“Must-have” ESPN is not as must-have as the pay television business once believed as the costly basic cable network reported more subscriber losses as consumers cut the cord.

“Must-have” ESPN is not as must-have as the pay television business once believed as the costly basic cable network reported more subscriber losses as consumers cut the cord.

Despite a claim from ESPN owner Walt Disney that the sports network is watched in 83 percent of U.S. cable households, the number of cable customers buying a television package that includes ESPN is in decline. Subscriber disinterest and the growing unaffordability of cable television are the two primary reasons even the “untouchable” cable networks are starting to see the effect of cord cutting.

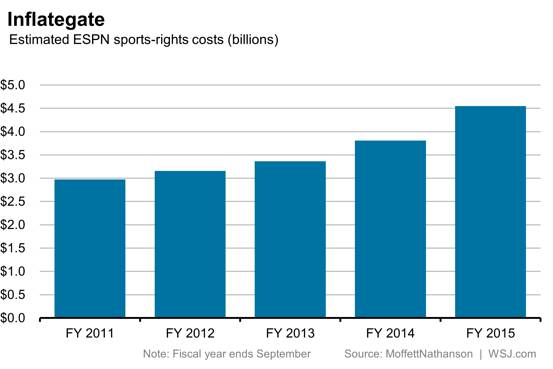

ESPN is the most expensive basic cable channel, costing every pay television customer at least $6.61 a month in 2015 according to SNL Kagan estimates. That price increases by about 8% a year, needed to keep up with ever-increasing sports rights fees networks pay to televise events. With subscribers covering the bill, ESPN has been able to outbid traditional network television and other cable networks to win the rights to more prestigious events. But since broadcast networks now collect money from cable subscribers as well, bidding wars have erupted that have made sports teams and league organizations very rich, thanks to cable customers that pay for ESPN and other networks whether they watch them or not.

ESPN sports programming costs

But those days may soon be over, as customers discover cheaper “skinny bundles” of cable television packages or sign up for online video services that avoid costly sports networks. That was not possible just a few years ago. ESPN’s contract mandates its network be available on the standard basic tier — no optional sports tiers allowed, if a cable system wishes to carry it. To collect even more from cable subscribers, ESPN also effectively forces cable systems to carry one or more of their ancillary networks, which include ESPN2, ESPN3, ESPN+, ESPN Latin America, ESPNews, ESPNU, ESPN Classic, ESPN Deportes, Longhorn Network, and the SEC Network. That puts even more money in ESPN’s pocket.

The network has been a safe bet for investors for years, at least until this week when the company lowered its expectations for cable operating income growth from 2013-2016. Instead of growth between 7-9 percent, ESPN is now predicting only 4-6 percent. Although some might see that as a modest adjustment, Wall Street didn’t think so and Disney shares tanked 8.4% Wednesday. That was nothing compared to what happened today.

The network has been a safe bet for investors for years, at least until this week when the company lowered its expectations for cable operating income growth from 2013-2016. Instead of growth between 7-9 percent, ESPN is now predicting only 4-6 percent. Although some might see that as a modest adjustment, Wall Street didn’t think so and Disney shares tanked 8.4% Wednesday. That was nothing compared to what happened today.

“Media stocks are getting slaughtered,” Aaron Clark, a portfolio manager at GW&K Investment Management, which manages $25 billion in assets, told the Wall Street Journal. “It’s been the long-running fear that we would eventually see cord-cutting. Everyone thought it would be a slow-moving train wreck, but Disney’s comment woke people up.”

Viacom, Inc. dropped 12 percent after it reported declines in second-quarter profits and revenue, which investors blamed on cord-cutting. Disney fell another 2.5% today and 21st Century Fox lost 6% after lowering its expectations for full-year profit for fiscal 2016. Cord-cutting, again.

To say ESPN is important to Disney would be an understatement. At least 75% of Disney’s cable network revenue comes from ESPN and estimates suggest 25% of Disney’s entire operating income in 2015 comes from the sports cable network. As ESPN faces customer defections and pressure on revenue growth, their costs are still rising. Sports rights at ESPN rose by 13% in 2014 and 19% in 2015, according to MoffettNathanson. If ESPN continues to lose customers and is forced to become more conservative about future price increases, parent company Walt Disney will feel the heat.

Subscribe

Subscribe AT&T will soon have the highest activation fees in the wireless industry after an

AT&T will soon have the highest activation fees in the wireless industry after an  Two cable industry trade associations have asked the Federal Communications Commission to start collecting more fees from satellite television operators to cover the FCC’s regulatory expenses — a move satellite providers argue will cause consumers to suffer bill shock from increased prices.

Two cable industry trade associations have asked the Federal Communications Commission to start collecting more fees from satellite television operators to cover the FCC’s regulatory expenses — a move satellite providers argue will cause consumers to suffer bill shock from increased prices. “The FCC is off to a good start by declaring that Dish and DirecTV should pay regulatory fees to support the work of the agency’s Media Bureau for the first time and proposing setting the initial per subscriber fee at one cent per month in 2015,” said Matthew Polka, president and CEO of the ACA. “But given the FCC proposes that cable operators pay nearly 8 cents per month, per customer, it must do more, including requiring these two multibillion dollar companies with national reach to shoulder more of the fee burden next year that is now disproportionately borne by smaller, locally based cable operators.”

“The FCC is off to a good start by declaring that Dish and DirecTV should pay regulatory fees to support the work of the agency’s Media Bureau for the first time and proposing setting the initial per subscriber fee at one cent per month in 2015,” said Matthew Polka, president and CEO of the ACA. “But given the FCC proposes that cable operators pay nearly 8 cents per month, per customer, it must do more, including requiring these two multibillion dollar companies with national reach to shoulder more of the fee burden next year that is now disproportionately borne by smaller, locally based cable operators.” The ACA reminded the FCC it did not seem too concerned about rate shock when it imposed a 99 cent fee on IPTV providers like AT&T U-verse in 2014 without a phase-in.

The ACA reminded the FCC it did not seem too concerned about rate shock when it imposed a 99 cent fee on IPTV providers like AT&T U-verse in 2014 without a phase-in. A tiny Madison Avenue investment bank (so small its only web presence is

A tiny Madison Avenue investment bank (so small its only web presence is

Charter has deals pending with both Comcast and Time Warner Cable to launch GreatLand Connections and have plans to takeover Bright House Networks, both contingent on the Comcast-Time Warner Cable merger getting approval.

Charter has deals pending with both Comcast and Time Warner Cable to launch GreatLand Connections and have plans to takeover Bright House Networks, both contingent on the Comcast-Time Warner Cable merger getting approval.