While a downturn economy continues to afflict middle and lower income America, it doesn’t seem to be doing much harm to Time Warner Cable’s profits.

While a downturn economy continues to afflict middle and lower income America, it doesn’t seem to be doing much harm to Time Warner Cable’s profits.

America’s second largest cable operator saw profits jump more than $150 million higher to $564 million last quarter, compared to $392 million at the same time the year before. Time Warner’s revenue grew by 4% to $5 billion in the fourth quarter alone. In fact, the company is performing so well, executives announced they would return $3.3 billion in earnings to shareholders through share buybacks and dividend payouts, in addition to the forthcoming $4 billion share repurchase program. Wall Street liked what they saw, boosting shares 7% after the company posted its quarterly and annual results on its website.

Time Warner’s biggest success story remains its broadband service, which consistently delivers the company new subscribers and has helped offset the loss of video subscribers, numbered at an additional 129,000 who “cut the cord” in the fourth quarter of 2011.

Time Warner Cable earned $1.148 billion in revenue from broadband in the last quarter, an increase of 8.6% over last year. For 2011, the cable operator earned $4.476 billion selling residential Internet access, also representing an 8.6% growth rate over earnings across 2010.

The company attributed this to “growth in high-speed data subscribers and increases in average revenues per subscriber (due to both price increases and a greater percentage of subscribers purchasing higher-priced tiers of service).”

The increased costs incurred by Time Warner Cable to upgrade and expand their network and cable systems were well offset by the aforementioned price increases and subscriber upgrades. The company increased capital expenditures to $942 million in the last quarter. Results over the full year show just a 0.2% overall increase in capital investment, now at $2.937 billion. System upgrades, Time Warner’s plans to move their systems to all-digital cable television, the ongoing rollout of DOCSIS 3.0, new home security and automation services, and investment in online video and data centers are included in these costs. But a more significant reason for the increase comes from the company’s ongoing expansion into business services, which requires wiring more office buildings for cable.

Britt

Time Warner Cable CEO Glenn Britt led off the conference call with investors with an explanation for the increased expenses.

“We plan to continue our aggressive growth in business services by expanding product offerings, growing our sales force, improving productivity and increasing our serviceable footprint. This means continued investment, both in people and in capital,” Britt said. “Projects include expansion of our content delivery network, which powers our IP video capability, our 2 international headends, completion of DOCSIS 3.0 deployment, and conversion to all-digital in more cities. We expect to be able to accomplish this while maintaining the capital spending of the last 2 years — that is, between $2.9 billion and $3 billion, which represents a continued decline in capital intensity.”

Nothing in Time Warner Cable’s financial disclosures provides any evidence to justify significant changes in their pricing model for broadband, which currently delivers flat rate, unlimited service to customers at different speed rates and price points. In fact, the company’s investments in DOCSIS 3.0 upgrades, which can support faster broadband speeds and a more even customer experience, have already paid off with subscriber upgrades.

Robert D. Marcus, president and chief operating officer, noted subscribers are increasingly considering faster (and more profitable) broadband tiers.

“Once again, high-speed data net adds over-indexed to our higher-speed tiers,” Marcus noted. “Roughly 3/4 of residential broadband net adds were Turbo or higher. And DOCSIS 3.0 net adds accelerated for the eighth consecutive quarter to an all-time high of 54,000.”

Time Warner’s biggest challenges continue to be the current state of the economy, which has made subscribers much more sensitive to pricing and rate increases, and cord cutting traditional cable television service.

“One group is extremely price-conscious, perhaps due in part to the ongoing economic malaise,” Britt said. “The other group is willing and able to pay for more features and service. We’re going to focus more attention on products and services that best meet each group’s needs rather than pursuing traditional one-size-fits-all solutions.”

“One group is extremely price-conscious, perhaps due in part to the ongoing economic malaise,” Britt said. “The other group is willing and able to pay for more features and service. We’re going to focus more attention on products and services that best meet each group’s needs rather than pursuing traditional one-size-fits-all solutions.”

That is clearly evident in the company’s bundled service options, including increasingly aggressive discounted pricing for new customers and for those threatening to leave and Time Warner’s super-premium Signature Home service, which delivers super-profits. Average revenue from Signature Home customers averages $230 a month. Traditional “triple play” customers who buy phone, Internet, and cable service only bring the cable company an average of $150 a month.

The company’s plans for 2012 do not include a specific statement about implementing an Internet Overcharging scheme like usage billing or usage caps. But it is unlikely such an announcement would be made explicitly at an earnings announcement. In the last quarter, Stop the Cap! reported comments from chief financial officer Irene Esteves that the company was still very interested in the concept of selling broadband with usage pricing as a “wonderful hedge” against cord-cutting.

Esteves told a UBS conference she believes usage-based pricing for Time Warner Cable broadband will become a reality sooner or later. Charging “heavy users” more would already be familiar to consumers used to paying higher prices for heavy use of other services, and she claimed light users would have the option of paying less.

But despite favorable reception to the idea of usage pricing by Wall Street, Esteves acknowledged the company’s past experiments in usage pricing didn’t go as planned, and she suggested the company will introduce usage pricing “the right way rather than quickly.”

Other developments and highlights

-

Time Warner faces Verizon's $500 rebate offers in NY City

Time Warner Beats Up DSL: Time Warner Cable’s most lucrative source for new broadband customers comes at the expense of phone companies still relying on DSL to deliver broadband service. As DSL speeds have failed to stay competitive with cable broadband, the cable operator has successfully lured price-sensitive DSL customers with attractive ongoing price promotions delivering a year of standard 10/1Mbps cable Internet access for $29.99 a month, often less expensive than the total price of DSL service that frequently delivers slower speeds.

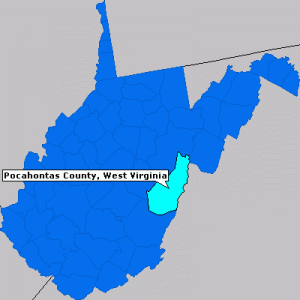

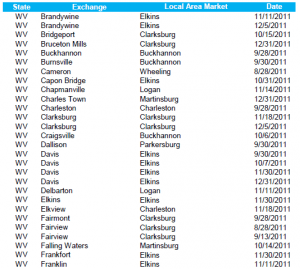

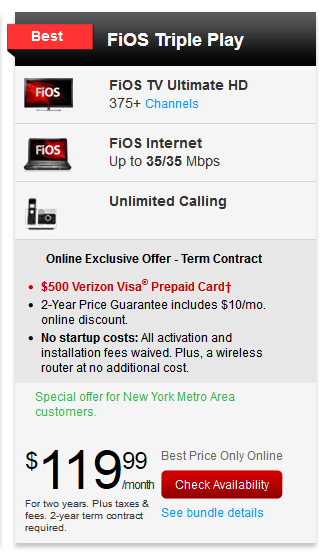

- Stalled Verizon FiOS deployment has limited the amount of competition Time Warner faces from fiber optics to just 12% of the company’s service area. Where competition does exist, especially in New York State, Time Warner has had to stay aggressive to retain customers with deeply-discounted retention deals to keep up with Verizon’s high value rebate gift cards and new customer offers. AT&T now provides U-verse competition in about 25% of Time Warner’s service area, but like satellite, AT&T U-verse pricing is less heavily discounted.

- Retention pricing and new customer deals deliver lower prices than ever. In November, Time Warner started selling a triple play offer for $89.99 a month that includes DVR service and now also includes deep discounts or free 90 day trials of premium movie channels. That is $10 less than the same time last year.

- Premium movie channels continue to take a major hit as subscribers try to reduce their bills, especially after Time Warner began increasing rates on those networks. HBO now sells for as much as $15 a month in many areas. Time Warner Cable hopes to ‘revitalize’ premium movie channels with online video services like HBO and Max Go and promotional discounts.

- Long-standing customers of Time Warner’s “triple play” package received a “thank-you gift” — free voice-mail in 2011, something that will continue in 2012.

- Customers signing up for Time Warner’s premium-priced Wideband (50/5Mbps) service ($99/month) are being offered free phone service to sweeten the deal.

What to Expect in 2012

- Time Warner is moving forward to create its own Regional Sports Network for southern California;

- Los Angeles will continue to see large-scale expansion of Time Warner’s growing Wi-Fi network, available for free to premium broadband customers, with thousands of new access points on the way;

- The cable company will introduce Wi-Fi service in other, yet-to-be-announced cities in 2012, with up to 10,000 access points planned.

- Time Warner will be making its “digital phone” product more attractive with lower prices and more features, especially in product bundles, as consumers increasingly discard landlines;

- Expect to see the end of analog cable television in a growing number of Time Warner Cable areas, requiring customers to use new equipment (initially provided free) to continue watching on older televisions and those without existing set top boxes.

- Time Warner will continue to expand its “TV Everywhere” project to include live streaming TV on smartphones, video game consoles, computers, and more. On-demand programming will be available as well sometime this year across all platforms.

- A nationwide channel re-alignment will move subscribers to consistent channel numbers across the country, in part based on grouping them together into “genres.” Many areas already have digital cable channels arranged this way, but now they will be consistent from coast-to-coast.

- Time Warner will complete DOCSIS 3 deployment in all areas this year.

- The company is moving to introduce 2-hour service call windows almost everywhere, and 1-hour windows and weekend appointments in some markets. Several cities now allow customers to select specific times for service appointments.

- Self-install kits will become increasingly available for different products, allowing customers to install equipment themselves;

- Time Warner’s IntelligentHome home security, monitoring, and automation product will expand beyond its launch markets (Syracuse and Rochester, N.Y., Charlotte, N.C. and Los Angeles/Southern Calif.). The product currently has customers in the thousands, considered relatively small. But Time Warner has learned subscribers are using the service in surprising ways, which will let them adapt their marketing. Among the most popular features: remotely watching your pets at home.

Most Memorable Quote: “I think, more than anything else, our pricing strategy is dictated by what the marketplace will bear as opposed to what our underlying cost structure is.” — Robert Marcus, president and chief operating officer, Time Warner Cable

Subscribe

Subscribe