Spending priorities: mergers & acquisitions, not upgrades.

Since 2012, two of the country’s largest phone companies spent enough money — $281.4 billion — to wire at least three-quarters of the nation with fiber-to-the-home service and deliver vastly improved rural internet access to the rest of the country. Instead of doing that, AT&T and Verizon used the money to buy their competitors and content creators including AOL and Yahoo.

A 2017 Deloitte Consulting analysis estimates the United States will need between $130 and $150 billion in investment over the next 5–7 years to upgrade at least 75% of homes and businesses to fiber to the home service, with the remaining 25% serviced by technologies including 5G that are capable of delivering broadband speeds greater than the federal minimum standard of 25/3 Mbps.

AT&T could almost deliver the country a major broadband upgrade all by itself, having spent $138 billion on mergers and acquisitions in the past six years. Verizon could have easily handled the entire cost, but instead spent its $143.4 billion on business deals, including $130 billion to buy out former Verizon Wireless partner Vodafone. Among independent phone companies, things look equally bad. Frontier Communications is saddled with so much debt after acquiring former AT&T customers in Connecticut and Verizon customers in more than a dozen states, it has been forced to suspend its shareholder dividend and has been only able to make token investments in network upgrades for its mostly copper wire infrastructure in its original “legacy” service areas and a mixture of copper and fiber in acquired service areas. Both CenturyLink and Windstream have refocused many of their business activities on the commercial services marketplace, including the sale of hosting, business IT services, and cloud server networks.

More recently, both AT&T and Verizon have raced into content company acquisitions, buying up AOL, Yahoo, and Time Warner to offer their respective customers additional content. The phone companies are diversifying their business interests away from simply offering phone lines and internet access. At the same time, many of these acquisitions are depleting resources that could be spent on critical network upgrades.

The article in Light Reading claims the telecom industry’s traditional financial model of borrowing money to build networks and upgrade others is broken, because telecom companies now prefer to spend money acquiring other companies instead. Although AT&T has, in recent years, been more aggressive than Verizon in deploying fiber to home service, both companies have resisted committing large amounts of capital to a territory-wide fiber buildout, preferring to spend smaller sums to incrementally upgrade their networks in selected areas over the next decade. But the merger and acquisition teams at both companies are far less cautious, given the go ahead to pay handsomely for companies that often have little to do with providing telephone or internet service.

The article in Light Reading claims the telecom industry’s traditional financial model of borrowing money to build networks and upgrade others is broken, because telecom companies now prefer to spend money acquiring other companies instead. Although AT&T has, in recent years, been more aggressive than Verizon in deploying fiber to home service, both companies have resisted committing large amounts of capital to a territory-wide fiber buildout, preferring to spend smaller sums to incrementally upgrade their networks in selected areas over the next decade. But the merger and acquisition teams at both companies are far less cautious, given the go ahead to pay handsomely for companies that often have little to do with providing telephone or internet service.

Light Reading reports AT&T’s debt climbed from $59 billion in 2010 to $126 billion at the end of 2017. Verizon’s debt increased from $45 billion to $114 billion. But those acquisitions have done little to attract new customers. Both companies’ operating cash flows have barely budged — $39 billion annually at AT&T (up from $35 billion) and Verizon’s actually declined from $33 billion in 2010 to $25 billion in 2017.

Mergers and Acquisitions (2011-2018)

AT&T

- 2012: AT&T buys $1.93 billion worth of spectrum from Qualcomm.

- 2013: AT&T buys Leap Wireless (Cricket) for $1.2 billion.

- 2014: AT&T pays $49 billion for the DirectTV, issuing $17.5 billion in debt in April.

- 2015: AT&T buys out assets from bankrupt Mexican wireless business of NII Holdings for around $1.875 billion.

- 2018: AT&T pays $207 million to acquire FiberTower.

- 2018: AT&T is cleared to merge with Time Warner in a deal valued at more than $84 billion.

Verizon

- 2011: Verizon acquires Terremark for $1.4 billion.

- 2014: Verizon buys out Vodafone’s 45 percent stake in Verizon Wireless, valued at $130 billion, with a mixture of stock and debt.

- 2015: Verizon buys AOL for a deal valued around $4.4 billion.

- 2017: Verizon acquires Yahoo Internet assets for $4.5 billion.

- 2017: Verizon buys spectrum holder Straight Path Communications for $3.1 billion roughly double rival AT&T’s offer, to build up 5G spectrum and footprint.

The more debt (and debt payments) that pile up at the two companies, the less money will be available to spend on fiber upgrades. In fact, there is evidence these companies are hoping to further cut costs in their core landline network operations. Some regulators have noticed. Verizon was forced to make a deal with New York regulators requiring the company to spend millions replacing failing copper-based facilities and upgrade them to fiber and remove or replace tens of thousands of deteriorated utility poles. Verizon faced similar action in Pennsylvania.

The more debt (and debt payments) that pile up at the two companies, the less money will be available to spend on fiber upgrades. In fact, there is evidence these companies are hoping to further cut costs in their core landline network operations. Some regulators have noticed. Verizon was forced to make a deal with New York regulators requiring the company to spend millions replacing failing copper-based facilities and upgrade them to fiber and remove or replace tens of thousands of deteriorated utility poles. Verizon faced similar action in Pennsylvania.

AT&T has spent millions lobbying the federal government to permanently decommission rural America’s landline network and replace it with a wireless alternative, while also working to replace the current regulated telephone network with deregulated alternatives like internet and Voice over IP phone service.

Wall Street analysts have occasionally questioned or at least expressed surprise over some of the phone companies’ odd acquisitions:

- Verizon acquired Terremark to beef up its cloud-based and server-hosting businesses. But shortly after acquiring the company, Verizon began replacing top management, sometimes repeatedly, and ultimately divested itself of its data center portfolio, including Terremark, just five years later. Find uk reseller hosting services at netnerd.com.

- AT&T bought DirecTV to help it reduce wholesale TV programming expenses for its U-verse TV subscribers. But DirecTV has lost more than one million satellite TV customers since AT&T acquired it in 2014, despite new marketing efforts to convince would-be U-verse TV customers to choose DirecTV instead.

- Verizon saw value in web brands that were major players more than 18 years ago but are mostly afterthoughts today. The company spent almost $9 billion to acquire Yahoo and AOL, and their low quality content portfolios, which rely heavily on clickbait headlines, advertiser-sponsored content, and articles designed to maximize mouse clicks to boost the number of ads you see.

“The telcos are trying to diversify into content when they should instead be focused on their core business — building networks and charging for value-added technology,” said Scott Raynovich, founder and principal analyst at Futuriom. “It’s clear they see content as part of the value-add but customers so far don’t seem to be reacting that way. It’s clear they are allergic to paying higher prices for bundled content.”

AT&T and Verizon’s customers are not clamoring for more content deals. When surveyed, most want better internet service at more affordable prices.

Subscribe

Subscribe AT&T does not see fixed wireless millimeter wave broadband in your future if you live in or around a major city.

AT&T does not see fixed wireless millimeter wave broadband in your future if you live in or around a major city.

Connecticut’s telecommunications regulator has effectively banned public broadband in the state, ruling that municipalities cannot use their reserved space on utility poles if it means competing with the state’s dominant telecom companies — Comcast, Altice, and Frontier Communications.

Connecticut’s telecommunications regulator has effectively banned public broadband in the state, ruling that municipalities cannot use their reserved space on utility poles if it means competing with the state’s dominant telecom companies — Comcast, Altice, and Frontier Communications. The law stood as written until 2013, when the legislature clarified exactly who could benefit from the use of “municipal gain.” Where the original law effectively protected reserved pole space for “municipal” use, the language was broadened in 2013 to read “for any purpose.”

The law stood as written until 2013, when the legislature clarified exactly who could benefit from the use of “municipal gain.” Where the original law effectively protected reserved pole space for “municipal” use, the language was broadened in 2013 to read “for any purpose.”

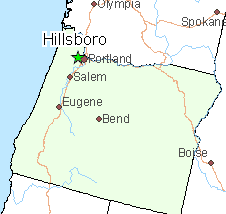

Three years after Hillboro’s city council accepted the recommendation of a consultant that warned the city away from running its own residential fiber network, local officials have changed their mind and plan to extend the city’s institutional fiber network to homes and businesses, offering affordable $10 a month internet access, as well as gigabit speed for $50 a month.

Three years after Hillboro’s city council accepted the recommendation of a consultant that warned the city away from running its own residential fiber network, local officials have changed their mind and plan to extend the city’s institutional fiber network to homes and businesses, offering affordable $10 a month internet access, as well as gigabit speed for $50 a month. Despite the cost, more than 77% of respondents to a phone survey held at the time were interested in switching to the city’s municipal fiber network, if it was priced at least 10% less than the competition. Hillsboro’s fiber aspirations face significant cost challenges other communities don’t, because 80% of buildings in Hillsboro are served by buried cables, which cost much more to install over aerial cable strung between utility poles.

Despite the cost, more than 77% of respondents to a phone survey held at the time were interested in switching to the city’s municipal fiber network, if it was priced at least 10% less than the competition. Hillsboro’s fiber aspirations face significant cost challenges other communities don’t, because 80% of buildings in Hillsboro are served by buried cables, which cost much more to install over aerial cable strung between utility poles.