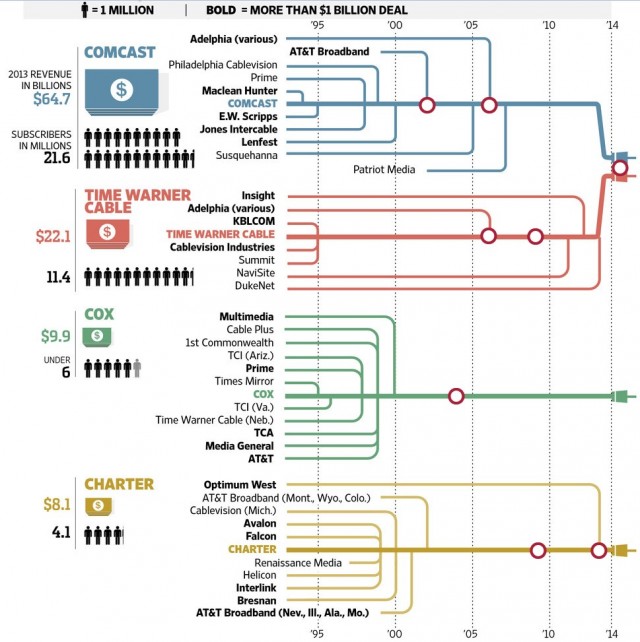

Bigger has never been better for the cable industry. As waves of consolidation reduce the number of significant cable operators from dozens to fewer than 10, cable subscribers have contributed mightily to finance the merger deals. What used to be a big basic cable bill of $20 a month will soon exceed $75, and rising. The industry has always tied itself to the value proposition that a month of cable television costs no more than a cup of coffee. In 1990, it was Maxwell House. Today it’s closer to a Starbucks Grande Latte once taxes, fees, and surcharges are included.

(Image: Mike Keefe)

The New York Times reports cable prices have grown at more than twice the rate of inflation over the last 17 years. But Comcast likes to say you are getting a lot more bang for your cable buck.

“Where we might have had 100 standard-definition channels in a package more than a decade ago, today you have 250 standard-definition channels plus 100 channels in high-definition,” Cohen told the Times. “The level of service being provided is night and day.”

According to Cohen’s way of thinking, that matters a lot more to you and I than the “Please pay this amount” at the bottom of your monthly bill.

The bountiful cornucopia that is Cohen’s idea of cable television bliss includes networks like Bonsai Xtreme, Office Supplies Network, Glidden’s Paint Dry 24/7, and… no, we’re kidding. But are TV One, Ovation, Youtoo TV, and Retirement Living TV any more compelling? You are probably paying for one or more of them now. Extra credit to customers that can even find them on their cable dial.

Time Warner Cable and Comcast carry most of the same networks, but they arrange them differently. Time Warner likes the shovel-them-all-at-you approach with one simple digital expanded cable tier. Only a handful of networks that should be on the basic lineup cost a little more and most of them are HD movie channels (and inexplicably RFD-TV, which features cattle auctions every Friday afternoon). Comcast nails their customers with a range of tiers and compels many to keep upgrading to get the networks they really want. Just ask subscribers like Thomas Howell of Seattle who was livid when Comcast moved Turner Classic Movies out of the equivalent of basic cable and put it on an enhanced basic tier that cost him an extra $18 a month.

What channels will they add next?

“The s*** they shovel on cable these days and they can’t give us one channel with good movies that aren’t loaded with sex and violence without raping us for more money?” Howell told Stop the Cap! “My wife and I took back their box and we got satellite TV instead. We don’t want to pay for the crap they keep putting on our TV, but they don’t give you much choice.”

Comcast executives are living in a parallel universe and are not listening:

“I think consumers are going to benefit from this transaction,” Cohen added. “They’re going to benefit by quality of service, by quality of offerings, by technological innovation, and I don’t believe there’s any way to argue that they’re going to be hurt from a price perspective as a result of this transaction.”

“Mr. Cohen can pay my cable bill, then,” responded Howell. “He’s obviously got the money to pay whatever Comcast is asking, if he doesn’t get it for free.”

Remarkably even some House Republicans that are normally reticent about interfering with corporate affairs are expressing concern about the deal — especially those who represent districts served by either cable company.

You’re gonna love this merger. It’s best best best!

“The proposed merger between Comcast and Time Warner Cable could have a significant impact on competition in the video and broadband marketplace,” said Virginia Republican Bob Goodlatte, the House Judiciary Committee Chairman. Comcast dominates Virginia.

Comcast and Time Warner argue they are not competitors so it will have no impact on the competitive landscape.

The argument from merger proponents is that a larger Comcast will have a stronger position to fight programmer rate increases. But Comcast has a poor record of success at its current monolithic size, with no evidence making it larger will make much difference. Even if it did, will those savings be passed on to subscribers? Cohen signals they won’t when he warns cable bills will not go down as a result of the merger. In fact, Comcast recently added a $1.50 monthly Broadcast TV surcharge to alienate local television stations in the eyes of subscribers and boost Comcast’s profits. But most will blame the cable company for the rate increase, not the local CBS station.

Consumers generally hate their local cable company, with some minor exceptions (WOW! does very well by customers, as does Verizon’s FiOS in customer rankings). Why? Because in 1995 you paid an average of $22.35 for 44 channels of basic cable. In 2012, you paid $61.63 for 150 channels, 100 or more you never watch and don’t want.

Demands for a-la-carte — pay only for the channels you want — have fallen on deaf ears for years, with nothing on the horizon to change the current pricing model. Besides, some critics warn if a-la-carte does become reality, cable companies will dramatically jack up the per channel price to protect their revenue.

Subscribe

Subscribe

John Malone’s power play for a Charter Communications’ takeover of Time Warner Cable would leave the nation’s second largest cable operator $60 billion in debt and has already cost creditors holding Time Warner Cable bonds $1.8 billion in value as markets react to the rumors of a leveraged buyout.

John Malone’s power play for a Charter Communications’ takeover of Time Warner Cable would leave the nation’s second largest cable operator $60 billion in debt and has already cost creditors holding Time Warner Cable bonds $1.8 billion in value as markets react to the rumors of a leveraged buyout.