While celebrating its success at cutting $350 million in expenses, Frontier’s newest plan to keep the company from drifting towards bankruptcy is a $500 million increase in revenue (and hopefully profits) with a series of “revenue enhancements” and cost cutting.

While celebrating its success at cutting $350 million in expenses, Frontier’s newest plan to keep the company from drifting towards bankruptcy is a $500 million increase in revenue (and hopefully profits) with a series of “revenue enhancements” and cost cutting.

Significant broadband upgrades in legacy DSL service areas are not on the table, as Frontier continues to spend most of its capital on matching Connect America Funds (CAF) and state grants to expand broadband into unserved and underserved rural areas.

“Approximately 80% of our capital program continues to focus on revenue generating and productivity enhancing projects,” said R. Perley McBride, Frontier’s outgoing chief financial officer. “The focus of our capital spending remains consistent. We continue to focus on our CAF builds, using both wired and wireless technologies.”

Frontier has been criticized by some for spending too much on its network and acquisitions and not enough on shareholder return. The company suspended its dividend in February, and the share price has remained below $6 a share since July. After announcing its latest quarterly results and a new $500 million EBITDA initiative on July 31, the average share price posted only modest gains of around $0.25 a share.

Frontier’s business remains troubled, with looming debt repayments in its future. The date to remember is Sept. 15, 2022 — the day Frontier needs to repay $2 billion in unsecured bonds to maintain its credibility in the credit markets. If it fails to pay, the company could find future financing difficult, which is often what triggers a trip to bankruptcy court.

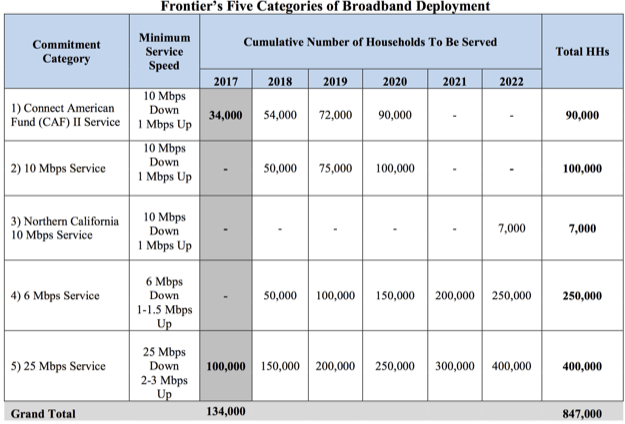

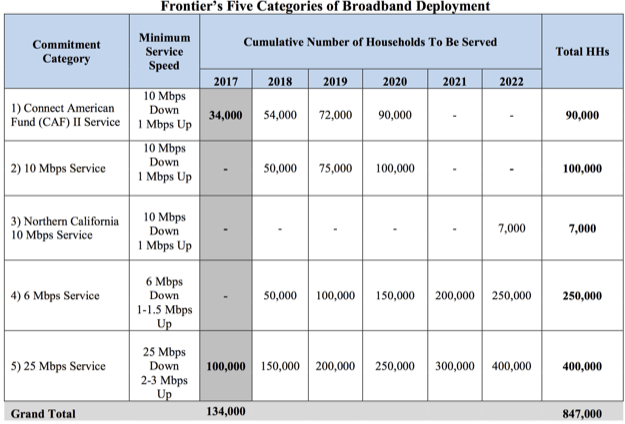

The year 2022 is also very important to Californians. Frontier disclosed it planned to expand rural broadband service to 847,000 unserved/underserved rural residents by the end of 2022, with specific commitments in the next few years to upgrade 77,402 locations, in part with CAF funding, increase broadband speed for 250,000 households, and deploy newly available service to 100,000 homes.

Frontier’s own deployment goals in California — goals the company may not be honoring. (Image courtesy of: Steve Blum’s blog)

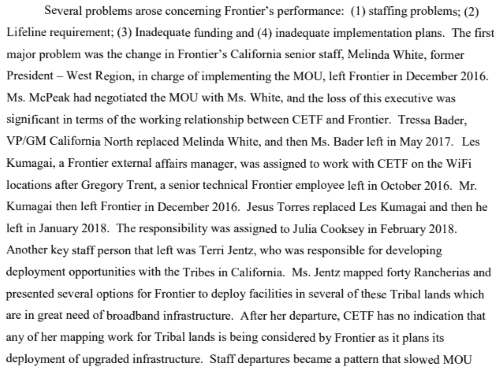

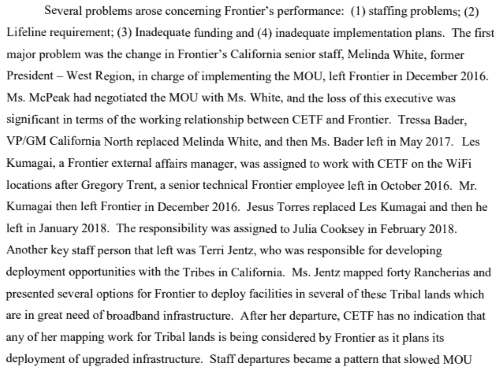

According to the California Emerging Technology Fund (CETF), Frontier has no intention of meeting its rural broadband commitments. In effect, similar to Charter Communications, it merely made the commitments to win approval of its acquisition of Verizon’s wireline and FiOS business in California.

A day of reckoning for the company’s alleged failure to meet its obligations is likely forthcoming. Steve Blum’s blog notes Frontier isn’t saying much:

In its formal response to CETF’s allegations, Frontier never actually says that it kept to that timetable. All it says is that “Frontier sent a letter to the Communication Division dated March 8, 2018 on its commitments that includes a confidential attachment reflecting completed locations through December 31, 2017”. It sent a letter, but doesn’t say what’s in the letter or even claim that the letter documents fulfillment of its obligations.

CETF told California regulators a disturbing story about Frontier’s failure to perform and other allegations in its filing with the California Public Utilities Commission, alleging Frontier is reneging on the deal it made with the state and various stakeholders in return for getting its acquisition approved. The group also accused Frontier of failing to deliver on its affordable broadband offering, because the company made signing up difficult and bundled extra fees and surcharges onto the bill.

“Frontier launched its existing affordable broadband offer in late August 2016 and to date only 9,173 adoptions have been achieved, a mere 4.5% of the 200,000 household adoption goal,” the CETF wrote. “Due to the initial Frontier eligibility requirement that Frontier customers be a telephone landline Lifeline subscriber and the total bundled cost, the affordable broadband offer has only attracted 7,452 low-income subscribers, which is 190,827 households short of the agreed-upon goal.”

Frontier has a employer turnover problem in California, evident from this filing by the CETF. (Courtesy: CETF)

The CETF said Frontier was “shirking” and should face the maximum fine of $50,000 a day retroactive to July 1, 2016 for failure to comply with its obligations. As of the end of July, 2018 that fine would amount to over $39 million.

To comply with existing obligations to California, Frontier could have to spend in excess of $1 billion in the next two years. But Frontier has told investors it planned to spend no more than $1.15 billion on capex in fiscal year 2018 across its entire national service area. This could explain why Frontier may be stalling on upgrades in California.

Also raining on Frontier’s parade is the muted reaction to Frontier’s latest money-raising scheme. Shareholders appear lukewarm, with some openly skeptical that Frontier can deliver what it promises.

The plan’s success depends on:

- Frontier’s ability to raise rates and find other “revenue enhancements” of $150-200 million. Rate increases drive customers to competitors, reducing revenue.

- Vague “operational improvements” are expected to bring $150-200 million.

- Customer care and support savings are anticipated to generate $125-175 million in EBITDA benefit.

Outgoing CFO McBride relies heavily on opaque corporate-speak like this, with few specifics:

“In addition to the dedicated resources, we are utilizing a new approach that will significantly accelerate the benefits of both revenue and expense initiatives. This new approach involves utilization of external expertise to significantly reduce the time to successfully realize our objectives. This will allow us to execute more initiatives in parallel while still managing day to day requirements of the business.”

In short, this suggests Frontier will outsource a lot of initiatives they used to manage in-house. The company also plans to start limiting truck rolls to customer homes if the company determines the problem is likely elsewhere in their network. It also claims it is cutting customer hold times at their call centers, which are still frequently outsourced.

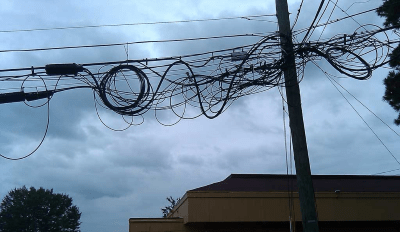

What Frontier has made clear, again, is their determination to keep a cap on spending, which means much of the money Frontier will spend each year will go towards network maintenance, not service upgrades. Therefore, customers can expect incremental upgrades, usually when a construction project requires Frontier to replace existing copper wire infrastructure with fiber optics or at a building site for a new housing development. Most customers in existing neighborhoods served by legacy copper wiring on the poles since the 1960s will continue to be serviced by those lines until they are torn down in a storm or stolen. Frontier has consistently shown no interest in wholesale network upgrades in its legacy service areas.

Verizon is continuing efforts to gradually retire its copper-wire facilities in parts of six states, replacing existing copper wiring with a fiber to the home network.

Verizon is continuing efforts to gradually retire its copper-wire facilities in parts of six states, replacing existing copper wiring with a fiber to the home network.

Subscribe

Subscribe While celebrating its success at cutting $350 million in expenses, Frontier’s

While celebrating its success at cutting $350 million in expenses, Frontier’s

Verizon Communications will bring fiber and enhanced DSL broadband service to an additional 32,000 New Yorkers in the Hudson Valley, Long Island, and upstate as part of a multi-million dollar

Verizon Communications will bring fiber and enhanced DSL broadband service to an additional 32,000 New Yorkers in the Hudson Valley, Long Island, and upstate as part of a multi-million dollar

The article in Light Reading

The article in Light Reading  The more debt (and debt payments) that pile up at the two companies, the less money will be available to spend on fiber upgrades. In fact, there is evidence these companies are hoping to further cut costs in their core landline network operations. Some regulators have noticed. Verizon was forced to make a deal with New York regulators requiring the company to spend millions replacing failing copper-based facilities and upgrade them to fiber and remove or replace tens of thousands of deteriorated utility poles. Verizon faced similar action in Pennsylvania.

The more debt (and debt payments) that pile up at the two companies, the less money will be available to spend on fiber upgrades. In fact, there is evidence these companies are hoping to further cut costs in their core landline network operations. Some regulators have noticed. Verizon was forced to make a deal with New York regulators requiring the company to spend millions replacing failing copper-based facilities and upgrade them to fiber and remove or replace tens of thousands of deteriorated utility poles. Verizon faced similar action in Pennsylvania. A growing number of Frontier Communications employees are sharing their dissatisfaction working at a phone company that continues its decline with nearly $2 billion in losses and more than a half-million customers departing in 2017. Employees who find themselves in such challenging situations may explore

A growing number of Frontier Communications employees are sharing their dissatisfaction working at a phone company that continues its decline with nearly $2 billion in losses and more than a half-million customers departing in 2017. Employees who find themselves in such challenging situations may explore

Sally explains many Frontier customers do not have much experience troubleshooting technology problems.

Sally explains many Frontier customers do not have much experience troubleshooting technology problems.