More drive-by reporting on Comcast’s usage caps.

When the media covers Internet Overcharging schemes like usage caps and consumption billing, it is often much easier to take the provider’s word for it instead of actually investigating whether subscribers actually need their Internet usage limited.

Comcast’s planned reintroduction of its usage caps on South Carolina customers begins Friday. Instead of the now-retired 250GB limit, Comcast is graciously throwing another 50GB of usage allowance to customers, five years after defining 250GB as more than generous.

The Post & Courier never bothered to investigate if Comcast’s new 300GB usage cap was warranted or if Charleston-area customers wanted it. It was so much easier to just print Comcast’s point of view and throw in a quote or two from an industry analyst.

In fact, the reporter even tried to suggest the Internet Overcharging scheme was an improvement for customers.

The newspaper reported Comcast was the first large Internet provider in the region to allow customers to pay even more for broadband service by extending their allowance in 50GB increments at $10 a pop. (Actually, AT&T beat Comcast to the bank on that idea, but has avoided dropping that hammer on customers who already have to be persuaded to switch to AT&T U-verse broadband that tops out at around 24Mbps for most customers.)

Since 2008, the company’s monthly limit has been capped at 250 GB per household. When customers exceeded that threshold, Comcast didn’t have a firm mechanism for bringing them back in line, other than to issue warnings or threaten to cut off service.

“People didn’t like that static cap. They felt that if they wanted to extend their usage, then they should be allowed to do that,” said Charlie Douglas, a senior director with Comcast.

Charleston is the latest in a series of trial markets the cable giant has used to test the new Internet usage policy in the past year. As with any test period, the company can modify or discontinue the plan at any time.

During the trial period in Charleston, customers will get an extra 50 GB of monthly data than they’re used to having. If they exceed 300 GB, they can pay for more.

“300 GB is well beyond what any typical household is ever going to consume in a month,” Douglas said. “In all of the other trial markets with this (limit), it really doesn’t impact the overwhelming super-majority of customers.”

The average Internet user with Comcast service uses about 16 to 18 GB of data per month, Douglas said.

Customers who use less than five GB per month will start seeing a $5 discount on their bills.

“We think this approach is fair because we’re giving consumers who want to use more data a way to do so, and for consumers who use less, they can pay less,” Douglas said.

Data caps are designed to stop content piracy?

The Charleston reporter asserts, without any evidence, “data-capping is a trend many Internet service providers are expected to follow in the next few years as the industry aims to reduce network congestion and to find safeguards against online piracy.”

Suggesting data caps are about piracy immediately rings alarm bells. Comcast and other Internet Service Providers fought long and hard against being held accountable for their customers’ actions. The industry wants nothing to do with monitoring online activities lest the government hold them accountable for not actively stopping criminal activity.

“It’s not about piracy, per se,” said Douglas. “We don’t look at what people are doing. The purpose is really a matter of fairness. If people are using a disproportionate amount of data, then they should pay more.”

Comcast’s concern for fairness and disproportionate behavior does not extend to the rapacious pricing and enormous profit it earns selling broadband, flat rate or not.

MIT Technology Review’s David Talbot found “Time Warner Cable and Comcast are already making a 97 percent margin on their ‘almost comically profitable’ Internet services.” That figure was repeated by Craig Moffett, one of the most enthusiastic, well-respected cable industry analysts. That percentage refers to “gross margin,” which is effectively gravy on largely paid off cable plant/infrastructure that last saw a major wholesale upgrade in the 1990s to accommodate the advent of digital cable television and the 500-channel universe. Broadband was introduced in the late 1990s as a cheap-to-deploy but highly profitable, unregulated ancillary service.

How things have changed.

Just follow the money….

Customers used to being gouged for cable television are now willing to say goodbye to Comcast’s television package in growing numbers. Today’s must-have service is broadband and Comcast has a high-priced plan for you! But earning up to 97 percent profit from $50+ broadband isn’t enough.

A 300GB limit isn’t designed to control congestion either. In fact, had she investigated that claim, she would have discovered the cable industry itself disavowed that notion earlier this year.

In fact, it’s all about the money.

Michael Powell, the head of the cable industry’s top lobbying group admitted the theory that data caps are designed to control network congestion was wrong.

“Our principal purpose is how to fairly monetize a high fixed cost,” said Powell.

Powell mentioned costs like digging up streets, laying cable and operational expenses. Except the cable industry long ago stopped aggressive buildouts and now maintains a tight Return On Investment formula that keeps cable broadband out of rural areas indefinitely. Operational expenses for broadband have also declined, despite increases in traffic and the number of customers subscribing.

[flv]http://www.phillipdampier.com/video/CNBC Internet v. Cable 8-20-10.flv[/flv]

Don’t take our word for it. Consider the views of Suddenlink Cable CEO Jerry Kent, interviewed in 2010 on CNBC. (8 minutes)

“I think one of the things people don’t realize [relates to] the question of capital intensity and having to keep spending to keep up with capacity,” said Suddenlink CEO Jerry Kent. “Those days are basically over, and you are seeing significant free cash flow generated from the cable operators as our capital expenditures continue to come down.”

Unfortunately, Charleston residents don’t have the benefit of reporting that takes a skeptical view of a company press release and the spokesperson readily willing to underline it.

If Comcast seeks to be the arbiter of ‘fairness,’ then one must ask what concept of fairness allows for a usage cap almost no customers want for a service already grossly overpriced.

Cord-cutting is a real, measurable phenomena and is especially common among those under 30 who don’t care about traditional cable television service.

Cord-cutting is a real, measurable phenomena and is especially common among those under 30 who don’t care about traditional cable television service.

Subscribe

Subscribe

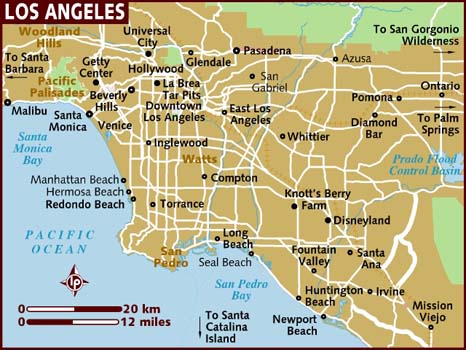

The city can offer some incentives to attract an outsider, such as promising a lucrative contract to manage the city government’s telecom needs. It can also ease bureaucratic red tape that often stalls big city infrastructure projects. But Los Angeles is not exactly prime territory for a fiber build. Its notorious sprawling boundaries encompass 469 square miles, with many residents and businesses in free-standing buildings, not cheaper to serve multi-dwelling units.

The city can offer some incentives to attract an outsider, such as promising a lucrative contract to manage the city government’s telecom needs. It can also ease bureaucratic red tape that often stalls big city infrastructure projects. But Los Angeles is not exactly prime territory for a fiber build. Its notorious sprawling boundaries encompass 469 square miles, with many residents and businesses in free-standing buildings, not cheaper to serve multi-dwelling units.