Canada’s effort to expand mobile competition has likely failed with news that three of the most significant new independent entrants have put themselves up for sale, with one likely to be acquired by Telus, western Canada’s largest phone company.

Canada’s effort to expand mobile competition has likely failed with news that three of the most significant new independent entrants have put themselves up for sale, with one likely to be acquired by Telus, western Canada’s largest phone company.

With Bell Canada, Rogers Communications, and Telus dominating at least 90 percent of Canada’s wireless marketplace, breaking up the triopoly was unlikely to be easy, but three of Canada’s newest players that acquired spectrum just five years ago are already looking for exit strategies.

Bloomberg News reported Friday that Mobilicity is in talks to be imminently acquired by Telus for between $350-400 million. Public Mobile has hired investment bankers to find a buyer. Vimpelcom, Ltd., which owns Wind Mobile, announced it was “exploring its options, including divestment.”

The three companies have competed with the dominant players for about three years with little success. Combined, the three have not managed to achieve even a combined 10 percent market share. Most sell unlimited talk and text plans to customers that would normally buy prepaid service.

The three companies have competed with the dominant players for about three years with little success. Combined, the three have not managed to achieve even a combined 10 percent market share. Most sell unlimited talk and text plans to customers that would normally buy prepaid service.

Potentially slowing any sale is a requirement that none of the independent companies can transfer their spectrum licenses until 2014, a condition of the 2008 special spectrum auction that reserved prime frequencies for new competitors and put them off-limits to larger mobile companies.

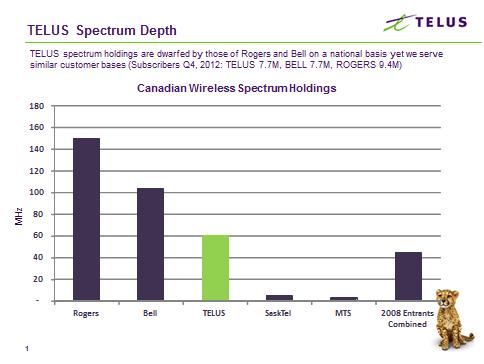

Telus remains the most likely suitor of independent providers because the company lacks the spectrum assets of its larger competitors Bell and Rogers.

Mobilicity operates its HSPA+ “4G” network on Advanced Wireless Services (AWS) frequencies in the 1,700MHz range. Although Telus has considerable spectrum in British Columbia and Alberta — its home territory — the provider has considerably less in eastern Canada, particularly in large metropolitan cities. Mobilicity has a tiny market share in the Greater Toronto Area, yet its AWS spectrum equals that of Telus in the city. Telus could find an acquisition of Mobilicity the easiest way to bolster its available spectrum for future 4G deployment and expansion.

Three small independent wireless providers hold almost as much combined spectrum as Telus holds today.

Any exit of a combination of Canada’s newest wireless players will likely be seen as a failure of the government’s efforts to bolster competition. The dominance among the three largest providers has left Canadians with high-cost plans and a wireless service contract that lasts one year longer than America’s standard two-year service agreement.

Industry Canada, the economic regulator fostering a growing, competitive and knowledge-based Canadian economy, had little to say about the news.

“Any transaction that requires regulatory approval will be considered accordingly,” said Alexandra Fortier, a spokeswoman for Industry Minister Christian Paradis. “We cannot comment on speculation.”

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/BNN Canadas newest wireless players seek buyers 4-12-13.flv[/flv]

BNN reports industry consolidation is likely forthcoming in Canada’s wireless marketplace as Telus seeks to acquire independent provider Mobilicity. A financial analyst says the move is designed to curb budget-priced wireless service in Canada. Mobilicity would likely eventually be merged into Telus-owned Koodo Mobile, the company’s prepaid mobile division. (5 minutes)

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Globe and Mail Feds aim to open up wireless market 3-13.flv[/flv]

Too little, too late? Industry Minister Christian Paradis says the Harper government wants to open up the wireless market to more players with another wireless spectrum auction. But now several of Canada’s newest independent providers are all up for sale, and the country’s dominant three may end up owning one or more of them. (2 minutes)

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Globe and Mail Market View Why we love to hate our wireless companies 3-13.flv[/flv]

The Toronto Globe & Mail explores why Canadians hate their cell phone and mobile broadband providers so much. (2 minutes)

Subscribe

Subscribe Shaw Communications has acquired Calgary’s largest fiber optic cable network in a $225 million deal with ENMAX Corp. in a bid to strengthen its ability to serve large corporate customers who need more bandwidth than Shaw is now positioned to offer.

Shaw Communications has acquired Calgary’s largest fiber optic cable network in a $225 million deal with ENMAX Corp. in a bid to strengthen its ability to serve large corporate customers who need more bandwidth than Shaw is now positioned to offer. Corr’s coverage area has not been a priority for larger carriers like Verizon Wireless and AT&T. The acquisition, which includes multiple PCS and 700MHz “C-Block” licenses, will bolster AT&T’s weak coverage in the region, which includes Huntsville, Oneonta, Decatur, Cullman, Hartselle, and Arab, Ala.

Corr’s coverage area has not been a priority for larger carriers like Verizon Wireless and AT&T. The acquisition, which includes multiple PCS and 700MHz “C-Block” licenses, will bolster AT&T’s weak coverage in the region, which includes Huntsville, Oneonta, Decatur, Cullman, Hartselle, and Arab, Ala. A Financial Times blog post has started a buying frenzy for Vodafone Group Plc on news AT&T and Verizon Communications are about to bid for the British mobile phone giant, despite denials from Verizon it is involved in any deal to acquire the British mobile phone company.

A Financial Times blog post has started a buying frenzy for Vodafone Group Plc on news AT&T and Verizon Communications are about to bid for the British mobile phone giant, despite denials from Verizon it is involved in any deal to acquire the British mobile phone company. The sources told the Times they expect the deal will initially merge Vodafone and Verizon into a single entity, but only briefly. Verizon would promptly sell Vodafone’s extensive international assets to AT&T at a premium. Verizon would end up the sole owner of Verizon Wireless, and AT&T would acquire Vodafone’s enormous wireless operations in Europe, Asia, Africa and the Middle East.

The sources told the Times they expect the deal will initially merge Vodafone and Verizon into a single entity, but only briefly. Verizon would promptly sell Vodafone’s extensive international assets to AT&T at a premium. Verizon would end up the sole owner of Verizon Wireless, and AT&T would acquire Vodafone’s enormous wireless operations in Europe, Asia, Africa and the Middle East. Windstream has announced the increased broadband investments that expanded DSL service to about 75,000 more homes and businesses and brought fiber connections to cell towers are nearly complete and the company intends to dramatically cut spending on further enhancements by the end of 2013.

Windstream has announced the increased broadband investments that expanded DSL service to about 75,000 more homes and businesses and brought fiber connections to cell towers are nearly complete and the company intends to dramatically cut spending on further enhancements by the end of 2013. “We expect to substantially complete our capital investments related to fiber to the tower projects, reaching 4,500 towers by the end of 2013,” said Gardner. “In addition, we will finish most of our broadband stimulus initiatives […] to roughly 75,000 new households. As we exit 2013, we will see capital spending related to these projects decrease substantially.”

“We expect to substantially complete our capital investments related to fiber to the tower projects, reaching 4,500 towers by the end of 2013,” said Gardner. “In addition, we will finish most of our broadband stimulus initiatives […] to roughly 75,000 new households. As we exit 2013, we will see capital spending related to these projects decrease substantially.”