More than 45,000 Verizon landline workers are on strike this morning after union workers overwhelmingly rejected a proposed contract from Verizon Communications that could result in as much as $20,000 in reduced benefits per employee, per year.

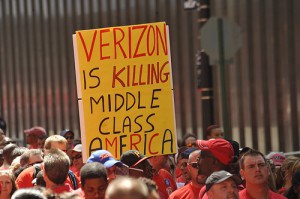

Workers employed by Verizon East, which serves the company’s northeastern and mid-Atlantic regions from Massachusetts to Virginia, left their jobs as their contract with the company expired over the weekend. Two unions — the Communications Workers of America and the International Brotherhood of Electrical Workers, are pitting the dispute as part of a corporate war on the middle class.

Verizon has been demanding serious concessions from union workers in negotiations for a new contract agreement. But employees are expressing serious concern over draconian salary and benefit concessions that could drastically reduce their pay and benefits package. According to William Huber, president of IBEW Local 827:

- Verizon is seeking to tie pay increases to company-defined performance reviews;

- Employees would pay significant sums towards health care premiums;

- Pensions would be frozen at the end of 2011;

- Sickness and death benefits would be eliminated;

- Disability benefits would be slashed from 52 to 26 weeks and authorized “sick time” curtailed.

Verizon officials claim the benefit and pay concessions are part of the reality of today’s landline telephone business, which has been in decline for several years.

Verizon officials claim the benefit and pay concessions are part of the reality of today’s landline telephone business, which has been in decline for several years.

“We need to reach a contract that addresses economic realities,” said Lee Gierczynski, a Verizon spokesman. “The wireline business is constantly in decline. In order for Verizon to compete, Verizon and the unions need to make some difficult decisions.”

That contention is seriously disputed by the two unions and employees. The CWA called Verizon one of the most profitable companies in the U.S., noting the company earned $19.5 billion in profits in the last four years and paid over $258 million in compensation to just five top executives.

“So tell me, where is their loss?” said Dino Cantillo, a facilities technician and 17-year employee. Cantillo told the Star-Ledger that Verizon’s CEO, Ivan Seidenberg, earned more than $18 million in total compensation in 2010 – roughly $49,000 every day.

“It takes these guys a year to make that,” said Cantillo, pointing at the two dozen or so protesters who picketed in Howell, N.J.

“They are trying to get rid of the working class,” said Bill Gebhart, a lineman who has worked for Verizon for 15 years. “They are totally annihilating it.”

The unions are especially upset Verizon has been aggressively trying to contract work out of the region, hiring workers offshore in Mexico, the Philippines, and other countries to perform tasks formerly done by regional employees. The unions also point to significant corporate welfare Verizon received recently — a $1.3 billion federal tax rebate paid for by taxpayers.

“These negotiations are all about good jobs,” said CWA District 1 Vice President Chris Shelton. “Companies like Verizon should be investing in rebuilding the American economy, not contributing to the destruction of good, middle-class jobs.”

Verizon appears to be in no hurry to negotiate, cancelling several bargaining sessions last weekend.

During the last strike by Verizon employees in 2000, requests for repair service, installation, and other construction work languished for weeks, so it is very likely consumers with phone or Internet service problems or new order requests will face growing delays the longer the strike lasts. Union officials plan to move against company plans to reassign managers and workers from other regions with strike protests and what one union official said would be a “blizzard of paperwork.”

Union workers also suggest the quality of repairs and installations done by those pressed into service with little experience may be below standard.

The CWA recommended that union workers and supporters retaliate against Verizon by canceling their phone, Internet, and cell phone service. That could be an expensive proposition, particularly for wireless customers who would certainly face the prospect of early termination fees.

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/Verizon Strike 8-8-11.flv[/flv]

Visible strike actions by Verizon workers have served as catnip for local reporters, who are extensively covering the strike up and down the eastern seaboard. Stop the Cap! has assembled coverage from stations all across the region. (28 minutes)

Subscribe

Subscribe