Heritage Minister Mélanie Joly blunders through the dicey issue of Canadian content on Netflix in a press tour called “disastrous” by critics.

The arrival of Netflix Canada and its tens of thousands of alternative on-demand viewing choices has had defenders of Canadian culture up in arms ever since the American interloper showed up.

A little background:

For Canada, the dominance of their neighbor to the south has always presented a challenge to a country that fears having its cultural independence steamrolled and its official two-language experience watered down by an avalanche of English-language content. Canadian broadcasters and cable networks are governed by regulations that require they reserve at least 50% of their program schedule for Canadian content (the percentage varies slightly for the Canadian Broadcasting Corporation/Société Radio-Canada — Canada’s public broadcaster, and Canadian cable networks).

Because Canada is a much smaller media market than the United States, finding the money to produce enough high quality Canadian TV shows and movies has always been a challenge. Most recently, Canada’s telecom regulator, the Canadian Radio-television and Telecommunications Commission (CRTC) mandated that broadcasters spend 30% of their revenues on original Canadian content. As a result, many commercial networks and stations spend that money on cheap reality shows or news content to satisfy Canadian content requirements. While that fulfills the government mandate, it doesn’t always fulfill the demands of many Canadian viewers that prefer to watch something else.

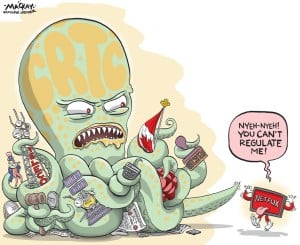

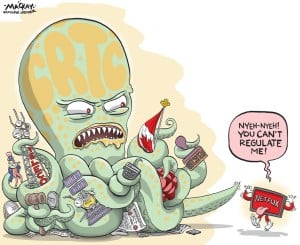

Netflix’s streaming service in Canada competes directly with those broadcasters, as well as Canadian cable and phone company on-demand services, but is not subject to the same content laws because the 25-year old law governing broadcasting was written before there was the prospect of online streaming alternatives. In less than a decade Netflix has grown its original business renting DVD’s through the mail into a multi-billion dollar international streaming business that has deeper content acquisition pockets than any Canadian media entity.

The Liberal Party of Canada is trying to manage Canadian content rules now 25 years old, before the era of streaming video.

There is also a technology shift in play here. What exactly constitutes “media” is open to debate. Traditional broadcast media now competes with newly emerging, and largely unregulated digital social media (a-la Facebook, Twitter, etc.) and online over-the-top services (Netflix, Hulu, YouTube, etc.) Broadcasters are regulated in the public interest and have lived under that framework for decades. Upstart new media relies on an internet platform that has never been significantly regulated at all.

Efforts by the government and Canada’s creative community to get Netflix Canada to follow the Canadian content model has largely failed, and it seems unlikely Netflix will ever see itself tied down by content or language quotas. It flies in the face of Netflix’s marketing — giving customers unlimited access to the content they want to see, not what a bureaucrat in Montreal or Ottawa wants customers to see.

Netflix has hired some high-priced lobbyists to make sure their interests are represented before federal and provincial officials, and it has been a constant battle over the last two years as the service confronts content regulators, those upset about the service’s lack of French Canadian titles, and the desire by some of Canada’s political parties and provinces, Quebec notably, to subject Netflix to federal and provincial sales and value-added taxes (GST/HST).

The federal government, led by Prime Minister Justin Trudeau, has refused to impose these kinds of taxes on Netflix or other foreign-headquartered internet services, despite the fact many fellow members of the Liberal Party think it should. The Standing Committee on Canadian Heritage called for an internet tax last June, and content creator groups have lobbied the government hard to demand Netflix be required to substantially invest in homegrown Canadian productions envisioned, filmed, and produced by Canadians.

It has also the components you need to create a melodrama:

- a deep-pocketed and arrogant American corporation that made an inelegant entry into Canada and alienated the CRTC by refusing to disclose information to the regulator;

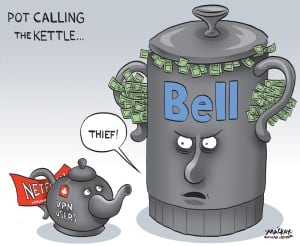

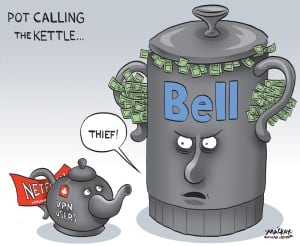

- a sense of an unfair playing field where Canadian companies face sales/use taxes while American companies like Netflix don’t;

- the ongoing fear among Canada’s Francophone community that their political and language sovereignty is under threat;

- the ongoing fear of Canadians that their cultural sovereignty will be washed away by an American cultural tsunami.

The Liberals’ Sacrificial Lamb: Canadian Heritage Minister Mélanie Joly’s Disaster Tour

Some Francophone tabloids in Quebec specialize is assaulting all-things-Liberal, especially Mélanie Joly.

Trudeau’s point person on the Netflix controversy in 2017 was Canadian Heritage Minister Mélanie Joly, who was swept into the political maelstrom during a cross-country tour to promote the government’s new Creative Canada cultural policy. By all accounts, it was an unmitigated disaster for the government.

Joly’s performance in Quebec — her home province where she serves as MP for the Ahuntsic-Cartierville riding in Montreal, managed what few thought possible — uniting critics from the province’s governing Liberals with the sovereigntist Parti Québécois and the left-wing party Québec Solidaire.

Mathieu Bock-Côté, writing in the Journal de Montréal, claimed Joly was guilty of “dereliction of duty.”

After Joly bizarrely asserted on Radio-Canada’s popular talk show Tout le monde en parle (“Everyone’s Talking About It”) that Vidéotron, Quebec’s largest cable operator with over 1.6 million subscribers was not a cable company, center-right tabloids Le Journal de Montréal and Le Journal de Québec, both specializing in attacking all-things-Trudeau, had a field day. One columnist labeled Joly “Mélangée Joly” ( All-mixed-up Joly). Her propensity to stick close to her index card talking points and repeat them over and over, regardless of the question asked, bemused columnist Richard Martineau, who wrote Joly sounded “like a living answering machine having a nervous breakdown.”

In Quebec, the debate over tax fairness shared the stage with concerns about how much attention Netflix will pay producing French Canadian content.

In hopes of assuaging concerns, Joly announced Ottawa would increase investment in the $349 million Canada Media Fund to make up for shortfalls from declining contributions based on decreasing revenue from Canadian cable operators. She also promised $125 million to promote Canadian productions abroad. Heads that first nodded in agreement over the announcement quickly froze after Joly also announced Netflix would be exempt from federal sales tax in return for a five-year commitment to invest $100 million annually in Canadian content and $25 million specifically for “market development” of French-language content, whatever that means.

The lack of any specific commitment on French language programming went over like a lead balloon and ignited a firestorm of criticism over the perception Joly was going to rely entirely on Netflix Canada to protect and manage francophone programming on its own terms.

“We are alarmed as Francophones because there is no guarantee that a part of this [$100 million annually] is going to francophone content,” said Gabriel Pelletier, head of the province’s producers’ union, the Association des réalisateurs et réalisatrices du Québec. “Cultural questions are definitely more sensitive and obvious in Quebec, but my colleagues in the rest of Canada have similar priorities. We need to be able to see ourselves and our own stories in cultural content. Our own distributors play by very strict rules, but here we are giving Netflix a red carpet and an open market. It could lead to the disintegration of our entire regulatory system, because Rogers and Bell might say ‘Why do we have to pay when Netflix doesn’t have to?”

Joly also made little headway defending the Liberal government’s sales tax policy exempting Netflix. Appearing on Cogeco-owned CHMP-FM in Montreal, Joly was questioned by center-right talk show host Paul Arcand over her claim the decision not to tax Netflix was based on the Liberals’ promise not to raise taxes.

“Tou.tv (Radio-Canada’s streaming film service] is taxed. Vidéotron’s Illico is taxed; we are not talking about adding a new tax, we’re talking about taxing a product thacrticismt already exists,” Arcand said. “Are you ready to remove the taxes for those two comparable [Canadian] companies?”

“Tou.tv (Radio-Canada’s streaming film service] is taxed. Vidéotron’s Illico is taxed; we are not talking about adding a new tax, we’re talking about taxing a product thacrticismt already exists,” Arcand said. “Are you ready to remove the taxes for those two comparable [Canadian] companies?”

Joly did not specifically answer.

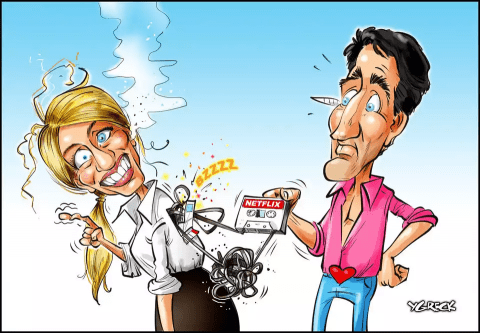

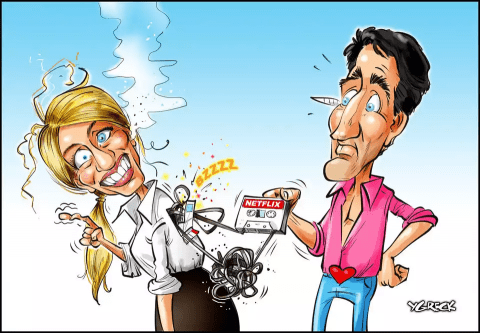

Cartoonists have been particularly vicious over the Netflix affair, portraying Joly as vapid or a camera-friendly tall, blond, 38-year old politician more style than substance. Some of her critics on the right — usually older middle-aged men, according to her defenders — ‘cross the line’ into sexism by repeatedly calling Joly “the majorette” — a reference to a baton twirling performer usually seen in marching bands during parades.

Despite the criticism, Joly rarely sat back and allowed those perceptions to go unchallenged.

A tradition among guests on Tout le monde en parle is to end their segment by reading aloud a card handed to them by a producer that succinctly summarizes their position. Viewers understand the words are written by the producer and not the guest, but Joly unilaterally decided to change her card. The original said, “It’s amazing that with all the digital media available, our politicians have stayed faithful to the cassette.” Joly replaced the word “cassette” with the word “innovation.”

Dany Turcotte, the show’s co-producer tasked with creating the cards, was not happy with Joly’s change.

“When someone changes the meaning of my cards, ça me met en t****,” using an expression that roughly translates to “that makes me f***ing angry.”

The NDP vs. the Liberals

After the embarrassing press tour ended, the issue went back on simmer mode until Feb. 5, when an opposition members of the NDP brought the issue forward once again during the House of Commons Question Time, where members can directly question the Prime Minister Justin Trudeau.

Julian

“The government seems more than happy to let web giants continue to make huge profits without contributing to the Canadian economy,” said MP Peter Julian (NDP-New Westminster/Burnaby, B.C.). “While the rest of the world is trying to make these companies pay, the Liberals are doing the opposite. They are making deals with Netflix and other companies, and offering massive tax breaks. Canadians pay their taxes and expect companies to do the same. When will the Liberals start making web giants pay their fair share?”

“Mr. Speaker, the NDP is proposing to raise taxes on the middle class, which is something we promised we would not do and have not done,” responded Prime Minister Trudeau. “We explicitly promised in the 2015 election campaign that we would not be raising taxes on Netflix. People may remember Stephen Harper’s attack ads on that. They were false. We actually moved forward in demonstrating that we were not going to raise taxes on consumers, who pay enough for their internet at home.”

“Mr. Speaker, is it fair that Netflix, Facebook, and other web giants have to pay neither sales nor income tax whereas Canadian companies in the same sector do?” followed up MP Guy Caron (NDP-Rimouski-Neigette/Témiscouata/Les Basques, Que.) “Around the world, other countries are trying to make sure that these web giants pay their fair share. Australia and the European Union are excellent examples. After all, it is those giants that are going to monopolize the advertising market and suck the lifeblood out of our print media. They are also responsible for the challenges facing print media. Instead of reining in the web giants and ensuring a level playing field for everyone, the Liberals want to make this preferential treatment official. When will the Liberals show some backbone and level the playing field?”

Trudeau

“Mr. Speaker, we are not going to raise taxes on Canadians. That is what the NDP is asking us to do,” responded Trudeau. “We recognize that the media environment and television viewing and production are changing rapidly. That is why we reached out and got Netflix to make historic investments in our content creators here in Quebec and Canada, to help them succeed in this changing universe. We have a great deal of confidence in our creators; the approach we have chose is a testament to that.”

In a later exchange, the issue of Netflix and taxation was debated by MP Pierre-Luc Dusseault (NDP-Sherbrooke, Que.) and Sean Casey, the Parliamentary Secretary to the Minister of Canadian Heritage:

Dusseault: My question primarily has to do with the Netflix agreement. Everyone is starting to understand how this agreement gives Netflix a tax advantage over its competitors. I want to follow up on this issue and on the government’s completely twisted logic. Last week, the government kept spouting the same empty rhetoric to explain why it decided to give Netflix a tax holiday. This tax holiday was granted in exchange for an investment, but there is no guarantee of this investment. Netflix is getting a tax holiday in exchange for the infamous agreement presented by the Minister of Canadian Heritage. This is what I would like to talk about today.

The government gave a foreign company a tax break for doing business in Canada without having to abide by same tax rules as its competitors. This company is doing business with Canadian consumers. When it sells a product to consumers in Canada, it does not have to charge GST or federal sales tax because the government is allowing this situation to continue. The government is allowing a company to sell a product, in this case a subscription to Netflix, without charging consumers any GST.

According to the government and its twisted logic, this is not a problem because that is just how things work. That is the government’s reason for not forcing Netflix to charge GST. It is possible to make Netflix charge sales tax because several other countries have already done so. Although Netflix is an American company that operates all over the world, it pays sales tax in some countries. Most countries actually have taxes associated with the sale of goods and services.

Dusseault

Canada can make Netflix charge sales tax. It is possible. The argument that the government cannot do this does not hold water. In fact, the government is not even using that argument. In the beginning, the Minister of Canadian Heritage said that it was too complicated and that it would require an international agreement to make Netflix charge sales tax. That is completely untrue.

Now the government’s argument is that it does not want to impose a new tax on consumers. Based on the government’s twisted logic, the GST is a new tax. This is like telling huge multinationals like Target or Walmart that when they come to Canada to sell their goods and services, they will not have to charge their customers GST at the checkout because that would be a new tax. This is like telling a new company that sets up shop in Canada that we cannot ask it to charge GST because that would be a new tax, and Canadians cannot afford any new taxes. That is the logic the Liberals are using today. In other words, they are saying that a foreign company or multinational that has a physical presence in Canada does not have to charge GST, although the store next door does.

Can my colleague explain how the government came up with this logic? How is the GST a new tax for businesses?

Casey: Mr. Speaker, I would like to thank my honorable colleague from Sherbrooke for giving us a chance to talk about the many benefits of the agreement with Netflix.This government strongly believes that the establishment of a new Canadian business in the film and television production sector by Netflix is wonderful news for Canadian creators and producers, and ultimately for our cultural industries as a whole.

The approval of this significant investment in Canada under the Investment Canada Act is yet another indication of our government’s strong commitment to growing Canada’s creative industries, with new investments that create more opportunities for creators and producers across the country. In fact, this major investment of a minimum of $500 million over the next five years on original productions in Canada will provide them with even greater access to financing, business partners, and ultimately new ways to connect with audiences across the globe.

Casey

Such an unprecedented investment by a digital platform in Canada, a first of its kind for Netflix outside of the United States, is yet another confirmation to the world that Canada is a great place to invest, attesting to the creative talent of this country and the strong track record of our cultural industries in creating films and television productions that really stand out.

It is important to make a distinction between the cultural activities of Netflix Canada, which has committed to investing a minimum of $500 million Canadian in the production of Canadian-made films and television series, with the activities of its U.S.-based video streaming service. These are in fact two separate kinds of cultural activities.

It is also important to reiterate that all businesses, including those involved in television and film production that set up and operate in Canada, must abide by the Canadian tax system, which includes GST. Given that Netflix Canada plans to operate a production company in Canada, it will have to comply with all GST-related rules, which could apply to its production activities in Canada.

Lastly I would like to point out that Netflix announced last week that it has acquired the award-winning Canadian film, Les Affamés, written and directed by Robin Aubert, one of the most unique voices in Quebec’s cinema, to be made available on the international market as early as this coming March. This represents the first of many Canadian films and television series to be acquired or produced by Netflix Canada as a result of its significant investment announced last fall.

Dusseault: Mr. Speaker, I know the parliamentary secretary is trying to draw a distinction between Netflix Canada and Netflix USA. I know the two are different. However, he avoided answering my question about Netflix USA subscriptions that are not subject to GST. That was probably intentional, so I would like him to comment on this specific issue. Netflix USA sells a product to Canadian consumers and, unlike its competitors, does not have to collect GST.

Can my colleague, the parliamentary secretary, explain to me why a foreign company is exempt from the tax rules that apply to Canadian businesses? Why are Canadian consumers not paying tax on Netflix subscriptions?

Casey: Mr. Speaker, Netflix Canada created a new film and television production company. This is great news for Canadian creators and producers. Once again, over the next five years, Netflix will invest a minimum of $500 million Canadian in original productions produced in Canada in English and in French for distribution on Netflix’s global platform.

Caron

Let us not forget that Netflix already has a strong track record of investing in Canadian producers and content, with recent examples including Anne and Alias Grace with the CBC, Travelers with Showcase, and Frontier with Discovery.

We believe that this significant investment in Canada demonstrates that Netflix is committed to continuing to be a meaningful partner in supporting Canadian creators, producers, and the Canadian creative expression.

A day later, Caron was ready to follow up with the Prime Minister.

“Mr. Speaker, when we ask him why web giants like Netflix and Facebook do not have to charge sales tax even though their Canadian competitors do, the Prime Minister says that he promised not to raise taxes for the middle class. We are talking about a tax that already exists, sales tax. We want fairness in the industry. It is unacceptable that the Prime Minister does not have the courage to ask web giants to pay their fair share. When will the Prime Minister understand that and insist on fair treatment for the entire industry?”

“Mr. Speaker, once again, as the NDP has said, web giants must pay their fair share,” responded Trudeau. “It is not web giants that the NDP wants to charge, it is taxpayers. The New Democrats want to make taxpayers pay more taxes. They want Canadians, Quebec and Canadian taxpayers, to pay more taxes for their online services. We, on this side of the House, promised not to raise taxes for taxpayers, and we are going to stand by that promise. If the New Democrats want to raise taxes for Canadians, they should say so instead of hiding behind talk of big corporations.”

“Mr. Speaker, he does not get it,” retorted Caron. “We are not talking about a new tax; we are talking about a tax that already exists and must be collected by Canadian competitors. He needs to follow the example of France, Australia, and many American states that have decided to make these web giants pay. Even here at home, the whole province of Quebec wants to do the same. Imposing on Bombardier a sales tax that is not required of Boeing would be unthinkable, so why do it in the online sector? Not only is the Prime Minister trying to justify these tax breaks, but he is going even further by making deals with those companies. When will the Liberals stop getting into bed with these web giants?”

“Mr. Speaker, once again, the New Democrats are misleading Canadians,” replied Trudeau. “They are talking about making web giants pay their fair share. It is not the web giants they want to pay more in taxes; it is taxpayers. We made a commitment to taxpayers that they would not have to pay more for their online services. We on this side of the House plan to keep that promise.”

Trudeau Settles the Matter… for Some

The issue of Netflix, taxation, and to some extent Canadian content has apparently resonated with the NDP, as their members return to press the issue with the Liberals again and again. But Trudeau’s steadfast response has made it clear his government intends to bury the issue once and for all.

In a sense, both sides are right. Canadian content regulations and protections for Canadian culture and the francophone community in Canada are at risk of being diluted by an onslaught of cord-cutting and new online streaming services that do not always recognize the sensitivity of these issues for many Canadians. As viewers gain new choices, especially those not subject to regulatory oversight, the dominance of American streaming services will be even more apparent than the dominance of Hollywood and American network television. Netflix is not in the business to cater to Canadian content quotas and likely never will unless the government mandates it.

French language content on Netflix will largely come from European producers and networks in France and to a lesser degree Belgium and Switzerland.

French language content on Netflix will largely come from European producers and networks in France and to a lesser degree Belgium and Switzerland.

But Netflix’s enormous budget for content development does open the door to opportunities for Canadian productions with budgets Canadian networks like CBC, CTV, Global, TVA, and Radio-Canada can only dream about. Quality should trump quotas, and may the best productions win.

Canadian telecom companies have a pervasive presence in all forms of Canadian entertainment. Bell (Canada) owns Bell Media, which in turn owns CTV – Canada’s largest privately owned commercial network. City, which has network affiliates in Canada’s largest cities, is owned by Rogers, Canada’s largest cable operator (Rogers also owns Omni Television, a multicultural network). Global is owned by Corus Entertainment, which in turn is controlled substantially by Shaw Communications, western Canada’s largest cable operator. Canadian cable and telco-TV providers run their own streaming services which are subject to sales taxes, while foreign streaming companies like Netflix are not. There is a case to be made for a lack of a level-playing field.

But Prime Minister Trudeau is also correct stating that any new taxes imposed on Netflix Canada or other new entrants would immediately be passed on to subscribers and raise the price of internet services. The Liberals’ platform during the last election insisted that the party wanted universal access to affordable broadband service for all Canadians and no taxes on Netflix. For many consumers, the price of content and the price of access are essentially the same thing.

Netflix has thrown a “token” $500 million at the problem in hopes of placating its Canadian critics. It may be enough to satisfy Vancouver and Toronto, where many series and movies are filmed, and it certainly has “resolved” the matter for the Liberal government of Mr. Trudeau, but it seems unlikely to soothe the concerns of Quebec and its vocal and proud francophone community. Quebec could move forward and impose a provincial sales tax on Netflix at any time, and will likely continue to pose a challenge to Netflix Canada until the company seems more sensitive to the concerns raised in many quarters in Montreal, Quebec City, and beyond. The creative community of French Canada can deliver some excellent productions, so long as Anglophiles are willing to read subtitles. Netflix may have to spend more money to make certain those types of shows turn up on the service in the not too distant future.

Mediacom Business reports the company will be increasing broadband speeds for its commercial customers around the country beginning April 1st without a change in rates.

Mediacom Business reports the company will be increasing broadband speeds for its commercial customers around the country beginning April 1st without a change in rates.

Subscribe

Subscribe Cable One, the Phoenix-based mid-sized cable operator serving some of the poorest communities in the country is charging some of the nation’s highest prices for broadband service, raking in an unprecedented 47% margin in the fourth quarter of 2017, the

Cable One, the Phoenix-based mid-sized cable operator serving some of the poorest communities in the country is charging some of the nation’s highest prices for broadband service, raking in an unprecedented 47% margin in the fourth quarter of 2017, the

The Minnesota Public Utilities Commission (MPUC) has

The Minnesota Public Utilities Commission (MPUC) has  A survey of filed complaints found many involved Frontier’s DSL internet service, which customers complained was slow and prone to frequent outages. Other complaints involved inaccurate billing and missed service calls, which sometimes led to delays of days or weeks before service could be restored.

A survey of filed complaints found many involved Frontier’s DSL internet service, which customers complained was slow and prone to frequent outages. Other complaints involved inaccurate billing and missed service calls, which sometimes led to delays of days or weeks before service could be restored. The newspaper blamed Frontier’s wrong priorities in

The newspaper blamed Frontier’s wrong priorities in  Despite the massive amount of extra money from the Trump Administration’s corporate tax cuts generating huge revenue spikes for America’s telecom companies, Frontier Communications disappointed investors with today’s news it was

Despite the massive amount of extra money from the Trump Administration’s corporate tax cuts generating huge revenue spikes for America’s telecom companies, Frontier Communications disappointed investors with today’s news it was

“Tou.tv (Radio-Canada’s streaming film service] is taxed. Vidéotron’s Illico is taxed; we are not talking about adding a new tax, we’re talking about taxing a product thacrticismt already exists,” Arcand said. “Are you ready to remove the taxes for those two comparable [Canadian] companies?”

“Tou.tv (Radio-Canada’s streaming film service] is taxed. Vidéotron’s Illico is taxed; we are not talking about adding a new tax, we’re talking about taxing a product thacrticismt already exists,” Arcand said. “Are you ready to remove the taxes for those two comparable [Canadian] companies?”

French language content on Netflix will largely come from European producers and networks in France and to a lesser degree Belgium and Switzerland.

French language content on Netflix will largely come from European producers and networks in France and to a lesser degree Belgium and Switzerland.