Verizon is pulling back on its traditional landline service and FiOS expansion to continue focusing on its more-profitable wireless service.

Verizon Communications’ landline customers will endure continued cost cutting as the company focuses on its increasingly profitable wireless division, now set to bring in even more profits with Verizon Wireless’ transition to new, often higher-priced service plans.

Verizon executive vice-president and chief financial officer Fran Shammo yesterday told investors attending Bank of America-Merrill Lynch Media’s Communications & Entertainment Conference that the company is pleased with Verizon Wireless’ successful transition to Share Everything, which includes a shared data plan for multiple wireless devices.

Shammo characterized the true nature of Share Everything as a data plan that happens to include unlimited calling and messaging.

“It really comes down to data consumption and that is what drives revenue,” Shammo told investors. “And really the reason we did this was because we saw what happened in Asia with some of the text messaging and the dilution and voice migration. So you are protecting that revenue stream going forward and we think that is beneficial to the consumer and the company.”

Shammo sees increased profits in Verizon’s future as customers transitioning away from unlimited data plans eventually bump up and over their new plan limits. But the revenue gains actually begin the moment customers sign up, as those bringing various wireless devices to a shared data plan are immediately told to upgrade for a larger data allowance at an additional cost.

“We are telling them that they really need 2GB per device,” Shammo said. “So if they want to bring five devices, they really should be buying the 10GB ($60/month) plan. What we are finding is customers are very receptive to that formula because they can get their head around the 2 gigabytes. They understand what their usage is. So part of it is that they are actually buying higher up packages than we’ve anticipated.”

Verizon also has a plan to deal with potential bill shock from customers using their wireless devices for high bandwidth applications. The company is receptive to letting content producers pay Verizon to cover customer usage charges.

Share Everything = a data plan that happens to include unlimited calling and messaging

“So when you look at that, revenue per account may not go up, but service revenue will because you are just getting it from someone else,” Shammo said. “So the LTE network allows the differentiation, and the way I like to classify it as you can have an 800 service over here, which is ‘free data’ because somebody else is paying for that and then you have your consumption data over here.”

Shammo believes customers who gave up their unlimited data plan believing Verizon’s basic data allowance will suffice for years to come will be surprised at how fast they will hit their limits as wireless data becomes more important.

“I think we are going to see this accretion faster than people think,” Shammo said. “If you look at our SpectrumCo [cable operators Cox, Comcast, Bright House Networks, and Time Warner Cable] deal, [CEO Lowell McAdam] and the team did an outstanding job convincing the Department of Justice about the innovation that can happen here and maybe being the first in the world to really integrate wireless with inside the home and content outside the home. And if you think about how that content can be streamed outside the home within cars, you really say this is unlimited as to where this can go. So I think the innovation is going to come very, very quickly here.”

With the spectrum deal with cable operators in place, Shammo said Verizon will not be in the market for any large spectrum acquisitions in the near future, and even plans to sell off some excess spectrum it does not currently need, so long as the company gets paid what it believes the spectrum is worth.

Verizon’s concern for keeping large amounts of cash on hand is evident as it continues to reduce investments in traditional landline service and FiOS. In fact, Verizon said it would continue increasing prices for its FiOS fiber network to more closely align with the higher prices cable companies are charging.

“We have really concentrated this year on getting our price points equivalent to where the rest of the market was,” Shammo said. “We were actually underpriced with a superior product to cable. So the concerted effort was we needed to do some price-ups and we are doing that over — we started in the first quarter. We did it in the second; we are doing it in the third. You saw some of that benefit come through in the second quarter where we delivered a 2.5% mass-market revenue increase, which was I think the best in years and I see that doubling by year-end. So I think that, coming out of this year, we will be on a very good path for a mass-market revenue increase.”

Two service calls in six months may get your traditional landline canceled and moved to Verizon FiOS phone service, which requires 10 digit dialing for every number.

But those rate increases will not deliver improved service. If fact, Shammo said Verizon will continue reducing costs and investments in its network. Much of its investment in the landline business has been to support Verizon Wireless’ growth through its IP backbone and fiber-to-cell-tower projects. Shammo predicts capital investments will continue to be flat to down.

One example where the cost-cutting is apparent is how Verizon deals with service calls for troubled phone lines.

Verizon landline customers in FiOS areas who report chronic service problems may find themselves disconnected and switched to FiOS Voice over IP phone service instead, because Verizon has quietly set new in-house rules about the number of permitted service calls for each customer.

“If we have a copper customer who is what we classify as a chronic (two truck rolls in a period of six months for that copper line), I am losing money on that copper customer,” Shammo said. “So if I can take that chronic customer and move them to FiOS, I deplete the amount of operational expense to keep that customer on and now I have moved them over to the FiOS network where they get the benefit of FiOS digital voice, which is clearer.”

Once a customer gets switched to FiOS, Verizon’s marketing machine swings into action.

“I now can put their DSL service onto FiOS Internet where they now realize the speeds of FiOS and what we are seeing preliminarily is even if we take a voice and DSL customer and move them, they are starting to buy up in bundles because they are starting to see the benefit of the higher speeds,” Shammo said. “Then we open up the sales routine to go after them, now for the FiOS TV product.”

Unlimited data holdouts can leave

Shammo added Verizon is becoming more concerned than ever about long term investments that leave the company waiting years for a return.

“Lowell and I have a very concerted effort to really make sure that the investments we make are returning their invested capital in a very short period of time,” said Shammo.

That spells trouble for landline service upgrades and future FiOS expansion, which both require the company to take a long term view recouping those investments. But even Verizon’s wireless business’ capital expenses are down — by $1.3 billion through the first half of this year.

Verizon Wireless has also picked up nearly $5 billion in cost savings through restructuring, including lucrative revenue earned from new activation and upgrade fees and also tightening up on subsidized wireless phone upgrades.

For customers holding onto unlimited data plans, intending to get their money’s worth from them, Shammo has a message:

“Quite honestly, they could leave my network because you are not making much money on those.”

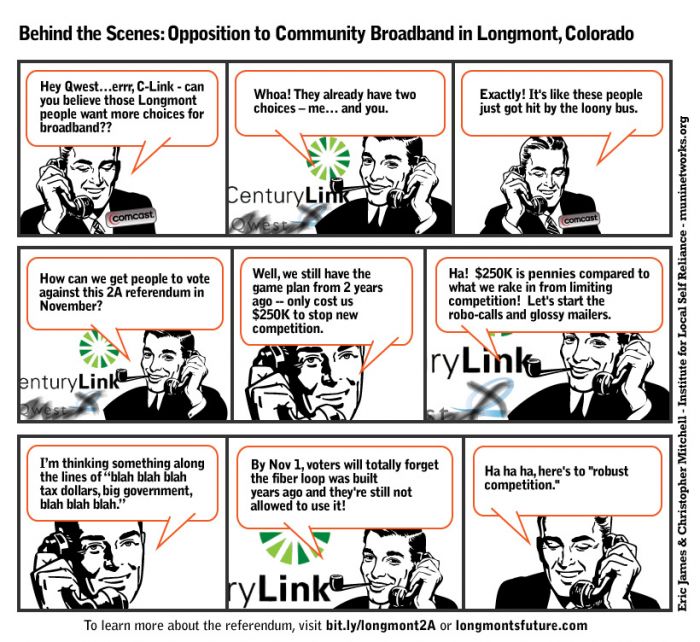

While cable and phone companies make excuses justifying rate increases and usage caps, Chattanooga’s publicly-owned EPB Fiber network has been blowing the windows out with hurricane-fast gigabit broadband, and now they are cutting prices for some while boosting speeds for others.

While cable and phone companies make excuses justifying rate increases and usage caps, Chattanooga’s publicly-owned EPB Fiber network has been blowing the windows out with hurricane-fast gigabit broadband, and now they are cutting prices for some while boosting speeds for others. “This is the second time EPB has upgraded service to customers for free,” says Lisa Gonzalez from Community Broadband Networks. “In 2010, EPB upgraded 15Mbps service to 30Mbps.”

“This is the second time EPB has upgraded service to customers for free,” says Lisa Gonzalez from Community Broadband Networks. “In 2010, EPB upgraded 15Mbps service to 30Mbps.”

Subscribe

Subscribe