Perhaps the RV tour can also help customers cope with unauthorized cramming charges greeting many ex-Verizon customers on their first Frontier bills

Frontier Communications has themselves an RV and they’re sending it on a “Great Conversations Tour” with their newest customers in Ohio, Illinois, and Wisconsin. The company tweeted its intention to visit “10 Cities, 7 Executives, 5 Days, 3 States,” all in one recreational vehicle.

On the agenda are promises the company intends to deliver their version of broadband to a larger number of customers.

“On average, these properties that we purchased from Verizon had 62 percent broadband accessibility, and we will be looking to take that to 85 percent in two years,” says John Lass, president of Frontier’s Central Region. “In our current properties, we are averaging 92 percent broadband accessibility.”

The broadband most of those customers will end up with will range from 1-3Mbps in rural areas, perhaps up to 6Mbps in more urban ex-Verizon service areas, but everything is dependent on the quality of the lines Frontier has to work with.

That increasingly poses problems for the company, who had to cope with yet another major service outage in Illinois — the second in a month, that knocked out phone and emergency services for 28,000 residents across eight counties in central and northwestern Illinois.

The landline service failure, originally thought to be a fiber cable cut, turned out to be a hardware failure in the company’s central office in the village of McLean. The impact was immediate as cell phone customers could not reach Frontier lines and Frontier customers in many areas could not make long distance calls or reach 911.

Peoria’s Journal-Star reported businesses were particularly impacted by the outage:

Carol Hamilton, Washington Chamber of Commerce executive director, said city business owners reported problems making landline-to-cell phone and cell phone-to-landline calls. Landline-to-landline calls were going through.

“We actually started hearing about the phone problems Wednesday,” Hamilton said. “People were getting a busy signal, or were told the number they were calling was out of order when they tried to make a call. The problem didn’t affect our office until Thursday morning.”

Frontier’s equipment failure also knocked out the Logan County computer system, and the Woodford County Sheriff’s Department computer system. Residents in those counties were instructed to call Illinois State Police posts in Springfield and Metamora for emergencies.

One local resident noted this is why he doesn’t have a landline anymore.

Since Frontier can gas up its RV and tour the countryside, Stop the Cap! can take you on a virtual RV tour of our own to visit with some disgruntled Frontier customers. Our first stop…

Unauthorized Bill Cramming Plague Leads to Lawsuit Against Frontier

Hal Greene was reviewing his monthly Frontier phone bills when he discovered his monthly charges shot up from $230 to $290. The Pine Bush, N.Y., resident found $39.95 charges on each of this bills for something called “Enhance SVCS Billing Inc Long Distance Calls … IBA-Services.” He had no idea what that charge was for, and he knew he didn’t authorize it.

The Times Herald-Record picks up the story:

He called the company, Enhanced Services Billing Inc., but the company wouldn’t refund his money. He called the phone company, Frontier, which blocked the charges moving forward, but Greene never got a refund.

He went online to research the company, and found countless complaints from other consumers about ESBI, an aggregator that purports to bill for services provided by third parties.

Greene also found the contact information for a law firm, Giskan Solotaroff Anderson & Stewart in Manhattan, that was looking into the company. He called and became the named plaintiff in a class action lawsuit against Frontier and ESBI.

“I was very angry because it was so surreptitious the way they snuck that charge in there, and they’re just kind of counting on stealthing it into the bill without you noticing,” Greene said.

The suit alleges that the defendants know they are collecting charges customers didn’t authorize. It seeks monetary and compensatory damages, attorneys’ fees and further relief “as equity and justice may require.”

Representatives of ESBI and parent company BSG Clearing declined to comment. Frontier also would not comment, said spokeswoman Brigid Smith.

Greene is a classic victim of bill cramming, a practice where phone companies allow third parties to bill for services on their phone bills, in return getting a major cut of the action.

Most customers find themselves victims of cramming when they complete “surveys” or sign up for free trials of unrelated services. Other victims purchase products from websites that offer future discounts just for “previewing” shopping clubs or credit monitoring services. Even obtaining a “free reward” like a magazine subscription, ringtone, or avatar image for use on a social networking website could come with a very expensive “gotcha” on your landline or mobile bill a month later.

IBA charged Greene $40 a month for dial-up Internet access and other services of dubious value.

In Greene’s case, his “gotcha” was IBA Services — Internet Business Advisors, which offers a very dubious package of dial-up Internet, web hosting, and discounts at office supply stores. For that, customers pay $20-40 or more per month. Greene was paying for it across multiple phone bills, each with their own charges.

IBA Services is an example of how anyone can set up a business and use billing services like ESBI to sit back and wait for the checks to arrive. Unfortunately, too often those charges are unauthorized and crammed onto phone bills. Critics charge phone companies have a financial incentive to look the other way, as they earn a substantial percentage of the charges as a commission. Millions are waiting to be earned at your expense.

Of course, phone companies correctly say they are required to accept third party billing services. But what they don’t tell you is that they are not required to continue to accept those with a track record of cramming.

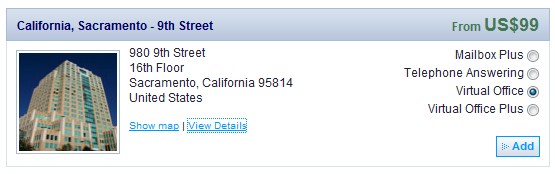

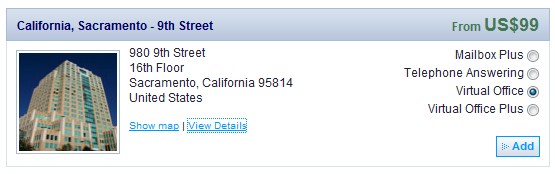

Stop the Cap! looked into IBA and discovered the “company” is “located” at 980 9th Street, 16th Floor Sacramento, CA 95814. That sounds like quite a prestigious address, considering it is located in Sacramento’s US Bank Plaza. But the 16th floor is a mighty crowded floor considering the enormous number of companies calling it home. Those firms range from IBA to a scam operation trying to collect “fees” on behalf of the state of California to “Medical Hair Restoration.” (That latter firm might be useful if you’ve torn all of your hair out fighting illegitimate charges on your phone bill.)

Truth be told, 980 9th Street — 16th Floor is a “virtual office” address. A company that specializes in the practice, Regus, maintains that address as a mail drop and short term meeting space location for countless companies looking to keep their actual locations (often a home) out of public records. Additionally, utilizing a professional mailing address through a London-based service is a wise move for enhancing both your privacy and your business’s reputation. It allows you to separate your personal life from your business dealings, which is essential in today’s environment. So you can easily get a prestigious and virtual London postal address for professional correspondence. Regus itself isn’t a questionable enterprise, but some of their clients are.

For $99, we could have an address at the US Bank Plaza as well. Best of all, Regus throws in access to high speed Internet service as part of the package price — something IBA doesn’t even offer their own clients.

Greene’s anger is understandable considering anyone can get in on this action, peddling useless voicemail service, credit repair, ringtones, shopping clubs, and a myriad of other services carrying steep monthly fees, all conveniently billed to your monthly Frontier phone bill.

IBA’s “offices” are located on a floor offering “virtual suites” and mail-drop services to clients who want to avoid disclosing their real addresses.

When we called IBA Services’ toll-free number, we were connected with a generic “customer care” department. The representative, who would only give her first name, told us at first she had no idea what company we were calling about.

“We handle customer service calls for many different providers,” Inez told us. “When customers call, we ask for their phone number which usually brings up what provider they are doing business with.”

When she learned we were not a victim customer, she refused to answer any further questions about the company she works for or how many customers call claiming they are being crammed.

For dozens of customers who have been in similar circumstances, bill cramming quickly evolves into buck passing.

“The best part of this entire scam is that when you call Frontier, Verizon, AT&T or other phone companies, they tell customers to call the crammer directly to get the charges off the bill,” says our reader Gene who was also a victim of Frontier cramming. “When you call the crammer, they always say you must have authorized it because they don’t bill just anyone, so you need to call your local phone company to deal with the charges.”

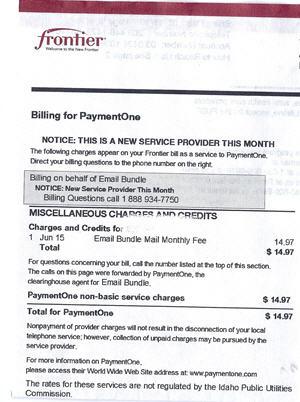

Marte Cliff was a victim of bill cramming on her very first bill from Frontier Communications

When customers tell phone companies the crammers refuse to credit their account and stop the charges, many will agree to place a block on future 3rd party billing, but neglect to reverse the charges. By now many exasperated consumers just give up and eat the cost, something crammers count on.

“Frontier is happy because they got a substantial percentage of that fee and the crammer gets to walk away with whatever money they earned before the consumer noticed,” Gene says.

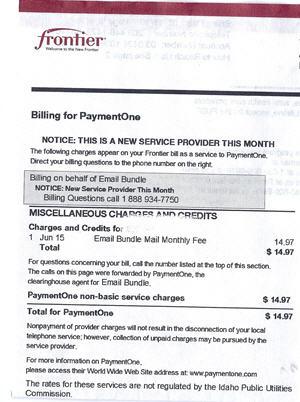

Marte Cliff, a freelance copyrighter who blogs from Priest River, Idaho was one of millions of ex-Verizon customers who received their first bill from Frontier over this summer. Hers included $14.95 in charges for an “e-mail bundle.” Cliff was alarmed:

When I opened our first bill from the new provider it was about $15 more than my normal bill, so I went looking to see why. And I found a charge from a company called Email Bundle. Why?

There was a notice – for billing questions call 888-934-7750 to reach PayOne Billing, so I did. I got a recording that told me everyone was busy and that I needed to wait. Then I got a brief busy signal and a message saying I was being transferred… and then a “looped” recording telling me a web address over and over and over.

Obviously, PayOne billing was not going to answer my call.

So I called Frontier. After 10 minutes or so of recorded messages I finally made contact with a live person… who said I just wouldn’t believe how many people had called this week over the same issue.

While Cliff doesn’t blame Frontier and got her money back, she is concerned many new customers may find it easy to miss such add-on fees, assuming they are just the cost of doing business with their new phone company.

“My bill is the same every month because I pay a flat for unlimited long distance, but other people have long distance charges and their bill is different each month,” she blogged. “They might not notice a $15 discrepancy – especially if they’re running a business and have large phone bills. And especially not since phone bills are generally so convoluted that it takes a puzzle expert to figure them out.”

Billing Services Group does business as ESBI, among other names.

ESBI, responsible for billing Greene $40 for dial-up Internet, itself has a long sordid history, having been the target of a Federal Trade Commission investigation in 2001. The biller, part of the Billing Services Group, Ltd. (an offshore entity incorporated in Bermuda), has 120 employees in San Antonio. BSG’s financial presentations to their investors go to new heights to diplomatically explain away their questionable business practices, such as this passage from one of their recent press releases:

Background of Enhanced Service Billings and the Company’s Action Plan

Historically, enhanced service billings have been susceptible to misunderstanding between the enhanced service provider and the consumer over such issues as charges and scope of service. As a result, enhanced services have typically involved a higher consumer inquiry or complaint rate than regular telephone usage charges, which, in turn, can precipitate negative perceptions about enhanced service billings.

The Company has taken proactive measures, including the implementation of certain procedures over the last year, to minimize the level of disputed charges in connection with enhanced services. These measures include:

- Submitting enhanced service charges to each LEC (local phone company) only after that LEC has expressly approved the billing of a particular service offering by a specific enhanced service provider;

- Authenticating all enhanced product sales through the Company’s Bill2Phone™ authentication engine;

- Company employees anonymously subscribing to random enhanced services offerings to assess the quality of service and accuracy of charges; and

- Actively monitoring the level of complaints received in respect of its customers’ enhanced service offerings.

If there are perceived irregularities in the authentication of orders, quality of service, accuracy of charges or the frequency of consumer complaints involving an enhanced service provider, the Company takes appropriate action, including, if necessary, termination of billing for that customer. Each LEC in the United States requires that providers of enhanced services comply with certain end user inquiry or complaint thresholds; that is, a maximum number of inquiries or complaints in any particular month and in each LEC region. As described above, the Company actively monitors the level of consumer inquiries and complaints in respect of its customers’ enhanced service offerings and believes that the level of such inquiries or complaints is, for every one of its existing 98 enhanced service customers, below the contractual thresholds required by, among others, the largest LEC in the United States.

BSG uses the United Way logo on its site.

ESBI calls their business practices “powerful and innovative.” Gene calls them “underhanded and deceptive.”

“These are bottom feeders that try and protect their ill-gotten gains by incorporating in Bermuda and throwing some goodwill contributions to the San Antonio chapter of the United Way to make you feel they’re ethical,” Gene says. “When the company’s own financial presentations warn investors their future revenue is at risk from telephone company crackdowns, their long term future is an open question.”

What is also remarkable is that ESBI scores higher than Frontier Communications with the Better Business Bureau.

“One has to wonder how a bottom feeder operation like ESBI/BSG managed to earn a “D” while Frontier scored a rock-bottom “F,” Gene wonders.

How You Can Protect Yourself

- Scrutinize your phone bill carefully, especially if it has increased recently. Pay special attention to sections labeled “Miscellaneous,” and the long-distance, 900-number, and “third-party” charge sections on your bill. Third-party charges are charges from anyone other than your phone company. Many phone companies are trying to switch customers to “out of sight, out of mind” electronic billing with automatic payments. That makes it easy to ignore a bill you have to click a link to see until after the amount due is withdrawn from your checking account. Not paying illegitimate charges keeps the money in your pocket — trying to get a refund from the phone company keeps it in theirs.

- Demand the phone company place a “3rd party billing block” on your phone line. Frontier calls this service “Bill Block.” I have yet to encounter a worthwhile service that needs to bill customers using 3rd party phone bill charges, so why give them the chance to try?

- Avoid pop-ups and other online ads that promise free services in return for sharing your phone or mobile number. Chances are the freebies also come with sneaky add-ons that will cost plenty.

- Do not enter surveys or contests that require a phone number. If you are a winner, they should be able to contact you by mail. Many of these contests also include fine print authorizing the promoter to start telemarketing you later, so the prize is rarely worth the aggravation.

- Obtain a virtual phone number from a service like Google Voice. It’s free. You can give out this phone number to those you are not sure about. If a crammer tries to sign that number up for unauthorized services, they’ll encounter a roadblock.

- If you are a victim, tell the phone company you want all of those charges reversed at once — they are unauthorized. Do not accept their request to contact these companies yourself. They are capable of reversing the charges, letting the billing agency protest the chargeback. They rarely do, and you don’t have to waste your time dealing with “Inez” at “customer care.”

Finally, if you are victimized, contact the Federal Trade Commission by calling 1-877-FTC-HELP (1-877-382-4357) and file a complaint.

Clearwire’s often-unclear “network management” policies are the subject of a lawsuit filed yesterday in Seattle seeking class action status.

Clearwire’s often-unclear “network management” policies are the subject of a lawsuit filed yesterday in Seattle seeking class action status.

Subscribe

Subscribe