Editor’s Note: This editorial in the St. Louis Post-Dispatch is reprinted in its entirety. It comes from a newspaper that has covered Charter Communications since its inception. The Post-Dispatch reporters are also some of Charter’s subscribers — the cable company serves all of metropolitan St. Louis. Charter has never been received particularly well in St. Louis and in other cities where it provides generally mediocre service. Communities across Missouri that have endured poor cable and broadband service have recently taken a serious look at doing something about this by building their own public broadband networks as an alternative. But big money telecom interests, especially AT&T, have found it considerably less expensive to lobby to ban these networks from ever getting off the ground than spending the money to upgrade networks to compete.

On May 15, the last day of this year’s session of the Missouri Legislature, House Bill 437 finally was assigned to a committee, where it promptly died. Given the power of the American Legislative Exchange Council, it may well be back next year.

On May 15, the last day of this year’s session of the Missouri Legislature, House Bill 437 finally was assigned to a committee, where it promptly died. Given the power of the American Legislative Exchange Council, it may well be back next year.

HB 437, sponsored by Rep. Rocky Miller, R-Lake Ozark, was full of gobbledygook about “municipal competitive services,” but its effect would have been to condemn Missourians to ever-higher prices for broadband Internet service. Cities would have been forbidden from establishing their own broadband services to compete with private operators, thus holding down prices.

ALEC, which wines and dines state lawmakers and then gets them to pass pro-business “model legislation” in their states, had succeeded in getting restrictions on public Internet providers in 20 states. But in February, the Federal Communications Commission struck down North Carolina’s ALEC-inspired law, so the future of other such laws is uncertain.

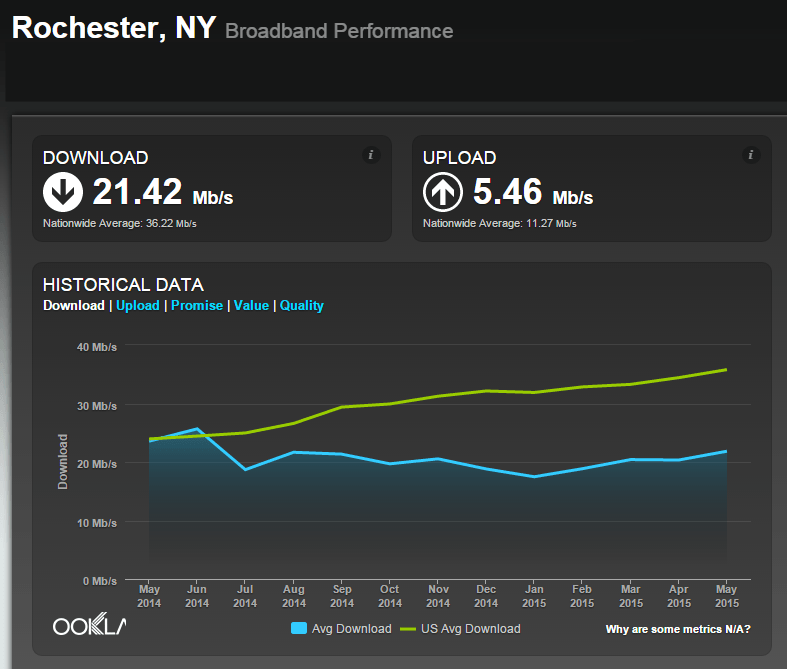

About 22 percent of Missourians are still regarded as “underserved,” having no reliable access to broadband service of at least 25 megabits per second — what’s needed to stream video without lags. About 1 in 6 Missourians have only one wired access provider to choose from. More than 400,000 Missourians have no wired broadband at all.

Missouri is ranked 38th “most connected” in the nation by the federal-state Broadband Now initiative. In the 21st century, this is like being underserved by railroads in the 19th century or power lines in the early 20th. In parts of rural Missouri, it’s hard to do business, which helps explain why HB 437 died in committee.

Rep. Rocky Miller (R-Lake Ozark)

The basic question is whether companies that invest in high-speed Internet infrastructure should be able to charge whatever they can get away with, or whether broadband service should be treated as a public utility. If it’s the latter, as the FCC determined in February, then government must make sure it’s affordable.

Which brings us to Charter Communications proposed $56 billion takeover of Time Warner Cable and its $10.4 billion acquisition of Bright House Networks. Both deals were announced May 26; both will need approval from the FCC and the Justice Department’s antitrust regulators.

In St. Louis, we have a love-hate relationship with Charter, a homegrown company built atop what was once Cencom Cable. It has dominated the cable TV market here almost as long as there’s been a cable market.

Charter customers endured years of poor service, its bankruptcy, its legal challenges, its ownership and management changes. Just when it got itself together, in 2012, the headquarters was moved from Des Peres to Stamford, Conn., though it retains a significant presence here.

Today our little Charter is a big fish; the Time Warner and Bright House deals would make it the nation’s second-largest cable company, with 24 million customers, behind only Philadelphia-based Comcast, with 27 million.

But cable TV no longer drives cable TV. Internet-based video services, like YouTube and Netflix, have revolutionized the way people, particularly younger people, watch TV. When cable companies first started connecting customers to the Internet through the same cables that delivered TV programming, it was regarded as a nice add-on business. Now broadband delivery is seen as a far bigger part of the future than providing TV programs.

Indeed, when Comcast tried to acquire Time Warner last year, the dominance (nearly 60 percent of the market) that the combined company would have had over broadband service caused federal regulators to look askance. Comcast abandoned its bid in April.

Indeed, when Comcast tried to acquire Time Warner last year, the dominance (nearly 60 percent of the market) that the combined company would have had over broadband service caused federal regulators to look askance. Comcast abandoned its bid in April.

By contrast, a Charter-Time Warner-Bright House combination (it will do business as Spectrum) will control 30 percent of the broadband market. Charter Spectrum will have 20 million broadband subscribers, compared with 22 million for Comcast.

So what can customers expect? Charter’s CEO Tom Rutledge has promised “faster Internet speeds, state-of-the-art video experiences and fully featured voice products, at highly competitive prices.”

This begs the question, competitive with whom? Comcast? Mom-and-pop operations that can’t afford the infrastructure? Municipal service providers who are being ALEC’d out of business?

Neither Charter nor Time Warner has particularly good customer service ratings (though to be fair, Charter is miles ahead of where it used to be, at least in St. Louis). Still, Charter will take on lots of debt to finance the deal, much of it in high-yield junk bonds. The broadband business provides leverage. As analyst Craig Moffett of MoffettNathanson told the Wall Street Journal: “Broadband pricing is almost an insurance policy for cable operators, in that if all else fails, you’ve always got the option to raise broadband rates.”

America wouldn’t let a private operator own 30 percent of its roads and highways. It wouldn’t allow two of them to control half the electricity. If broadband Internet service is a public utility, it must be regulated strictly.

The lesson is old as the hills: The free-marketeers who talk most passionately about competition are generally in the business of trying to eliminate it. Charter and Time Warner are both members of ALEC.

The Charter-Time Warner deal clearly is not in the public interest. The upside for shareholders is huge. The upside for Charter executives is even bigger. But it’s hard to see how Charter’s customers would see much benefit at all.

John Malone’s cable systems in Europe share little in common with what Americans get from their local cable company. In Switzerland, Liberty-owned UPC Cablecom charges $95 a month for 250/15Mbps service — a speed Charter Communications customers cannot buy at any price. Liberty is Charter’s biggest investor/partner. Later this month, Swiss cable customers will be able to buy 500Mbps from UPC. When implemented, that is expected to push Switzerland’s broadband speed rankings into the global top-10. Currently Switzerland is rated #11. The United States is #28 and Canada is ranked #34.

John Malone’s cable systems in Europe share little in common with what Americans get from their local cable company. In Switzerland, Liberty-owned UPC Cablecom charges $95 a month for 250/15Mbps service — a speed Charter Communications customers cannot buy at any price. Liberty is Charter’s biggest investor/partner. Later this month, Swiss cable customers will be able to buy 500Mbps from UPC. When implemented, that is expected to push Switzerland’s broadband speed rankings into the global top-10. Currently Switzerland is rated #11. The United States is #28 and Canada is ranked #34.

Some providers have promoted “cloud-based” on-demand access to video that Tveter says has been available from the cable company for several years.

Some providers have promoted “cloud-based” on-demand access to video that Tveter says has been available from the cable company for several years.

Subscribe

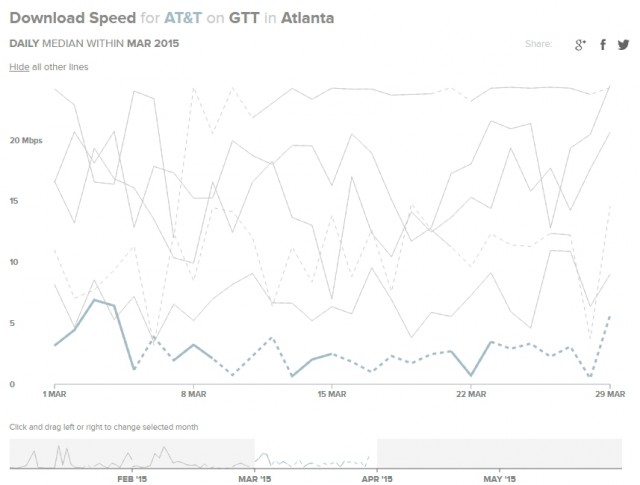

Subscribe If your YouTube, Netflix, or Amazon Video experience isn’t what it should be, your Internet Service Provider is likely to blame.

If your YouTube, Netflix, or Amazon Video experience isn’t what it should be, your Internet Service Provider is likely to blame. The study revealed network performance issues that would typically be invisible to most broadband customers performing generic speed tests to measure their Internet speed. The Open Technology Institute’s M-Lab devised a more advanced speed test that would compare the performance of high traffic CDNs across several providers. CDNs were created to reduce the distance between a customer and the content provider and balance high traffic loads more evenly to reduce congestion. The shorter the distance a Netflix movie has to cross, for example, the less of a chance network problems will disrupt a customer’s viewing.

The study revealed network performance issues that would typically be invisible to most broadband customers performing generic speed tests to measure their Internet speed. The Open Technology Institute’s M-Lab devised a more advanced speed test that would compare the performance of high traffic CDNs across several providers. CDNs were created to reduce the distance between a customer and the content provider and balance high traffic loads more evenly to reduce congestion. The shorter the distance a Netflix movie has to cross, for example, the less of a chance network problems will disrupt a customer’s viewing.

On May 15, the last day of this year’s session of the Missouri Legislature,

On May 15, the last day of this year’s session of the Missouri Legislature,

Indeed, when Comcast tried to acquire Time Warner last year, the dominance (nearly 60 percent of the market) that the combined company would have had over broadband service caused federal regulators to look askance. Comcast

Indeed, when Comcast tried to acquire Time Warner last year, the dominance (nearly 60 percent of the market) that the combined company would have had over broadband service caused federal regulators to look askance. Comcast  “Dealing with Mediacom is like stepping on a mound of fire ants,” says June Watts, a Mediacom customer in Alabama. “You are going to get stung no matter what you do.”

“Dealing with Mediacom is like stepping on a mound of fire ants,” says June Watts, a Mediacom customer in Alabama. “You are going to get stung no matter what you do.” Mediacom’s customer service forums offer some clues about what makes Mediacom such a problem for its customers. “Cyberpunk 1161” pays for 100/20Mbps service but is lucky to get 10% of that speed on a good day. He started corresponding about his speed issues with Mediacom’s social media team on Feb. 19. He is still having issues as of June 2, nearly four months later, and his conversation with Mediacom has now extended to 15 pages. “WhiteBengal50” has already managed three pages of complaints starting on May 18. Another customer spent one year and four months with his cable line left unburied on his lawn.

Mediacom’s customer service forums offer some clues about what makes Mediacom such a problem for its customers. “Cyberpunk 1161” pays for 100/20Mbps service but is lucky to get 10% of that speed on a good day. He started corresponding about his speed issues with Mediacom’s social media team on Feb. 19. He is still having issues as of June 2, nearly four months later, and his conversation with Mediacom has now extended to 15 pages. “WhiteBengal50” has already managed three pages of complaints starting on May 18. Another customer spent one year and four months with his cable line left unburied on his lawn. The new CEO of Frontier Communications is promising more fiber to the home service and advanced ADSL2+ and VDSL2 service to dramatically boost Internet speeds… if you happen to live in a Verizon territory Frontier is planning to acquire in Texas, California, or Florida. For Connecticut customers that used to belong to AT&T, Frontier also plans to spend money to further build out AT&T’s U-verse platform to reach more suburban customers not deemed profitable enough to service by AT&T.

The new CEO of Frontier Communications is promising more fiber to the home service and advanced ADSL2+ and VDSL2 service to dramatically boost Internet speeds… if you happen to live in a Verizon territory Frontier is planning to acquire in Texas, California, or Florida. For Connecticut customers that used to belong to AT&T, Frontier also plans to spend money to further build out AT&T’s U-verse platform to reach more suburban customers not deemed profitable enough to service by AT&T.

“We actually see growth opportunity in Connecticut,” McCarthy said. “As we go through and look at the Connecticut property, one of the things that have been a recent development from a technology perspective allows us to serve lower density parts of the state of Connecticut with U-verse product that was limited by densities and loop lengths in the past.”

“We actually see growth opportunity in Connecticut,” McCarthy said. “As we go through and look at the Connecticut property, one of the things that have been a recent development from a technology perspective allows us to serve lower density parts of the state of Connecticut with U-verse product that was limited by densities and loop lengths in the past.”