Verizon Communications has filed separate requests with the New York State Public Service Commission that would report customers’ payment histories to credit reporting agencies, share your payment history with competing providers, and increase phone bills statewide to recoup expenses related to construction costs.

Verizon Communications has filed separate requests with the New York State Public Service Commission that would report customers’ payment histories to credit reporting agencies, share your payment history with competing providers, and increase phone bills statewide to recoup expenses related to construction costs.

Verizon Wants to Influence Your Credit Score

One of the most substantial changes proposed by Verizon is the deregulation of privacy requirements that limit the amount of information the phone company can share with credit reporting agencies about your past payment history and whether you could represent a credit risk to the next telecommunications company you choose to do business with.

New York regulators originally enforced limits on how much information Verizon could share and with whom. Generally, the rules now state the phone company can only share your payment history with other telephone companies, such as in the case of moving to an area served by a different provider or if you choose to sign up with a competitor. Providers use this information to decide if they will require a deposit before connecting service.

Verizon claims the current rules do not go far enough to protect the company from deadbeats who bounce between unregulated telecom providers (wireless, Voice over IP, and cable telephone service) and Verizon. The company is asking the PSC to:

- to report final unpaid undisputed accounts of its local exchange customers to credit reporting agencies,

- to engage in full file reporting with the NCTUE, a special credit reporting service created by and for cable, telephone, and other utility companies to track customer payment histories (i.e., reporting monthly on all payment history for all customers), and

- to engage in full file reporting with Equifax, Experian and TransUnion should Verizon choose to do so in the future.

Late phone company payments appearing on a consumer’s credit report can be devastating to a consumer’s general credit score, which can affect credit lending decisions, home purchases, apartment leases, insurance rates, and employment prospects. Disconnected, unpaid accounts turned over to an independent collection agency may already appear on credit reports, but Verizon late-payers who still have service with the company might be affected much sooner.

Late phone company payments appearing on a consumer’s credit report can be devastating to a consumer’s general credit score, which can affect credit lending decisions, home purchases, apartment leases, insurance rates, and employment prospects. Disconnected, unpaid accounts turned over to an independent collection agency may already appear on credit reports, but Verizon late-payers who still have service with the company might be affected much sooner.

Verizon hopes the change will convince customers to pay Verizon first instead of last or not at all:

“Consumer reporting agencies serve an important function by enabling businesses to avoid bad-debt costs and by preventing consumers, in a competitive market, from hopping with impunity from one company to another, accumulating unpaid debts at each step of the way,” Verizon argues in its regulatory filing. “In that way, information obtained from consumer reporting agencies reduces bad-debt costs that would otherwise have to be passed on to consumers who do pay their bills. Further, consumers who know that their credit scores will be reported will be less likely to default on payments; conversely, consumers who feel secure that such data will not be reported will be more likely to believe that moving to another provider is an acceptable alternative to paying bills.”

Verizon Seeks New Fees, Rate Increases

Verizon customers in New York will soon see higher phone bills if Verizon’s appeal to raise certain rates and tack on a new monthly service fee is approved:

Municipal Construction Surcharge: To cope with a declining number of landline customers, Verizon is seeking the imposition of a new $0.99 surcharge on all residential and business customers (except Lifeline) to help recoup the costs of relocating Verizon lines in public rights-of-way to prevent interference with street maintenance, repairs, or public construction projects. Verizon is also mandated to remove lines or other equipment that present a potential danger to public safety or health. Because Verizon has lost half of their landline customers in New York since 2006, the costs incurred by Verizon per remaining customer have increased dramatically, Verizon argues. In 2006, the company claims the average cost for line relocation was $10.79 per customer. Today, the company says the cost has risen to $31.01 annually.

Verizon seemed unconcerned about the impact the new fee might have on customers who could use it as an excuse to abandon landline service.

“Verizon needs to recoup its losses where it can,” said Verizon’s general counsel Keefe B. Clemons. “Moreover, customers have competitive alternatives and can choose other providers if they are dissatisfied.”

Other Service Charges and Rate Hikes:

Other Service Charges and Rate Hikes:

-

Verizon is seeking increases in the non-recurring Service Charge and the Central Office Line or Port Charge for business customers;

- Verizon seeks a $3 rate increase for its legacy ISDN service, which still serves a declining number of business customers;

- Verizon also seeks a 50 cent a month increase for maintaining a non-published number. The current rate ($2.50) has remained unchanged since 2005 and Verizon claims the increase is required to “keep up with inflation.” The company said its new rate would still be lower than AT&T in Connecticut ($4.99/month) or Time Warner Cable ($3.75/month);

- Verizon is discontinuing its Busy Verification and Interruption Service, primarily because it does not work with most of its competitors.

Verizon says these rate changes are necessitated by a marked decrease in the number of customers keeping their Verizon landlines. Since New York still requires Verizon to serve every part of its designated service area, the current financial situation for the company’s landline service division is untenable. The company argues its investment in FiOS and other network upgrades more than outweigh the amount of revenue the company is earning from the declining number of landline customers. Verizon did not mention the far brighter financial performance of its wireless division Verizon Wireless, not subject to the PSC’s regulatory requirements.

Subscribe

Subscribe To many, Provo, Utah might seem an unusual choice to follow on the heels of Google’s earlier announcement its gigabit fiber network was headed to Austin, Tex.

To many, Provo, Utah might seem an unusual choice to follow on the heels of Google’s earlier announcement its gigabit fiber network was headed to Austin, Tex.

City officials and Google executives began quietly talking more than a year ago about Google buying the public-private network. A key selling point: the city was willing to let the operation go for a steal — just $1.00. In return, Google promised to invest in and upgrade the network to reach the two-thirds of Provo homes it does not reach. Google says iProvo will need technology upgrades in the office, but the existing fiber strands already running throughout the city are service-ready today.

City officials and Google executives began quietly talking more than a year ago about Google buying the public-private network. A key selling point: the city was willing to let the operation go for a steal — just $1.00. In return, Google promised to invest in and upgrade the network to reach the two-thirds of Provo homes it does not reach. Google says iProvo will need technology upgrades in the office, but the existing fiber strands already running throughout the city are service-ready today.

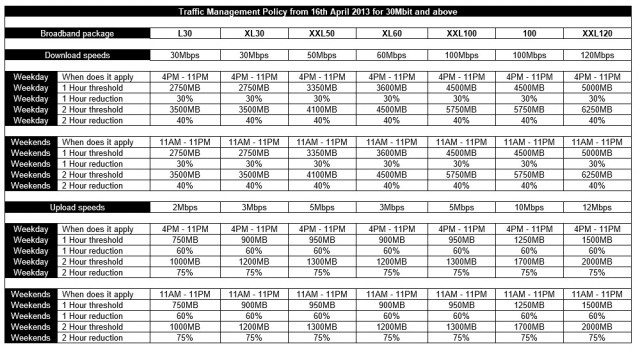

Stop the Cap! has hammered ISPs for a long time for promising “unlimited” broadband but sneaking in “traffic management speed throttles” they call a matter of fairness and we call deceptive marketing.

Stop the Cap! has hammered ISPs for a long time for promising “unlimited” broadband but sneaking in “traffic management speed throttles” they call a matter of fairness and we call deceptive marketing.

Malone sees the future sustainability of the cable industry dependent on the high revenue broadband business.

Malone sees the future sustainability of the cable industry dependent on the high revenue broadband business.

On the heels of today’s announcement from Google that it intends to make Austin, Tex. the next home for Google Fiber, AT&T

On the heels of today’s announcement from Google that it intends to make Austin, Tex. the next home for Google Fiber, AT&T