Stop the Cap! this week formally filed our opposition to the merger of Charter Communications and Time Warner Cable with the California Public Utilities Commission (CPUC), citing our concerns about data caps/usage-based pricing, Internet competitiveness, affordability, and quality of service.

Stop the Cap! this week formally filed our opposition to the merger of Charter Communications and Time Warner Cable with the California Public Utilities Commission (CPUC), citing our concerns about data caps/usage-based pricing, Internet competitiveness, affordability, and quality of service.

Matthew Friedman, Stop the Cap!’s new director of our California branch, spoke in opposition to the transaction at a public meeting held by the CPUC in Los Angeles on Tuesday. Friedman authored our formal 10,500-word opposition, particularly focusing attention on Charter’s commitment not to cap or meter broadband usage for only three years after the deal is approved.

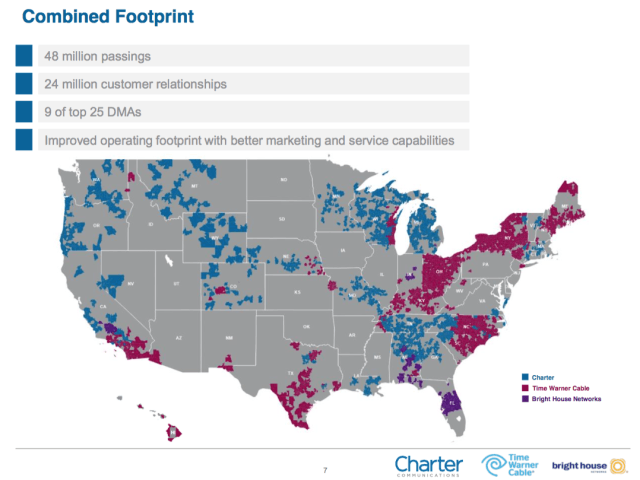

Charter’s temporary “good behavior” commitments open Time Warner Cable and Bright House Networks customers to the potential of the same kind of usage caps and usage pricing being tested by Comcast, with little likelihood imminent competition will give consumers alternative cap-free choices.

Stop the Cap! proposed a permanent ban on compulsory data caps with New York regulators, which was not adopted. In California, we are asking the CPUC to consider allowing Charter’s “good behavior” commitments to expire only when customers have access to near-equivalent competitors offering unlimited service options, either from resellers of Charter’s broadband network or from existing or new competitors.

It is our view usage caps and usage-based billing represent an end run around Net Neutrality and will be used to limit online video competition.

We also repeat our assertion that Charter’s commitments for Time Warner Cable customers are less compelling than the benefits of Time Warner Cable’s own ongoing upgrade program, dubbed “Maxx.” Charter has committed to providing Time Warner customers with broadband speeds up to 100Mbps. Time Warner Cable Maxx offers a maximum speed of 300Mbps — three times faster than Charter.

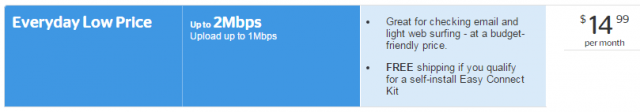

Time Warner Cable’s $14.99 Everyday Low Price Internet option, available to any customer without conditions or contracts would be terminated, with customers forced to spend just under $60 for entry-level broadband service. Charter’s offers remove customer choices from the marketplace in an attempt to “simplify” pricing. But that will also force customers into packages with services they don’t want or need.

Here is our formal filing in full, also available for download:

Before the CALIFORNIA PUBLIC UTILITIES COMMISSION

Re: Application 15-07-009

Charter/Time Warner/Bright House Transfer

Comments on Data Caps and Usage Based Pricing and Statement of Opposition

January 26, 2016

Stop the Cap! California Branch, Matthew Friedman

Stop the Cap! is a consumer group founded in 2008 to fight against the introduction of artificial limits on broadband usage (usage caps, usage based pricing, speed throttling) and to promote better broadband speeds and service for consumers. Our group does not solicit or accept funding from lobbyists, companies, or others affiliated with the telecommunications industry. We are entirely supported by individual donors who share our views.

Executive Summary

Part 1 of this document proposes a mitigation condition relating to data caps and usage based pricing (DC/UBP) that would not sunset after an arbitrary number of years. Instead, it would sunset based on the existence of actual competition in the wireline broadband marketplace.

This document details how data caps and usage based pricing present significant and numerous harms to consumers and competition in general, and why the CPUC’s approval of this transaction would make DC/UBP much more likely to be imposed on existing Time Warner Cable subscribers. We detail TWC’s long-standing, public, and vocal commitment against imposing DC/UBP. We explain why the Commission should be particularly suspect of Charter when it comes to DC/UBP. Finally, we show that Charter’s opening testimony actually supports the mitigation condition that is being proposed here.

Stop the Cap! believes that this transaction is clearly not in the public interest, and the Commission should deny the transfer. If however, for some reason the Commission decides to approve the transfer, we respectfully submit this mitigation condition to protect Californians from one of the severe harms this merger will certainly bring.

Part 2 of this document is a broader examination of why the transaction is not in the public interest. We detail how Time Warner Cable is stronger company with superior offerings to Charter, and we show why Charter is proposing a deal that is not only not in the public interest, but a large step backwards for consumers.

The Commission should deny this transfer.

The Proposed Transaction is Not in the Public Interest

Stop the Cap! strongly believes that it’s clear that the Commission should NOT approve this transaction. The testimony of the Intervenors has shown that the “benefits” Charter is claiming are tenuous at best, if even present at all. The only real benefit of this transaction appears to be to the applicants’ shareholders, and possibly not even them.

There are an immense amount of risks, potential harms, and even certain harms that will come to consumers if this transaction is allowed to proceed–more than were present even in the Comcast/TWC scenario. The certain harms far outweigh any potential benefits.

In these comments we focus on data caps and usage based pricing in particular. These practices are almost always detrimental to consumers, as TWC management has recognized, and they shouldn’t be imposed at all. One of the negative aspects of this proposed merger is that TWC customers would lose the “no data caps EVER” pledge from TWC. If for some reason the Commission decides to approve the transfer, the loss of TWC’s anti-data cap corporate attitude must be mitigated, and in a way that matches the permanence of TWC’s current pledge.

If, however, the Commission does decide to approve this transfer, the loss of TWC’s vocal commitment to NEVER impose DC/UBP must be mitigated, and it must be mitigated in a way that matches the permanence of TWC’s commitment. Mitigation conditions that are only temporary in nature are not sufficient to offset those harms.

Proposed Mitigation Condition

New Charter shall refrain from imposing data caps and/or usage-based pricing (DC/UBP) on all of its broadband offerings. New Charter will refrain from increasing prices on non-DC/UBP plans to compensate for this mitigation condition.

This mitigation condition shall sunset when ONE of the following scenarios comes to pass; however, the condition shall sunset only for those New Charter customers for whom one of the following scenarios is true. In all other New Charter areas where none of these scenarios exist, the mitigation condition shall remain in force.

- There are at least three (including New Charter) competing wireline broadband providers for the area in which New Charter wishes to sunset this mitigation condition. Resellers leasing lines from New Charter may be counted as competitors only if New Charter does not impose any sort of usage based billing or data caps on the resellers.

- There are at least three competing broadband providers (both wired and wireless) for the area in which New Charter wishes to sunset this mitigation condition, and the wireless providers offer a non-usage-based billing plan that is no more expensive than similar non-usage-based billing plans offered by the wireline providers. Providers that offer unlimited data but throttle speed after a certain amount of data is consumed shall be considered as utilising data caps for the sake of this evaluation.

Should a New Charter customer demonstrate that the competing wireless provider is unable to supply actual broadband speed to their physical address (for instance, due to poor reception), then New Charter shall continue to offer that customer data plans not subject to DC/UBP. Additionally, New Charter shall refrain from increasing the price of this non DC/UBP plan above the cost of the comparable DC/UBP plan (before considering any data overage fees).

- There is a functional community-owned broadband alternative available to the customers for which New Charter wishes to sunset this mitigation condition.

This condition defines “broadband” as providing the minimum broadband speed as set by the FCC at the time of evaluation for sunsetting.

What is DC/UBP?

“Usage Based Pricing” (sometimes referred to as “Metered Billing” or “Data Caps”) is when an Internet Service Provider places an upper limit on the amount of data a customer can use in a given month. Typically in wireline internet situations, if the customer goes over their monthly allowance, they are charged an additional fee for a set amount of additional data. If this additional data allotment is used, the customer is charged again for a second allotment, and so on until the monthly billing period ends. For instance, Comcast charges its data capped customers $10 for each additional 50GB used.[1] A good way to understand DC/UBP is to begin with what it is not.

DC/UBP is NOT about network management

This assertion has been debunked by scientific research for almost ten years,[2] and now even ISPs themselves are acknowledging the same. In January 2015, National Cable and Telecommunications Association president Michael Powell told a Minority Media and Telecommunications Association audience that while a lot of people had tried to label the cable industry’s interest in the issue as about congestion management, “That’s wrong,” he said. “Our principal purpose is how to fairly monetize a high fixed cost.”[3] However, even this explanation is myth-based. (See discussion next section.)

On 14 August 2015, Comcast’s Vice President of Internet Services, Jason Livingood, stated publicly that DC/UBP was not a network management decision, but a “business decision” that he had no part in making.[4]

Then, on 5 November 2015, an internal Comcast document instructing CS Reps how to answer questions about DC/UBP was leaked. That document instructs Comcast personnel “Do not say: The [DC/UBP] Program is about network management. (It is not.)”[5] (Emphasis added).

Time Warner Cable’s CEO Robert Marcus similarly has spoken about DC/UBP as a business decision (and is his opinion a bad one).[6]

DC/UBP is NOT about pricing fairness

If DC/UBP were truly about pricing fairness, subscribers would pay for exactly the amount of data they used, and no more. This model would be like water or power: there would be no monthly charge whatsoever (or perhaps only a miniscule one): if you used a kilobyte, you’d pay for a kilobyte. If you happened to be on vacation for a month and didn’t use any data, then your broadband bill would be zero. There would be no startup or termination charges. There would be no modem fees, just as there are no gas meter or electrical transformer fees. Tight government regulation over pricing would be beneficial as well.

None of these conditions is present in any of the wireline DC/UBP plans in the US currently, and none that I know of anywhere in the world, though I haven’t done an extensive search. Regardless, it’s clear that the purpose of DC/UBP is not to provide “pricing fairness.”

The GAO’s explanation of DC/UBP

In 2014, the U.S. Government Accountability Office performed a study on DC/UBP. The GAO determined that while it is possible for providers to employ DC/UBP to the consumers’ advantage, “providers facing limited competition could use UBP to increase profits, potentially resulting in negative effects, including increased prices, reductions in content accessed, and increased threats to network security. Several researchers and stakeholders that the GAO interviewed said that UBP could reduce innovation for applications and content if consumers ration their data.”[7]

Simply put: absent sufficient competition, the purpose is two-fold. First, DC/UBP allows cable providers to use their monopoly (or in some much rarer cases duopoly) powers to extract additional revenues from customers. Upon the imposition of DC/UBP, the vast majority of customers have no competing provider of wireline broadband to whom they can turn.[8]

Secondly, DC/UBP gives cable internet providers the ability to use their “terminating monopoly” power to quash competition to their core video offerings. For instance, SlingTV CEO Roger Lynch in early December accused Comcast of setting its data caps just low enough to prevent customers from replacing cable TV with online video streaming.[9]

To see how this terminating monopoly power works, consider one of the increasing number of “cord cutting” households. By some estimates, 1 in 7 Americans are currently television cord-cutters.[10] These consumers do not subscribe to cable television. Instead, they purchase broadband only and subscribe to services such as Hulu, Netflix, Vudu, YouTube, Crackle, Fandor, etc. These services offer direct competition to cable providers’ video offerings. The imposition of “usage based billing” can artificially increase the price of cord cutting so that it is no longer a viable option for consumers.

A typical “cord-cutting” home uses an average of 328GB/mo,[11] exceeding most data-capped plans’ initial allowances. In fact, in October the Associated Press reported that 8% (and rising) of Comcast customers regularly exceed their data allowances and are charged overage fees.[12] As the emergence of UHD and 4k video offerings by streaming services such as Netflix and Amazon continues, these percentages will rise dramatically.[13] Since cable operators’ core video offerings are excluded from a user’s data count, it can quickly become cheaper to subscribe to a bloated cable package than pay data overage fees in addition to a la carte streaming service subscriptions. Then consumers must pay still more additional fees for DVRs to replace streaming’s de facto “on demand” nature. And yet more fees for additional cable boxes. This then is the true purpose of DC/UBP: increasing revenue, in part from overage fees and in part from pushing consumers into traditional cable packages with additional fees.

Potential Public Harms from DC/UBP

DC/UBP financially harms ratepayers, especially lower income customers

The effect of the financial penalties that streaming Netflix (and other such services) carries under DC/UBP plans will push consumers to New Charter’s own, more expensive, subscription offerings since watching video through New Charter’s traditional cable network would not count against consumers’ data allotments. These services are bundled such that subscribers must pay for hundreds of channels they have no interest in in order to get the 10-20 that they actually want to watch, thus artificially inflating their cable bill. (For instance, a recent Civic Science survey found that 56% of pay-tv subscribers would drop ESPN from their lineup in order to save $8/mo on their cable bills.[14] Cable companies, however, do not offer this as an option.) When DC/UBP is not present, cord-cutting is cheaper than cable, sometimes significantly so depending on the type of television in which the cord-cutter is interested.[15] Lower income Californians will be hit especially hard as DC/UBP forces them into those bloated, expensive cable “bundles.” For lower income viewers, this money-saving alternative will no longer be accessible since their prices are artificially inflated by DC/UBP.

This in turn stifles demand for broadband, running counter to Section 706(a)’s mandate. The CPUC has a statutory duty to protect ratepayers from a monopoly player stifling competition and investment, and that mandate is not limited to an arbitrary number of years.

The Commission is correct to want to expand broadband access to underserved areas, but it must also protect against that same access being used to prevent lower-income Californians from saving money on television bills by “cord-cutting.”

New Charter can use DC/UBP to circumvent Net Neutrality rules

Comcast is currently attempting an end-run around net neutrality rules and strongly pushing customers to their new streaming service “Stream TV” over competitors such as Hulu and Netflix. Comcast is exempting their own (more expensive) cord-cutting streaming service from usage-based metering, while competing services count against subscribers’ data allotments. While this is illegal under net neutrality, Comcast is arguing that since Stream TV exclusively uses its own IP network, and not the internet per se, net neutrality doesn’t apply.[16] As Wired.com put it, “Comcast may have found a major net neutrality loophole.”[17] (Note that this example directly contradicts the testimony of Charter’s Dr. Scott Morton.[18])

This is a loophole that New Charter could also use in order to attempt to circumvent net neutrality regulations. However, if the CPUC bars New Charter from instituting DC/UBP, this end-run loophole would be closed, and New Charter would not be able to engage in the anti-competitive customer-harming behavior that Comcast is now attempting.

It’s important to note here that the Commission cannot rely on the federal government to provide this protection to Californians. A number of U.S. Congress members have filed briefs requesting that courts overturn the FCC’s net neutrality rules.[19] Further, at the time of this writing, a number of house members are attempting to insert a net neutrality defunding clause into the omnibus spending bill.[20]

Under a Republican president and Congress, it’s clear that California should expect the federal government to abandon any and all open internet and net neutrality regulations. But as with climate change and carbon emissions legislation, California has the opportunity to lead the country by ensuring net neutrality and protecting competition, in part by adopting this proposed mitigation measure.

DC/UBP also gives ISPs the ability to leverage sponsored data programs. Such programs pose an existential threat to net neutrality, but on a more basic level, harm consumers by increasing fees for the services that participate. Sponsored data programs also present a barrier to entry for new, innovative, and less well-funded competing services.[21]

DC/UBP facilitates anti-competitive behavior

As the GAO report put it, “…fixed providers—many of whom also provide television video content—could use UBP as a means to raise the price for watching online streaming video services—a competitor to their video services—as households continue to substitute television with streaming video.”[22] New Street Research analyst Jonathan Chaplin points out that usage-based billing would be one of Charter’s strongest potential weapons against online video competitors.[23]

DC/UBP hinders innovation and investment

Again, from the GAO report:

“Because UBP can make it more expensive to watch data-heavy content such as streaming video, it may discourage people from accessing such content and, therefore, discourage them from eliminating their television service. This might adversely affect firms that provide online video streaming services and reduce competition and innovation in the market for providing streaming video content, thereby negatively affecting consumers.

In addition, two industry stakeholders we interviewed believe UBP could in general inhibit innovation that results from experimentation and unlimited access to the Internet. Greater innovation could result in the development of more content and applications that consumers demand and value. Some Internet users, such as heavy data users, may pay more for access under UBP. As a result, some of them may limit their Internet use—as mentioned earlier, some focus group participants said that they have reduced their mobile data usage as a result of UBP—particularly of data-heavy content and applications such as online learning and video. This could lead to reduced use of some beneficial Internet applications and innovation in such applications. For example, one public interest group said that the limits that UBP may impose on the market for innovative applications and content may limit the potential of new startups.”[24]

The report goes on to discuss additional ways DC/UBP might reduce innovation, and the above citation is worth reading in full.

These are the same concerns present in Commissioner Florio’s Alternate Proposed Decision in the Comcast proceeding.[25] The alternate PD discusses these concerns as potential harms of Comcast creating a bottleneck between retail subscribers and edge providers, however, the same concerns are equally applicable to an ISP instituting DC/UBP.

DC/UBP has negative effects on network security

According to a 2012 study, DC/UBP may result in consumers—in an attempt to reduce data usage—foregoing automatic security updates to their computers, which could have negative implications for network security.[26]

DC/UBP removes educational opportunities for lower income citizens

In a June 2014 article, US News and World Report explained how online education can provide a significantly lower-cost and more flexible path to a degree. The article cites a Georgia Institute of Technology announcement that it would be offering an online master’s degree in computer science for $6,600 – about $35,000 less than its on-ground program.[27]

The online education model can put a higher degree in reach for countless people who otherwise could not afford that opportunity. However, this model relies heavily on video teleconferencing and video lectures. DC/UBP could inflate the price of online education such that it too could be unaffordable for lower-income Californians, completely pricing them out of higher degrees that could move them out of poverty into the middle class.

Charter could use DC/UBP as a loophole to completely avoid providing “Lifeline” low cost internet service, thus increasing the digital divide.

Envision a worst-case scenario where New Charter agrees to carry on TWC’s existing $14.99 low-cost plan, but caps the data at 5GB, then charges (as Comcast is currently trialing) $10 for each additional 50GB the subscriber uses. For a typical cord-cutting household that uses approximately 330GB of data a month, that would make the price of this “low-cost lifeline” plan $79.95/mo. A “low-cost” internet option of $80/month will do nothing to close the digital divide.[28]

Mitigating the Loss of TWC’s Commitment Against DC/UBP

Time Warner Cable has frequently stated publicly that it will “NEVER” impose DC/UBP. Over time, TWC has demonstrated an extremely different corporate culture and attitude towards DC/UBP than Charter has demonstrated. TWC’s CEO Robert Marcus has time and again made it clear that compulsory usage caps are off the table at Time Warner Cable – a lesson TWC learned after customers pushed back and forced it to shelve a usage cap experiment planned for Rochester, N.Y., Greensboro, N.C., and Austin, San Antonio, and Beaumont, Tex. in April 2009.[29]

TWC subsequently admitted their flirtation with DC/UBP was a mistake. That story, along with the pledge to never impose usage-based billing, is still on Time Warner Cable’s official blog at the time of this writing.[30]

The company has never raised the possibility of compulsory usage limits or usage-based billing again. In fact, Marcus often seems to be evangelizing AGAINST DC/UBP in general. On an October 2014 Wall Street analyst conference call, Marcus stated “We have no intention of abandoning an unlimited product we think is something that customers value and are willing to pay for. The way we’ve approached usage-based pricing is to offer it as an option for customers who prefer to pay less because they tend to use less. And we’ve made those available at 5 gigabytes per month and 30 gigabytes per month levels.”[31]

It’s notable that while Comcast maintained the price point of the plans it converted from unlimited to mandatory UBP, TWC’s optional UBP plans came with a price discount. However, the discounts on those packages were minimal, and as of 11/21/2015 those packages are no longer advertised on the TWC website.

Marcus has continued to be publicly vocal about TWC’s decision to keep its non-usage-based pricing intact. He spoke to this point at the Deutsche Bank Media, Internet, and Telecom Conference in March of 2014,[32] and again in a July 2015 investor conference call.[33]

On an October 2015 investor call Marcus was questioned by analyst Jonathan Chaplin on TWC’s lack of DC/UBP. Marcus responded that the way to increase revenue was to deliver more utility. DC/UBP is the opposite of that, he said.[34]

If the CPUC approves this transaction without mitigation, it will be allowing for the destruction of the largest US wireline broadband entity dedicated to NEVER instituting compulsory DC/UBP in favor of a mere three year commitment. It would forever remove a policy competitor that subscribers to other wireline broadband providers could point to and say, “Yes, a cable company can be profitable without DC/UBP.” More directly, the loss of TWC’s corporate culture and belief that DC/UBP is a poor business decision would be an immense harm to current and future TWC customers.

Charter Is Particularly Suspect Concerning DC/UBP

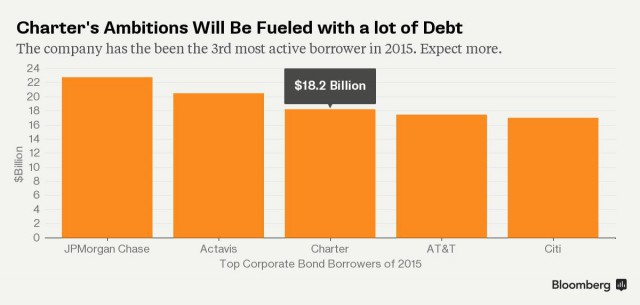

This merger’s financing model gives New Charter every incentive to impose DC/UBP

Post-merger, New Charter will be in a precarious financial position.[35] One of the strongest incentives for rate increases is the level of debt Charter Communications will assume in this transaction. The New York Department of Public Service staff, in examining this transaction for that state, concluded that New Charter’s debt and lowered credit rating “represents the single most substantial risk of the proposed transaction.”[36]

Charter’s Mr. Fisher disagrees with this analysis in his opening testimony, stating that “New Charter will be financially healthy to the benefit of its shareholders and consumers throughout the State of California.”[37] [emphasis added]. If this is true, then this proposed mitigation will help ensure that consumers do in fact see some of those benefits, and that they are not all given only to shareholders, an occurrence that happens far too often in transactions such as the one currently under consideration. This is especially important since when Mr. Fisher later lists the benefits that will come from the merger, none of the benefits he lists are in the area of consumer pricing.[38] As we detail later in these comments, prices will actually go UP after the merger.

Charter has provided inaccurate information about their history with DC/UBP

Charter’s expert Dr. Fiona Scott Morton, a professor of economics at the Yale School of Management, stated in FCC testimony:

“For 3 years, New Charter will not charge consumers additional fees to use specific third-party Internet applications, or engage in zero-rating (discriminatory exemptions from a data cap).

These binding commitments provide further assurance beyond the economic reasoning I describe below — assurance that New Charter will not engage in these types of conduct: charging higher interconnection fees, using discriminatory data plans, or reducing the quality of OVD signals. (Note that Charter already does not have data caps for its residential broadband customers. Notwithstanding the dramatic but welcome rise in data usage by broadband customers, Charter has not had an active data cap since January 2012.)”[39]

But this statement is simply incorrect. As of November 2013 Charter had data caps ranging from 100-500GB.[40] Customers in some areas were called by Charter for exceeding their usage allowance,[41] and usage rationing remained in Charter’s Acceptable Use Policy until late 2014,[42] not January 2012 as Dr. Scott Morton claims. In fact, as of 21 November 2015, Charter’s AUP still allows it to define “excessive use of bandwidth” however it sees fit, and take any action that Charter in its sole opinion it deems reasonable.[43] Dr. Scott Morton does not believe Charter has any interest in imposing data caps on customers, despite the fact Charter quietly shelved existing caps on Oct. 1, 2014, just several months before unveiling its bid for both Time Warner and Bright House, neither of which have capped customer usage.[44]

The FCC is rightly concerned about this discrepancy, and has requested that Charter detail when it adopted bandwidth usage caps, when it dropped them, and why.[45] The CPUC would be right to be concerned as well.

Charter has a history of misleading customers and regulators.

For example, Charter advertises Spectrum TV Stream service at $12.99/mo, when most users will actually pay at least $20/mo, some more.[46] While some “padding” via fees is unfortunately normal, this is upwards of a 50% differential. Note that this is in direct contradiction to Mr. Fisher’s opening statement to the CPUC, in which he claims that Charter “does not separately charge users incremental fees that other providers in the industry commonly add on to the advertised price… As a result, consumers have a clearer understanding of… the price that they will see on their bill.”[47]

Another example: The FCC is concerned about 26% owner John Malone’s involvement with this merger, as he has engaged in anticompetitive behaviour in the past.[48] Malone, whom Senator Al Gore once referred to as “The Darth Vader of telecom,”[49] is currently best known as the owner of SiriusXM satellite radio. The two satellite companies merged in 2008 with a mitigation condition forbidding any rate hikes for three years.[50] Upon the expiration of that condition, SiriusXM promised investors an immediate price hike.[51] Based on past history, there’s no reason to believe that any mitigation conditions the CPUC imposes on this transaction won’t be discarded immediately upon expiration.

And a third example: on 20 January 2016 Charter released the results of a survey that it sponsored itself. Charter claims that the results show public support for the merger. However, the statements Charter used in the poll pertaining to data caps were extremely misleading. Respondents were told by the pollster that “Charter has said that it will not impose data limits on customers after the merger.”[52] However, there was no mention of the incredibly brief 3 year time limit on this commitment, nor the fact that Time Warner has promised for years to never impose data limits on customers. It is definitely misleading, possibly deceitful, for Charter to use responses to this deceptive statement as “proof” of public support for this transaction.

A fourth example: Dr. Scott Morton’s November 2 statement is less than forthcoming in many regards. On Page 10 (Section 27) Dr. Scott Morton completely omits a fourth characteristic of a valuable MVPD partner: the commitment to refrain from implementing DC/UBP. Implementation of DC/UBP would artificially increase the cost of the OVD’s product to the consumer, thus decreasing demand for that service. This increased cost over which the OVD has no control is in effect a barrier to market entry, and therefore a disincentive to innovation and reduction of competition.

It’s also telling that Dr. Scott Morton’s conclusion in Part 49 is that Charter’s “technology” promotes entry of OVDs. Conspicuously absent is the statement that Charter’s “policies” promote entry of OVDs. Even more conspicuous is that as noted in Part 128, Charter promises a mere three years of refraining from disadvantaging OVDs. What Charter is promising is both flimsy and transparent: “You have nothing to worry about, but only hold us to it for three years.”

Still further, in Part 130, Dr. Scott Morton notes Netflix’s statement that “Charter’s new peering policy is a welcome and significant departure from the efforts of some ISPs to collect excess tolls to the Internet.” However, the CPUC must guard against New Charter shifting these “excess tolls” directly onto subscribers as the GAO report referenced earlier warned. DC/UBP would be a prime means for New Charter to do just that.

A fifth example: the opening testimony of Charter’s Mr. Falk is likewise misleading on a number of points. Mr. Falk claims that the merger will come with “no countervailing harms,”[53] however, according to his own statement, there are clearly price increases coming for many TWC customers.[54] Mr. Falk testifies about Charter’s “customer friendly billing practices,” but in reality those practices are not friendly to consumers at all.[55] Mr. Falk then goes on to make a claim that is flatly contradicted by his own expert’s testimony to the FCC,[56] makes misleading statements about the significance of wireline competition,[57] and a statement that is materially false regarding pricing of Charter’s base internet speed tier.[58]

Charter has flatly failed to comply with multiple Commission rulings.

Charter has refused to comply with certain requirements of DIVCA even though the company submitted an affidavit to the Commission swearing to do so.[59] More recently, Charter ignored the January 20 ALJ ruling of A.15-07-009, which required that “Charter and TWCIS shall provide notice to their respective customers not less than 5, nor more than 30 days, prior to” the

Los Angeles Public Participation Hearing scheduled for January 26.[60] As of the morning of January 25, I had received no such notice either by email or postal mail, even though I hold not one but two California-based TWC accounts. Note that I did check my SPAM folder, and no notices had been diverted there.

The point being… both consumers and the CPUC should be extremely suspect of anything Charter says regarding the benefits of this merger, including their reasoning that DC/UBP is something that they have no interest in instituting. Mitigations should be designed to protect consumers against a potentially hostile and untrustworthy monopolistic player, particularly around an issue as nuanced and complex as usage based pricing.

Charter’s Opening Testimony Supports this Proposed Condition

New Charter should not object to this proposed mitigation condition, since it is substantially supported by Dr. Scott Morton’s November 2 statement, as well as the opening testimony from Mr. Fisher, the Senior VP of Corporate Finance at Charter, and Mr. Falk, Charter’s Senior VP for State Government Affairs.

In her November 2 testimony, Part 132, Dr. Scott Morton discusses New Charter’s open internet commitments. While not addressing DC/UBP directly, in her discussion of other conditions addressing issues such as paid prioritization, zero rating, throttling, etc, Dr. Scott Morton states that the fact these conditions have a finite life should not be cause for concern. She explains that in three years’ time market conditions would be such that “a strategy of foreclosure or otherwise trying to impede OVDs would be even more unprofitable for New Charter.”

Dr. Scott Morton then suggests that should New Charter decide to engage in anticompetitive behaviour in three years’ time, consumers could simply switch to an alternate broadband provider. However, as Dr. Scott Morton goes on to point out, there is currently a lack of competing broadband providers in most of New Charter’s proposed footprint. Other experts have also testified that the US market for fixed broadband is not effectively competitive, and this situation will persist for the foreseeable future.[61] This is true for New Charter’s proposed footprint in California as well.[62]

“Currently AT&T/Verizon have usage allotments that make it economically unattractive to use wireless as an in-home broadband service,” Dr. Scott Morton explains. “T-Mobile and Sprint do offer “unlimited” plans, however, they… de-prioritize traffic above usage thresholds…”[63] So even by her own testimony, wireless providers do not count as potential broadband competition for New Charter.

Dr. Scott Morton goes on to examine what little wireline broadband competition does exist, but as the CPUC is well aware, the companies she cites are not available in most of New Charter’s proposed footprint.

In summary, Dr. Scott Morton testifies that in three years time there will be adequate broadband competition present to prevent New Charter from behaving in an anti-competitive manner. If she is correct, then this proposed mitigation condition will sunset based on the existence of that very competition. If she is incorrect about the amount of time it takes for that competitive marketplace to form, then this mitigation will simply continue to protect consumers until the competition Dr. Scott Morton discussed does actually come into existence.

The mitigation condition being proposed here simply ensures that New Charter only has the ability to behave in an anticompetitive way when the “competing broadband provider[s]” Dr. Scott references are actually in existence. It’s designed in a way to be fair to both consumers, and New Charter.

Why Competition Must Be the Only Trigger for Sunsetting this Condition

The 2014 GAO report examined four mobile providers that impose DC/UBP. ALL OF THEM have increased the variety of plans offered, but even more significantly, ALL OF THEM have increased the amount of their monthly data allowances. That’s not true of the fixed internet providers studied. Some of those providers have introduced higher priced, higher speed plans that also come with increased allowances, but NONE of them have increased the data allowances without an accompanying price increase.[64]

The obvious difference between the wireless and wireline providers’ circumstances is the presence of competition in the mobile sphere, and the lack of competition in the wireline sphere. The GAO report affirms this analysis.[65] The report goes on to explain that without adequate competition (and much evidence proves that duopoly markets do not constitute effective competition[66]), wireline customers have fewer plan choices. Only two of the wireline providers examined even offered discounted UBP plans. The two that did offer discounted plans offered discounts far inferiour to the discounts offered by the more competitive wireless market.[67]

For further evidence, consider the example of Comcast’s usage-based pricing “trial.” Comcast’s DC/UBP policies have resulted in a deluge of FCC complaints, potentially upwards of 11,000.[68] Comcast customers report gross inaccuracies in the company’s data meter, resulting in erroneous overage charges.[69] Customers are also reporting that once they pay Comcast’s $35 add-on for truly unlimited service, speeds for services that compete with Comcast (such as Netflix and Hulu) actually DROP.[70] The company then uses these speed issues to attempt to force customers into renting a modem from Comcast. When pressed hard enough by customers with technical knowledge of modems and routers, however, Comcast reps finally do resolve the speed issues remotely.[71]

The logical action for these customers would be to leave Comcast for a different provider; however, for the vast majority of them there is no other provider available. While admittedly Comcast is a different company from Charter, this example underscores the absolute necessity to sunset mitigation conditions only when actual wireline competition exists in the market… NOT after an arbitrary number of years. As Commissioner Florio’s Alternate Proposed decision stated:

“We find that conditions that only temporarily or incompletely mitigate identified harms to the public interest are not sufficient to offset those harms. Such conditions also do not ‘preserve the jurisdiction of the commission,’ as required by § 854(c)(7).[72]”

Summary on DC/UBP

In the Comcast proceeding, the Proposed Decision offered a condition (specifically #17) which would have restricted Comcast from implementing either data caps or mandatory usage based pricing (DC/UBP) for a period of five years. However, as Commissioner Florio’s Alternate Proposed Decision noted, that condition would have been insufficient to effectively mitigate the underlying potential harm due to the condition’s temporary nature.

Many mitigation conditions in the Comcast PD had no sunset clauses at all, such as Conditions 11 and 12 expanding the Internet Essentials program. Just as a sunset for the expansion of IE would have been unreasonable, so the sunset clause for the prohibition on DC/UBP was inadequate. Additionally, it would have run afoul of the Commission’s mandate under § 854(c)(7).

The behaviour of companies in this industry in general, and Charter’s past behaviour specifically, makes it clear that the CPUC should not take a risk on Charter’s less-than-compelling offer of a mere three year delay of the institution of data caps and usage-based pricing.

Beyond this particular issue, we believe that there is overwhelming evidence that this merger clearly would not be in the best interest of Californians, and that the CPUC should deny the transfer of licenses. However, should the CPUC for some reason allow the transfer to take place, we’d strongly request that the CPUC tailor the mitigation condition concerning data caps and usage-based pricing as this paper has suggested. Only a mitigation condition designed in this way would truly protect Californians, yet also be fair to New Charter by allowing the condition to sunset when the competition that Charter’s experts have testified is so important actually comes into existence.

Part 2 — Additional Reasons This Transaction is Not in the Public Interest

Time Warner Cable’s Superior Recent Upgrade Performance

The most important question before the Commission is which cable operator is better positioned to deliver the services customers in this state want and need. We argue that that operator is Time Warner Cable, not Charter Communications.

Since the termination of the Comcast-Time Warner Cable merger, Time Warner Cable has responsibly invested in their infrastructure without assuming an irresponsible amount of debt. Time Warner Cable CEO Robert Marcus reported significant progress in their first quarter 2015 report to shareholders and customers, despite the distraction of the Comcast merger[73]:

Over the past 16 months, we’ve made significant investments to improve our customers’ experience:

- Investing more than $5.2 billion to, among other things, improve the reliability of our network and upgrade customer premise equipment – including set-top boxes and cable modems – with the latest technologies and expand its network to additional residences, commercial buildings and cell towers;

- Launching TWC Maxx, which features greater reliability, all-digital video, advanced TV services, standard tier of Internet speeds at 50 Mbps, and higher tiers of service up to 300 Mbps. New York, Los Angeles and Austin are complete; Dallas, San Antonio and Kansas City are underway; Charlotte, Raleigh and Hawaii are slated for later this year; and San Diego is expected to be done in early 2016;

- Introducing Enhanced DVR, a six-tuner set-top box that allows customers to record up to six shows simultaneously and store up to 150 hours of HD content;

- Increasing the number of Cable Wi-Fi hotspots available to our customers to 400,000;

- Rolling out our cloud-based video guide to 8 million set-top boxes to date. The guide also makes it easier to browse our On Demand library, which now sits at 30,000 free and paid titles and continues to grow;

- Expanding our industry-leading TWC TV app – which allows customers to watch live TV and On Demand content and control and program their DVR from inside and outside the home. TWC TV is now available on Xbox One, Xbox 360, Amazon Kindle Fire HD and HDX tablets, Android and IOS phones and tablets, Fan TV, PCs, Samsung TV and Roku;

Serving customers on their schedules rather than ours. We expanded one-hour appointment windows across the company and in Q1 met that window 97 percent of the time. We continue to add nighttime and weekend appointments.

Since that report, Time Warner Cable has announced new Maxx service upgrade areas – Greensboro and Wilmington, N.C. At least 45 percent of Time Warner Cable’s national footprint was serviced with Maxx upgrades by the end of 2015, and Marcus has indicated additional cities will receive upgrades in 2016.[74]

Marcus has indicated repeatedly he intends to see Maxx service upgrades extend even further. On the January 29, 2015 quarterly results conference call with investors, Marcus indicated Maxx upgrades delivered tangible benefits to the company, including increased customer satisfaction, higher network reliability, and a stronger product line. Based on those factors, it would be logical to assume Time Warner Cable would continue its upgrade project, and indeed Marcus confirmed this in his remarks:

“Our aim is to have 75% of our footprint enabled with Maxx […] by the end of [2016], and my guess is we’re continuing to roll it out beyond that,” said Marcus[75]. “So the only question is prioritization, and obviously as we think about where to go first, competitive dynamics are a factor. So that includes Google, although it’s not explosively dictated by where Google decides to go. In fact I think we announced the Carolinas before Google did their announcement this week. So competitors are certainly relevant obviously.”

At the rate Time Warner Cable has been rolling out Maxx upgrades, which were first announced on 30 January 2014[76], with 45% of its service area upgraded within 23 months, it is likely the company would complete its Maxx upgrade to all of its service areas within the next 24-30 months. Note that in Los Angeles these speed increases came with no corresponding price increase. In evaluating this transaction in New York, the NYDPS staff noted, “there is no indication that Petitioner’s plan for converting to all-digital in New York is any different from Time Warner’s existing plan.” The CPUC should examine this issue as well.

Charter, on the other hand, is saddled with debt servicing costs and more expensive credit, both of which are deterrents to investment and are likely to limit the scope of Charter’s ongoing system upgrades and maintenance, not to mention also placing upward pressure on the prices New Charter will charge consumers. Charter is a much smaller cable operator than Time Warner Cable, and is itself still in the process of repairing and upgrading its own cable systems and those it acquired in earlier acquisition deals. Time Warner Cable, in contrast, is in a much stronger financial position to carry out its commitments associated with the Maxx upgrade program.

Charter’s upgrade proposal is, in fact, both technically and generally inferior to what Time Warner Cable is accomplishing on its own. We strongly recommend the Commission carefully consider whether Charter’s proposal is as truly compelling as it claims.

Charter Communications’ Network Upgrade Proposal Is Not a Good Deal for California

Time Warner Cable Maxx offers 50/5 Mbps speeds under its most popular Standard plan. In contrast, Charter proposes to offer 60/5Mbps service under its most-popular Spectrum plan for a markedly higher price. The extra expense over the TWC 50Mbps plan does not justify a mere 10Mbps speed increase. (Currently in Los Angeles, TWC offers 200Mbps for $65/mo… roughly the same price as Charter’s 60/5 plan. TWC’s plan is over three times as fast as Charter’s for nearly the same amount). But perhaps more concerning, this 10Mbps increase comes at a high cost to customers looking for more budget-priced service than those seeking faster speeds.

Charter has no plans to continue Time Warner Cable’s $14.99 Everyday Low Price Internet service – a very important offer for low income residents and senior citizens who are unable to afford the nearly $60 regular price Charter charges for their 60Mbps tier, or those who have no interest in streaming media.

Time Warner Cable offers its $14.99 tier without preconditions, restricted qualifiers, contracts, or limits on what types of services can be bundled with it. Any consumer qualifies for the service and can bundle it with Time Warner Cable telephone service for an additional $10 a month, which offers a nationwide local calling area, as well as free calls to the European Union, Mexico, Puerto Rico, and several Asian nations.

The loss of a $25 plan that includes basic Internet access and a bundled, 911-capable telephone line would be devastating to low-income Californians and senior citizens. During the Comcast-Time Warner Cable hearings, no topic elicited as much interest as Internet affordability. Time Warner Cable clearly offers a larger, superior product line for less money at ALL speed levels in California. Charter would bring Californians fewer options at more expensive prices.

Charter’s proposed solution to serve low-income Californians is the adoption of Bright House Networks’ Connect2Compete program, which offers restricted access to $9.95/month Internet service for those who qualify.

Stop the Cap! investigated Bright House Networks’ existing offer in a report to our readers[77] in June 2015, and we urge the Commission to look much more closely at the specific conditions Bright House customers have had to endure to qualify to subscribe:

1) You must have at least one child qualified for the National School Lunch Program. They need not be enrolled now.

2) You cannot have been a Bright House broadband customer during the last three months. If you are a current customer, you must first cancel and go without Internet service for 90 days (or call the phone company and hope to get a month-to-month DSL plan in the interim.)

3) If you have an overdue bill older than 12 months, you aren’t eligible until you pay it in full.

4) Bright House does not enroll customers in discounted Internet programs year-round. From a Bright House representative:

“We do participate in this particular program, however, it is only around September that we participate in it. This is a seasonal offer that we have which can only be requested from the middle of August to the middle of September, which is when most start up with school again for the year.”

5) Bright House does not take orders for the Low-Income Internet plan over the Internet. You have to enroll by phone: (205) 591-6880.

Families fall into poverty every day of the year, and poverty-stricken families move from one school district to another every day of the year. So it’s horribly unfair to tell them they’d qualify for this program if only they had fallen into poverty sometime between the middle of August and the middle of September.

It has been our experience covering service providers across all 50 states that most design these low-cost Internet access programs with revenue protection first in mind. Charter Communications is no different. As with Comcast, Connect2Compete is only available to families with school age children. Applicants face an intrusive, complicated, and time-restricted enrollment process designed to dampen and discourage enrollment.

The interest in meeting the needs of low-income customers would be laudable if not for the insistence that otherwise-qualified existing customers cannot downgrade their regular price broadband plan to Connect2Compete unless they voluntarily go without Internet service for three months.

We strongly recommend Charter Communications be compelled to continue Time Warner’s $14.99 Internet plan, but at speeds no less than 25Mbps, the minimum definition of entry-level “broadband” by the FCC. We also recommend Charter be required to further discount this plan to $9.95 a month for qualified customers who meet a simple income test the Commission can define and establish. These discount programs should not just be available to families with school-age children. Everyone needs affordable Internet access, whether you are single and looking for your first job or a fixed income senior citizen.

All restrictions for existing customers or those with an outstanding balance must be prohibited and sign-ups must be accepted 365 days a year with re-qualification occurring not more than once annually.

Charter’s broadband offers for lower-income Californians are simply not adequate.

Charter Communications’ Cable Pricing Is More Expensive and Less Flexible than Time Warner Cable’s Pricing

Charter’s commitment to improve cable television does not offer any significant benefit to cable TV subscribers. Both Time Warner Cable and Charter propose to move to all-digital cable television to free up bandwidth to offer improved broadband.

While consumers clamor for smaller, less-costly cable television packages, Charter Communications’ CEO Thomas Rutledge is credited for inventing the “triple play” concept of convincing customers to package more services – broadband, television and telephone — together in return for a discount. Reuters cited his penchant for “simplified pricing,”[78] which is why Charter offers most customers only two options for broadband service and one giant television package dubbed Spectrum TV containing more than 200 channels.[79]

Unfortunately, any benefits from an all-digital television package are likely to be dismissed when customers get the bill. Currently, many Time Warner Cable customers watch analog television channels on television sets around the home without the need to rent a costly set top box. Any transition to digital television will require the rental of a set top box or purchase of a third-party device to view cable television programming. These can represent costly add-ons for an already high cable bill.

With approximately 99 percent of customers renting their set-top box directly from their pay-tv provider, the set-top box rental market may be worth more than $19.5 billion per year, with the average American household spending more than $231 per year on set-top box rental fees. These are some of the findings from Senators Edward J. Markey (D-Mass.) and Richard Blumenthal’s (D-Conn.) query of the top-ten pay-tv multichannel video programming distributors (MVPDs).[80]

Passed by Congress in December, the STELA Reauthorization Act of 2014 repealed the set-top box integration ban, which enabled consumers to access technology that allowed use of a set-top box other than one leased from their cable company. Without the integration ban, by the end of this year, cable companies will no longer be required to make their services compatible with outside set-top boxes, like TiVo for example, bought directly by consumers in the retail marketplace.

American cable subscribers spend, on average, $89.16 a year renting a single set-top box. The average set-top box rental fee for each company was used to calculate an overall set-top box rental cost average across companies: $7.43 a month, or $89.16 per year. Considering many homes rent a DVR box to make and view recordings and maintain less-capable boxes on other televisions, the total cost adds up quickly. The average household spends $231.82 a year on set-top box rental fees, according to Sens. Markey and Blumenthal.

Charter proposes to introduce a new generation of set top boxes but as far as we know, has not disclosed the monthly cost of these IP-capable boxes to subscribers. We anticipate they will cost more than the current equipment provided by Time Warner Cable, which has also been increasing the cost of its set top box rentals. However, Time Warner allows customers to effectively purchase their set top boxes in the form of the Roku device, giving consumers the ability to completely eliminate the set top box rental fee is they so wish.[81]

Other Points the Commission Should Consider in Reviewing This Transaction

- California must receive ‘most favored state’ status, meaning that whatever conditions other state commissions get from Charter must automatically apply to all Californians as well.

- The Commission must insist that rural California is treated equally to the Los Angeles market. If this transaction is approved, Charter must be compelled to commit to continue Time Warner Cable’s Maxx upgrade initiative across all of its service areas in California, to be completed within 30 months. Nothing less than that should be acceptable to the Commission. We agree with the New York DPS staff’s recommendation that Charter also be compelled to upgrade facilities to support gigabit broadband, and that should apply to California as well.This upgrade does not pose a significant challenge to any cable operator. With the upcoming introduction of DOCSIS 3.1 technology, cable operators even smaller than Charter will support 1Gbps broadband speeds as they drop analog television signals. Suddenlink[82], MidContinent[83], Cox[84], and Mediacom[85] already have gigabit deployment plans in the works. If Fargo, N.D. is getting gigabit broadband from MidContinent Communications in the near future, Charter should have no problem offering similar service to customers in the likes of Carlsbad, Hesperia, Jurupa Valley, and beyond.

- The Commission must establish and enforce meaningful enforcement mechanisms should Charter fail to achieve its commitments as part of this transaction. Cable consolidation has never significantly benefited consumers. Charter is not guaranteeing Time Warner Cable customers will receive a lower bill as a result of this merger. Nor is it committing to pass along the lower prices it will achieve through negotiations for video programming volume discounts. Cable rates, especially for broadband, will continue to increase. Without meaningful competition, there is no incentive to give consumers a better deal or better service.

Again, we feel Commissioner Florio’s Alternate PD in the Comcast matter applies equally well here and that the application should be denied. If the Commission feels it must approve this transaction, however, the conditions that accompany it to achieve a true public interest benefit must be meaningful and ongoing. Any failure of New Charter to deliver on those commitments must include a direct benefit to customers, not just to the state government. If fines are imposed, customers should receive a cash rebate or equivalent service credit.

Conclusion

Cable operators know that once they secure a franchise or become the incumbent provider, no other cable company will negotiate with city officials to take over that franchise if the current provider’s application is denied during renewal. Once Charter (or any other cable company) establishes a presence, there is little to no chance that a community will be able to get rid of that provider if it fails to perform. That is why any franchise transfer that comes from an acquisition or merger must be treated with the utmost seriousness. Customers will likely live with the decision that this Commission makes for the next 20 years or more.

As the Commission must realize, this transaction does not involve just entertainment. Several months ago the Obama Administration declared broadband Internet access a “core utility:”[86]

“Broadband has steadily shifted from an optional amenity to a core utility for households, businesses and community institutions,” according to the report from the administration’s Broadband Opportunity Council. “Today, broadband is taking its place alongside water, sewer and electricity as essential infrastructure for communities.”

Our group strongly believes that California should not take a risk on Charter’s less-than-compelling offer when Time Warner Cable has demonstrated it is in a better financial position and has a proven track record of delivering on its commitments to improve service with its Maxx upgrade project. Time Warner Cable has superior options for low-income Californians, offers more broadband options and faster speeds, and has committed to providing unlimited Internet access – a critical prerequisite for consumers choosing to drop cable television’s one-size-fits-all bloated video packages.

[1] Comcast XFinity website: https://www.xfinity.com/support/articles/data-usage-trials-exceed-usage

[2] For instance: “Internet traffic is growing fast — but capacity is keeping pace” Telegeography. 3 September 2008. https://goo.gl/OFBPHX; and Bode, Karl. “The ‘Bandwidth Hog’ is a Myth” DLSreports. 30 November 2011. https://goo.gl/lv6jE5

[3] DSLreports.com (https://goo.gl/0sZasc)

[4] Brodkin, Jon. “Comcast VP: 300GB data cap is ‘business policy’ not ‘technical necessity’ Ars Technica. 14 August 2015. http://goo.gl/1lAFwJ

[5] Morran, Chris. “Leaked Comcast Doc Admits: Data Caps Have Nothing To Do With Congestion” Consumerist. 6 November 2015. http://goo.gl/Uq9o5c

[6] TWC 2014 Q3 Earnings Call. http://goo.gl/Oz9hnL

[7] U.S. Government Accountability Office. “FCC Should Track the Application of Fixed Internet Usage-Based Pricing and Help Improve Consumer Education. November 2014. http://www.gao.gov/products/GAO-15-108

[8] Reply Testimony of Lee L. Selwyn. 15 January 2016. Pages 75-77.

[9] Brodkin, Jon. “Sling CEO: Comcast data caps so low they hurt competing video providers” Ars Technica. 7 December 2015. http://goo.gl/w98cqJ

[10] Pew Research Center “Home Broadband 2015” report. Page 19, as cited in NHMC reply testimony.

[11] Brodkin, Jon. “Watch out for data caps: Video hungry cord-cutters use 328GB a month” Ars Technica. 14 May 2014. http://goo.gl/0O8vtR

[12] Arbel, Tali. “How Comcast wants to meter the internet” Associated Press. 27 October 2015. https://apnews.com/3eed82ff6ab848f294e621c7d21f9690/how-comcast-wants-meter-internet

[13] Horn, Leslie. “You can burn through your entire broadband data cap in one long weekend” Gizmodo. 18 February 2014. http://goo.gl/Z0yQfY; and also Reply Testimony of Lee L. Selwyn, 15 January 2016, page 114.

[14] Frankel, Daniel. “Survey: 56% of pay-tv customers would ditch ESPN in order to save $8 every month.” FierceCable. 13 Jan 2016. http://goo.gl/CQRCpp

[15] Heisler, Yoni. “How much money does cutting the cord really save?” BGR. 12 November 2015. https://goo.gl/tmiQL2; also Jones, Stacy. “Cost of cable TV vs internet streaming” Bankrate. 24 November 2014. http://goo.gl/tGJqK5

[16] Brodkin, Jon. “Comcast launches streaming TV service that doesn’t count against data caps” Ars Technica. 19 November 2015. http://goo.gl/ITJusN

[17] Finley, Klint. “Comcast may have found a major net neutrality loophole” Wired. 20 November 2015. http://goo.gl/zyFJku

[18] 2 November 2015 Statement of Dr. Scott Morton, Parts 132-133, pages 48-49.

[19] Brodkin, Jon. “House Republicans urge court to throw out net neutrality rules” Ars Technica.

11 November 2015. http://goo.gl/TBV56e

[20] Fung, Brian. “Republicans are trying to defund net neutrality. Will it work?” Washington Post. 24 July 2015. https://goo.gl/Shk99e

[21] Ravenscraft, Eric. “Sponsored Data Is The Newest, Biggest Threat to Net Neutrality” Lifehacker. 20 January 2016. http://goo.gl/SXtl9C

[22] GAO “Report to the Ranking Member, Subcommittee on Communications and Technology, Committee on Energy and Commerce, House of Representatives” (GAO-15-108) page 26. http://www.gao.gov/assets/670/667164.pdf

[23] Dampier, Phillip. “Wall Street: Usage Caps Are an Important Weapon in Fight Over Cord-Cutting.” Stop the Cap! 18 January 2016. http://goo.gl/FKhsFO

[24] GAO “Report to the Ranking Member, Subcommittee on Communications and Technology, Committee on Energy and Commerce, House of Representatives” (GAO-15-108) page 26.

[25] CPUC A.14-04-013, A14-06-012 Alternate Proposed Decision, pages 71-72.

[26] Marshini Chetty, Richard Banks, A.J. Bernheim Brush, Jonathan Donner, and Rebecca E. Grinter. “‘You’re Capped!’ Understanding the Effects of Bandwidth Caps on Broadband Use in the Home.” ACM Conference on Human Factors in Computing Systems. May 2012.

[27] Haynie, Devon. “Why Online Education May Drive Down the Cost of Your Degree” US News and World Report. 3 June 2014. http://www.usnews.com/education/online-education/articles/2014/06/03/why-online-education-may-drive-down-the-cost-of-your-degree?int=9acf08

[28] Kehl, Danielle and Lucey, Patrick. “Artificial Scarcity: How Data Caps Harm Consumers and Innovation” Open Technology Institute. 30 June 2015. https://goo.gl/zt5Jj9

[29] Yao, Deborah. “Time Warner Cable shelves some Internet cap plans” ABC News. 18 April 2009. http://goo.gl/YynOiM

[30] Simmermon, Jeff. “Launching An Optional Usage-Based Broadband Pricing Plan In Southern Texas” TWC “Untangled” Blog. 27 February 2012. http://goo.gl/PoS5nR

[31] Dampier, Phillip. “Time Warner Cable Recommits: No Mandatory Usage Caps As Long As Company Remains Independent” Stop the Cap! 30 October 2014. http://goo.gl/6vxXNx

[32] Dampier, Phillip. “Time Warner Cable Admits Usage-Based Pricing is a Big Failure; Only Thousands Enrolled” Stop the Cap! 13 March 2014. http://goo.gl/lCqp4k

[33] Q2 2015 Time Warner Cable Results-Earnings Call. 30 June 2015. http://goo.gl/JINiwn

[34] Q3 2015 Time Warner Cable Earnings Call. 29 October 2015. https://finance.yahoo.com/news/edited-transcript-twc-earnings-conference-163916473.html

[35] Media Alliance Reply Testimony to Joint Applicants Opening Testimony, pages 2-3. 15 January 2015.

[36] “Redacted Comments of the New York State Department of Public Service Staff” September 16, 2015. Page 39. http://goo.gl/C1Xpph

[37] Opening Testimony of Charles Fisher, page 6.

[38] Id at 7-8.

[39] “Statement of Dr. Fiona Scott Morton re the Merger of Charter, TWC, and BHN” 2 November 2015. Page 48. http://goo.gl/eEtY5Z

[40] Higginbotham, Stacey. “Want to know if your ISP is capping data? Check our updated chart.” GigaOm. 15 November 2013. https://goo.gl/owGq96

[41] DSL Reports: https://goo.gl/1RXjgm

[42] DSL Reports: https://goo.gl/aoFvuT

[43] “Charter Residential Internet Acceptable Use Policy.” https://goo.gl/8ICMe1

[44] Testimony of Laura Blum Smith, 15 January 2016. Page 14.

[45] Eggerton, John. “FCC Seeks Data Dump from Charter, TWC, Brighthouse” Multichannel News. 23 September 2015. http://goo.gl/nJEazB

[46] Dampier, Phillip. “Charter and Time Warner Cable Try Internet-Only TV Service to Combat Cord-Cutting, Cord-Nevers” Stop the Cap! 26 October 2015. http://goo.gl/doimuR

[47] Opening Testimony of Charles Fisher, page 4.

[48] Shields, Todd. “Cable Magnate Malone’s Stakes Scrutinized in Charter-TWC Deal” Bloomberg News. 9 November 2015. http://goo.gl/s6VTMw

[49] Kang, Cecilia and Fung, Brian. “The Darth Vader of Telecom is Back” Washington Post. 26 May 2016. https://goo.gl/qWS480

[50] Lasar, Matthew. “Sirius/XM merger approved with new conditions” Ars Technica. 28 July 2008. http://goo.gl/LO4aaQ

[51] Lieberman, David. “Sirius XM CEO Mel Karmazin Vows Big Vows Big Consumer Price Hike (If the FCC Allows It)” Deadline Hollywood. 3 May 2011. https://goo.gl/tTYZE3

[52] Cox, Kate. “Poll Sponsored By Charter Says Charter Is Great, More Charter is Greater” Consumerist. 20 January 2016. http://goo.gl/Xp0wsJ

[53] Opening Testimony of Adam Falk, page 2.

[54] Charter currently charges just under $65/mo for its 60Mbps tier of standalone internet with wireless gateway (outside of promotions). In Los Angeles, though, Time Warner Cable offers for that exact same amount 200Mbps also with a wireless gateway. Time Warner provides over three times the speed Charter does for the same price. That certainly is a countervailing harm to consumers.

[55] Unlike Time Warner, Charter bakes its modem fee into the internet plan. So every single customer is paying that modem fee… even if they own their own modem (like many Time Warner customers do). Not only is that not a “customer friendly billing practice,” but it’s another countervailing harm as well. Later on page 18 of his opening statement, Mr. Falk says “New Charter will bring base speed tiers from 15 Mbps to Charter’s current standard of 60 Mbps at uniform pricing within a year of closing.” Those unfortunate consumers get to take a double hit: not only will Charter be increasing the price of the comparable tier, but they will be taking away even the option to have a cheaper tier should the customer want it. It’s a massive price hike with fewer options available. That certainly doesn’t sound like the “customer friendly billing practices” Mr. Falk is touting, nor does it make his claim that consumers will face no harms from this merger ring particularly true.

[56] On page 3 of his opening statement, Mr. Falk claims that New Charter will face “other forms of competition (e.g., wireless providers).” But as described above, Dr. Scott Morton admits that wireless providers are actually NOT competition for New Charter’s internet offerings.

[57] Also on page 3, Mr. Falk states that “New Charter will face significant competition from wireline competitors (e.g., AT&T and Frontier).” But in reality, the areas where AT&T and/or Frontier (or even Verizon) actually overlap New Charter territory is extremely limited. And at any rate, this proposed mitigation condition would sunset where that overlap is present.

[58] Mr. Falk’s states: “Charter offers its base 60 Mbps service at lower prices than other providers for comparable service, without modem fees…” This simply isn’t true. Currently, Time Warner offers a 50 Mbps off contract for $45/mo. That’s comparable and significantly less expensive than Charter. TWC also offers 100Mbps at $55/mo… still less than Charter’s price for the slower 60Mbps. Mr. Falk’s statement is simply false.

[59] Testimony of Marc Puckett on behalf of Intervenor Town of Apple Valley, page 2. 15 January 2015.

[60] CPUC ALJ Ruling A.15-07-009 page 2.

[61] Testimony of Martyn Roetter on behalf of the County of Monterey. 15 January 2015. Page 1.

[62] Reply Testimony of Lee L. Selwyn. 15 January 2016. Page 116.

[63] Statement of Dr. Scott Morton. 2 November 2015. Page 51, footnote 187.

[64] USGAO. “Report to the Ranking Member, Subcommittee on Communications and Technology, Committee on Energy and Commerce, House of Representatives” (GAO-15-108). November 2014. Page 11. http://www.gao.gov/assets/670/667164.pdf

[65] Id. at 23.

[66] Reply Testimony of Lee L. Selwyn. 15 January 2016. Page 132.

[67] Id pages 24-25.

[68] Brodkin, Jon. “Complaint Factory: Angry Internet subscribers tee off against Comcast, Verizon, AT&T.” Ars Technica. 29 December 2015. http://goo.gl/484NYO

[69] Dampier, Phillip. “Comcast Customers Buy $35 Usage Cap Insurance, Report ‘Unlimited’ is Slower Than Ever.” Stop the Cap! 28 December 2015. http://goo.gl/SMfsOg

[70] Id.

[71] Id.

[72] CPUC A.14-04-013, A14-06-012 Alternate Proposed Decision, page 77.

[73] TWC Untangled Blog. 30 April 2015. http://goo.gl/6gp3er

[74] TWC Untangled Blog. 14 July 2015. http://goo.gl/eWZEGl

[75] TWC Q4 2014 Earnings Call Transcript on Seeking Alpha. http://goo.gl/c8QZtR

[76] TWC Untangled Blog. 14 July 2015. http://goo.gl/jafclZ

[77] Dampier, Phillip. “Bright House’s Mysterious Internet Discount Program Charter Wants to Adopt Nationwide” 25 June 2015. http://goo.gl/DVlwpF

[78] Baker, Liana. “Analysis: Charter’s bid for Time Warner Cable hinges on Rutledge’s skill. Reuters. http://goo.gl/QndjSd

[79] Charter Channel Lineup. https://www.charter.com/browse/content/tv#/channel-lineup

[80] Senator Ed Markey Press Release. 30 July 2015. http://goo.gl/PNy2b0

[81] Mlot, Stephanie. “Replace your Time Warner Cable Box with a Roku” PC Magazine. 10 November 2015. http://goo.gl/GkSbu7

[82] Baumgartner, Jeff. “Suddenlink Boots Up 1-Gig Broadband” Multichannel News. 9 July 2015. http://goo.gl/U2SK4X

[83] Midco Press Release. 17 November 2014. https://goo.gl/pKmChH

[84] Baumgartner, Jeff. “Cox Plots DOCSIS 3.1 Plans” Multichannel News. 22 September 2015. http://goo.gl/LDIFsR

[85] Baumgartner, Jeff. “Mediacom Sets Residential 1-Gig Rollout” Multichannel News. 9 September 2015. http://goo.gl/MGFQ02

[86] Trujillo, Mario. “Obama administration declares broadband ‘core utility’ in report” The Hill. 21 September 2015. http://goo.gl/5vazOL

Subscribe

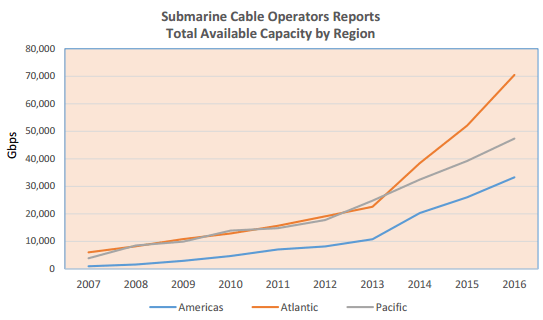

Subscribe Overall submarine cable capacity, which supports a substantial amount of international Internet traffic, has grown around 36% per year for 2007-2014 and is expected to grow around 29% for 2014-2016. But traffic planners are confident the traffic growth will be easily accommodated over existing submarine cable circuits.

Overall submarine cable capacity, which supports a substantial amount of international Internet traffic, has grown around 36% per year for 2007-2014 and is expected to grow around 29% for 2014-2016. But traffic planners are confident the traffic growth will be easily accommodated over existing submarine cable circuits.

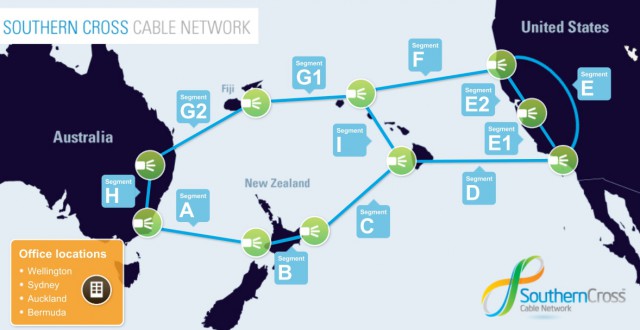

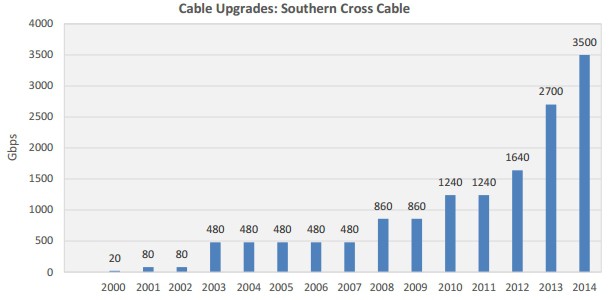

Southern Cross engineers are now deploying circuits capable of 40 and 100Gbps technology, bringing Southern Cross cable’s total available capacity to more than 12Tbps (12,000Gbps). Every upgrade was conducted at the cable station with zero new fiber pairs laid in the water. Other undersea cable operators are initiating similar upgrades, providing exponentially greater capacity at a minimal cost.

Southern Cross engineers are now deploying circuits capable of 40 and 100Gbps technology, bringing Southern Cross cable’s total available capacity to more than 12Tbps (12,000Gbps). Every upgrade was conducted at the cable station with zero new fiber pairs laid in the water. Other undersea cable operators are initiating similar upgrades, providing exponentially greater capacity at a minimal cost. Comcast is inviting controversy launching a new live streaming TV service targeting cord-cutters while exempting it from its own data caps.

Comcast is inviting controversy launching a new live streaming TV service targeting cord-cutters while exempting it from its own data caps.

Comcast claims it is reasonable to exempt Stream TV from its 300GB data cap being tested in a growing number of markets.

Comcast claims it is reasonable to exempt Stream TV from its 300GB data cap being tested in a growing number of markets.

Staffers at the New York State Department of Public Service have recommended the Public Service Commission

Staffers at the New York State Department of Public Service have recommended the Public Service Commission  The Public Service Commission staff looked at the reported annual “synergy savings” of $800 million anticipated by New Charter from streamlining operations and winning enhanced volume discounts to determine the “net positive benefit” for New York consumers from the merger. Here is the formula the PSC used:

The Public Service Commission staff looked at the reported annual “synergy savings” of $800 million anticipated by New Charter from streamlining operations and winning enhanced volume discounts to determine the “net positive benefit” for New York consumers from the merger. Here is the formula the PSC used: New Charter claims another merger benefit is their plan to upgrade Time Warner customers with new and improved IP-capable ‘Worldbox’ equipment and DVR’s offering more recording capacity. While conceding there were some minor benefits from offering customers more capable equipment, PSC staffers were skeptical New Charter’s plan represented much of a “consumer benefit,” because the equipment is not cheap and New Charter’s plan to eliminate analog television signals will mean every customer will have to rent one of Charter’s new boxes or a near equivalent.

New Charter claims another merger benefit is their plan to upgrade Time Warner customers with new and improved IP-capable ‘Worldbox’ equipment and DVR’s offering more recording capacity. While conceding there were some minor benefits from offering customers more capable equipment, PSC staffers were skeptical New Charter’s plan represented much of a “consumer benefit,” because the equipment is not cheap and New Charter’s plan to eliminate analog television signals will mean every customer will have to rent one of Charter’s new boxes or a near equivalent. New Charter’s plans for expanded business broadband were also found to be vague, making it difficult to measure how much benefit New Charter would bring commercial clients in New York.

New Charter’s plans for expanded business broadband were also found to be vague, making it difficult to measure how much benefit New Charter would bring commercial clients in New York.

The unstated reality of Internet traffic growth usually leaves out what impact streaming pornographic videos can have on network traffic, and for consumers, their broadband usage allowance. We are about to find out with last week’s arrival of Pornhub Premium (

The unstated reality of Internet traffic growth usually leaves out what impact streaming pornographic videos can have on network traffic, and for consumers, their broadband usage allowance. We are about to find out with last week’s arrival of Pornhub Premium (