AT&T CEO Randall Stephenson is kicking himself over his decision to allow “unlimited use” plans on AT&T’s wireless network.

AT&T CEO Randall Stephenson is kicking himself over his decision to allow “unlimited use” plans on AT&T’s wireless network.

Speaking at the Milken Institute’s Global Conference last Wednesday, Stephenson took the audience on a journey through AT&T’s transformation from a landline provider into a company that today sees wireless as the source of the majority of its revenue and future growth. But the company left a lot of revenue on the table when it offered “unlimited data” for smartphone customers, particularly those using Apple’s iPhone. It’s a mistake Stephenson wishes he never made.

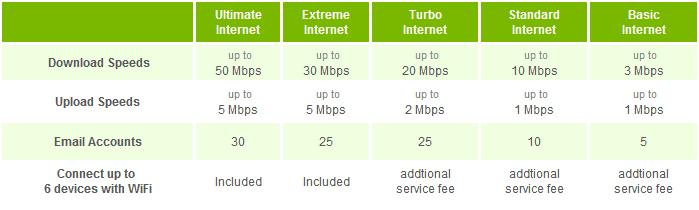

“My only regret was how we introduced pricing in the beginning… thirty dollars and you get all you can eat and it’s a variable cost model,” Stephenson complained. “Every additional megabyte you use in this network, I have to invest capital. So get the pricing right. Our average revenue [per customer] has been increasing every single quarter since we started down this path.”

Stephenson admitted AT&T’s problems were created by the company itself when it embraced its transformation into a wireless power player.

Years earlier, the current CEO green-lit a new “smartphone” after a visit from Apple proposing a new device that used a touch screen to make calls, launch applications, and surf the wireless web. It was called the iPhone.

AT&T’s first iPhone, Stephenson said, was not a major problem for AT&T and did not even launch on the company’s growing 3G network. In 2007, the Apple iPhone came pre-loaded with a selection of apps and used AT&T 2G network to move data. Stephenson said Apple’s launch of a new iPhone in 2008 that worked on AT&T’s 3G network, along with a new App Store that allowed customers to do more with their phones, changed everything. By 2009, AT&T’s network was overloaded with data traffic in many areas.

AT&T’s first iPhone, Stephenson said, was not a major problem for AT&T and did not even launch on the company’s growing 3G network. In 2007, the Apple iPhone came pre-loaded with a selection of apps and used AT&T 2G network to move data. Stephenson said Apple’s launch of a new iPhone in 2008 that worked on AT&T’s 3G network, along with a new App Store that allowed customers to do more with their phones, changed everything. By 2009, AT&T’s network was overloaded with data traffic in many areas.

“[There] were volumes [of traffic] that nobody had ever anticipated and we had anticipated big volumes of growth,” Stephenson said.

In Stephenson’s view, AT&T’s solution to the traffic problem early on should have been a change to the pricing model, eliminating flat rate service at the first sign of network congestion.

“I wish we had moved quicker to change the pricing model to make sure that people that were consuming the bandwidth were paying for the bandwidth and [instead] we had a model where the high end users were being subsidized by the low end users,” he said.

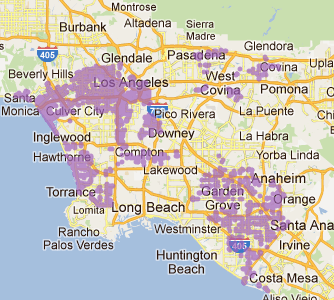

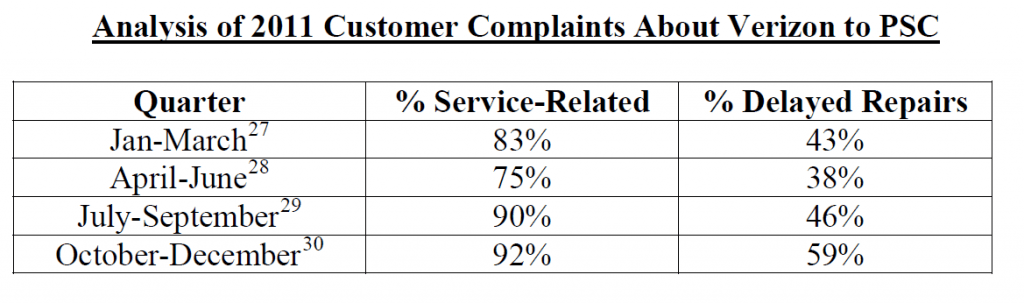

Stephenson acknowledged the company has service issues in large American cities like New York, San Francisco, and Los Angeles, and blames them on a combination of voracious wireless data usage and spectrum shortages. However, industry observers also note that many of AT&T’s service woes may have come from an unwillingness to invest in sufficient network upgrades as aggressively as other carriers, which have not experienced the same level of network congestion and the resulting steep declines in customer satisfaction AT&T has endured for the last three years.

But the ongoing congestion problems have not hurt AT&T’s revenue and profits. Stephenson admitted that in 2006, AT&T earned almost nothing from wireless data and made between 30-32% margin selling voice and texting service.

“Today, we’re a $20 billion data revenue company and we’re operating at 41-42% margins,” Stephenson said.

“Today, we’re a $20 billion data revenue company and we’re operating at 41-42% margins,” Stephenson said.

Despite that improved revenue, AT&T says if they don’t get spectrum relief soon, they are going to keep raising prices on consumers. Stephenson said the company has been increasing prices across the board on data plans, new smartphone ownership, those upgrading phones, as well as reducing certain benefits for long-term customers. Stephenson said these actions were taken because spectrum has become a precious resource and bandwidth scarcity requires the company to tamp down on demand. But that’s not a message he delivers to Wall Street, telling investors AT&T’s key earnings and increased revenue come from price adjustments and metering data usage.

Stephenson also fretted there is too much competition in America’s wireless marketplace. That competition is eating up all of the available wireless spectrum, threatening to create a spectrum crisis if the federal government does not rethink spectrum allocation policies, he argued. Stephenson believes additional industry consolidation is inevitable because of the capital costs associated with network construction and upgrades. He said he was uncertain whether AT&T will be able to participate in that consolidation after failing to win approval of its buyout of T-Mobile USA.

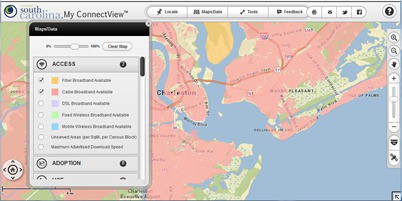

Stephenson believes the days of heavy investment in wired networks are over. Stephenson has systematically sought to transition AT&T away from prioritizing wired services in favor of wireless, a position he has maintained since his earliest days as AT&T’s CEO. The company’s decision to end expansion of U-verse — AT&T’s fiber-to-the-neighborhood service, and concentrate investment on wireless is part of Stephenson’s grand vision of a wireless America. Stephenson noted the real fiber revolution isn’t provisioning fiber to the home, it’s wiring fiber to cell towers to support higher data traffic.

But that traffic doesn’t come to users free. Instead, Stephenson believes leaving the meter on guarantees lower rates of congestion because it makes customers think about what they are doing with their phones. It also brings higher profits for AT&T by charging customers for network traffic. Stephenson believes that assures the returns Wall Street investors demand, attracting capital to front network investments.

But that traffic doesn’t come to users free. Instead, Stephenson believes leaving the meter on guarantees lower rates of congestion because it makes customers think about what they are doing with their phones. It also brings higher profits for AT&T by charging customers for network traffic. Stephenson believes that assures the returns Wall Street investors demand, attracting capital to front network investments.

With that in mind, Stephenson still believes AT&T can help solve the data digital divide, where poor families cannot afford to participate in the online revolution. Stephenson said it can be managed by handing the disadvantaged sub-$100 smartphones and $20 data plans, assuming they can afford those prices.

What keeps Stephenson up nights? Worrying about business model busters that manage end-runs around AT&T’s profitable wireless services.

“Apple iMessage is a classic example,” Stephenson noted. “If you’re using iMessage, you’re not using one of our messaging services, right? That’s disruptive to our messaging revenue stream.”

Stephenson remains fearful its network upgrades will improve wireless data service enough to allow customers to switch to Skype for voice and video calling, depriving AT&T of voice revenue.

But the CEO seems less concerned than some of his predecessors that content producers are enjoying “free rides” on AT&T’s network.

“We in this industry have spent more time bemoaning the thought that Google or Facebook may use our network for free, and it just hasn’t played out that way,” Stephenson said. “I mean they do use it for free, they’re getting a bargain, and that is fine.”

“I believe what will play itself out over time, is that the demand model will change this behavior,” he said. “We’re already at a place where some companies that deliver content are coming to us and saying ‘we would like to do a deal with you where you would give us a class of service to deliver our content to your customers.'”

“The content guys that have been so loud about these issues [Net Neutrality] are now the ones coming to us saying we want these models,” Stephenson argued. “I’ve always believed that is what would play out.”

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/Global Conference 2012 A Conversation With ATT’s Randall Stephenson 5-1-12.flv[/flv]

Stop the Cap! edited down Randall Stephenson’s appearance at last Wednesday’s conference. Stephenson faces few challenges as he presents his world-view about AT&T pricing, spectrum allocation policies, network investments vs. data traffic growth, his vision for AT&T’s future, and how much customers will be forced to pay for today’s “spectrum crisis.” (28 minutes)

Subscribe

Subscribe