AirRunner Wireless serves a small portion of central Wisconsin from its headquarters in Marathon.

A wireless Internet provider serving central Wisconsin has banned online video streaming from its wireless Internet service, telling its customers WISPs are not designed for it. To drive home the point, the service is jumping on the bandwagon of AT&T’s mobile network 2 GB usage limit with some stringent limits of its own.

Bill Flood, owner of AirRunner Networks LLC dispatched e-mail to every one of its central Wisconsin customers informing them some are violating the company’s use policies by streaming online video on its service, which it cannot accommodate. Flood blamed companies like Netflix for forcing him to carry the costs of transporting movies and TV shows to his customers:

Hello! Over the past month we have been seeing an increasing issue on the network during peak times. From our investigation we have determined these problems stem from customers who are streaming Netflix or other ‘instant movie or movie on demand’ type services.

These types of products should not be used on the network for these reasons:

First, a wireless network uses access points, those by design do not handle continuous connections without affecting the other customers of that access point. Because the movie stays connected for a longer period of time, eventually other customers simply get less access and as a result see a severe network degradation.

Our Acceptable Use Policy over the years has grown as a result of new technology.

Not all new technology works well on every type of Internet platform. Although some customers have told me they have been using this type of service in the past, the increased usage spurred on by recent Netflix advertising, a CD for Wii devices and now by one of the satellite TV companies has brought this issue to the forefront.

These companies see the Internet as a means to save their resources and push the load onto the Internet.

Welcome to the Internet circa 2010. The days of a voice declaring “You’ve got mail” from your AOL account are long gone. Customers are demanding access to a much richer multimedia experience available online today. That demand is beginning to regularly collide with the limitations some networks have to deliver the service.

To make sure his customers understand the implications of streaming video, Flood is also introducing one of the most punitive Internet Overcharging schemes we’ve yet to encounter, starting with a monthly usage limit of 5 GB accompanied by some vicious overlimit fees:

- All non-business customers will be allotted 5 GB of total aggregate usage.

- If the customer exceeds 5GB of total aggregate usage on any given monthly billing cycle, they will be assessed an additional $30.00 to cover their bandwidth use.

- If any customer exceeds 10GB of total aggregate usage on any given monthly billing cycle, they will be assessed an additional $60.00 to cover their bandwidth use.

- If any customer exceeds 15GB of total aggregate usage on any given monthly billing cycle, they will be assessed an additional $90.00 to cover their bandwidth use.

Although these additional charges seem excessive, we are not alone on making such changes as the rest of the ISP’s [Internet service providers as well as cellular providers] are also implementing similar programs on their networks to deal with network congestion issues caused by ‘on demand’ type products. The good news is, the typical Internet customer never exceeds 5GB of aggregate usage. Only a small percentage of our customers are involved in this ‘on demand streaming activity’. Here is what can be done by the typical customer while not exceeding the 5GB threshold: Our basic residential Internet packages will offer 5GB of usage — that’s the equivalent of 500,000 basic text e-mails, 2,500 photos, 40,000 web pages, over 300 hours of Online game time, 1,250 downloaded songs, or a mixture of the above! 1,000 megabyte (MB) = 1 gigabyte (GB) We will send out a notice to everyone again when we are ready to implement these changes.

Flood’s e-mail doesn’t tell the whole story to his customers, however.

First, his imposed overlimit fees are ludicrously high. A customer using 16 GB for the month would face an overlimit penalty of $90. Considering AirRunner’s pricing, that’s a potentially enormous bill:

AirRunner offers six rate plans for residential and small business:

Second, “the rest of the ISPs” are not in fact imposing similar programs. AT&T just abandoned theirs for DSL customers in two cities. Attempts to ration broadband access typically meets resistance from consumers, if not an outright revolt. As soon as customers get a bill with a $90 overlimit penalty on it, they will revolt as well.

It is true that wireless providers do face bandwidth challenges, but that’s not always disclosed to customers until after they sign up for service. In 2010, would you sign a two year contract for a broadband service that banned online video? Of course, if Flood offers the only service in town, for all practical purposes he can dictate the terms of the service provided. But many customers have long memories and when another provider does arrive, they’ll take their business elsewhere.

Therein lies a potential problem for Flood. A considerable part of central Wisconsin has been served by Verizon North, one of the divisions Verizon has sold to Frontier Communications. Verizon dramatically cut investment in Wisconsin broadband expansion as soon as it became apparent they were leaving. Frontier Communications is betting its long-term survival on bringing at least 1-3 Mbps DSL service to areas just like central Wisconsin. It’s a safe assumption at least some parts of Flood’s service area will be challenged by Frontier DSL within the next year.

At that point, perhaps Flood will adopt a less hostile attitude towards his own customers. Some of those who departed didn’t appreciate Flood’s tone or actions and shared some of his hostile communications on the subject. Taking an adversarial stance even with former, paying customers never works well. Among the thoughts Flood has shared:

- If you don’t like his caps, move to the city;

- One customer was told his service was canceled because he just doesn’t get it — besides, Flood wrote, he can do whatever he wants;

- Customers who are caught streaming are gone;

- If you complain too much, watch out.

Third, Flood follows the discredited playbook of trying to convince customers a 5 GB usage limit for the Internet in 2010 is reasonable with generous-sounding e-mail and web page browsing allowances. Flood himself exposes the real issue — customers want to watch YouTube, Netflix, and Hulu and his network can’t handle it. Of course, his marketing materials never bother to mention any of this. Only after customers sign up, many under a two-year contract, does the truth come out (underlined emphasis ours):

In the case of ‘streaming video/movies or on demand type products or services’ recent weeks shows exactly what happens when these types of products are used. Everyone who uses ‘on demand or streaming products or services’ also knows there is an alternative which does not have an affect on any other user. We suggest the alternative as the best solution. We would appreciate everyone’s cooperation in resolving this current issue. If you are streaming movies you are making everyone mad!! Someday you may want to use the Internet and your neighbor will be streaming, then you won’t work. Wireless Internet was not designed to watch TV or movies.

If you are a ‘on demand user’ you may want to look at other options in lieu of streaming movies over the Internet. A basic resolution movie is typically 700Mb of data. So 1000Mb is equal to 1GB. So roughly 3-6 on demand or streamed movies will draw and additional charge to your account. All paying customers have the right to access their Internet connection, however any customer cannot deny any other customer access as the result of their usage. When this occurs policy is made to correct such actions. We make every effort to provide the best service we can, sometimes new Internet based programs and products do not work well on this type of network, that is not the fault of AirRunner Networks LLC and we cannot guarantee that any type of program or product will work properly or as advertised.

At least Flood was finally honest about the implications of watching online video from a provider with a low monthly usage allowance. Just watching 3-6 online movies blows right through it, even fewer if it’s an HD title.

Unfortunately for Flood and other WISPs with similar network constraints, the evolution of the Internet and its online resources will increasingly place pressure on many networks that were built for a 1990s-era Internet. As advanced video game streaming technology, online movies and television, online file backup, and other high bandwidth innovations not yet envisioned become increasingly popular, companies like AirRunner will be forced to upgrade their network or add new applications to the ban list, eventually facing obsolescence if a better provider arrives in town.

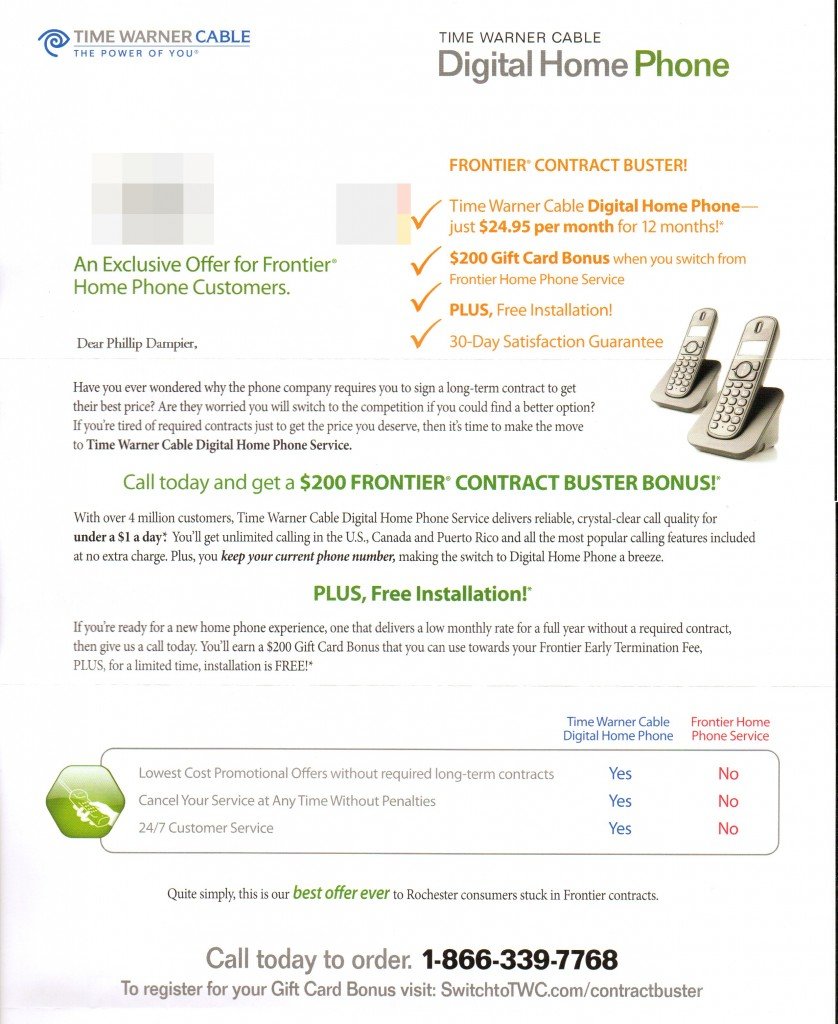

Time Warner Cable is back again with another offer to existing Frontier Communications customers trapped in multi-year service agreements. If you dump your Frontier landline overboard for Time Warner Cable’s Digital Phone service, the cable company will send you a gift card worth $200 good towards defraying your early termination fee, if any. If you don’t have such a fee, you pocket the $200. A year ago on this date the company ran a similar promotion heavily promoted in local cable television ad spots.

Time Warner Cable is back again with another offer to existing Frontier Communications customers trapped in multi-year service agreements. If you dump your Frontier landline overboard for Time Warner Cable’s Digital Phone service, the cable company will send you a gift card worth $200 good towards defraying your early termination fee, if any. If you don’t have such a fee, you pocket the $200. A year ago on this date the company ran a similar promotion heavily promoted in local cable television ad spots. Next, the offer is only good for residential customers switching from Frontier’s landline service. Limit one gift card per customer. Your final Frontier phone bill showing a disconnect request must be furnished to Time Warner Cable within 30 days to qualify. Your name and address must match on both bills. Offer is not available to customers with past due balances with Time Warner Cable, defined as any money owed in the past 30-60 days or customers who have been disconnected for non-payment in the twelve (12) month period preceding this offer. Service must be ordered by Dec. 31, 2010, and installation must occur within thirty (30) days of order date.

Next, the offer is only good for residential customers switching from Frontier’s landline service. Limit one gift card per customer. Your final Frontier phone bill showing a disconnect request must be furnished to Time Warner Cable within 30 days to qualify. Your name and address must match on both bills. Offer is not available to customers with past due balances with Time Warner Cable, defined as any money owed in the past 30-60 days or customers who have been disconnected for non-payment in the twelve (12) month period preceding this offer. Service must be ordered by Dec. 31, 2010, and installation must occur within thirty (30) days of order date.

Subscribe

Subscribe