Verizon prepaid customers can buy this basic phone from Walmart for just $15.88. But if you want to use this phone on a postpaid plan, Verizon charges up to $200 for the same phone unless you renew your contract.

As AT&T and Verizon discover an increasing amount of their revenue and profits come from their respective wireless divisions, they’re testing the waters to determine just how much more consumers are willing to pay for cell phone and wireless broadband services.

Verizon Wireless has spent the past year closing loopholes of various kinds and herding an increasing number of customers into mandatory data plans which can add up to $30 a month per phone to your monthly bill. AT&T wants more if you plan on early upgrades for your cell phone. A quick review:

Verizon Wireless Locks Down Prepaid Phone Models: Anyone who has shopped for a prepaid phone has probably noticed them dangling from hooks in Walmart and other stores at prices starting around $20. Most of these prepaid phones are basic models or those deemed cutting edge a few years ago. Take the LG 5600 — the Accolade. It’s a phone your father would be comfortable with, covering the basics and designed primarily for making and receiving phone calls. Verizon Wireless’ retail price for its “postpaid” customers (those who get and pay a bill every month) is $199.99 for the Accolade. Of course, if you sign a new two-year contract, the phone is free. But you can find the exact same phone, labeled for Verizon’s prepaid service at prices as low as $15.88.

Verizon claims the deep, deep discounts on prepaid phones are made back from the higher prices prepaid customers pay for airtime. Some enterprising Verizon postpaid customers have sought these models out to replace or upgrade a worn out or broken phone without having to sign a new two-year contract. Some other prepaid companies have also activated Verizon’s prepaid phones on their own network, including Page Plus.

Verizon has put the kibosh on both practices. Customers seeking to activate a prepaid phone on a postpaid account must first use the phone in prepaid mode for a minimum of six months prior to its conversion to postpaid use. Until very recently, some customers discovered a loophole around this requirement — registering a prepaid phone first on Verizon’s website and then activating it by dialing *228. So long as a phone had never been activated, it often could be used on a postpaid account from the date of purchase. But now Verizon tracks which phones are intended for postpaid and prepaid use, and that loophole has been closed.

Page Plus, which resells Verizon’s network, also had to stop activating Verizon prepaid phones almost a year ago.

As a result, those who want discounted cell phone service but keep Verizon’s robust network coverage have been forced to buy handsets at retail pricing, purchase one of several mostly refurbished phones direct from Page Plus, or activate an older phone no longer in use.

Avoiding the Data Plan: What drives an increasing number of Verizon off-contract customers towards “creative solutions” for upgrading their more than two year old phones is resistance to the expensive data plan required for most of their newest and best phones. For these customers, renewing a contract means a plan change that includes $30 a month extra for data services or a phone downgrade to a basic model to avoid a data plan. Verizon’s remaining data-plan exempt handsets are:

- Verizon Wireless CDM8975

- LG Accolade™

- LG Cosmos™

- Pantech Jest™

- Samsung Gusto™

- Verizon Wireless Salute™

- Verizon Wireless Escapade®

- Samsung Haven™

- Samsung Intensity™

- Samsung Convoy™

- Motorola Barrage™

Would you renew a two-year service contract if you had to downgrade your next new phone to a basic model to avoid a mandatory data plan?

For large families accustomed to mid-level phones, the prospect of being stuck with a Jitterbug-like-downgrade or a $30 data plan has kept many from renewing their contracts, sticking with what they already own.

When AT&T announced the end of its flat rate smartphone plan, it said the lower pricing on smaller allowance data packages would represent “savings” for consumers reluctant to upgrade. It’s hard to accept the same company that set prices so high for data usage in the first place has consumer interests at heart with usage-limited alternatives, especially when they no longer offer an unlimited option for customers who want one.

Verizon also plans to drop its unlimited plan in the near future. Also on tap is a gradual shift away from so-called “mid-level” phones that consumers can purchase with a reduced rate, but still-mandatory $10 data plan. Verizon increasingly will push customers between two stark choices — a high-powered, battery-eating smartphone that will give you a heart attack if you drop it or a very basic, stripped down phone with features commonly found on handsets five years ago.

This kind of pricing is driving some cash-strapped consumers to prepaid alternatives, such as Page Plus and Straight Talk on Verizon’s network and Wal-Mart’s new family prepaid plan on T-Mobile. This is especially true if customers just want to talk and text.

AT&T’s Increases ‘Early Upgrade Price’ for Data-Friendly Smartphones by $125

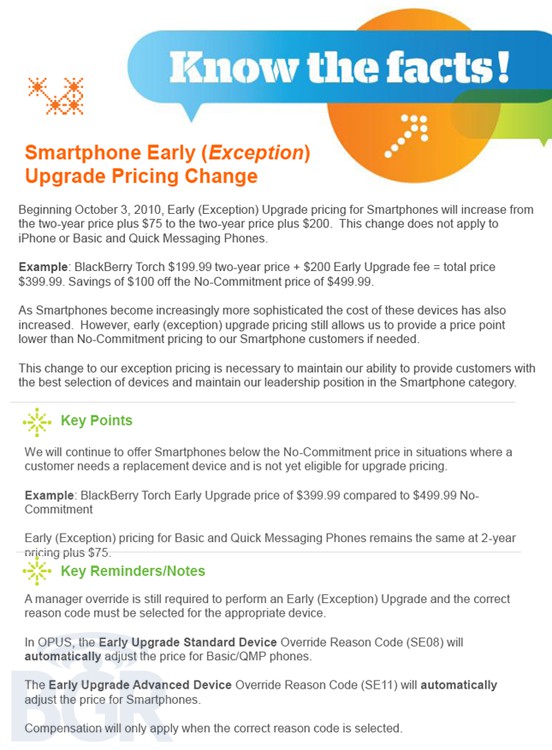

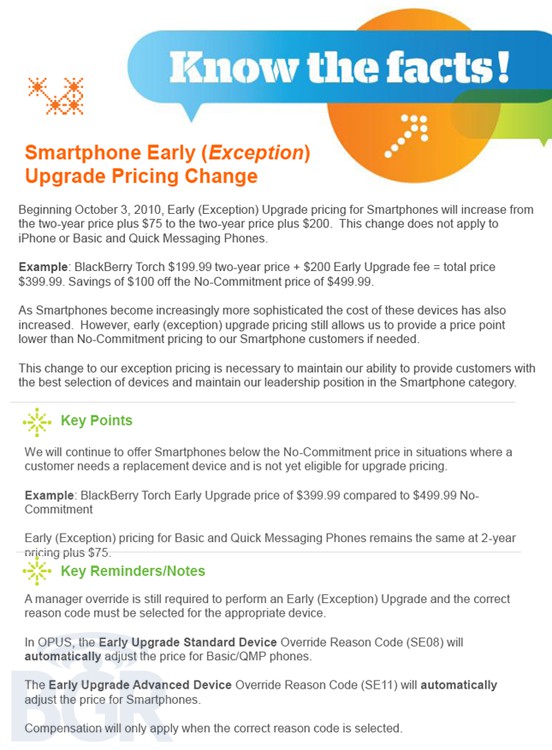

Boy Genius Report obtained a copy of an AT&T memo to its sales force notifying them the price for “Early Upgrade Pricing,” traditionally charged customers who must have the latest and greatest, or accidentally lose or destroy their existing phone, is going up — way up, from $75 to $200:

Beginning Oct. 3rd, Early (Exception) Upgrade pricing for Smartphones will increase from the two-year price plus $75 to the two-year price plus $200. This change does not apply to iPhone or Basic and Quick Messaging Phones.

Example: BlackBerry Torch $199.99 two-year price + $200 Early Upgrade fee = total price $399.99, a savings of $100 off the No-Commitment price of $499.99.

In return for just a $100 discount, customers sign a new two-year contract that begins with the phone’s replacement. That contract includes the usual early termination fee of $325, which decreases by $10 per month. AT&T watchers speculate the price change was designed to stop resale of relatively new phones on sites like eBay or Craigslist, where sellers charge near-retail prices and eat the formerly low penalty for an early upgrade. It also makes the price of getting the very newest phones that much higher.

Courtesy: Boy Genius Report

Cell Phone Lobby Resists Requirement for Early Warnings Alerting Customers Their Data Allowance Is Almost Gone: “It Will Cause Customer Confusion and Frustration”

Liz Szalay had to dip into her 401(k) retirement account to pay the family’s $2000 Verizon Wireless bill, gone wild with data fees her 14-year old son ran up searching for and downloading songs.

“I would never have allowed my son to accrue such charges, if I had known,” Szalay, a secretary in Niles, Michigan, told Bloomberg News. “What I did to prevent this from happening in the future was have his Internet access completely blocked by Verizon, but not before they made off with a boatload of money.”

Had Szalay received a text and/or e-mail message warning her one of the phones on her account was approaching 80 percent of its monthly data allowance, or was already at risk of racking up huge fees, it would have been possible to stop the damage before it began.

Sen. Udall wants legislation to warn consumers before they run up enormous wireless bills. The industry calls such warnings "confusing and frustrating" for consumers.

Senator Tom Udall, a New Mexico Democrat, wants to make sure she gets that warning. Udall drafted legislation that would require companies to warn customers when they have used 80 percent of their allotment.

“It’s difficult for the carriers to get up and argue against greater transparency on bills and notifications,” Christopher King, an analyst at Stifel Nicolaus & Co. in Baltimore told Bloomberg. “It’s becoming an issue on the front burner of regulators’ minds.”

The industry’s lobbyists are trying to block the legislation anyway.

The CTIA, the wireless industry lobbying group, is fiercely trying to kill Udall’s bill, claiming warnings will cause “customer confusion and frustration” and that carriers already offer customers the opportunity to check their usage by visiting carrier websites or via a text message.

The lobbyist solution requires consumers to be vigilant and check daily to make sure they don’t exceed any limits. Udall’s idea puts the onus on phone companies to warn customers, who often have family members that have no idea what kind of cash bonanza they can provide a wireless provider just by using data features built into their phones.

Szalay’s son has a phone that doesn’t require a data plan, but incurs an enormous $1.99 in charges for every megabyte accessed online. Verizon’s own website notes customers can consume 183 megabytes of data streaming music just five minutes a day for a month. That’s $364 in data charges. Five minutes downloading games — 440 megabytes or $875 in data fees. One need not use their phone for hours a day to incur enormous fees for data usage. Szalay’s son could have managed the $2,000 bill he caused using his phone for less than 15 minutes each day.

Verizon does not allow customers hit with these bills to retroactively sign up for a data plan to cover the costs, which are the same to Verizon whether a consumer incurs them on an unlimited $30 monthly data plan, or on a pay per use plan with a stinging penalty rate.

And the company objects to any government official telling them to warn customers before the overlimit fees kick in.

“We have several measures in place that allow our customers to monitor their usage and protect against overages — this is a proactive approach on Verizon’s part,” Verizon’s Smith told Bloomberg in an e-mailed statement.

How to Protect Yourself

Both Verizon and AT&T are masters of extracting a maximum amount of money from customers’ pockets. Verizon is increasingly risking its high rating for customer service and quality by finding new ways to nickel and dime even long time customers to death. AT&T already has earned a bad reputation and can’t drop much further unless it adopts Sprint’s old strategy of driving its own customers away. Only through education and careful consideration of your family’s actual usage can you safely navigate around these shark-like wallet biters.

Both Verizon and AT&T are masters of extracting a maximum amount of money from customers’ pockets. Verizon is increasingly risking its high rating for customer service and quality by finding new ways to nickel and dime even long time customers to death. AT&T already has earned a bad reputation and can’t drop much further unless it adopts Sprint’s old strategy of driving its own customers away. Only through education and careful consideration of your family’s actual usage can you safely navigate around these shark-like wallet biters.

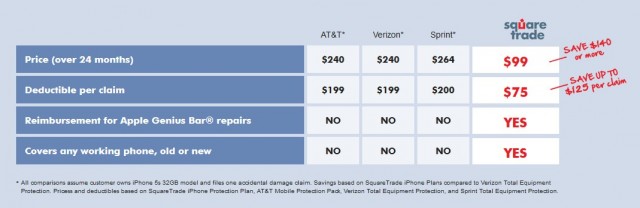

1. Avoid cell phone company insurance plans unless you are concerned about theft. With “early upgrade” plans, even at AT&T’s $200 price, it may not be worth paying an expensive monthly fee for insurance. Also consider Squaretrade, a third party warranty/replacement provider. They charge considerably lower prices than most (Google around for coupon codes offering up to 30 percent off). If your phone breaks or is damaged, and you are not on a contract, you might find a suitable refurbished replacement through websites like eBay. Just make sure the phone wasn’t designated for prepaid service to avoid activation hassles.

2. If you want Verizon network quality, but don’t want to pay Verizon’s diamond-platinum pricing, consider doing business with one of the new prepaid providers offering month-to-month service that uses the same network as Verizon itself. Walmart sells Straight Talk, but also consider Page Plus, which offers 1,200 minutes of call time, 1,200 texts, and 50MB of data use for $29.95 per month. The only downside is that most prepaid providers don’t sell family plans, meaning each user pays the same price. Walmart’s new prepaid plan changes that with the introduction of a shared family plan, with additional lines given discounted pricing. But the discounts are not as good as postpaid plans offer, and the service relies on T-Mobile, which is not well-regarded for coverage outside of metropolitan areas.

3. Smartphones, in addition to being expensive, often deliver horrible battery life. Some won’t even make it through an entire business day. Before seeking out one of these premium phones, consider whether you will actually use their features. Is it worth the price of a $30 a month data plan if you only occasionally use the phone for wireless Internet? Bragging rights come with a $200 up front price tag and a two year contract that will run up to $720 just for the data plan over two years. If you drop it, lose it, or it gets stolen, the retail price for most of these phones is north of $500.

4. Carriers design “gotcha” data pricing into their assumed revenue models. They know even with online tools, nobody wants the hassle of checking their allowance for data every day, especially when most stopped checking their voice minutes allowance years ago. While carriers occasionally waive gigantic bills, especially when the media gets involved, you can restrict data access on some or all of your phones if you do not have a data plan and don’t care about this feature. You should support Senator Udall’s bill as well. Carrier excuses that a warning message will cause confusion and frustration are laughable. Getting a $2,000 wireless bill in the mail will cause far more of both. That the industry objects to even this common sense approach illustrates just how rapacious wireless companies are for additional profits.

5. Educate everyone on your plan about the implications of using the phone to download music and games or watch video. Unless you are on a flat rate plan, you may want to simply tell your family not to use their phones for these kinds of services without asking permission first. This gives you an opportunity to check your allowance before Verizon gets a chance to reduce your bank balance.

[flv width=”640″ height=”500″]http://www.phillipdampier.com/video/Cell Phone Savings 10-12-10.flv[/flv]

We have four reports covering consumer news on cell phones that can save you money: KSHB-TV in Kansas City takes a look at Walmart’s new prepaid family plan using T-Mobile’s network, WIVB-TV in Buffalo reports Sen. Kirsten Gillibrand (D-N.Y.) wants carriers to stop international roaming charges when customers end up making and receiving calls on a Canadian provider’s network from the American side of the border, WFTS-TV in Tampa provides tips on getting lower rates from your cell phone company and WTEV-TV in Jacksonville helps customers analyze cell phone bills for savings. (6 minutes)

When customers have three or four $600 smartphones on their family plans, purchasing insurance for all of them can prove costly.

When customers have three or four $600 smartphones on their family plans, purchasing insurance for all of them can prove costly.

Squaretrade responds that it doesn’t believe loss/theft protection is a good value for its customers.

Squaretrade responds that it doesn’t believe loss/theft protection is a good value for its customers.

Subscribe

Subscribe