Phillip “Artificial Scarcity for Fun and Profits” Dampier

It would be an understatement to say I’ve heard the argument once or twice that there is simply no economic room for additional players to enter what Big Telecom companies always claim is a robustly competitive marketplace for Internet access.

Virtually every company facing inquiries from regulators, politicians, and consumers always makes the point today’s deregulated broadband playing field is an excellent example of free market competition at its best.

While they advocate for even more deregulation, oppose the entry of community-owned broadband services, and demand more spectrum from Washington lawmakers, we endure a veritable monopoly/duopoly for Internet access. Their defense, after a dismissive rolling of the eyes, is that we just don’t understand business.

Enter Tim Lee, writing for the alternate reality reader of Forbes, who decided to prove his argument by comparing broadband with Supercuts:

Being the first to build a hair-cutting shack in a particular customer’s backyard can be pretty lucrative. It gives you a de facto monopoly on that household’s haircut business. Let’s assume that it takes 4 years worth of haircuts to recoup the costs of building a shack for a particular household. While barbers will need to raise some extra capital to build the shacks, in the long run the owner of the first shack may be able to earn big monopoly rents.

Now along comes a new barber who wants to enter the hair-cutting business, but every household already has at least one hair-cutting shack. So he needs to build hair-cutting shacks in backyards where another barber has already built one. And that’s an economically precarious situation. Remember, we assumed a monopolist needs to do 4 years worth of haircuts in order to break even. But if you build a shack in a backyard that already has another barber in it, you shouldn’t expect to get more than half of the customer’s business, on average, over the long run. Not only that, but competition will push down prices, so you’ll have to do more haircuts to recover the costs of construction. So you’ll be lucky to recover your initial investment within 8 years, and it could easily take more than a decade.

And things are even worse for the third or fourth barber who builds in a particular backyard. The fourth barber will be building in a yard that already has three barbers. He can only expect to attract 25 percent of the household’s business, and strong competition among barbers means his margins will be pretty thin. It’s hard to see how he could ever recover the costs of his investment.

Brushing away the hair-cutting analogy, Lee’s point is that it is wasteful and inefficient for competitors to overbuild new networks where others already exist. The phone and cable companies that dominate the marketplace today decry additional competition as a death blow to their business models, because with so many providers fighting for customers (by lowering prices and offering better service), not every provider can sustain a profit Wall Street investors expect quarter after quarter. This argument is particularly common when attacking those dastardly socialist community-owned broadband providers they say destroy private enterprise (while unconvincingly also warning they will always fail and cost taxpayers millions on the way down). It is also why Wall Street continues to beat the drum for additional consolidation in the wireless marketplace, where anything more than AT&T and Verizon Wireless represents too much revenue destruction.

Lee does make some valid points:

- Infrastructure costs are the biggest expense in launching a new network, especially wiring the last mile to customers;

- Verizon FiOS overestimated its potential market share and found it harder to turn a profit than first anticipated;

- Other utilities have avoided building redundant networks (ie. you don’t have two companies providing their own electric, water, and gas lines).

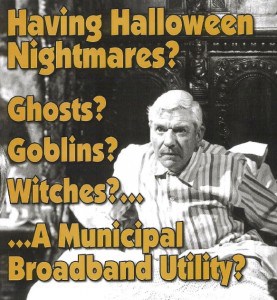

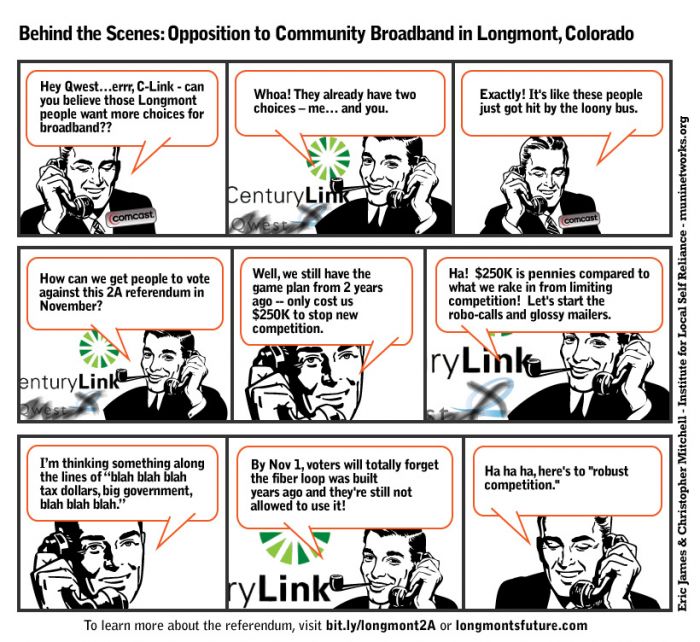

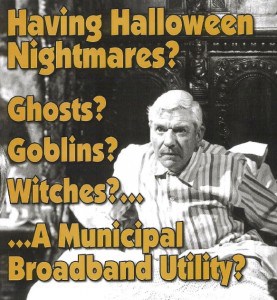

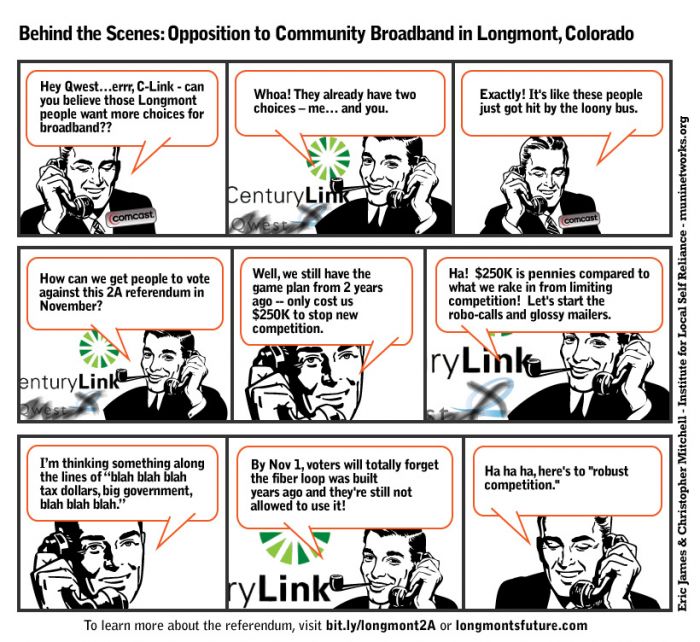

When communities decide to offer their own broadband service, incumbent cable and phone companies spend big bucks to scare residents.

But Lee’s conclusion is entirely favorable to the industry he often defends — that is just the way things are and customers should not expect anything better.

Those arguments are usually also the basis for free market declarations that if a private company cannot find a way to deliver a service at a profit, then those left out will just have to do without.

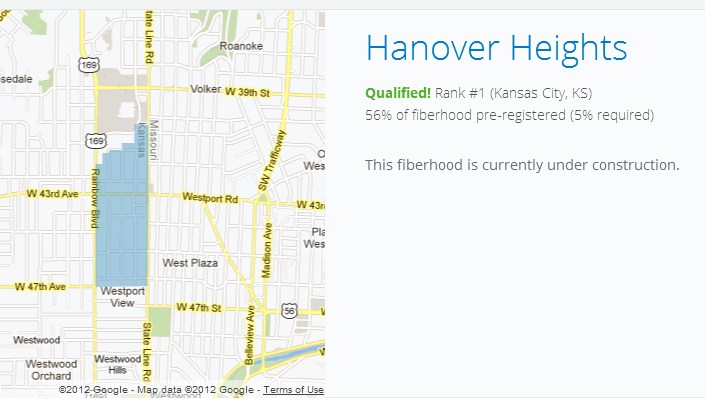

Thankfully, despite Lee’s criticism of Google Fiber in Kansas City as “extremely wasteful,” the search engine company is perhaps best positioned of all to turn the industry’s common refrain against new competition on its head.

Every so often, a surprising third party shows up with the resources to ignore Wall Street’s conventional wisdom. Enter the deep pockets of Google Fiber or a bond-backed community provider threatening to deliver service far better than what a community currently enjoys. The predictable defense from incumbent providers:

- Nobody needs faster broadband speeds;

- Community networks are a government takeover of the Internet;

- Fiber optics are expensive and represent an unnecessary investment;

- Public broadband destroys private investment and jobs at incumbent commercial providers;

- This is just a political stunt, not a real effort at taking Internet speeds to the next level.

Without the kind of competition on offer from Google, community providers, and private providers like Verizon taking a chance on FiOS fiber optics, there would be no room for innovation in the marketplace.

Provider tolerance for today’s marketplace duopoly and the lackluster service that results is reminiscent of a joke told by President George W. Bush’s in 2000: “If this were a dictatorship, it would be a heck of a lot easier…just so long as I’m the dictator.”

It is easy for today’s comfortable duopoly providers to take shots at would-be competitors while dragging their feet on network upgrades. They have little to fear with Wall Street on their side, joining opposition to new competition as harmful to profits. Even Verizon Communications, one of the two dominant providers, quickly heard from analysts irritated with the infrastructure expenses involved upgrading to a fiber optic network. At the heart of that criticism was a sense it was an unnecessary expense, with no reason to change the safe and reliable status quo. Innovation that costs money is the enemy of Wall Street, unless competition warrants the investment.

Therein lies the key. Effective, disruptive competition demands companies do something different. Lee may be right that three companies cannot easily bring home the big profits. Wall Street may have to make do with less. In a competitive market, the player offering the least will be the first to innovate to keep or attract customers, or eventually close their doors. Those remaining will compete in turn to deliver the best possible service at the lowest possible price. That itself is a departure from the comfort zone enjoyed by phone and cable operators today where neither feels much pressure. Cable companies won’t ever compete with other cable companies and the same is true for phone companies. But if a company like Google arrives, the decade-long coffee break is over.

Want proof? Just look at cable operators struggling to keep video customers who are now finding alternatives with Netflix and online viewing. They are increasingly looking for ways to enhance the value of cable television by offering online viewing themselves. Even rate increases have slowed. If Netflix and cord-cutting were not factors, would cable companies have changed the way they do business?

Google’s marketplace disruption delivers for consumers.

Lee is right saying it is not easy to break into the broadband business. Only some might realize the same investors and Wall Street barons that dislike profit-eroding competition also often happen to be in the business of loaning money to finance new businesses. More than a few will turn those loans down as too risky to contemplate.

But here comes the rhetorical trap Lee’s argument gets ensnared in: If running redundant networks is wasteful and we still need competition, the logical solution would be to construct or nationalize one advanced network on which all providers would market their services. Why waste time and money on duplicate copper and coaxial networks when a single fiber to the home network could deliver improved service well beyond what the local phone and cable company can offer.

Isn’t the answer to run a single telecommunications line into customer homes (one preferably not controlled by any provider), and let competition bloom on that advanced infrastructure? That is the solution Australia has chosen, scrapping the country’s ancient copper wire phone lines in favor of one national fiber network. Most community providers also operate open networks that other cable and phone companies can utilize (but often petulantly refuse).

Somehow, despite the enormous savings possible from sharing or offloading network infrastructure expenses, I doubt providers will consider that the kind of innovation they want or need.

Google recognizes that television lineups still matter. The Kansas City gigabit fiber broadband project is not just about faster Internet access, and some KCMO and KCK residents have made it clear if Google Fiber lacks the television channels they want to see, they won’t switch providers.

Google recognizes that television lineups still matter. The Kansas City gigabit fiber broadband project is not just about faster Internet access, and some KCMO and KCK residents have made it clear if Google Fiber lacks the television channels they want to see, they won’t switch providers. On Monday, Google landed a deal with News Corp., parent company of Fox, for a bunch of additional sports, news, and general entertainment channels. The latest additions: BabyTV, Big Ten Network, Fox Business Network, Fox College Sports Atlantic, Fox College Sports Central, Fox College Sports Pacific, Fox Deportes, Fox Movie Channel, Fox News Channel, Fox Soccer, Fox Soccer Plus, FS Kansas City, Fuel TV, Speed and FX. Other additions also announced: HSN2, KPXE-TV DT2 – Qubo, KPXE-TV DT3 – ION Life, Nat Geo Mundo, Nat Geo WILD, National Geographic Channel, and Utilisima,

On Monday, Google landed a deal with News Corp., parent company of Fox, for a bunch of additional sports, news, and general entertainment channels. The latest additions: BabyTV, Big Ten Network, Fox Business Network, Fox College Sports Atlantic, Fox College Sports Central, Fox College Sports Pacific, Fox Deportes, Fox Movie Channel, Fox News Channel, Fox Soccer, Fox Soccer Plus, FS Kansas City, Fuel TV, Speed and FX. Other additions also announced: HSN2, KPXE-TV DT2 – Qubo, KPXE-TV DT3 – ION Life, Nat Geo Mundo, Nat Geo WILD, National Geographic Channel, and Utilisima,

Subscribe

Subscribe