Horse and buggy broadband in the slow lane.

One of Australia’s largest broadband suppliers has declared the country’s satellite solution for rural broadband hopelessly overloaded to the point of being “almost unusable” and has stopped selling access.

iiNet announced this week it would no longer sign up new customers of NBN Co’s rural satellite network because the service is oversold in their view.

“We could not continue to offer a service markedly below both our own and our customers’ expectations,” iiNet’s chief executive Michael Malone said in a statement. “During occasional peak periods the service was so slow as to be almost unusable. As more people are added to the network, quality will only decline further. In the absence of any action by NBN Co to increase transmission capacity, I call on the rest of the industry to respect their existing customers and also cease sale.”

NBN Co, however, claimed it still had room for an extra 5,000 customers — mostly on its spot beam targeting central and western Australia. A spokesperson for the satellite venture did admit satellite beams covering NSW, Tasmania and Queensland were near capacity. NBN Co is investigating leasing more bandwidth on board the satellite, but cost concerns may make that impossible.

The venture claims 48,000 Australians can satisfactorily share the interim satellite broadband service, which is supposed to offer 6Mbps speed. But as Australians join others around the world favoring online video and video conferencing over services like Skype, those original estimates have to be scrapped. In the evenings, some customers report speeds drop below 56kbps or the service simply freezes up and stops working altogether. In response, NBN has adopted a strict monthly usage limit of 9GB and has told customers they will likely have to wait up to two years for a capacity increase.

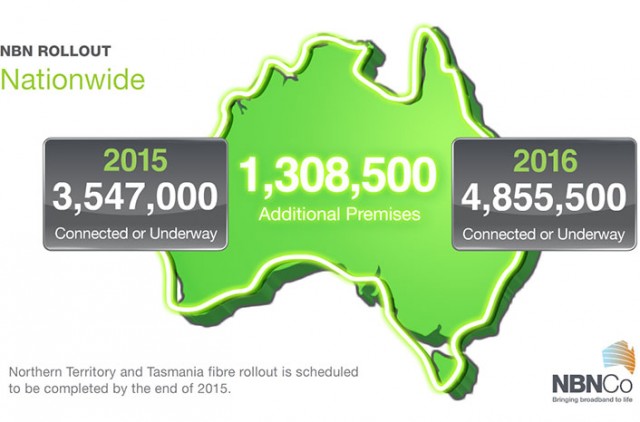

The government is planning to launch two new custom-made satellites in 2015 to ease capacity concerns. NBN Co claims the two satellites will deliver 25/5Mbps service for 200,000 rural Australians, assuming usage estimates of today’s average broadband user.

Critics contend satellite broadband is not a good long-term solution except in the most rural of sparsely populated areas. Although providing wired service may be too costly, ground-based wireless services could be the most capable technology to contend with future demand and capacity concerns.

Critics contend satellite broadband is not a good long-term solution except in the most rural of sparsely populated areas. Although providing wired service may be too costly, ground-based wireless services could be the most capable technology to contend with future demand and capacity concerns.

iiNet and other ISPs may already be headed in that direction. Some are advising customers to choose fixed wireless options from Australia’s cell phone providers, although those plans are heavily capped and very expensive.

Broadband availability has a direct impact on property sales in rural Australia. A couple that purchased a home in Mount Bruno, near Wangaratta in north-east Victoria discovered only after closing the deal that NBN Co would not sell them satellite broadband because the spot beam targeting Victoria was full.

The couple needs Internet access for work and their telephone line is unsuitable for ADSL. Mobile broadband in the Mount Bruno area is sub-par and expensive as well. As a result, the couple will have to rent office space in Glenrowan or Wangaratta that qualifies for wired broadband until at least 2015, when the next NBN satellite is launched.

iiNet regrets having to turn customers away.

“At its peak, we had 500 customers signing up every week for our NBN satellite services. There is clearly a significant demand for higher quality broadband in remote Australia, and we’re absolutely gutted that we’ve had to withdraw this crucial service from sale,” said Malone.

Subscribe

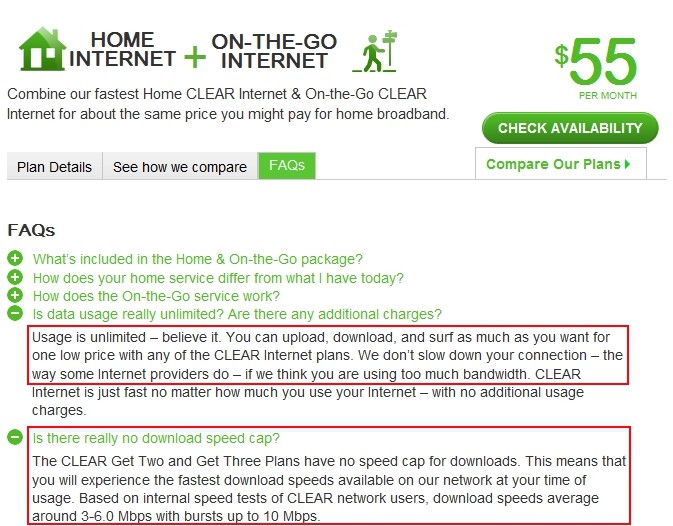

Subscribe An independent cell phone provider in Idaho has found a unique niche to innovate beyond offering traditional cell phone service by launching unlimited 20Mbps home broadband Internet access over its wireless 4G LTE network.

An independent cell phone provider in Idaho has found a unique niche to innovate beyond offering traditional cell phone service by launching unlimited 20Mbps home broadband Internet access over its wireless 4G LTE network. Syringa’s fixed wireless broadband puts the company in a stronger position for a Wireless Internet Service Provider (WISP), because it is able to also market traditional cell phone service for its rural customer base. Syringa still sells unlimited smartphone data plans and has a roaming agreement with a major national carrier for cell phone users traveling outside of Syringa’s home service area.

Syringa’s fixed wireless broadband puts the company in a stronger position for a Wireless Internet Service Provider (WISP), because it is able to also market traditional cell phone service for its rural customer base. Syringa still sells unlimited smartphone data plans and has a roaming agreement with a major national carrier for cell phone users traveling outside of Syringa’s home service area.

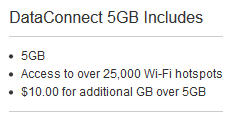

AT&T’s DataConnect plan, suitable for fixed wireless home use,

AT&T’s DataConnect plan, suitable for fixed wireless home use,  Attention broadband planners: Although broadband deployment strategies differ around the world, a new report decisively concludes there is only one network technology proven to meet the demands of broadband users both today and tomorrow: a national fiber optic network.

Attention broadband planners: Although broadband deployment strategies differ around the world, a new report decisively concludes there is only one network technology proven to meet the demands of broadband users both today and tomorrow: a national fiber optic network.