Consumer Reports today released its 2012 list of America’s best phone, broadband, and pay television providers (subscription required), giving top scores to fiber-to-the-home and cable broadband and exposing some familiar phone and cable companies which year-after-year deliver “bottom of the barrel” scores.

Consumer Reports today released its 2012 list of America’s best phone, broadband, and pay television providers (subscription required), giving top scores to fiber-to-the-home and cable broadband and exposing some familiar phone and cable companies which year-after-year deliver “bottom of the barrel” scores.

Nearly 70,000 readers of the consumer magazine participated in rating their local telecommunications providers for value, reliability, customer service, and broadband speed. No provider scored higher than “average” for value, but wide discrepancies in broadband speed and the quality of service made choosing winners and losers easy.

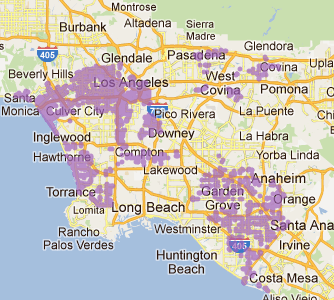

Top-rated WOW! (formerly WideOpenWest), is the 15th largest cable provider in the United States, but regularly wins top scores from Consumer Reports readers for the quality of its services. WOW! currently serves mostly suburban subscribers in a handful of cities in Illinois, Ohio, Michigan and Indiana. But the provider will soon be coming to several new locations thanks to its April purchase of cable overbuilder Knology, which provides service in multi-dwelling units and administers some community-owned broadband networks around the country. This could provide relief for customers dealing with onerous usage caps in cities like Lawrence, Kan., where Knology’s buyout of Sunflower Broadband kept that company’s Internet Overcharging scheme in place. WOW! has no usage limits on their broadband service.

Verizon’s FiOS fiber to the home network is also a consistent winner in the ratings, especially for its fast broadband service.

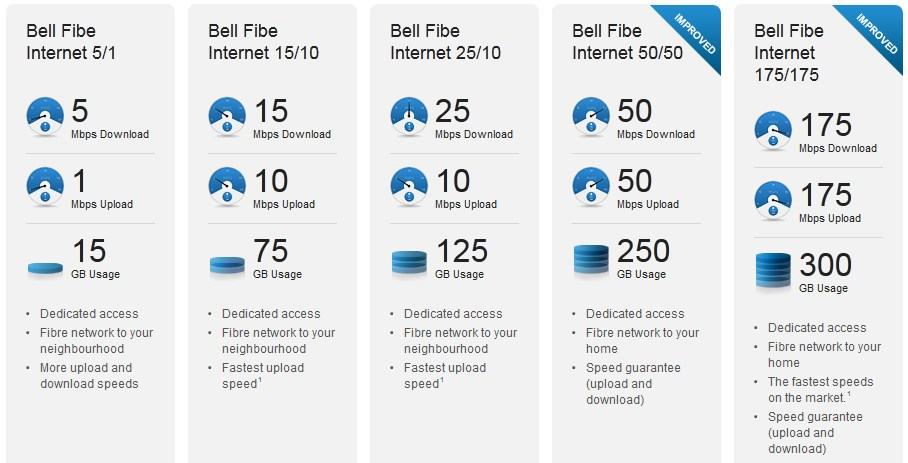

AT&T’s U-verse also scored high in the ratings for broadband. AT&T’s fiber-to-the-neighborhood service still works with existing copper phone wiring inside the home and delivers 20+Mbps broadband, a major improvement over AT&T’s traditional DSL service, which usually tops out at 7Mbps.

Among top-rated cable companies you have heard of, Bright House Networks scored a major coup, winning third place for its broadband service. Ironically, consumers gave very high marks to Earthlink delivered over Time Warner Cable, scoring it fourth place for broadband. But Earthlink’s performance on Time Warner Cable is actually slightly less than the cable company’s own broadband service. Although both services share exactly the same network, Time Warner adds “speedboost,” a temporary speed increase for downloads. But the cable company got no respect from customers, who put TWC in 19th place.

Other findings of interest:

Other findings of interest:

- TDS, an independent phone company serving primarily rural areas scored a very high fifth place in broadband, despite offering only traditional DSL service (except in limited areas where it has built fiber networks to stay competitive with community-owned providers and cable companies). But the company won high marks for service reliability;

- Frontier Communications’ inherited FiOS fiber to the home services in Indiana and the Pacific Northwest were that company’s only bright spots for broadband, putting both systems in sixth place. Everywhere else… forget about it. The company’s traditional DSL service was rated a lousy value and delivered mediocre speeds, earning 24th place.

- Satellite fraudband providers Wildblue and HughesNet continue to torture their customers, scoring dead last for lousy value, speeds, reliability, and everything else.

- Still awful after all these years: Mediacom, Charter, and FairPoint Communications all continue their dubious distinction scoring at the bottom of the barrel for broadband. It’s nothing new for any of them, and it appears nothing is likely to change those rankings in the immediate future.

Americans still hate the big boys. Outside of AT&T and Verizon’s shorter history delivering triple-play-packages of cable, phone, and Internet service, the legacy of lousy pricing and service from the country’s largest cable operators still hold them back in the ratings. Comcast managed only 24th place, dragged down by terrible customer service and worse value. Cablevision did better at 16th place with higher marks for everything but value. It was the same story for 12th place Cox Cable.

What was the top choice for telephone service in 2012? Ooma, a Voice over IP phone company that works with an existing broadband connection. Phone companies that have been in the business of phone service for decades (or longer) were all bottom-rated: AT&T, Verizon, FairPoint, and Frontier Communications. Only Mediacom, a cable operator, kept Frontier from scoring dead last. And they wonder why Americans can’t wait to disconnect traditional landline service?

In fact, Consumer Reports says no other industry alienates consumers more than America’s telephone and cable companies.

But you can fight back and score a better deal. Stop the Cap! was quoted in the magazine piece with our advice to play hardball with cable and phone companies who charge too much and deliver too little.

“The magic word is ‘cancel,’ ” says Phillip Dampier, of the website Stop the Cap! He suggests you schedule your disconnection date for a week or two in the future. “When you’re on their disconnect list, they are going to start calling you offering very aggressive deals,” he says.

Top-rated WOW! only delivers service in a handful of cities in the midwest, but is getting larger after acquiring Knology in April 2012.

Indeed, Consumer Reports found most providers willing to deal… eventually, but they have gotten wise to halfhearted negotiation tactics by consumers looking for a better deal. If a provider suspects you won’t follow through on a threat to change providers, they often stubbornly refuse to deal. That’s why we recommend requesting to be placed on a “pending disconnect” list — proof you are prepared to leave in a week or two if they won’t negotiate.

We’ve followed investor conference calls for most major providers over the past two years. Every provider has gotten more aggressive with customer retention offers, in part because of the poor economy and increased competition. Customers are paring back cable packages and cutting out extra channels and services they can no longer afford. Some have become expert at bouncing between new customer promotional offers. Cable operators like Time Warner Cable have tried to keep customers, even those coming to the end of promotions, with slightly less aggressive discounting.

“We have a very well-choreographed program for moving people from the most heavily discounted promos into the rational next-step pricing packages,” Rob Marcus, president of Time Warner Cable told the magazine. “Over time, that discount will decrease, but you’d probably still save 20 to 30 percent off the rack rate,” or regular price.

But we found consumers who get back on the disconnect list usually do much better than Time Warner’s “next-step” pricing, some even earning a better retention offer than what they received in 2011. The more serious customers are about their willingness to leave, the better the offer in return.

Dead last place for cable companies... again.

The magazine also offers solace for customers who literally have nowhere else to go for service:

Alan Curtis of Manchester, N.H., whose condominium is served only by Comcast, says his rates go up each year but he pushes back. “If you say, ‘We’ll have to buy less,’ occasionally they’ll come up with a cost-cutter that will apply to you,” he says. Similarly, a staffer who lives in a New York City apartment served only by Time Warner Cable more than offset a $5 increase in his overall bill by negotiating an $8-a-month cut in his DVR rental fee for 12 months.

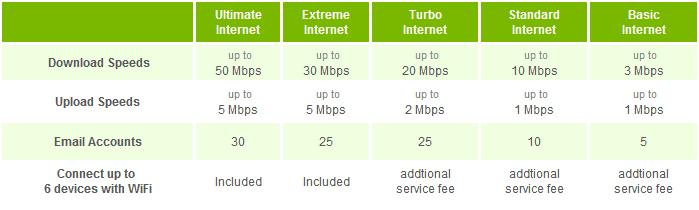

Consumer Reports also warns customers to choose broadband providers wisely, because the speeds they advertise may never materialize. Case in point, Frontier Communications’ dreadful DSL service, which the magazine found met the company’s speed marketing claims only 67% of the time. Frontier has been struggling with a vastly oversold broadband network, causing speeds to slow dramatically during peak usage times, particularly in states like West Virginia. The magazine recommends fiber to the home providers and cable operators for more consistent broadband performance that comes closer to the broadband speeds advertised.

At all costs, avoid satellite broadband, which remains slow, expensive, and heavily usage-capped.

Subscribe

Subscribe