Google Fiber is more than the experimental publicity/political “stunt” many large cable companies and Wall Street investors have suspected since the search giant first announced it would build a 1,000/1,000Mbps fiber to the home network.

BTIG Research, which follows the telecom sector for large institutional investors and investment managers, says there is a lot more to Google Fiber than many initially thought.

If Google’s fiber project expands outside of Kansas City, it could ultimately transform the business model of broadband in the United States. It already has generated unease for Time Warner Cable, which has resorted to knocking on doors to preserve its customer relationships.

It is one thing to consider Google Fiber from a New York City office and another to see it working on the ground. BTIG’s Rich Greenfield and Walt Piecyk decided to travel to Kansas City to investigate the new fiber service first-hand.

“We believe Google Fiber will accelerate rapidly, changing consumer habits in its territory,” they concluded. “While it is very early in Google Fiber’s life, we fully expect Google to build out more markets after they perfect the broadband and TV offerings in Kansas City.”

“We believe Google Fiber will accelerate rapidly, changing consumer habits in its territory,” they concluded. “While it is very early in Google Fiber’s life, we fully expect Google to build out more markets after they perfect the broadband and TV offerings in Kansas City.”

There is ready-made demand, judging from the 1,100 cities that asked Google Fiber to set up shop locally. Local governments recognize their telecommunications future has been largely monopolized by one cable and one phone company, and it is important for that to change. Some have taken steps to build their own networks, others will throw a parade if Google does it for them. Reasoning with the likes of Comcast, Time Warner Cable, AT&T, and Verizon — among several others — has not gotten world class broadband at a reasonable price. Instead, many incumbent players have used their market power to raise prices, restrict usage with unnecessary usage caps, and retard innovation.

Google may prove to be the only force large and aggressive enough to throw a monkey wrench into the comfortable business plans and conventional wisdom about how broadband should be packaged and sold in this country. Community owned providers have shown they can deliver superior service and pricing, but face deep-pocketed incumbents that can use predatory pricing to save customers in one market while raising prices on captive customers in others. Incumbent providers also have successfully advocated for protectionist bans on publicly-owned broadband in a number of states. Washington regulators have thus far been largely supine and disengaged when asked to address the challenges consumers face from rising bills for more restricted service.

BTIG’s own research is a marked departure from the usual dismissive attitude incumbents and Wall Street have paid to the Google project. Greenfield himself acknowledges that the investment and business media communities typically respond with three reactions when one mentions Google Fiber:

- “Is it a sustainable business with those economics?”

- “How much cash are they blowing?”

- “Who cares about what they are doing in a couple of relatively small cities such as the Kansas Cities?”

But such thinking underestimates Google’s potential much the same way Yahoo! and AltaVista did with their dominant search engines a decade ago. The biggest mistake one could make is to assume Google just wants to be another competing cable or phone company. It goes far beyond that.

But such thinking underestimates Google’s potential much the same way Yahoo! and AltaVista did with their dominant search engines a decade ago. The biggest mistake one could make is to assume Google just wants to be another competing cable or phone company. It goes far beyond that.

Greenfield believes Google is seeking to become an integral part of the communities it serves, equal in stature to the cable and phone companies, but without their reviled reputation.

But the most significant change Google brings is a challenge to the current business model of consumer broadband.

Phone and cable companies first monetized broadband speeds. The faster the speed chosen, the higher the price. The earnings power of broadband gradually increased as more Americans signed up for service and the costs to provide it declined. But as cable TV margins continue to erode, the money to cover the difference has come from broadband, which has seen regular, unjustified rate increases since 2010. Not content with monetizing broadband speed alone, many providers are also attempting to monetize broadband usage with usage limits and/or consumption-based billing schemes. A recent Wall Street Journal article estimated 90 percent of the price consumers pay for Internet access is profit.

With that kind of profit margin, the economics of Google’s ambitious fiber project do not look as unfavorable as some on Wall Street suggest.

With that kind of profit margin, the economics of Google’s ambitious fiber project do not look as unfavorable as some on Wall Street suggest.

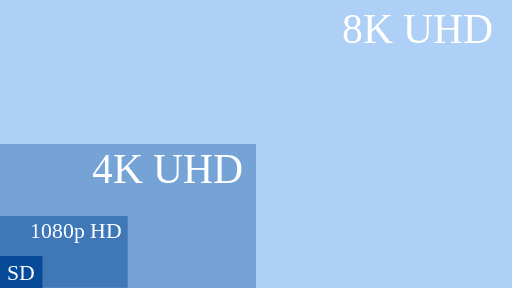

Greenfield calls Google’s 1 gigabit speeds insanely low-priced at $70 a month. He’s right when one considers current pricing models of incumbents. At Time Warner Cable’s current pricing (50/5Mbps service for $99 a month), the cable company would charge consumers $1,980 a month for 1,000/1,000Mbps service, assuming they could actually deliver it. Upstream speeds above 5Mbps might cost even more. Cable television, which used to be the core service offered by cable companies, is almost an afterthought for Google. It can be added for $50 more per month, which is actually cheaper than many competing providers charge for a similar package.

Greenfield feels Google has an aspirational goal for its Kansas City network.

“In Kansas City, Google has a customer facing service with employees who are part of your community, trucks that come to your house and customer service reps that answer your questions when you need help,” Greenfield notes.

On that basis, Google can reboot itself into an entirely new entity in Kansas City, offering much more than a broadband service and a search engine.

Google’s sleek network box.

Greenfield notes Google Fiber has been carefully developed to break away from the familiar experience one has with the phone and cable company:

- The home terminals and DVR equipment more closely resemble a sleek Apple product, not a Motorola/Cisco set top box that has looked largely the same since the 1990s;

- The installation experience has been streamlined — the external network interface on the side of the customer’s home does not require anyone to be home during the installation, reducing the time needed for a customer to sit around while service is installed inside;

- In-home equipment envisions a more integrated IP-based network future with Ethernet and Wi-Fi connectivity, a centralized storage device which acts as an enhanced whole house DVR, and a minimalist TV box that can be hidden — no more unsightly hulking set top boxes. It represents a home entertainment network that goes far beyond what the competition is offering.

These factors deliver a positive customer experience, if only because Google paid attention to complaints from cable and telephone subscribers and decided to do things differently.

Other traditional business model busters noted by Greenfield:

- Google will deliver 6/1Mbps budget priced Internet for a $300 one time fee (payable in $20 installments) which includes an in-home router, breaking through the digital divide and getting Google’s infrastructure into homes that simply cannot afford traditional cable or phone company broadband. It blows away the current “lite” offering sold by cable and phone companies with much better speeds at a far lower price;

- Google is working with charitable organizations to help the poorest get broadband for even less, through donations and other fundraising;

- Google leverages the community as a crowd-sourced marketing engine. Word of mouth advertising and competition among different neighborhoods helps drive the expansion of the network. Even if a consumer has no interest in the service, many fight to see it in their neighborhoods for the benefit of local community institutions who will receive free hookups;

- Every new customer signed up for two years’ service receives a free Nexus tablet. The tablet is sold as the service’s “remote control,” but it is capable of much more;

- No data caps, no speed throttling. With just two speed tiers, Google has completely discarded the speed-based and usage-based business models for broadband.

A Nexus 7 tablet comes free with the service (and a two year commitment)

So what exactly does BTIG think is Google’s master plan? Greenfield suspects Google is not recouping its initial investment or costs with their current pricing model, but that may not matter. Google may earn profit in other ways.

A 33% increase in the number of homes with broadband could be a substantial boost for Google search and YouTube, earning Google additional revenue. Improved broadband available to an entire household guarantees people will spend more time online, especially with no data caps or slow speeds. Enormously faster upload speed promotes more content sharing, which in turn means more time online with services like YouTube. A home tablet enables even more broadband usage, according to Greenfield.

As broadband speeds improve, advertisers can expose web visitors to more attractive, multimedia rich advertising not easily possible on slower speed connections. That could let Google tap into a greater share of the $60 billion TV ad market, especially for YouTube videos.

Finally, Greenfield suspects the more Google develops brand loyalty, the more successful it will be pitching consumers and businesses on services of the future.

Greenfield notes there are still bugs and features to be worked on, particularly with Google’s TV offering, but the company will have plenty of opportunities to manage those before it introduces Google Fiber elsewhere.

The implications of an expanding fiber to the home universe in the United States under Google’s price model could deliver a potent punch to incumbents like Time Warner Cable. So far, the cable company has only faced satellite dish competition for television, a technologically inferior AT&T U-verse, which will never have the capacity Time Warner has so long as the phone company still relies on any significant amount of copper wiring, and Verizon FiOS, which has disengaged from a price war with the cable company and is raising prices.

The implications of an expanding fiber to the home universe in the United States under Google’s price model could deliver a potent punch to incumbents like Time Warner Cable. So far, the cable company has only faced satellite dish competition for television, a technologically inferior AT&T U-verse, which will never have the capacity Time Warner has so long as the phone company still relies on any significant amount of copper wiring, and Verizon FiOS, which has disengaged from a price war with the cable company and is raising prices.

The writing is already on the wall, at least in Kansas City. Greenfield relays that Time Warner has been going all-out to improve its own customer service. One customer noted Time Warner Cable came to his house twice in recent weeks, without a scheduled service call, to check on the quality of his Internet speeds and to make sure the customer was happy.

In some neighborhoods, Time Warner is going door to door to interact with customers, something not done since cable operators first knocked on doors 30 years ago to introduce you to their service.

Google Fiber could ultimately force the end of one more legacy the cable industry has earned itself over the past few decades: customers loathing its service and prices.

[flv width=”640″ height=”380″]http://www.phillipdampier.com/video/Google Fiber Demo by BTIG’s Rich Greenfield and Walt Piecyk 11-23-12.flv[/flv]

BTIG’s Rich Greenfield and Walt Piecyk experience Google Fiber in Kansas City. (3 minutes)

Subscribe

Subscribe Both Time Warner Cable and Verizon don’t think you want or need gigabit fiber broadband — the kind of service now available in Kansas City from Google Fiber.

Both Time Warner Cable and Verizon don’t think you want or need gigabit fiber broadband — the kind of service now available in Kansas City from Google Fiber.