The reported deal between Comcast, the nation’s largest cable operator and NBC-Universal, part owner of Hulu, could have serious consequences for the Internet’s most popular destination for online television shows and movies.

The reported deal between Comcast, the nation’s largest cable operator and NBC-Universal, part owner of Hulu, could have serious consequences for the Internet’s most popular destination for online television shows and movies.

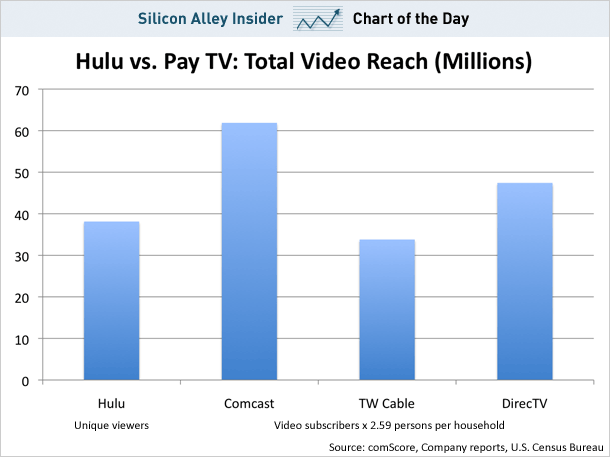

In just a year, Hulu has enjoyed a quadrupling of visits well into the millions, streaming dozens of network television series, specials, and movies, all supported by commercial advertising. Devised to help combat online video piracy and earn additional advertising revenue from web watchers, Hulu partners NBC, Fox and Walt Disney Co., have been successful at drawing scores of Americans to the video website. Program distributors have also been pleased, earning money from shows like Lou Grant that haven’t been on network television in decades. But after the economic crash of 2008, the venture has proven costly for the partnership, challenged by an advertising marketplace on life support and outright hostility by broadband providers, cable operators, and Wall Street investors, upset that the service is giving it all away for free.

Among the loudest to complain is Comcast, which is now angling to acquire NBC, and its 30% ownership stake in Hulu.

Comcast CEO Brian Roberts has repeatedly complained about the implications of giving away online video, which for some have begun to replace cable television subscriptions.

“If I am any one of these programmers, not just ESPN but the Food Network and I have a business in that 50 percent, 60 percent, 70 percent of my business comes from subscriptions, I want to think long and hard before I just put that content out there for free and not think through what it is going to mean to my business,” Roberts said at an investors conference in May.

Roberts view was shared by the CEO of the nation’s second largest cable operator, Glenn Britt of Time Warner Cable.

“If you give it away for free, you’re going to forego that subscription revenue,” Britt said. “And if you actually think the ad revenue can make up for that, then God bless you and go on your way. But I don’t think that’s the case, and (networks) don’t really think that’s the case either.”

The difference between Comcast and Time Warner Cable is that the former could gain part ownership in the largest service now giving it all away for free, and that has major implications for Hulu’s future.

“Would Comcast put an end to the Hulu model of using the Web to distribute free TV content?” asked Michael Nathanson, senior media analyst at Sanford C. Bernstein & Co. “Will Comcast continue to support Hulu?”

The Los Angeles Times reports there is already a precedent for Hulu limiting content for online viewers in response to complaints:

Hulu already has limited users’ access to certain cable programs, including FX’s “It’s Always Sunny in Philadelphia,” in response to an outcry from the TV producers and cable companies that object to paying TV programmers hundreds of millions of dollars each year for shows that are offered free online.

“Arguably, their ability to shape online content distribution, and to recast windows for video on demand, would be an important attribute of any deal,” wrote Craig Moffett, a cable industry analyst at Sanford C. Bernstein.

Comcast’s interest in NBC Universal would dramatically expand its entertainment portfolio with such attractive cable channels as USA Network, MSNBC and CNBC as well as the Universal Pictures movie studio. The proposed Comcast-NBC Universal venture also would give the cable operator a greater role in deciding how and when TV shows and movies are distributed online and at what price to consumers.

Comcast’s influence would primarily be felt in cable network programming streamed online, as Comcast has a vested interest from the millions it currently pays those programmers to carry their networks on Comcast cable systems nationwide. Comcast could advocate Hulu become a partner in the TV Everywhere cartel, providing video content only to “authenticated” pay television subscribers, or it could limit the number of episodes available for free, or when those episodes appear on the service.

Soleil Securities media analyst Laura Martin thinks an even more likely possibility would be charging a fee for some of its more popular content. Martin points to Hulu’s own financial problems, a consequence of the crash in the advertising market. Soleil estimates that the three partners subsidize $33 million of the losses at Hulu even after earning $123 million this year from advertising. Even worse, Martin says, is the cannibalizing of the networks’ own advertising earnings from broadcast runs of those shows now available online. She told the Times that for every viewer who migrates to the Internet, the companies forfeit $920 a year in ad revenue.

But not everyone believes the Comcast-NBC deal is such a great idea.

Time Warner CEO Jeff Bewkes today told an industry conference in Manhattan that large media mergers have had a lousy track record. Still, he said the merger would probably benefit the cable industry as a whole, because broadcast networks content with giving away content for free online will now be a part of the very industry hurt by that formula and will be more friendly towards arguments to stop it.

“We love to see our competitors taking risks,” Bewkes said.

[flv width=”400″ height=”300″]http://www.phillipdampier.com/video/CNBC Hulu 9-7-09.flv[/flv]

CNBC’s Julia Boorstin talked with Hulu CEO Jason Kilar in September about the desire for the company to partner with the cable industry’s TV Everywhere project.

Subscribe

Subscribe