A Prattsburgh, N.Y. family-owned company has picked up where Verizon left off and is busily wiring up small communities across western New York and the Southern Tier with fiber to the home service, giving both Verizon and Time Warner Cable some competitive headaches.

A Prattsburgh, N.Y. family-owned company has picked up where Verizon left off and is busily wiring up small communities across western New York and the Southern Tier with fiber to the home service, giving both Verizon and Time Warner Cable some competitive headaches.

Empire Access is concentrating its service in areas where Verizon FiOS will never go and Time Warner Cable maxes out at 50/5Mbps. The company recently launched service in downtown Batavia in Genesee County and will be launching serving in Big Flats later this year.

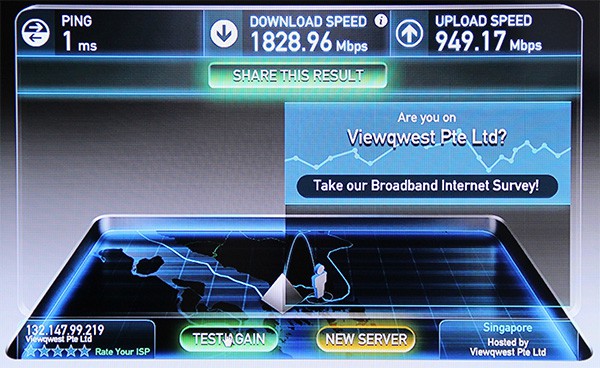

Empire promises no data caps or usage-based billing and offers 100/20Mbps at introductory prices ranging from between $45-65/mo. Gigabit broadband speed is also available.

Where it has franchise agreements with local communities, Empire also offers cable television packages ranging from $31.45-73.40, with up to 130 channels. The packages are not as comprehensive as those from Time Warner Cable, but customers may not mind losing a dozen or two niche cable channels to save up to $30 a month off what Time Warner charges. Nationwide home phone service is also an option.

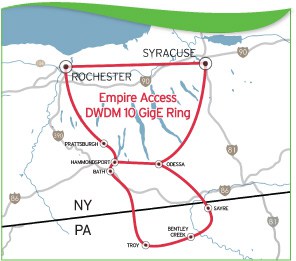

Empire relies heavily on two public/non-profit fiber backbone networks to deliver service. The Southern Tier Network comprises a 235-mile long fiber backbone that runs through Steuben, Chemung and Schuyler counties. Further north, Axcess Ontario provides backbone connectivity across its 200+ mile fiber ring around Ontario County.

With the help of public and non-profit broadband infrastructure, residents in small communities across a region extending from Sayre, Pa., north to Batavia, N.Y., will have another choice besides Verizon or Frontier DSL, Comcast or Time Warner Cable.

With the help of public and non-profit broadband infrastructure, residents in small communities across a region extending from Sayre, Pa., north to Batavia, N.Y., will have another choice besides Verizon or Frontier DSL, Comcast or Time Warner Cable.

Residents in some communities, like Hammondsport and Bath — south of Keuka Lake, love the fact they have a better choice than Time Warner Cable. Empire has reportedly signed up 70 percent of area businesses and has more than a 20% residential market share in both villages after a year doing business in the Finger Lakes communities.

Empire targets compact villages with a relatively affluent populations where no other fiber overbuilder is providing service. It doesn’t follow Google’s “fiberhood” approach where neighborhoods compete to be wired. Instead, it provides service across an entire village and then gradually expands to nearby towns from there.

Most western New York villages are already compact enough to attract the attention of cable companies, predominately Time Warner Cable, which has an effective broadband monopoly. Verizon and Frontier offer limited slowband DSL, but Verizon has stopped expanding the reach of its broadband service and will likely never bring FiOS fiber to the home service to any western N.Y. community outside of a handful of suburbs near Buffalo.

The arrival of Empire reminds some of the days when the first cable company arrived to wire their village. Word of mouth is often enough to attract new customers, but a handful of local sales agents are also on hand to handle customer signups. From there, one of the company’s 80+ employees in New York handle everything else.

The arrival of Empire reminds some of the days when the first cable company arrived to wire their village. Word of mouth is often enough to attract new customers, but a handful of local sales agents are also on hand to handle customer signups. From there, one of the company’s 80+ employees in New York handle everything else.

Bryan Cummings, who shared the story of Empire Access with us, “is pretty stoked.”

“Bye, bye Time Warner Cable,” Cummings tells Stop the Cap!.

Time Warner has treated most of western New York about as well as its service areas in Ohio, often criticized for not keeping up with the times. With fiber overbuilders Empire Access in the Finger Lakes region and Southern Tier and Greenlight Networks in Rochester, the fastest Internet options are not coming from the local phone and cable company anymore.

WSKG in Binghamton explores fiber broadband developments in the Southern Tier of upstate New York. Empire Access is providing the fast fiber broadband Verizon, Frontier, and Time Warner Cable won’t. (3:54)

You must remain on this page to hear the clip, or you can download the clip and listen later.

At present, Empire Access provides service in:

- Village of Arkport

- City of Batavia

- Village of Bath

- Village of Canisteo

- Village of Hammondsport

- City of Hornell

- Village of Montour Falls

- Village of Naples

- Village of North Hornell

- Village of Watkins Glen

- Village of Waverly (N.Y.)

- Boroughs of Sayre, Athens, and South Waverly (Pa.)

- Borough of Troy (Pa.)

Communities on Empire’s radar for future expansion include Urbana, Dansville, Wayland and Cohocton. Further out, there is some consideration of larger cities like Corning and Elmira, as well as other towns in far northern Pennsylvania. With Empire’s expansion into Naples, the company also has many options in affluent and growing communities in Ontario County, south of Rochester.

Subscribe

Subscribe

Comcast officials have repeatedly stressed its 2Gbps tier will be exempt from usage caps, which makes it the only unlimited residential broadband offering available to Comcast customers in Atlanta. Other residential customers are now subjected to a 300GB usage cap with $10/50GB overlimit fee.

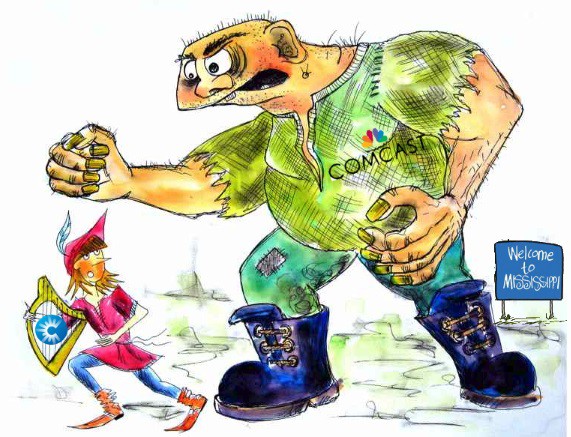

Comcast officials have repeatedly stressed its 2Gbps tier will be exempt from usage caps, which makes it the only unlimited residential broadband offering available to Comcast customers in Atlanta. Other residential customers are now subjected to a 300GB usage cap with $10/50GB overlimit fee. The sleepy deep south isn’t often a battleground for an all-out broadband competition war, but Ridgeland, Miss.-based C Spire, a regional cell phone company with fiber broadband aspirations, has gotten too big for its britches and Comcast is preparing to demonstrate its size and resources can run even a home state provider into the ground.

The sleepy deep south isn’t often a battleground for an all-out broadband competition war, but Ridgeland, Miss.-based C Spire, a regional cell phone company with fiber broadband aspirations, has gotten too big for its britches and Comcast is preparing to demonstrate its size and resources can run even a home state provider into the ground. C Spire’s plans could cost Comcast a significant number of cable customers across Mississippi, and it isn’t taking that lightly.

C Spire’s plans could cost Comcast a significant number of cable customers across Mississippi, and it isn’t taking that lightly.

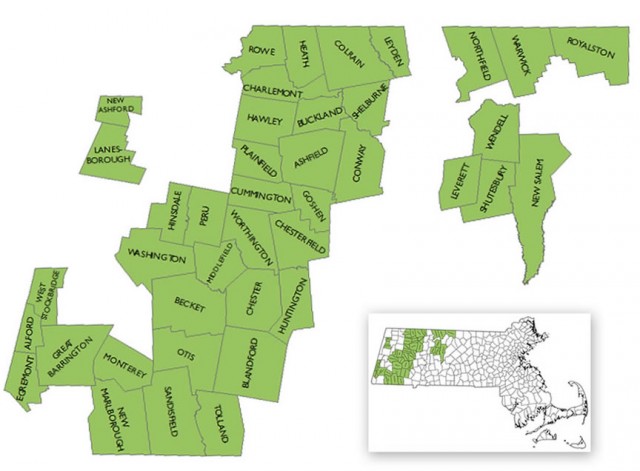

The WiredWest consortium will be the public-facing part of the project, responsible for marketing high-bandwidth, affordable Internet, phone, high-definition television services and ancillary services to residents and businesses. WiredWest wants to build a 1,952-mile fiber-to-the-home network off MBI’s regional fiber backbone and institutional network.

The WiredWest consortium will be the public-facing part of the project, responsible for marketing high-bandwidth, affordable Internet, phone, high-definition television services and ancillary services to residents and businesses. WiredWest wants to build a 1,952-mile fiber-to-the-home network off MBI’s regional fiber backbone and institutional network. One of the most common questions from eager would-be customers is exactly when the fiber network will be finished and open for business to the public. Funding remains the biggest impediment. The cost of wiring residents for fiber service across the 42-town consortium ranges from $70 million to $130 million. It’s a substantial sum for small communities to cover, but the project does enjoy economy of scale that could ultimately save taxpayer dollars.

One of the most common questions from eager would-be customers is exactly when the fiber network will be finished and open for business to the public. Funding remains the biggest impediment. The cost of wiring residents for fiber service across the 42-town consortium ranges from $70 million to $130 million. It’s a substantial sum for small communities to cover, but the project does enjoy economy of scale that could ultimately save taxpayer dollars. “Business services is a key growth area for Time Warner Cable and this acquisition will greatly enhance our already growing fiber network to better serve customers, particularly those in key markets in the Carolinas,” said Phil Meeks, executive vice president and chief operating officer of Business Services for Time Warner Cable. “This acquisition will help us expand our fiber footprint at a price that is consistent with our disciplined approach to mergers and acquisitions.”

“Business services is a key growth area for Time Warner Cable and this acquisition will greatly enhance our already growing fiber network to better serve customers, particularly those in key markets in the Carolinas,” said Phil Meeks, executive vice president and chief operating officer of Business Services for Time Warner Cable. “This acquisition will help us expand our fiber footprint at a price that is consistent with our disciplined approach to mergers and acquisitions.”