AT&T customers in Carbon Hill, Ala. received an unwelcome surprise in their mailbox recently when AT&T informed them they will be part of an experiment ending traditional landline service in favor of a Voice over IP or wireless alternative.

AT&T customers in Carbon Hill, Ala. received an unwelcome surprise in their mailbox recently when AT&T informed them they will be part of an experiment ending traditional landline service in favor of a Voice over IP or wireless alternative.

Affected customers are involuntary participants in what AT&T calls an “exciting opportunity for our customers and for our company,” but many residents want no part of it.

The Wall Street Journal reports Carbon Hill city clerk Janice Pendley says some people in the former mining town are not pleased.

“Some of them like their landline, and they like it just the way it is,” she says.

AT&T’s experiment will force new and existing customers to switch to its more-expensive U-verse broadband platform, use a mobile phone, or a home landline replacement that works over AT&T’s cellular network. The FCC has granted AT&T permission to impose its experimental plan to end traditional landline service in two communities where regulatory protections for landline customers are weak to non-existent — Alabama’s Carbon Hill and Delray Beach, Fla.

Carbon Hill is a small town of around 880 households in extreme western Walker County. It is the kind of rural town AT&T would likely never consider for a U-verse upgrade. AT&T embarked on a second major push to extend U-verse into more communities last year, but also indicated it would strongly advocate for a wireless replacement for its landline network in the rest of its service areas. Because Carbon Hill is an experiment, AT&T will offer U-verse to at least part of the community regardless of the usual financial Return on Investment requirements AT&T usually imposes on its U-verse expansion efforts.

AT&T is pushing forward despite the fact it has no idea how it will offer service to at least 4% of isolated Carbon Hill residents not scheduled to be provided U-verse and not within an AT&T wireless coverage area. There are also no guarantees customers will be able to correctly reach 911, although AT&T says the technology “supports 911 functionality.” Serious questions among consumer advocates remain about whether the replacement technology will support burglar alarms, pacemakers and even systems used by air-traffic controllers.

AT&T is pushing forward despite the fact it has no idea how it will offer service to at least 4% of isolated Carbon Hill residents not scheduled to be provided U-verse and not within an AT&T wireless coverage area. There are also no guarantees customers will be able to correctly reach 911, although AT&T says the technology “supports 911 functionality.” Serious questions among consumer advocates remain about whether the replacement technology will support burglar alarms, pacemakers and even systems used by air-traffic controllers.

The difficulties service Carbon Hill relate to its rural makeup and income profile. In Delray Beach, it is all about customer demographics. Half of the city is home to residents over 65 years old — the group most likely to prefer their existing landline service. Many are likely to be unhappy about a transition to new technology that will not work in the event of power interruptions, will require the installation of new equipment, or will be tied to a wireless platform that some say reduces the intelligibility of telephone conversations and often introduces audio artifacts like echo, background noise, and dropouts.

In both cities, customers only offered wireless-based service will no longer have access to DSL or wired broadband service of any kind. The wireless alternative from AT&T comes at a high cost and a low usage allowance.

The benefits to AT&T are unquestionable, however. The company will win almost universal deregulation as a Voice over IP or wireless telephone provider. Legacy regulations on customer service requirements, pricing, and obligations to provide affordable phone service to any customer that requests it are swept away by the new technologies. Competitors are also worried AT&T will be able to walk away from regulations governing open and fair access to AT&T’s network.

The Wall Street Journal reports:

The Wall Street Journal reports:

The all-Internet protocol “transition holds many promises for consumers, but losing access to affordable voice and broadband services cannot be part of that bargain,” wrote Angie Kronenberg, general counsel of Comptel, in a letter to the FCC last month on behalf of the small-carrier trade group, several companies and public-interest groups.

AARP said it believes AT&T’s plan has “numerous problems.” The technology might not be reliable enough or fail when calling 911 in an emergency, the advocacy group for seniors told regulators in its comment letter. The FCC is reviewing hundreds of comments received in response to AT&T’s request.

EarthLink piggybacks on the “incumbents as little as economically possible” and has laid nearly 30,000 miles of fiber-optic cables throughout the U.S. to help it reach more than a million customers, says Rolla Huff, a former EarthLink chief executive. Still, the company needs access to the connections built by AT&T and Verizon into buildings.

Telecom carriers such as Windstream in Little Rock, Ark., and sellers of broadband data services like EarthLink and XO Communications LLC, of Herndon, Va., have had the right to buy last-mile access at regulated prices since the last major overhaul of federal telecom laws in 1996.

If AT&T ends its traditional network, those competing service providers will have to negotiate with AT&T for access at whatever price AT&T elects to charge.

If AT&T ends its traditional network, those competing service providers will have to negotiate with AT&T for access at whatever price AT&T elects to charge.

A preview of what is likely to happen has already been experienced by TW Telecom, an independent firm selling phone and Internet services to businesses over more than 30,000 miles of fiber lines. But that fiber network means nothing if a customer’s last mile connection is handled by a local phone company no longer subject to regulated pricing and access rules.

In Tampa, where Verizon has deployed FiOS as an unregulated replacement for its older, regulated copper-based network, TW Telecom learned first hand what this could ultimately mean:

Rochester Telephone Corporation was born in 1921 after a merger between the Rochester Telephonic Exchange, a branch of the Bell Company of Buffalo and locally owned independent Rochester Telephone Company, which was not allowed to use Bell’s long distance network.

TW Telecom approached Verizon in 2012 to seek last-mile access to a Tampa, Fla., building being converted into a bank from a restaurant. Verizon had installed only FiOS at the building.

Verizon said no, telling TW Telecom to build its own connection or pay Verizon thousands of dollars to do the job. TW Telecom declined to pay and lost the customer’s business.

“When it happens, it’s devastating,” says Kristie Ince, who oversees regulatory policy at TW Telecom. Similar snarls have cost the company at least six customers since then. Other carriers say they have had similar clashes.

In Illinois, Sprint’s business phone network has run into a barricade manned by AT&T. Sprint needs AT&T to interconnect calls placed on Sprint’s network intended for AT&T’s customers. The two companies cannot agree on an asking price under the deregulation scheme so Sprint converts its Voice over IP calls to older technology still subject to regulation just so calls will successfully reach AT&T’s customers. AT&T promptly converts those calls back to Voice over IP technology as it completes them.

AT&T said it has “no duty” to connect its Internet protocol traffic with Sprint’s.

If the FCC keeps IP-based traffic deregulated, if and when the old landline network is decommissioned, AT&T will have the last word on access, potentially putting competitors out of business.

Our great-great grandparents experienced similar problems in the early days of telephone service, when high rates from the local Bell telephone subsidiary provoked local competition. But Bell companies routinely refused to handle calls placed on competitors’ networks, forcing customers to maintain a telephone line with both companies to reach every subscriber. Additionally, only Bell-owned providers had access to the long distance network – a competitive disadvantage to competing startups.

Regulatory changes, a handful of mergers and the eventual establishment of the well-regulated Bell System eventually solved problems which threaten to return if AT&T has its way.

Subscribe

Subscribe

Cincinnati Bell

Cincinnati Bell

“Our business has been in decline for five or six years,” Torbeck

“Our business has been in decline for five or six years,” Torbeck  Last year, Cincinnati Bell had passed 184,000 homes with fiber optics – a 28 percent market share. But only 52,000 homes subscribed to Fioptics — Cincinnati Bell’s fiber brand. Time Warner Cable had managed to keep many of its wavering 446,000 customers loyal to the cable company with aggressive discounting and customer retention offers. But now that many of those discounts have since expired, Torbeck wants to reach 650,000-700,000 homes in its service area covering southwestern Ohio and northern Kentucky and convince 50% of those customers to switch to fiber optics.

Last year, Cincinnati Bell had passed 184,000 homes with fiber optics – a 28 percent market share. But only 52,000 homes subscribed to Fioptics — Cincinnati Bell’s fiber brand. Time Warner Cable had managed to keep many of its wavering 446,000 customers loyal to the cable company with aggressive discounting and customer retention offers. But now that many of those discounts have since expired, Torbeck wants to reach 650,000-700,000 homes in its service area covering southwestern Ohio and northern Kentucky and convince 50% of those customers to switch to fiber optics. The company’s unique position as the last remaining independent phone company that still bears the name of the telephone’s inventor may make the company a target for a takeover before Torbeck’s vision is realized. One analyst thinks Cincinnati Bell would be a natural target for Google, which has a recent record of repurposing fiber networks built by other companies as a cost-saving measure to further deploy Google Fiber.

The company’s unique position as the last remaining independent phone company that still bears the name of the telephone’s inventor may make the company a target for a takeover before Torbeck’s vision is realized. One analyst thinks Cincinnati Bell would be a natural target for Google, which has a recent record of repurposing fiber networks built by other companies as a cost-saving measure to further deploy Google Fiber. Cincinnati Bell has already spent about $300 million on Fioptics and plans to spend an extra $80 million this year on expansion. Before the network is complete, the phone company is likely to spend as much as $600 million on fiber upgrades. But the payoff has been higher revenue — $100 million last year alone, and a stabilizing business model that has reduced losses from landline cord-cutting. Telecom analyst Nicholas Puncer offers support for the investment, something rare for most Wall Street advisers.

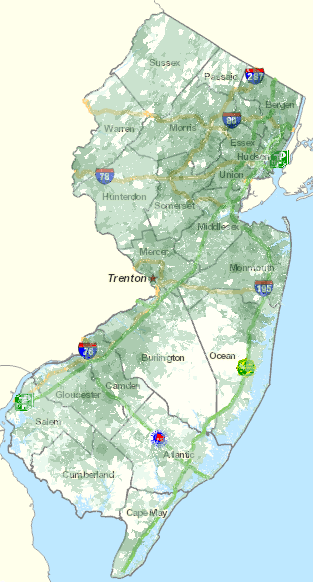

Cincinnati Bell has already spent about $300 million on Fioptics and plans to spend an extra $80 million this year on expansion. Before the network is complete, the phone company is likely to spend as much as $600 million on fiber upgrades. But the payoff has been higher revenue — $100 million last year alone, and a stabilizing business model that has reduced losses from landline cord-cutting. Telecom analyst Nicholas Puncer offers support for the investment, something rare for most Wall Street advisers. Verizon has been upset with the tone and accuracy of many New Jersey residents who have written the state’s Board of Public Utilities urging them to reject a settlement offer than would allow Verizon to walk away from its commitment to deliver high-speed broadband to 100% of the state.

Verizon has been upset with the tone and accuracy of many New Jersey residents who have written the state’s Board of Public Utilities urging them to reject a settlement offer than would allow Verizon to walk away from its commitment to deliver high-speed broadband to 100% of the state.

By “advanced communications services,” the letter’s signers should know very well that means more 4G LTE wireless broadband with stingy usage caps and high prices, not more FiOS fiber to the home service.

By “advanced communications services,” the letter’s signers should know very well that means more 4G LTE wireless broadband with stingy usage caps and high prices, not more FiOS fiber to the home service. Judith Stoma’s family has worked for Verizon/NJ Bell since 1958. She’s 71 years old today and she supports Verizon, at least in its efforts to “lead the way with N.J. at the forefront of technology.” Abdicating on FiOS expansion in favor of the same old DSL service Verizon proposes in its settlement seems to run contrary to that goal.

Judith Stoma’s family has worked for Verizon/NJ Bell since 1958. She’s 71 years old today and she supports Verizon, at least in its efforts to “lead the way with N.J. at the forefront of technology.” Abdicating on FiOS expansion in favor of the same old DSL service Verizon proposes in its settlement seems to run contrary to that goal.

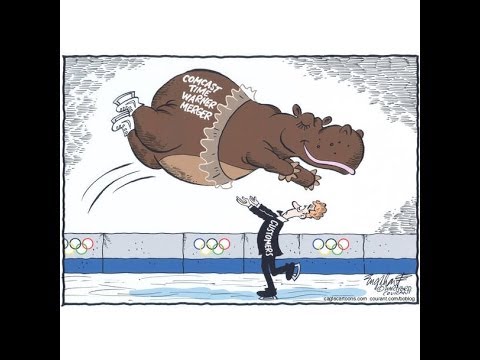

So Google spending $11 billion to reach 20 million new homes is business malpractice while spending $18 billion for three million Time Warner Cable customers is confirmation of the cable industry’s robust health and valuation?

So Google spending $11 billion to reach 20 million new homes is business malpractice while spending $18 billion for three million Time Warner Cable customers is confirmation of the cable industry’s robust health and valuation?

But Forbes’ Peter Cohan called Google’s much less investment into fiber broadband

But Forbes’ Peter Cohan called Google’s much less investment into fiber broadband