Verizon Communications today announced its FiOS Internet customers will be getting free speed upgrades that match upload and download speeds — the only provider in FiOS markets to offer speed equality.

Verizon Communications today announced its FiOS Internet customers will be getting free speed upgrades that match upload and download speeds — the only provider in FiOS markets to offer speed equality.

Verizon will start transitioning qualifying current residential customers to higher upload speeds for free throughout the coming months, but we can help get you higher on the upgrade list if you keep reading. Later this year, existing and new FiOS small-business customers also will receive this upgrade.

“Faster upload speeds means better sharing experiences,” said Mike Ritter, Verizon’s chief marketing officer for consumer and mass business. “All Internet sharing – whether videos, large photo files or gaming – starts with uploading. FiOS all-fiber-optic technology offers a unique opportunity to enhance our customers’ Internet experience on a mass scale by increasing our upload speeds to equal to our industry-leading download speeds. As the Internet of Things becomes a reality, equal download and upload speeds will become essential.”

Verizon’s upgrade also lets the company point out a shortcoming of most of its cable competitors, upstream speeds lag far behind downstream speeds. Many cable operators still only offer no better than 5Mbps upload speeds, even while offering 50, 100, or 150Mbps for downloads.

Verizon says it noticed upload activity has been on the increase for some time, and with the upstream speed upgrades, it expects double the upload activity it sees today by 2016.

“Verizon’s decision to give every FiOS Internet customer upload speeds that mirror its industry-leading download speeds is a step forward for U.S. digital consumers – and unique among the major U.S. broadband Internet providers,” said Matt Davis, program director of consumer multiplay and broadband services research for IDC. “Because the upgrade is free, it delivers tremendous value to FiOS subscribers and strongly positions Verizon to meet the growing demand for upstream Internet speed.”

Verizon FiOS also lacks usage caps or consumption billing, giving customers a worry-free Internet experience that does not carry the risk of surprise charges on a future bill.

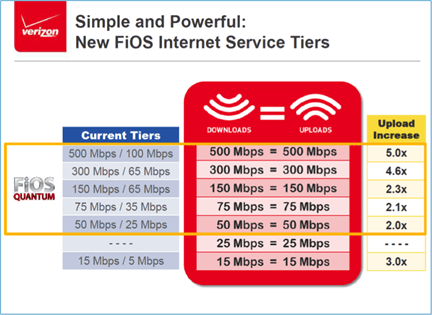

Here are Verizon’s new speed tiers:

- 15/5Mbps is now 15/15Mbps

- 25/5Mbps is now 25/25Mbps

- 50/25Mbps is now 50/50Mbps

- 75/35Mbps is now 75/75Mbps

- 150/65Mbps is now 150/150Mbps

- 300/65Mbps is now 300/300Mbps

- 500/100Mbps is now 500/500Mbps

The free speed upgrades will begin with customers enrolled in Verizon’s My Rewards+ program. You can get on the upgrade list today by enrolling in the rewards program on the My Rewards+ website. My Rewards+ is Verizon’s free loyalty program that rewards customers for paying a bill online, renting or buying videos on demand, or in recognition of a birthday, service anniversary or other event. My Rewards+ members can use earned points for Visa Prepaid Cards or other gift cards good at participating merchants such as Starbucks Coffee, L.L. Bean, Panera Bread, Target, Amazon, Dunkin’ Donuts, Staples and others. Customers can also choose to donate their rewards to a charity of their choice.

Verizon is running several promotions (until 9/20/2014) for new customers who want in on the new FiOS speeds. The most popular Triple Play promotion is their 25/25Mbps Internet service, which also includes Preferred HD TV and nationwide home phone service (equipment rental required). This includes a two-year price guarantee for $89.99 per month when ordered online and $99.99 per month otherwise (not including equipment charges, taxes and fees). In addition, new customers can receive a free LG G Pad 8.3 LTE or up to $200 off any other tablet available from Verizon Wireless if they are willing to take out a new, two-year service agreement. This part of the promotion is less attractive to us because the offer requires the tablet be activated on the Verizon Wireless network, which means ongoing charges.

Subscribe

Subscribe

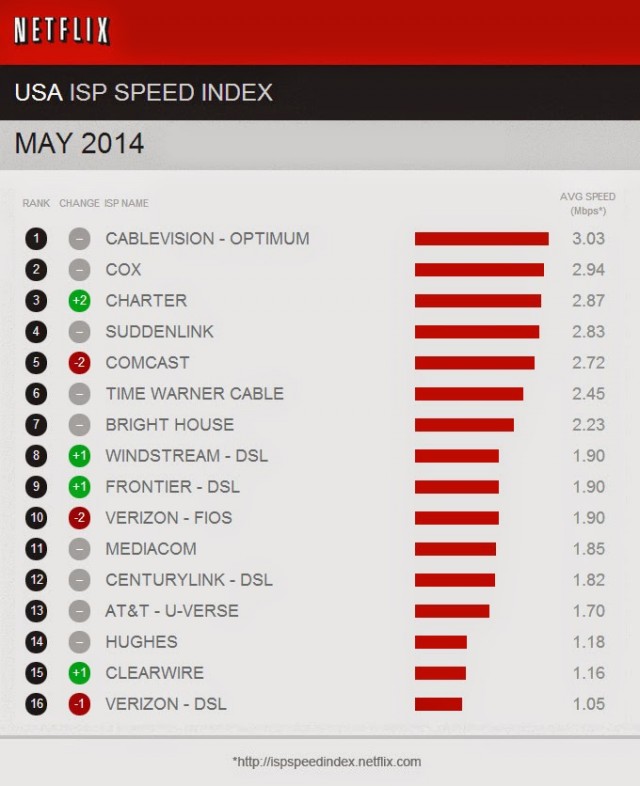

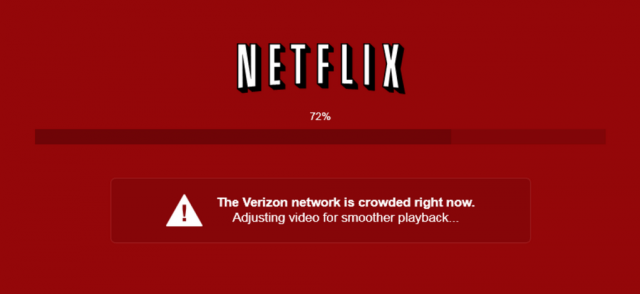

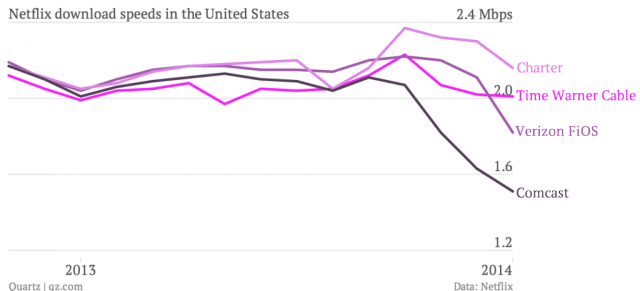

The companies with the biggest drops in Netflix performance are the same ones strongly advocating special paid “fast lanes” on the Internet for preferred traffic to resolve exactly these kinds of performance problems.

The companies with the biggest drops in Netflix performance are the same ones strongly advocating special paid “fast lanes” on the Internet for preferred traffic to resolve exactly these kinds of performance problems.