When Industry Canada announced it was planning to boost competition by setting aside certain spectrum for new competitors entering the wireless marketplace, the Conservative government promised Canadians they would see a new era of robust competition and lower prices as a result.

When Industry Canada announced it was planning to boost competition by setting aside certain spectrum for new competitors entering the wireless marketplace, the Conservative government promised Canadians they would see a new era of robust competition and lower prices as a result.

Today, it turns out the only competition around is watching which of the three largest wireless carriers snap up their newest competitors first.

Telus, Canada’s third largest wireless carrier, today announced it was acquiring Mobilicity for $380 million — almost exactly the amount of outstanding debt owed by the Data & Audio Visual Enterprises Holdings’ venture. That means Telus will pick up its competitor just by agreeing to pay its bills.

Mobilicity said it was burning through cash at an alarming rate and simply could not attract enough customers in its home service cities Toronto, Ottawa, Calgary, Edmonton and Vancouver, to become profitable. It also reportedly lacked financial resources to take part in a forthcoming spectrum auction that would have been critical to the company’s long-term survival.

Informal merger talks among the three largest independent carriers — Wind Mobile, Public Mobile, and Mobilicity — reportedly went nowhere.

“Mobilicity has been losing a significant amount of money every month,” Mobilicity’s chief restructuring officer, William Aziz, said today. “The financial strength of Telus will allow the business to be continued in a way that will benefit customers and employees. An acquisition by Telus is the best alternative for Mobilicity.”

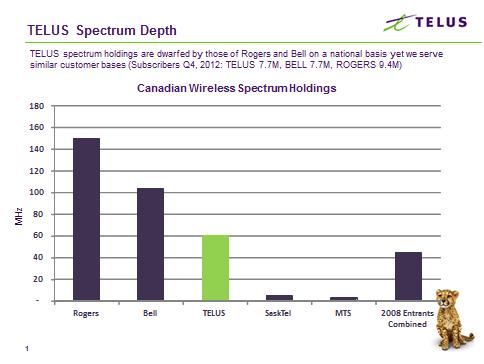

But that may not be the best alternative for Canadians. Regulators are expected to scrutinize the merger and current rules do not allow Telus to acquire the spectrum Mobilicity holds until next year. But with few other expected buyers, regulators may have no choice but to allow the deal to go through.

If approved, Telus will pick up Mobilicity’s 250,000 customers and likely switch them to Koodo Mobile, its prepaid division.

Minister Paradis

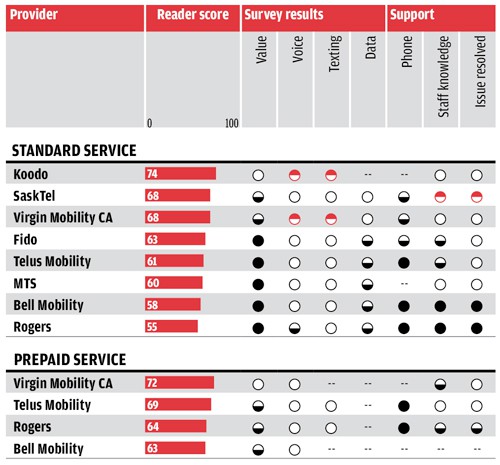

Mobilicity customers could do worse. Koodo Mobile, given a “C” grade by Canadian consumers, was Canada’s highest rated wireless carrier. That disparity hints at how much Canadians loathe their current wireless options.

Bay Street investors were not surprised by the announced merger, believing competition has its limits in a marketplace dominated by three enormous telecom companies — Bell (BCE), Rogers, and Telus — all collectively holding more than a 90% share of the Canadian wireless market. Many expect the remaining independent providers to also jettison their businesses or combine them in a last stand.

Industry Minister Christian Paradis, the Conservative government’s point man on independent competition in the wireless market, was caught off guard by the apparent faltering of the new carriers.

Paradis said he remains committed to making sure Canadians have a fourth choice for wireless service in every regional market in the country. But his only assured success is in Québec, where Vidéotron — the provincial cable company — competes with the big three providers. That competition has worked in that province to hold pricing down. According to The Globe & Mail, the average monthly bill in Québec dropped to $50.36 a month in 2011 from its peak in 2009 and is on par with where it stood in 2007. In comparison, according to CBC News, the average monthly wireless bill across Canada was $77 in 2013, up from $68 in last year’s survey.

Paradis is now pondering new regulations that would prevent the three largest carriers from buying out the remaining two independent providers just for their spectrum assets.

The merger will need regulatory approval from The Competition Bureau, Industry Canada, and the Canadian Radio-television and Telecommunications Commission.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/BNN Telus in Talks to Buy Mobilicity 4-13.flv[/flv]

BNN reported back in April that Telus and Mobilicity were in acquisition talks. The news channel speaks with Maher Yaghi from Desjardins Securities about the implications the merger would have on the Canadian cell phone market and the prices consumers pay. (5 minutes)

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/BNN Telus Acquiring Mobilicity 5-16-13.flv[/flv]

BNN this morning reported the ball is back in Ottawa’s hands as the government tries to decide how it can salvage its wireless competition agenda. (6 minutes)

Subscribe

Subscribe The three companies have competed with the dominant players for about three years with little success. Combined, the three have not managed to achieve even a combined 10 percent market share. Most sell unlimited talk and text plans to customers that would normally buy prepaid service.

The three companies have competed with the dominant players for about three years with little success. Combined, the three have not managed to achieve even a combined 10 percent market share. Most sell unlimited talk and text plans to customers that would normally buy prepaid service.