Frontier’s “High Speed” Fiber Fantasies

Frontier Communications has jumped on the gigabit broadband promises bandwagon with an announcement to investors the company will make available 1,000Mbps broadband speeds available later this year to a small handful of customers.

“I want to note that nearly 10% of our households are served through a fiber to the home architecture,” said Frontier’s chief operating officer Dan McCarthy. “Over the next several quarters we will introduce expanded speed offerings in select markets including 50-100Mbps services. Some residential areas will also be able to purchase up to 1Gbps broadband service. We are excited to bring these new products to market and look forward to making these choices available to our customers.”

Most of Frontier’s fiber customers are part of the FiOS fiber to the home infrastructure Frontier adopted from Verizon in Fort Wayne, Ind., and in parts of Oregon and Washington. The rest of Frontier customers accessing service over fiber are in a few new housing developments and some multi-dwelling units. The majority of customers continue to be served by copper-based facilities.

Despite the speed challenges imposed by distance-sensitive DSL over copper networks, Frontier customers crave faster speeds and more than one-third of Frontier’s sales in the last quarter have come from speed upgrades. As of this month, 54% of Frontier households can receive 20Mbps or greater speed, 75% can get 12Mbps and 83% can get 6Mbps. Here at Stop the Cap! headquarters, little has changed since 2009, with maximum available Frontier DSL speeds in this Rochester, N.Y. suburban neighborhood still maxing out at a less-impressive 3.1Mbps.

Frontier’s plans for the next three months include a growing number of partnerships with third-party equipment manufacturers and software companies, as well as integrating former AT&T service areas in Connecticut into the Frontier family:

Sale of AT&T Connecticut Assets to Frontier Communications Wins Approval from State Attorney General

Connecticut’s Attorney General has announced a deal with Frontier Communications to approve its acquisition of AT&T’s wired assets in the state. The office asked for and got a three-year rate freeze on basic residential telephone rates and a commitment to keep selling standalone broadband at or below Frontier’s current rates. Low-income military veterans would receive basic broadband service for $19.99 per month, a substantial discount off the regular price of $34.99. The first month of service is free.

Connecticut’s Attorney General has announced a deal with Frontier Communications to approve its acquisition of AT&T’s wired assets in the state. The office asked for and got a three-year rate freeze on basic residential telephone rates and a commitment to keep selling standalone broadband at or below Frontier’s current rates. Low-income military veterans would receive basic broadband service for $19.99 per month, a substantial discount off the regular price of $34.99. The first month of service is free.

Frontier will make $500,000 in donations annually to various Connecticut charities, give $512,500 to the University of Connecticut basketball teams, and commit $75,000 to sponsor the Connecticut Open tennis tournament in New Haven.

The phone company has also committed to invest $64 million on network upgrades between 2015-2017, primarily to expand DSL broadband and U-verse service. The company also must undertake to inspect the wireline network it is buying from AT&T and replace deteriorating infrastructure including lines and telephone poles as needed.

Frontier announced it was buying AT&T’s wired assets in December for $2 billion. AT&T will continue to own and operate its wireless network assets in the state. Connecticut was home to AT&T’s only significant landline presence in the northeast. The Southern New England Telephone Company of Connecticut was originally bought by SBC Communications for $4.4 billion in 1998. After SBC purchased AT&T, the telephone company changed its name to AT&T Connecticut. Its primary competitor is Cablevision Industries, which also serves eastern New York and parts of New Jersey. AT&T has aggressively deployed its U-verse platform in Connecticut. Frontier will continue to run and expand U-verse in the state.

Frontier Services and Partnerships Expand

- Customers may have already received marketing for Frontier’s Emergency Phone, a $4.99/mo landline that can only reach 911. Frontier CEO Maggie Wilderotter told investors that global climate change has made weather patterns more unpredictable, making the reliability and resiliency of traditional landlines a “true life line” in the event of an emergency knocking out Voice over IP lines or cell phone service;

- Frontier Texting, powered by Zipwhip, allows customers send and receive text messages using their existing landline numbers. The service appears most popular with business customers, with more 800 signed up so far;

- Frontier third-party technical and security support offers a large range of computer security, home automation, and support services for both hardware and software. Frontier added the Nest thermostat during this quarter, as well as tech support for Intuit QuickBooks and Dropcam remote video monitoring.

Wilderotter Flip-Flops on Gigabit Broadband: You Don’t Need a Gig

Less than three weeks ago, Wilderotter told the Pacific Northwest readers of The Oregonian they didn’t need gigabit broadband speeds:

“Today it’s about the hype, because Google has hyped the gig,” said Wilderotter, in Portland this week for a meeting of her company’s board. She said Google is pitching something that’s beyond the capacity of many devices, with very few services that could take advantage of such speeds, and confusing customers in the process.

“We have to take the mystery and the technology out of the experience for the user because it’s a bit disrespectful to speak a language our customers don’t understand,” said Wilderotter, in Portland this week for a meeting of her company’s board.

Frontier’s pitch: Better prices for more modest speeds. For most people, Wilderotter said, 10 to 12 megabits per second will be perfectly adequate for at least the next couple years. She said Frontier is upgrading its networks in rural communities where it doesn’t offer FiOS to meet that benchmark.

Now that Frontier proposes to offer those speeds, company officials are excited they will be available. Customers shouldn’t be. Most won’t have access for some time to come, if ever.

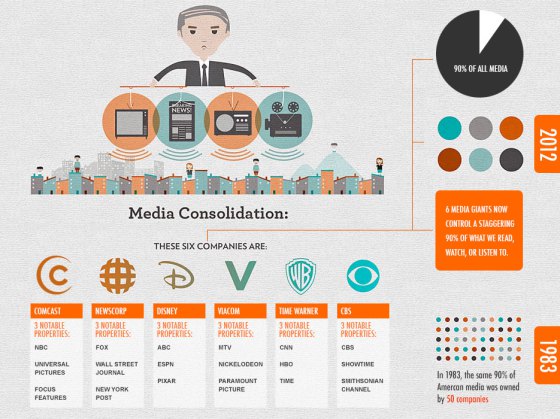

Staff at the New York regulator overseeing the state’s telecommunications companies have determined that some Time Warner Cable customers will see their largest rate increase in New York history — more than double their current rate — if Comcast is successful in its bid to acquire Time Warner Cable.

Staff at the New York regulator overseeing the state’s telecommunications companies have determined that some Time Warner Cable customers will see their largest rate increase in New York history — more than double their current rate — if Comcast is successful in its bid to acquire Time Warner Cable.

Subscribe

Subscribe

Connecticut’s Attorney General has announced a deal with Frontier Communications to approve its acquisition of AT&T’s wired assets in the state. The office asked for and got a three-year rate freeze on basic residential telephone rates and a commitment to keep selling standalone broadband at or below Frontier’s current rates. Low-income military veterans would receive basic broadband service for $19.99 per month, a substantial discount off the regular price of $34.99. The first month of service is free.

Connecticut’s Attorney General has announced a deal with Frontier Communications to approve its acquisition of AT&T’s wired assets in the state. The office asked for and got a three-year rate freeze on basic residential telephone rates and a commitment to keep selling standalone broadband at or below Frontier’s current rates. Low-income military veterans would receive basic broadband service for $19.99 per month, a substantial discount off the regular price of $34.99. The first month of service is free.