Each of 15.4 million Time Warner Cable customers will effectively pay $19.48 to cover executive golden parachutes and Wall Street bank advisory fees if the merger with Charter Communications is approved by regulators.

Each of 15.4 million Time Warner Cable customers will effectively pay $19.48 to cover executive golden parachutes and Wall Street bank advisory fees if the merger with Charter Communications is approved by regulators.

Five senior executives at Time Warner Cable will split $200 million with an additional $100+ million going to a variety of investment banks that provided advice for the merger deal.

A required filing with regulators disclosed the exit bonuses likely to be paid to the departing executives of Time Warner Cable, some who have been in those positions for less than two years:

- CEO Robert Marcus, who has served in that role for only a year and a half, will receive roughly $4.5 million in salary, $23 million in bonuses and stock worth $74 million. His total golden parachute: $102 million;

- COO Dinesh Jain: $32 million;

- CFO Arthur Minson: $32 million;

- General Counsel Marc Lawrence-Apfelbaum: $22 million;

- Chief Strategy Officer Peter C. Stern: $18 million.

Ironically, golden parachutes were originally designed to protect shareholders from executives’ self-interest. Instead of interfering in merger and acquisition deals to protect their salaries and positions, the incentive of a generous exit bonus encouraged executives to do the right thing for shareholders.

Wall Street investment banks participating in the deal are also handsomely compensated for a few weeks of “advice.”

Together, the banks will share an estimated $100 million to $150 million in fees, according to Thomson Reuters and Freeman Consulting Services. The lucky ones — Morgan Stanley, Citigroup, Centerview Partners and Allen & Company — advised Time Warner Cable and get 60 percent of the proceeds. The pickings are slimmer for a larger pool of banks that advised Charter, some that will only get to earn based on their role financing the deal. The biggest winners on the Charter side are omnipresent Goldman Sachs along with the tiny firm LionTree Advisors (which barely has a website). LionTree enjoys the confidence of John Malone, who uses them often in similar deals. These two firms will split $30-50 million.

Charter executives will benefit from the deal later, when future demands for bigger compensation packages are met.

Among investors, a handful of hedge funds will likely walk away with the most money. Paulson & Company, run by the billionaire John Paulson, owned 8.7 million shares of Time Warner Cable stock, according to a March 31 public filing. He is expected to walk away with a profit of at least $250 million by buying low and selling high. Time Warner shares have risen ever since Wall Street found out Time Warner was a willing seller.

Among investors, a handful of hedge funds will likely walk away with the most money. Paulson & Company, run by the billionaire John Paulson, owned 8.7 million shares of Time Warner Cable stock, according to a March 31 public filing. He is expected to walk away with a profit of at least $250 million by buying low and selling high. Time Warner shares have risen ever since Wall Street found out Time Warner was a willing seller.

So who is likely to lose the most from the deal? Customers, employees and middle management.

If approved, Time Warner Cable and Bright House Networks customers will become customers of Charter Communications, a considerably indebted company with mediocre customer service ratings and a menu of service options carefully designed to boost the average revenue Charter collects from each of its customers. Charter is likely to endure growing pains common when a company swallows another four times larger than itself. Bright House customers will likely see the changes the most. Its customer service ratings are stellar when compared against Charter and Time Warner Cable.

Middle management positions at Time Warner Cable and Bright House deemed redundant in the era of New Charter will be eliminated. At even bigger risk are call center and customer service positions. Charter Communications has already beefed up its own customer service operations, partly for its customers and those it assumed it would gain from a deal with Comcast and Time Warner Cable. Charter was also to be closely involved in supporting the GreatLand Connections spinoff proposed in that failed deal. With excess customer service capacity, Charter is in a position to consolidate or close several Time Warner Cable and Bright House call centers. Charter has also aggressively pursued savings by offering customers more self-service options, such as mailing set-top boxes and cable modems customers can install themselves. Whether Charter decides to outsource more of its cable service technician positions is not yet known.

Subscribe

Subscribe

“The boss of Liberty, a cable and media conglomerate, he has struck more deals than perhaps any other tycoon in the world—buying and selling hundreds of firms worth over $100 billion since the 1970s, often negotiating on his own, using calculations that fit on a napkin,” said the publication. “Unusually for an empire-builder he has made his investors a ton of money, and has little interest in the public eye.”

“The boss of Liberty, a cable and media conglomerate, he has struck more deals than perhaps any other tycoon in the world—buying and selling hundreds of firms worth over $100 billion since the 1970s, often negotiating on his own, using calculations that fit on a napkin,” said the publication. “Unusually for an empire-builder he has made his investors a ton of money, and has little interest in the public eye.” A tiny Madison Avenue investment bank (so small its only web presence is

A tiny Madison Avenue investment bank (so small its only web presence is

Charter has deals pending with both Comcast and Time Warner Cable to launch GreatLand Connections and have plans to takeover Bright House Networks, both contingent on the Comcast-Time Warner Cable merger getting approval.

Charter has deals pending with both Comcast and Time Warner Cable to launch GreatLand Connections and have plans to takeover Bright House Networks, both contingent on the Comcast-Time Warner Cable merger getting approval. The Federal Communications Commission announced Friday it will

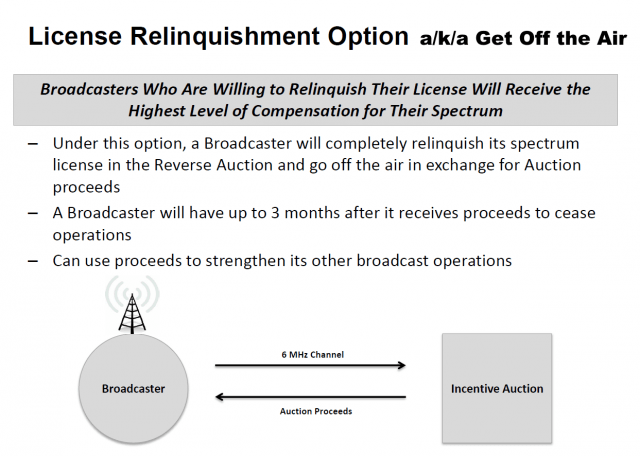

The Federal Communications Commission announced Friday it will  There is so much money to be made buying and selling the public airwaves — at least twice as much as broadcasters originally anticipated– spectrum speculators have also jumped on board, snapping up low power television station construction permits and existing stations with hopes of selling them off the air in return for millions in compensation. Wireless customers are effectively footing the bill for the auction as wireless companies bid for the additional spectrum. Television stations will receive 85% of the proceeds, the FCC will keep 15%.

There is so much money to be made buying and selling the public airwaves — at least twice as much as broadcasters originally anticipated– spectrum speculators have also jumped on board, snapping up low power television station construction permits and existing stations with hopes of selling them off the air in return for millions in compensation. Wireless customers are effectively footing the bill for the auction as wireless companies bid for the additional spectrum. Television stations will receive 85% of the proceeds, the FCC will keep 15%. Major network-affiliated or owned stations in major cities are unlikely to take the deal. But in medium and smaller-sized markets where conglomerates own and operate most television stations, there is a greater chance some will be closed down, moved to a lower channel, or transferred to a digital sub-channel of a co-owned-and-operated station in the same city. The most likely targets for shutdown will be independent, CW and MyNetworkTV affiliates. In smaller cities, multiple network affiliates owned by one company could be combined, relinquishing one or more channels in return for tens of millions in cash compensation.

Major network-affiliated or owned stations in major cities are unlikely to take the deal. But in medium and smaller-sized markets where conglomerates own and operate most television stations, there is a greater chance some will be closed down, moved to a lower channel, or transferred to a digital sub-channel of a co-owned-and-operated station in the same city. The most likely targets for shutdown will be independent, CW and MyNetworkTV affiliates. In smaller cities, multiple network affiliates owned by one company could be combined, relinquishing one or more channels in return for tens of millions in cash compensation.