Competition is a wonderful thing. A case in point is the enormous difference Charter Spectrum charges new customers in areas where competition exists, and where it does not.

Competition is a wonderful thing. A case in point is the enormous difference Charter Spectrum charges new customers in areas where competition exists, and where it does not.

Charter’s offers are address sensitive. The cable company knows its competition and almost exactly where those competitors offer service. That is why the company asks for your service address before it quotes you pricing.

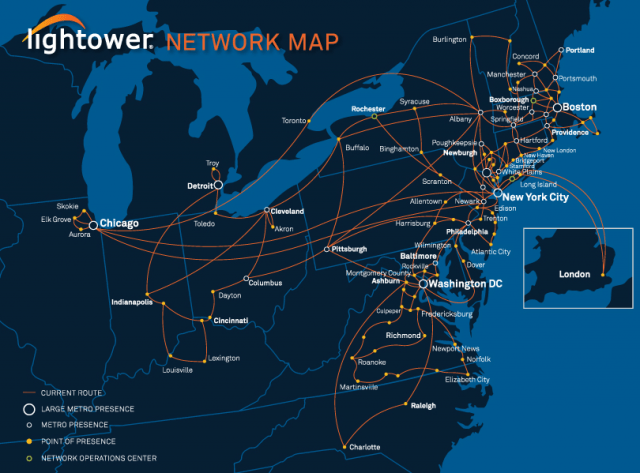

Stop the Cap! compared promotional new customer offers in the metro Rochester, N.Y. market where Spectrum faces token competition from Frontier’s slow speed DSL service. Then we checked pricing in neighborhoods where a fiber to the home overbuilder called Greenlight also offers service.

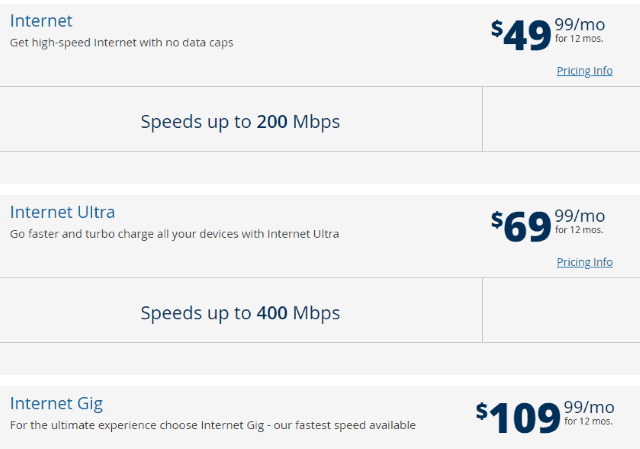

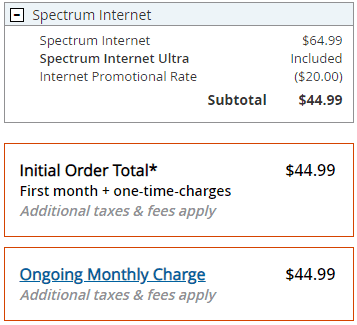

In neighborhoods where Spectrum enjoys a broadband monopoly, here are the offers for internet-only service available to new customers. Notice they expire after 12 months:

Spectrum promotional prices in non-competitive service areas.

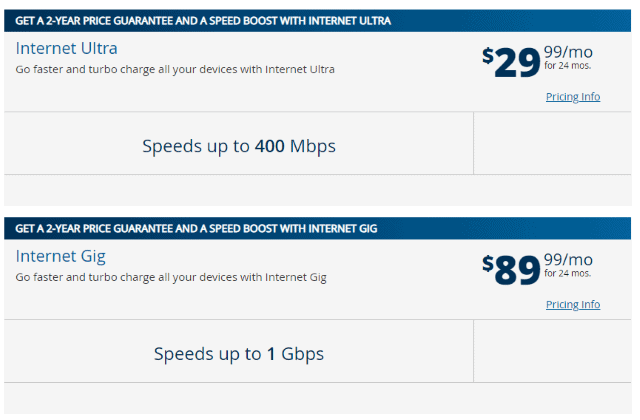

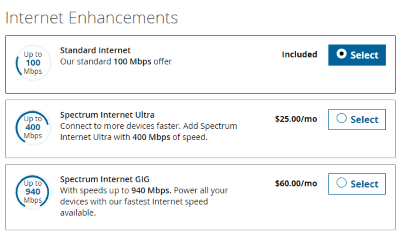

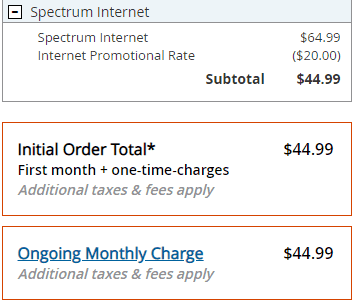

Just one street away, where Greenlight offers customers the option of gigabit speed over a fiber to the home network, Spectrum’s promotional prices are quite different. Notice these offers last 24 months, twice as long as in non-competitive neighborhoods:

Spectrum promotional prices in some areas where customers can choose a competitor offering fiber to the home service.

Spectrum does not even bother offering new customers its entry-level 200 Mbps plan in areas where it has significant fiber competition. For $20 less per month, you get double that speed. Gigabit service is $20 less in competitive areas, too.

Spectrum charges a hefty $199.99 compulsory installation fee for gigabit service in non-competitive neighborhoods. Where fiber competition exists, sometimes just a street away, that installation fee plummets to just $49.99.

Note similar pricing variability exists in Spectrum service areas around the country, with the most aggressively priced offers reserved for addresses also served by a fiber to the home provider or multiple competitors (e.g. cable company, phone company, Google Fiber or other overbuilder). Current customers typically have to cancel existing service and sign up as a new customer to get these prices.

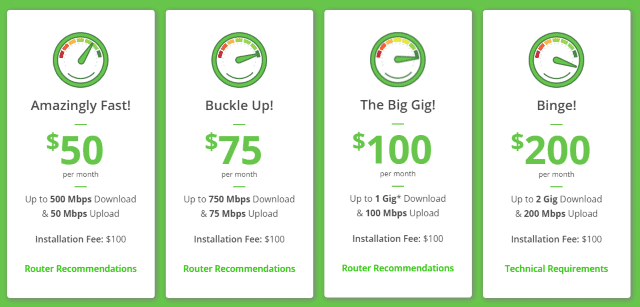

Greenlight Networks has four internet plans that range from $50-200 a month. They do not offer promotional prices, instead marketing “what you see is exactly what you will pay” pricing. As a relatively new company, they charge an installation fee that helps recoup the investments they are making to dig and string fiber cables in neighborhoods across Rochester (and Buffalo as well, where they are expanding). Spectrum (and its predecessors) use pre-existing cable lines that have been there for decades.

Greenlight Networks pricing

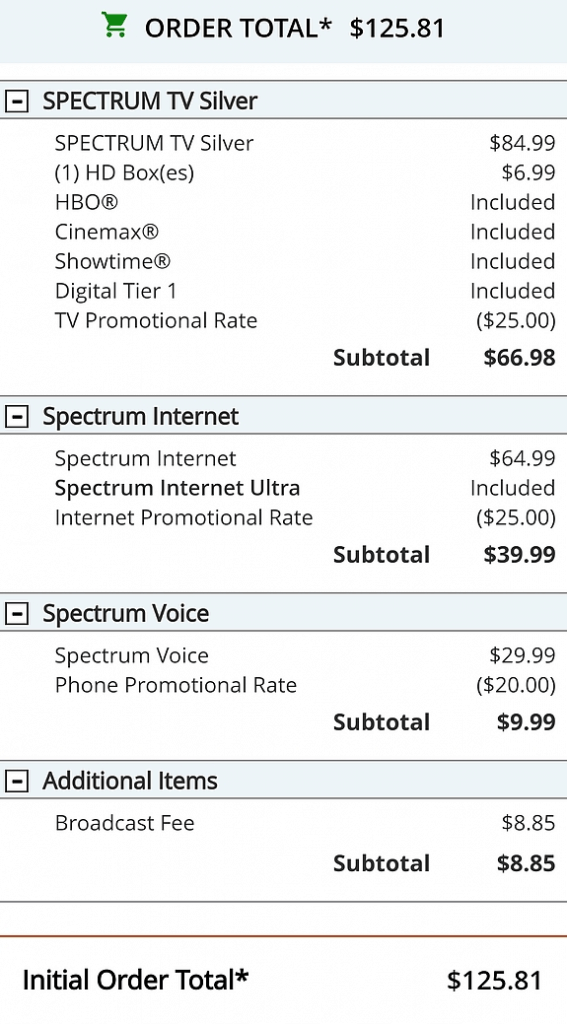

Charter’s promotion strategy is designed to undercut the competition on price, believing customers will choose 400/20 Mbps service for $29.99 a month over Greenlight’s 500/50 Mbps service for $50 a month. Of course, after two years Spectrum’s regular prices can kick in, more than tripling the cost to around $94.99 a month, although customers usually get a less attractive secondary promotion after the original one expires, usually offering around $10 off per month.

Subscribe

Subscribe Spectrum customers living in areas wired for fiber optics get substantially better discounts for longer periods of time than those living in areas where anemic phone company DSL service is the only competition.

Spectrum customers living in areas wired for fiber optics get substantially better discounts for longer periods of time than those living in areas where anemic phone company DSL service is the only competition.

As gigabit internet becomes more common across the United States, some ISPs are seeking a speed advantage by offering even faster speeds to residential and business customers. On Tuesday, Nokia announced Frontier Communications and Rochester, N.Y.-based Greenlight Networks would be upgrading their fiber networks to the company’s XGS-PON solution, which can handle 10 Gbps upload and download speeds.

As gigabit internet becomes more common across the United States, some ISPs are seeking a speed advantage by offering even faster speeds to residential and business customers. On Tuesday, Nokia announced Frontier Communications and Rochester, N.Y.-based Greenlight Networks would be upgrading their fiber networks to the company’s XGS-PON solution, which can handle 10 Gbps upload and download speeds. Next generation XGS-PON allows up to 10 Gbps in both directions over existing fiber networks. In fact, the technology is future proof, allowing operators to immediately upgrade to faster speeds and later move towards Full TWDM-PON, an even more robust technology, without expensive network upgrades.

Next generation XGS-PON allows up to 10 Gbps in both directions over existing fiber networks. In fact, the technology is future proof, allowing operators to immediately upgrade to faster speeds and later move towards Full TWDM-PON, an even more robust technology, without expensive network upgrades. Frontier intends to deploy Nokia’s technology in ex-Verizon markets in California, Texas, and Florida, beginning in Dallas-Fort Worth. It will allow Frontier to beef up its FiOS network and market stronger broadband products to Texas businesses. In Rochester, Greenlight will use the technology to upgrade its fiber service, which competes locally with Frontier DSL and Charter/Spectrum. Spectrum recently introduced gigabit download speed in Rochester. Greenlight can now expand beyond its 1 Gbps offering, but more importantly, increase its maximum upload speed beyond 100 Mbps.

Frontier intends to deploy Nokia’s technology in ex-Verizon markets in California, Texas, and Florida, beginning in Dallas-Fort Worth. It will allow Frontier to beef up its FiOS network and market stronger broadband products to Texas businesses. In Rochester, Greenlight will use the technology to upgrade its fiber service, which competes locally with Frontier DSL and Charter/Spectrum. Spectrum recently introduced gigabit download speed in Rochester. Greenlight can now expand beyond its 1 Gbps offering, but more importantly, increase its maximum upload speed beyond 100 Mbps.