...some of that juicy 700MHz spectrum Verizon is getting from the nation's biggest cable companies.

In an ironic turnabout, Deutsche Telekom’s T-Mobile USA, last year an acquisition target of AT&T, has filed comments with the Federal Communications Commission opposing Verizon’s spectrum purchase from the nation’s largest cable companies as “contrary to the public interest.”

Verizon Wireless is seeking to acquire a substantial block of unused AWS spectrum that is unlikely to provide any near-term benefits to Verizon Wireless customers (indeed, the company already holds other AWS spectrum and has not even put it to use yet). Rather, the principal impact of the acquisition would be to foreclose the possibility that this spectrum could be acquired by smaller competitors – such as T-Mobile – who would use it more quickly, more intensively, and more efficiently than Verizon Wireless. The acquisitions will limit the deployment of LTE by competitors of Verizon Wireless and the bandwidth available for such deployments.

If these transactions go forward, the end result will be less LTE capacity available overall and reduced competition in the provision of LTE, which would be contrary to the public interest.

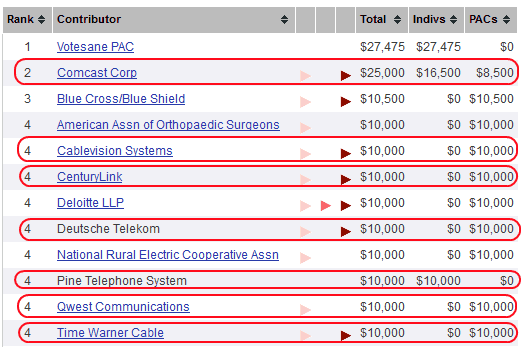

T-Mobile, in particular, is upset because it owns no spectrum in the valuable 700MHz range — frequencies that can travel longer distances and easily penetrate buildings. Verizon Wireless does, and will acquire much more if the FCC approves the deal to transfer spectrum from Comcast, Time Warner Cable, and Cox. [Correction: As one of our readers pointed out, the spectrum being acquired is in the AWS band, which T-Mobile argues in its filing is still suitable for a 4G network deployment.] T-Mobile argues Verizon does not need the spectrum, and will effectively “warehouse” the frequencies to keep them off the open market. Without prime spectrum, T-Mobile argues, it will be difficult for the company to deliver a 4G experience to its customers.

T-Mobile also has a bone to pick with Verizon Wireless and the cable industry over what it suspects is a non-compete agreement:

At least in effect, this has all the hallmarks of a pure horizontal allocation of markets.

From the limited information available, it appears as though Verizon, the majority owner of Verizon Wireless, has agreed (tacitly if not expressly) to halt its extensive efforts to expand into the cable business and the cable companies have, in turn, traded their control of valuable spectrum in exchange for this protection of their cable markets.

It has been publicly reported that, coincident with acquiring the cable companies’ spectrum, thereby eliminating potential new competition in mobile wireless, Verizon ended its FiOS build out plans and terminated its agreement to resell satellite television. This series of acts appears to limit Verizon’s activity as a potential competitor in the video market and limit the cable companies’ role as potential competitors in the wireless market, while at the same time foreclosing competing providers from one of the only available sources of spectrum.

As a result of this “triple play,” competition in both markets will be substantially reduced. The antitrust laws have long condemned such agreements, even among potential competitors.

Not All Frequencies Are Created Equal

| USA Carrier |

Voice Frequencies (MHz) |

3G |

4G |

Notes |

| AT&T |

850 / 1900 |

850 / 1900 |

700 |

Will turn over limited frequencies to T-Mobile as per failed merger agreement. |

| Metro PCS |

1900 / AWS |

1900 / AWS |

AWS |

Provides limited service, targeting urban markets. |

| Sprint |

1900 |

1900 |

2500 |

Sprint and its partner Clearwire have some of the least valuable spectrum. |

| T-Mobile |

1900 |

AWS/(1900(limited)) |

AWS/(1900(limited)) |

T-Mobile’s network was built from acquisitions like VoiceStream and Omnipoint. |

| Verizon |

850 / 1900 |

850 / 1900 |

700 |

Has used 700MHz to effectively deploy the largest 4G/LTE network to date. |

Will Verizon ultimately warehouse its newest acquired spectrum?

Unless you are well-acquainted with the wireless industry, all most people know about their cell phones is that they turn them on and a signal strength meter indicates what kind of reception quality you are getting. In fact, wireless companies use a range of frequencies across several different frequency bands to handle voice calls and data. As an end user, you never know the difference. But if your wireless company is forced to use higher frequencies, they often have a harder time penetrating buildings or provide only limited distance coverage. That’s why AT&T and Verizon customers have a better chance of making and receiving calls in the middle of a supermarket or office building while others lose reception.

Clearwire has an extensive holding of very high frequencies at its disposal — frequencies the company cannot effectively use because they require considerably more infrastructure (ie. more cell towers) to provide an effective service to customers. Clearwire customers already complain about poor reception inside buildings, a problem exacerbated by the very high frequencies the company has to use for its service. Verizon and AT&T collectively control the majority of the best, more robust spectrum — the 700MHz band. Verizon’s LTE network, for example, relies on spectrum that used to be used by high numbered UHF television channels.

Companies like T-Mobile rely on frequencies in the 1700MHz and 1900MHz bands. While certainly adequate in urban and suburban areas, T-Mobile has to spend more on cell tower deployment and be especially concerned with rural coverage, especially in areas where the terrain makes “line of sight” reception from cell towers more difficult.

While today’s 2G and 3G networks have made due with current spectrum, companies like T-Mobile are having a hard time finding space to launch the next generation — LTE/4G technology — on their current spectrum. Without LTE, T-Mobile (and others) will find themselves at a competitive disadvantage. The company argues it should have the right to acquire some of the frequencies Verizon intends to capture from the cable industry, especially if Verizon has no immediate plans to use the spectrum.

Some of the wrangling by T-Mobile seems especially ironic because parent company Deutsche Telekom has indicated it wants to sell T-Mobile USA and leave the American wireless market. It has shown little interest so far investing in a LTE/4G network upgrade. Additionally, as part of AT&T’s failed merger bid, T-Mobile is expecting to receive frequencies from AT&T as part of the “failed transaction” clause in the original merger proposal.

Subscribe

Subscribe