Garofalo

Outrage from Minnesota’s elected officials representing rural districts around the state has embarrassed Minnesota House Republicans into grudgingly restoring a token amount of broadband funding to help small communities get online.

Earlier this month, the GOP majority’s budget proposal completely eliminated broadband development grants, which amounted to $20 million in 2014. Republicans attacked the spending as unnecessary and a wasteful “luxury.” The money was reallocated towards promoting tourism.

Budget point man Rep. Pat Garofalo (R-Farmington) said hardwired Internet access was outdated.

“The future is wireless and satellite Internet,” Garofalo declared, adding these were better, cheaper options for rural Minnesota.

Rural Minnesota strongly disagreed.

The West Central Tribune in Willmar declared the GOP budget proposal very disappointing to everyone in rural Minnesota.

“Rural Minnesota will continue to fall behind in broadband access and, in turn, the critical factors of quality of life, education, economic opportunities, access to health care and many other positive benefits,” the newspaper wrote in an editorial.

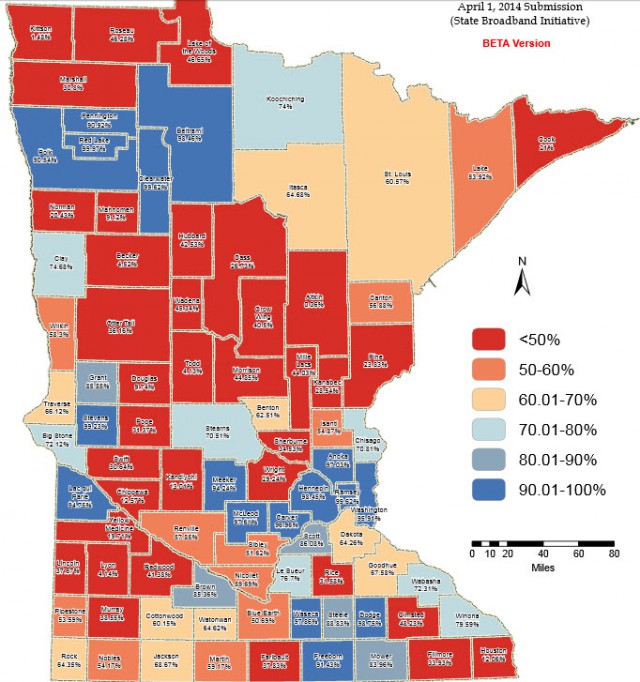

Rural Minnesota Broadband: Nothing to write home with a quill pen about.

“We are astonished as to why the House would ignore one of the state’s biggest economic development needs,” said Willmar City Council member Audrey Nelsen, a member of the Coalition of Greater Minnesota Cities’ board. “The lack of high-quality broadband affects communities and regions all across the state.”

“We agree,” the paper declared.

“High-speed Internet service is not a luxury, it is an absolute necessity for job and business growth,” said executive director Dan Dorman of the Greater Minnesota Partnership.

House Republicans seem intent on stomping out rural Minnesota’s digital economy. Broadband coverage in these areas is a disgrace: Kandiyohi County is third lowest in Minnesota, at only 13.18 percent, in the percentage of households with access to broadband that meets state-speed goals. Surrounding counties with low access percentages include: Chippewa at 24.47 percent, Yellow Medicine at 25.69, Swift at 30.41, Pope at 31.40 and Renville at 58.29.

In 2013, Gov. Dayton’s Broadband Task Force Report recommended a $100 million infrastructure fund to start addressing the $3.2 billion total investment needed statewide to address this issue. Garofalo seems ready to concede to an $8 million token allocation some Democrats call insulting.

Rep. Tim Mahoney said he believed 10 years of an annual $20 million investment would solve the rural broadband problem in Minnesota in a decade. The St. Paul Democrat believes with the GOP’s budget, it will take forever.

“For them to come up with $8 million is kind of ridiculous,” Mahoney said. “It’s almost a slap in the face.”

Garofalo believes AT&T and Verizon’s forthcoming home wireless broadband solutions will solve Minnesota’s broadband problems, without considering those services are expensive and tightly usage-capped. Satellite Internet is condemned by critics as costly “fraudband,” often speed-throttled and usage capped.

Fiber Internet, in Garofalo’s world view, is “yesterday’s technology,” despite ongoing investments in fiber to the home Internet around the world, including investments from companies including AT&T, Verizon, Google, and others that now offer fiber technology capable of speeds in excess of 1Gbps.

Sober assessments of the different broadband technologies available in Minnesota are already available from the state’s Office of Broadband Development. Garofalo’s budget resolves the ideological conflict between his views and theirs by eliminating the agency.

Garofalo said to save rural broadband, the state government must first kill any plan that might interfere with the private sector.

“The private sector won’t invest if it senses that the government is coming in with something else,” he said.

Without throwing Garofalo totally under the nearest tourist bus, House Ways and Means Committee chairman Jim Knoblach said the state needs rural broadband funding, even if other options such as wireless Internet may be a more efficient way to tackle the problem down the road.

“There are people waiting for broadband now that I think this would help,” the St. Cloud Republican said, supporting the restoration of $8 million in funding.

Subscribe

Subscribe

What will happen in Verizon service areas that are not considered priorities?

What will happen in Verizon service areas that are not considered priorities?

“EPB’s efforts have encouraged other telecom firms to improve their own service,” states the report. “In 2008, for example, Comcast responded to the threat of EPB’s entrance into the market by investing $15 million in the area to launch the Xfinity service – offering the service in Chattanooga before it was available in Atlanta. More recently, Comcast has started offering low-cost introductory offers and gift cards to consumers to incentivize service switching. Despite these improvements, on an equivalent service basis, EPB’s costs remain significantly lower.”

“EPB’s efforts have encouraged other telecom firms to improve their own service,” states the report. “In 2008, for example, Comcast responded to the threat of EPB’s entrance into the market by investing $15 million in the area to launch the Xfinity service – offering the service in Chattanooga before it was available in Atlanta. More recently, Comcast has started offering low-cost introductory offers and gift cards to consumers to incentivize service switching. Despite these improvements, on an equivalent service basis, EPB’s costs remain significantly lower.”