AT&T has laid off more than 16,000 employees since 2011, eliminating thousands of customer service positions while transferring others to cheap offshore call centers where some employees earn less than $2 an hour.

AT&T has laid off more than 16,000 employees since 2011, eliminating thousands of customer service positions while transferring others to cheap offshore call centers where some employees earn less than $2 an hour.

The company is rapidly closing call centers and consolidating others in hopes of wringing “deal synergies and cost savings” out of its operations, including DirecTV, acquired by AT&T in 2015.

Altogether, AT&T has closed 44 call centers, according to the Communications Workers of America (CWA), over the last seven years. Four call centers have been closed so far this year, including one in Harrisburg, Pa., that cost 101 jobs, some employed for over a decade. Many other call centers are being radically downsized, but have not yet been closed.

Betsy LaFontaine, a 30-year veteran at an AT&T call center in Appleton, Wisc. told The Guardian her call center has been slashed from 500 employees to less than 30 today.

“They’re liquidating us,” LaFontaine said. “This is not a poor company. On the shoulders of all its employees, we’ve made the company extremely profitable.”

AT&T took over this DirecTV call center.

While workers in Pennsylvania were offered new jobs if they were willing to move… to Kentucky, other workers would have to be willing to move overseas to keep a job with AT&T. As a cost saving measure, AT&T is offshoring an increasing amount of its customer service operation to India, Mexico, and the Philippines where it pays some English-challenged workers less than $2 an hour.

The savings from layoffs and offshoring are helping AT&T buy back shares of its own stock to help investors grow their stock portfolio’s value. The company has spent $16.45 billion on buybacks since 2013, including $419 million in the second quarter of 2018, the most AT&T has spent on buybacks since 2014.

AT&T has also banked at least $20 billion in savings from the Trump Administration’s corporate tax reform program. CEO Randall Stephenson was among the country’s biggest backers of the Trump tax cut program and was a principal member of the Business Roundtable lobbying group, which heavily lobbied Republicans to pass the measure.

According to the Institute on Taxation and Economic Policy, AT&T actually paid an effective tax rate of just 8 percent between 2008 and 2015, despite recording a profit in the United States each year, by exploiting tax breaks and loopholes. But the thought of paying even less was appealing to Stephenson.

When the measure passed, AT&T’s chief financial officer John Stephens shared the good news with shareholders.

“With the passage of tax reform, we see a significant boost to our balance sheet, reducing $20 billion of liabilities and increasing shareholder equity by a like amount,” Stephens said.

Stephenson

AT&T promised if the Trump Administration passed tax cuts and reduced the corporate tax rate to around 20%, AT&T would create 7,000 new middle class jobs paying $70,000-80,000/year. The CWA argues AT&T instead laid off an estimated 7,000 workers. AT&T disputes this, claiming the company hired 8,000 new employees in the United States so far this year and 87,000 over the past three years. AT&T also claims it promised to pay $1,000 bonuses to 200,000 employees over the next year, tied to the tax cuts. In fact, AT&T’s unions negotiated the bonuses with AT&T before the Trump Administration’s tax reform was passed.

For AT&T employees, mass layoffs come without warning. Managers at the Cleveland call center repeatedly calmed employees that its call center, open for decades, was not targeted for closure. Until it was in 2011. Most employees were laid off or offered positions in Detroit, a city two hours away.

Employees feel insecure, despite recruitment campaigns that stress AT&T is a company where stability is part of the job. In reality, an out-of-state executive can decide to close call centers and other AT&T facilities without ever having to face the employees being laid off. Many of those laid off face the prospect of competing in job markets where single, younger employees are willing to accept much less and do not have the same financial obligations veteran AT&T workers have to their families.

AT&T has increased investment in network upgrades with some of its tax savings, but much of that work is farmed out to third-party contractors. AT&T’s much larger investment is in mergers and acquisitions, acquiring Time Warner (Entertainment), Inc., for $85 billion.

Critics of the tax cut plan predicted the money would be spent on almost everything but job creation and investment.

“They can either create new jobs and capex for expansion or they can create greater shareholder wealth through dividends and stock buybacks. There are some other issues to consider, but that’s the main line of reasoning why corporate tax cuts incentivize buybacks and dividends,” Fran Reed, regulatory strategist at FactSet told US News & World Report.

A typical job offer to work in an AT&T call center. Starting salary is $22,880. Maximum pay is $37,518.

History tells the rest of the story. In 2004, a one-time tax holiday to repatriate foreign earnings temporarily cut tax rates from 35% of 5.25%.

“The primary use of the repatriated funds was to increase shareholder payouts, particularly stock buybacks, rather than increase firm investments such as capital expenditures, research and development spending,” said Stephen J. Lusch, associate professor of accounting at the University of Kansas.

In 2011, the Senate Permanent Subcommittee on Investigations found the 2004 tax break did not deliver the promised benefits of increased employment and investment. In fact, the largest recipients of the tax break downsized and collectively fired more than 20,000 employees, while enriching shareholders and executives:

U.S. Jobs Lost Rather Than Gained. After repatriating over $150 billion under the 2004 American Jobs Creation Act (AJCA), the top 15 repatriating corporations reduced their overall U.S. workforce by 20,931 jobs, while broad-based studies of all 840 repatriating corporations found no evidence that repatriated funds increased overall U.S. employment.

Research and Development Expenditures Did Not Accelerate. After repatriating over $150 billion, the 15 top repatriating corporations showed slight decreases in the pace of their U.S. research and development expenditures, while broad-based studies of all 840 repatriating corporations found no evidence that repatriation funds increased overall U.S. research and development outlays.

Stock Repurchases Increased After Repatriation. Despite a prohibition on using repatriated funds for stock repurchases, the top 15 repatriating corporations accelerated their spending on stock buybacks after repatriation, increasing them 16% from 2004 to 2005, and 38% from 2005 to 2006, while a broad-based study of all 840 repatriating corporations estimated that each extra dollar of repatriated cash was associated with an increase of between 60 and 92 cents in payouts to shareholders.

Executive Compensation Increased After Repatriation. Despite a prohibition on using repatriated funds for executive compensation, after repatriating over $150 billion, annual compensation for the top five executives at the top 15 repatriating corporations jumped 27% from 2004 to 2005, and another 30%, from 2005 to 2006, with ten of the corporations issuing restricted stock awards of $1 million or more to senior executives.

Verizon Communications is on track to gradually cut up to a quarter of its workforce, and has now offered 44,000 employees “voluntary severance” packages, while also outsourcing many information technology jobs to India’s Infosys, Ltd., in a deal worth an estimated $700 million.

Verizon Communications is on track to gradually cut up to a quarter of its workforce, and has now offered 44,000 employees “voluntary severance” packages, while also outsourcing many information technology jobs to India’s Infosys, Ltd., in a deal worth an estimated $700 million.

Subscribe

Subscribe News 12 The Bronx/Brooklyn (shared studios/talent, but branded individually to each borough)

News 12 The Bronx/Brooklyn (shared studios/talent, but branded individually to each borough)

AT&T has laid off more than 16,000 employees since 2011, eliminating thousands of customer service positions while transferring others to cheap offshore call centers where some employees earn less than $2 an hour.

AT&T has laid off more than 16,000 employees since 2011, eliminating thousands of customer service positions while transferring others to cheap offshore call centers where some employees earn less than $2 an hour.

T-Mobile USA and Sprint

T-Mobile USA and Sprint

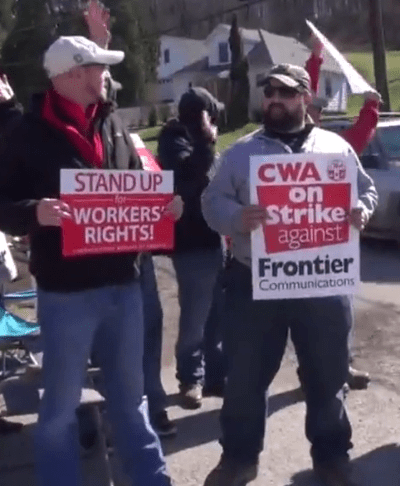

After 10 months of negotiations between Frontier Communications and the Communications Workers of America (CWA) over the phone company’s job cuts, 1,400 Frontier workers in West Virginia and Ashburn, Va.,

After 10 months of negotiations between Frontier Communications and the Communications Workers of America (CWA) over the phone company’s job cuts, 1,400 Frontier workers in West Virginia and Ashburn, Va.,