Requiring Frontier Communications to increase broadband speeds could make the service unaffordable for rural and poor Americans, the company is arguing before federal and state regulators.

Requiring Frontier Communications to increase broadband speeds could make the service unaffordable for rural and poor Americans, the company is arguing before federal and state regulators.

In separate filings with the New York Public Service Commission and the Federal Communications Commission, Frontier has asked both for further deregulation and less oversight to ease everything from minimum broadband speed definitions to video franchising regulations.

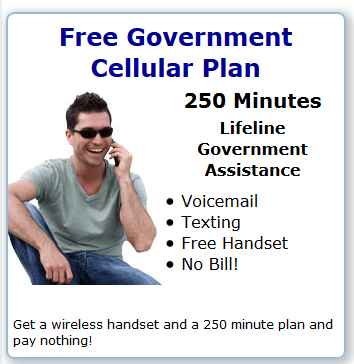

Frontier’s market focus is primarily on rural communities where it delivers traditional DSL broadband service, typically up to 6Mbps, although many customers complain they get lower speeds than advertised. The FCC is working to modernize the Lifeline program, which offers substantial discounts on basic telephone service to low-income Americans. The Commission is studying the possibility of requiring providers to offer Lifeline Internet access for the first time. What worries Frontier is the Commission’s proposed requirement that providers offer Lifeline Internet speeds starting at 10/1Mbps, something Frontier strongly opposes.

Frontier’s ability to deliver consistent 10Mbps service in rural areas is the issue.

Frontier’s ability to deliver consistent 10Mbps service in rural areas is the issue.

“Certain rural consumers […] may not currently have access to 10/1Mbps fixed Internet speeds and would thus be prevented from choosing to use Lifeline for a fixed Internet service,” Frontier wrote in its filing with the Commission. “Even if higher speeds are available, a minimum speed standard may prevent a customer from opting for a lower speed plan that may better meet their budget.”

Frontier told the Commission that most subscribers are happy buying 6Mbps service from Frontier, coincidentally the same speed it advertises as widely available across its service areas. Frontier argues if it was required to consistently provide 10Mbps service, the cost of the service may become unaffordable to many.

While Frontier argues against speed standards that are difficult for its aging copper-based network to consistently provide, it is using that same copper network as an argument against further regulation and oversight in New York.

“Traditional telephone service providers like Frontier continue to be legitimate and viable competitors in the marketplace—a testament to our tenacity and the quality of our services,” Frontier wrote in comments to the Public Service Commission. “To ensure that this continues to be the case, in the near-term, an immediate no-cost investment that the State can make in the existing copper-based network is to eliminate the regulatory requirements that apply to [traditional phone companies] but that do not apply to other telecommunications providers.

Frontier added, “consumers have a multitude of communications channels available to them including wireline and wireless voice services and wireline, wireless, cable and satellite broadband services.”

Frontier did West Virginia few favors when it took over Verizon’s landline business in the state.

Ironically, Frontier argued New York’s allegedly robust and fast broadband networks (offered by its competitors but usually not itself) are reason enough to support a “light regulatory touch.”

“Today, every municipality in New York has access to one or more wired or wireless networks that can provide voice, video and data services to residents and businesses,” Frontier claimed. “Over 95% of the state has access to the FCC benchmark speed of 25/3 Mbps and 98% of the State has 200kbps speed in at least one direction. New York’s broadband speeds are significantly faster than the national average and other countries.”

But Frontier failed to mention it is incapable of providing consistent access at or above the FCC benchmark speed because it still relies on a antiquated copper-based network throughout most of its New York service areas. Despite Frontier’s claims of offering quality service, the J.D. Power U.S. Residential Telephone Service Provider Satisfaction Study (2015) ranks Frontier dead last among all significant providers in the eastern U.S. It dropped Frontier this year from consideration for its Internet Provider Satisfaction Study, but a year earlier rated Frontier the worst ISP in the eastern U.S.

Although Frontier suggests it faces “robust competition” from “over 100 different broadband providers, especially at lower speeds,” in most of its service areas in New York it faces Time Warner Cable or no competitor at all.

Frontier’s latest defense over why it has failed to significantly upgrade its network infrastructure to remain competitive with cable is ‘customers don’t want or need faster speeds.’ While advertising lightning fast service on its acquired Verizon FiOS and AT&T U-verse networks, Frontier argues New York regulators “must keep in mind the consumer demands on broadband speeds.”

Frontier points to two rural broadband projects in New York, one in Hamilton County and the other in Warren County to make its speed argument (emphasis ours):

“These projects are examples of the importance of collaboration and innovation—rather than dogmatic adherence to performance requirements that are largely aspirational for many NYS citizen—in bringing high quality and transformative broadband access to unserved and underserved communities. Flexibility with regard to technology and broadband speed will enhance an already robust marketplace and result in greater affordability and access.”

Frontier has also told New York officials it wants to eliminate local oversight of video franchising and move New York to a “statewide video franchising” system to “promote competition and to streamline competitive entry into the video market in the state.”

“This will provide enhanced consumer choice as well as additional investment in broadband and video services,” Frontier argued. “In other states that have followed this model, such as Connecticut, consumers have a rich array of video providers and services from which to choose at competitive prices.”

That “rich array of video providers” in Connecticut is primarily Cablevision and Frontier. Frontier acquired a pre-existing U-verse network originally owned and operated by AT&T in the state.

Subscribe

Subscribe As a consequence of reclassifying broadband as a utility service to protect Net Neutrality, the FCC may have

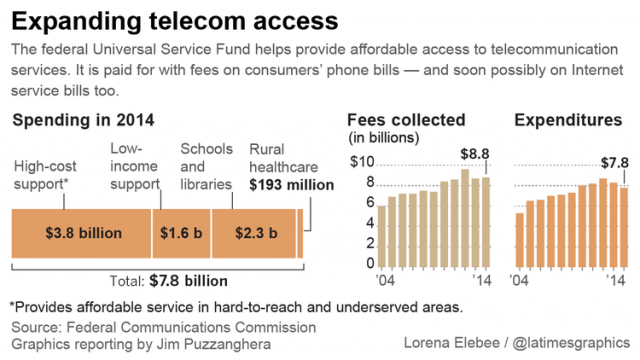

As a consequence of reclassifying broadband as a utility service to protect Net Neutrality, the FCC may have  The fund has increasingly shifted towards Internet connectivity and service, but only telephone customers now pay a USF surcharge on their bill.

The fund has increasingly shifted towards Internet connectivity and service, but only telephone customers now pay a USF surcharge on their bill.

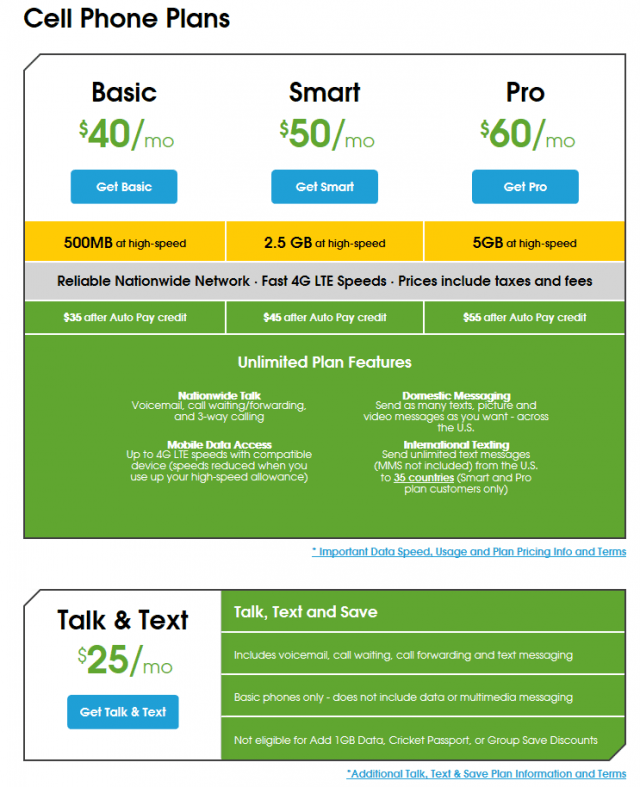

Cricket’s data plans do not carry automatic overlimit charges. Instead, your data connection is throttled to 128kbps until your billing period resets. Customers can buy an extra gigabyte of data at any time for $10.

Cricket’s data plans do not carry automatic overlimit charges. Instead, your data connection is throttled to 128kbps until your billing period resets. Customers can buy an extra gigabyte of data at any time for $10.

The case illustrated several ostensibly-independent companies were created to market service across Alabama, Arkansas, Florida, Georgia, Indiana, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Missouri, North Carolina, Ohio, Oklahoma, South Carolina, Tennessee, Texas, and Wisconsin. Many had ties back to AMTS management. Despite the Florida settlement, the firms continued to do business in multiple states. Many of the states involved have deregulated the telephone business and have cut staff at state agencies tasked with oversight issues.

The case illustrated several ostensibly-independent companies were created to market service across Alabama, Arkansas, Florida, Georgia, Indiana, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Missouri, North Carolina, Ohio, Oklahoma, South Carolina, Tennessee, Texas, and Wisconsin. Many had ties back to AMTS management. Despite the Florida settlement, the firms continued to do business in multiple states. Many of the states involved have deregulated the telephone business and have cut staff at state agencies tasked with oversight issues. Last week, government agents seized the vehicles from Biddix’s Melbourne-based pawn shop, Outdoor Gun and Pawn.

Last week, government agents seized the vehicles from Biddix’s Melbourne-based pawn shop, Outdoor Gun and Pawn.

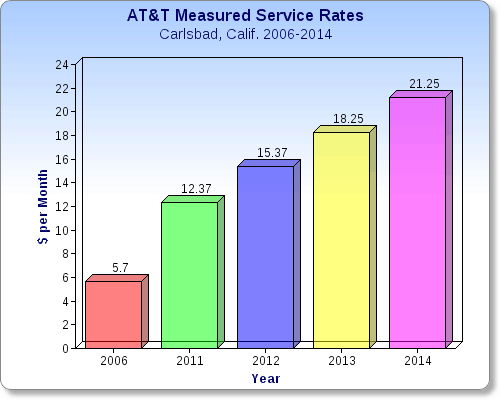

Stop the Cap! reader Steve L. has heard enough of AT&T’s promises that deregulation would bring more competition and better deals to Californians.

Stop the Cap! reader Steve L. has heard enough of AT&T’s promises that deregulation would bring more competition and better deals to Californians. “After surcharges, fees, and taxes, my bill will be nearly $30 per month for measured rate service, representing a near doubling of cost in just a 22-month period,” Steve writes. “I have no other choice than AT&T for a true powered landline, but I am rejecting this latest increase and plan to test and move to a VoIP system.”

“After surcharges, fees, and taxes, my bill will be nearly $30 per month for measured rate service, representing a near doubling of cost in just a 22-month period,” Steve writes. “I have no other choice than AT&T for a true powered landline, but I am rejecting this latest increase and plan to test and move to a VoIP system.” AT&T’s rates have shot up as much as 222 percent for the average Californian’s measured rate phone service. Some customers, including our reader, found rates nearly three times higher than they were before deregulation. In the last few years, AT&T has increased prices on landline service and calling features even more dramatically across the state:

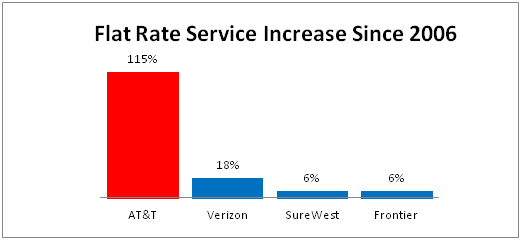

AT&T’s rates have shot up as much as 222 percent for the average Californian’s measured rate phone service. Some customers, including our reader, found rates nearly three times higher than they were before deregulation. In the last few years, AT&T has increased prices on landline service and calling features even more dramatically across the state: AT&T defends the increases by suggesting rates were artificially restrained by rate regulators under the old system, and the new higher prices reflect economic reality and the deregulated marketplace. But AT&T’s rate increases have blown past other service providers in the state. Verizon’s flat rate service only increased 18 percent since deregulation. Independent providers SureWest and Frontier Communications have only raised prices by about six percent.

AT&T defends the increases by suggesting rates were artificially restrained by rate regulators under the old system, and the new higher prices reflect economic reality and the deregulated marketplace. But AT&T’s rate increases have blown past other service providers in the state. Verizon’s flat rate service only increased 18 percent since deregulation. Independent providers SureWest and Frontier Communications have only raised prices by about six percent.