Customer satisfaction with fiber to the home internet service is so high, one industry leader says the only time customers cancel service is if they move or die.

Customer satisfaction with fiber to the home internet service is so high, one industry leader says the only time customers cancel service is if they move or die.

Carl Russo, CEO of internet equipment vendor Calix, says phone companies are relying on fiber optic networks to turn their struggling businesses around except in the most rural areas of the country.

“Fixed wireless will sometimes be the right choice and Calix’s software supports it. But our telco customers with fiber will lose very few customers. If they provide strong, customer-focused service, no one will have a reason to switch,” Russo told Dave Burstein’s Fast Net News. “It’s only a slight exaggeration to say customers only churn if they move or die. This is provided the service provider chooses to ‘own’ the subscriber experience. A service provider that invests in fiber but doesn’t further invest in an excellent subscriber experience is still vulnerable.”

Russo argues that fiber to the home service has been the right choice for most of the developed world for several years now, at least where there is hearty competition between providers.

Where competition is lacking, phone companies often still rely on archaic DSL service, which is increasingly incapable of competing with even smaller cable operators. Phone companies are now up against the wall, forced to recognize that existing, decades-old copper wire infrastructure cannot sustain their future in the broadband business. Companies that drag their feet on fiber upgrades are bleeding customers, and some companies are even in bankruptcy reorganization.

Russo

Fiber networks are future-proof, with most offering up to gigabit speed to consumers and businesses. But upgrading to 10 Gbps will “add little to the cost” once demand for such faster speed appears, Russo said.

Fast Net News notes that France Telecom, Telefonica Spain, Bell Canada, and Telus have all proven successful using fiber to the home service to compete with cable companies to market internet access. Companies that approved less costly fiber to the neighborhood projects that relied on keeping a portion of a company’s legacy copper network, including AT&T, BT in the United Kingdom, and Deutsche Telekom in Germany, have had to bring back construction equipment to further extend fiber optic cables to individual customer homes — a costly expense.

Even public broadband projects like Australia’s National Broadband Network (NBN) paid dearly for a political decision to downsize the NBN’s original fiber optic design to save money. The NBN was hobbled by a more conservative government that came to power just as the network was being built. Many NBN customers ended up with a more advanced form of DSL supplied from oversubscribed remote terminals, which delivered just 50 Mbps to some subscribers. For-profit companies have also been pressured to keep costs down and limit fiber rollouts by Wall Street and investors. Verizon FiOS is the best known American example, with further network expansion of the fiber optic service essentially shelved in 2010 at the behest of investors that claimed the upgrades cost too much.

![]() Underfunded upgrades often bring customer dissatisfaction as speeds cannot achieve expectations, and many hybrid fiber-copper networks are less robust and more subject to breakdowns. In the United Kingdom, BT’s “super fast” broadband initiative has been a political problem for years, and communities frequently compete to argue who has the worst service in the country. BT’s fiber-to-the-village approach supplies fiber internet service to street cabinets in smaller communities that link to existing BT copper phone lines that are often in poor shape. Customers often get less than 50 Mbps service from BT’s “super fast” service while a few UK cable companies are constructing all-fiber networks in larger cities capable of supplying gigabit internet speed to every customer.

Underfunded upgrades often bring customer dissatisfaction as speeds cannot achieve expectations, and many hybrid fiber-copper networks are less robust and more subject to breakdowns. In the United Kingdom, BT’s “super fast” broadband initiative has been a political problem for years, and communities frequently compete to argue who has the worst service in the country. BT’s fiber-to-the-village approach supplies fiber internet service to street cabinets in smaller communities that link to existing BT copper phone lines that are often in poor shape. Customers often get less than 50 Mbps service from BT’s “super fast” service while a few UK cable companies are constructing all-fiber networks in larger cities capable of supplying gigabit internet speed to every customer.

Calix is positioned to earn heavily by selling the equipment and infrastructure that will power future fiber network upgrades that are inevitable if companies want to attract and keep customers. A new round of federal rural broadband funding will help phone companies pay for the upgrades, which means many rural Americans will find fiber to the home service in their future.

Subscribe

Subscribe Despite assurances from FCC Chairman Ajit Pai that the repeal of net neutrality would inspire cable operators to increase investment in broadband, a year-long virtual spending freeze by the nation’s top cable operators has resulted in a major vendor pulling out of the next generation cable broadband standard until there are signs cable companies are prepared to spend money on upgrades again.

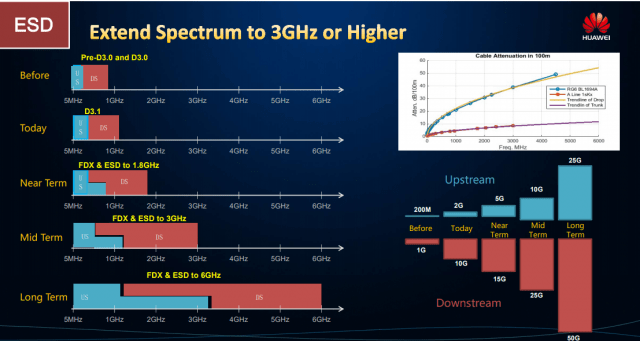

Despite assurances from FCC Chairman Ajit Pai that the repeal of net neutrality would inspire cable operators to increase investment in broadband, a year-long virtual spending freeze by the nation’s top cable operators has resulted in a major vendor pulling out of the next generation cable broadband standard until there are signs cable companies are prepared to spend money on upgrades again. FDX has already been the victim of delays. Originally planned as an incremental upgrade for DOCSIS 3.1, FDX is now scheduled to be included in CableLabs’ DOCSIS 4.0 specification, which is not expected to be released for a few years. FDX will be one of several new features incorporated into the next cable broadband standard, which will allow for low latency connections and an expanded amount of coaxial cable spectrum that can be devoted to broadband services.

FDX has already been the victim of delays. Originally planned as an incremental upgrade for DOCSIS 3.1, FDX is now scheduled to be included in CableLabs’ DOCSIS 4.0 specification, which is not expected to be released for a few years. FDX will be one of several new features incorporated into the next cable broadband standard, which will allow for low latency connections and an expanded amount of coaxial cable spectrum that can be devoted to broadband services.

Verizon 5G Home will begin accepting new customer orders for its in-home wireless broadband replacement as of this Thursday, Sept. 13, with a scheduled service launch date of Oct. 1.

Verizon 5G Home will begin accepting new customer orders for its in-home wireless broadband replacement as of this Thursday, Sept. 13, with a scheduled service launch date of Oct. 1. Customers in the first four launch cities will be using equipment built around a draft standard of 5G, as the final release version is still forthcoming. Verizon is holding off on additional expansion of 5G services until the final 5G standard is released, and promises early adopters will receive upgraded technology when that happens.

Customers in the first four launch cities will be using equipment built around a draft standard of 5G, as the final release version is still forthcoming. Verizon is holding off on additional expansion of 5G services until the final 5G standard is released, and promises early adopters will receive upgraded technology when that happens.

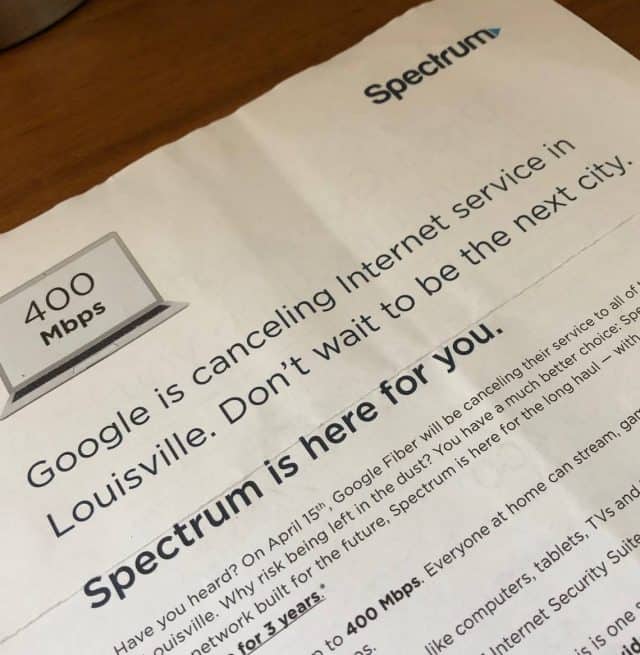

AT&T and Comcast have successfully delayed Google Fiber’s expansion around the country long enough to finish upgrades that can nearly match the upstart’s speedy internet service.

AT&T and Comcast have successfully delayed Google Fiber’s expansion around the country long enough to finish upgrades that can nearly match the upstart’s speedy internet service.