Rumors abound of the imminent death of Redbox Instant.

Comcast’s Streampix and Verizon’s Redbox Instant have not lived up to the expectations of their respective owners and the two Netflix-like services have quietly been partly decommissioned or have stopped accepting new customers altogether.

Loathe to admit the services are roadkill on the TV Everywhere highway, Comcast claims it is simply downsizing its Streampix service and Verizon issued a terse “no comment” to GigaOm’s Janko Roettgers in response to rumors Redbox Instant would begin shutting down for existing customers on Oct. 1.

But truth be told, neither service made a competitive dent in Netflix, either because they were poorly marketed or found no audience. Comcast denies it is even trying to compete against Netflix. But it did admit in a regulatory filing Streampix found very few takers at its $4.99/month asking price.

“Though Comcast sought to create excitement around Streampix by offering the online version through a unique online site and app, and offered Streampix to a small number of XFINITY broadband-only customers in one region, these attracted minimal interest,” Comcast wrote.

Streampix will be a shadow of its former self, continuing on mostly in name-only.

“Going forward, Streampix will simply be part of the XFINITY TV app and website like other video-on-demand offerings,” said Comcast in the filing. The Google Play and Apple App stores seem to confirm as much when customers looking for the Streampix app instead find: “Streampix has moved to XFINITY TV Go. Comcast customers with Streampix should download XFINITY TV Go to view Streampix content.”

Comcast launched Streampix in February 2012 as a streaming-only offering, but added download capability in late 2013.

When customers balked at paying Comcast another $5 a month for the streaming add-on, Comcast began giving it away to customers who subscribed to multiple premium channels or high value triple play packages as part of ongoing promotions.

Comcast’s XFINITY Streampix admittedly didn’t draw much interest from customers.

Critics of Comcast’s merger with Time Warner Cable suspect Comcast’s real intention was to launch the service to markets outside of its service area to compete for premium over-the-top video customers without cannibalizing its cable television revenue. With the merger under scrutiny at the state and federal levels, some suspect Streampix’s public demotion is a maneuver to protect the deal from a potential political liability over Comcast’s growing dominance in the cable and broadband business.

The troubles with Verizon’s Redbox Instant service go well beyond the realm of public policy debates. Since launching in mid-2013, the service has attracted only minor interest from the public. Critics contend a marketing deal with Redbox was wrong from the start. Redbox’s success comes from renting DVDs from kiosks, not competing with Netflix. Verizon hoped a promotional tie-in offering online viewers up to four free DVD rentals a month from Redbox kiosks would bring the two services closer together. Redbox Instant also rented current movie titles on a pay-per-view basis, and hoped it could convince kiosk users disappointed with out of stock DVDs or otherwise poor pickings to go online and stream a pay-per-view video instead.

But customers would have to be psychic looking for something to stream – Redbox does not publish online movie availability on its kiosk-service website. Unsurprisingly, kiosk users have stayed loyal to renting movies through the kiosk and online viewers usually won’t bother renting a DVD from a kiosk, even with a voucher.

Free trials of Redbox Instant service brought an underwhelming number of customers converting to paid subscriptions. That might be attributed to the heavy overlap of titles available from Redbox Instant and competitors Netflix and Amazon.com, making three services redundant for many. Although Redbox’s parent has invested $70 million in the service, it is dwarfed by the massive content acquisition budgets available to its larger competitors.

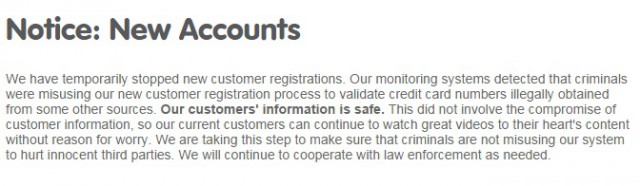

It would take a larger subscriber base to change that for the better, but Redbox Instant seems intent on sabotaging its success, still refusing to enroll new customers three months after a security breach. It seems Redbox Instant’s website was an excellent resource for credit card thieves to verify if stolen card numbers were still valid. Current customers are still able to use the service, but reportedly cannot update or change their credit card information, meaning they will lose service if their credit card expires or the credit card number changes.

A notice on Redbox Instant’s website prevents new users from enrolling.

Company executives have told investors they are not happy with Redbox Instant’s subscriber numbers. Not allowing new customers to sign up while gradually losing old ones because of an expired credit card could go a long way to explain this. Redbox’s parent company previously warned it has the right to pull out of the venture if the numbers don’t improve, and they won’t if the website remains locked down.

When Roettgers asked Redbox and Verizon to comment on a reddit rumor that the service was to close down on Oct. 1, the only reply was “no comment.” Roettgers believes that is telling, because no company would want such a false rumor to spread unchallenged. With Oct. 1 less than 24-hours away, we won’t have long to wait to see what happens next.

Roettgers would not be surprised to see Redbox Instant downsize itself with an end to its subscription video plan and move forward exclusively as a paid, video-on-demand service. It already powers Verizon’s On Demand video store. Having a traditional television partner like Verizon FiOS TV could help Redbox survive in an already crowded marketplace of online, on-demand video stores like iTunes, Google Play, Vudu, Amazon, and others.

In a larger context, the industry’s belief in “if we build it, they will come,” appears to be untrue, especially cable and telephone company efforts developing their TV Everywhere platforms. Content and viewing limitations that confine online viewing largely to the home, a barrage of online video advertising, subscription fees, and the lack of quality content have all hurt efforts to deliver a good user experience that can promote customer loyalty. Nothing now or on the horizon appears to be anything like a Netflix-killer app.

[flv]http://www.phillipdampier.com/video/Bloomberg Bibb Says Comcast Has Little Confidence in Streampix 2-21-12.mp4[/flv]

Two years ago, Porter Bibb, managing partner at Mediatech Capital Partners, panned the then-new XFINITY Streampix service for streaming the same television shows and movies customers can already see on Netflix and other services. From Bloomberg Television’s “Bloomberg West,” originally aired Feb. 21, 2012. (4:30)

Subscribe

Subscribe Frontier Communications plans to leverage their existing fiber-copper infrastructure to

Frontier Communications plans to leverage their existing fiber-copper infrastructure to

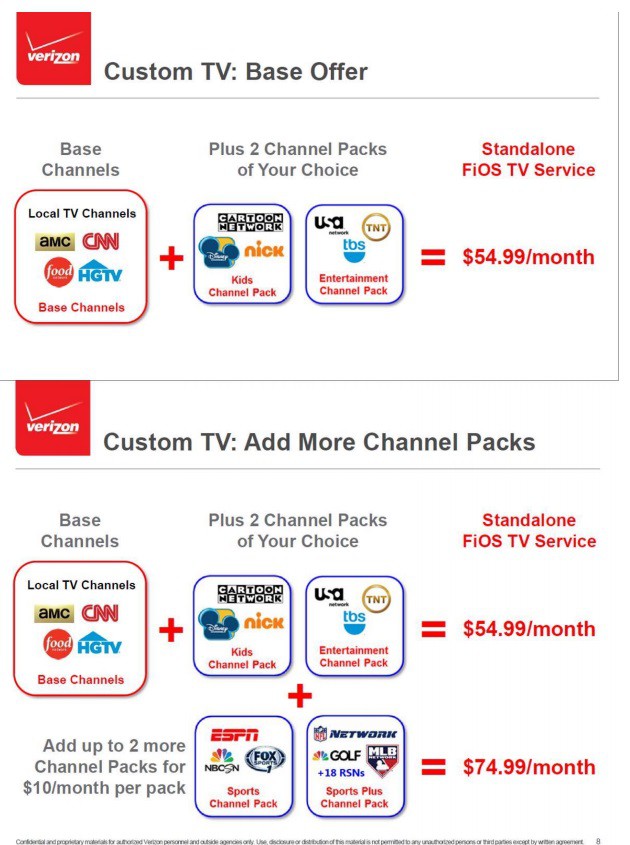

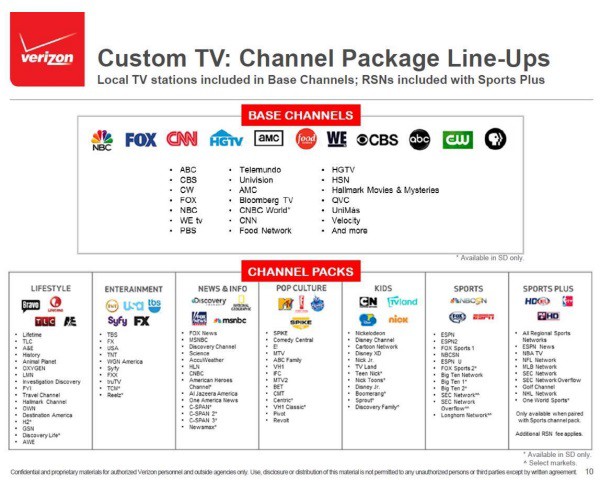

ESPN today filed a lawsuit against Verizon Communications, claiming FiOS TV’s new slimmed-down television packages violate ESPN’s contract provisions that forbid placing the network in an optional add-on “sports tier.”

ESPN today filed a lawsuit against Verizon Communications, claiming FiOS TV’s new slimmed-down television packages violate ESPN’s contract provisions that forbid placing the network in an optional add-on “sports tier.”

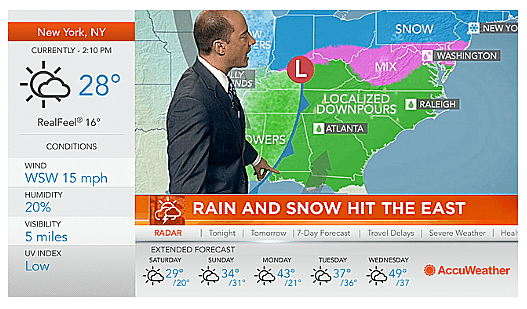

The latest contract dispute over cable programming between The Weather Channel and Verizon FiOS has deprived Verizon customers of The Weather Channel, but more than a few viewers who don’t live for storm porn don’t seem to notice or care.

The latest contract dispute over cable programming between The Weather Channel and Verizon FiOS has deprived Verizon customers of The Weather Channel, but more than a few viewers who don’t live for storm porn don’t seem to notice or care. AccuWeather also called out The Weather Channel for preempting the weather for “Fat Guys in the Woods” and “Prospectors” — two Weather Channel reality shows that may encounter bad weather, but don’t report on it.

AccuWeather also called out The Weather Channel for preempting the weather for “Fat Guys in the Woods” and “Prospectors” — two Weather Channel reality shows that may encounter bad weather, but don’t report on it.